It’s essential for traders to know the most active stocks…

Why? Because if they’re the most active stocks today, it means other people are trading them!

And if other people are trading them, it’s critical that you know why.

Nasdaq’s most active stocks list has some names that will be familiar to you…

Apple, Microsoft, and Tesla trade in the tens of millions of shares per day.

Our SteadyTrade Team doesn’t look at those figures too long. It usually just means the same thing it’s meant since these stocks first became blue chips…

Traders, investors, and institutions all trade these stocks. They’re dependable and have a lot of liquidity.

When we’re scanning for the most active stocks in premarket, that’s not what we’re looking for.

What we scan for is unusual volume. Tesla might still come up — but we want to see it trading double or triple the amount it usually does.

This unusual volume is the best sign that extra eyes are looking at the stock.

Remember, the market is a game of supply and demand. When new volume pours in, it’s a good sign that demand’s up.

Table of Contents

- 1 What Are the Most Active Stocks?

- 2 Why Should You Search for the Most Active Stocks?

- 3 How to Find the Most Active Stocks

- 4 Most Active Stocks in the Last 30 Days

- 5 Most Active Stocks Today

- 6 Most Active Stocks Under $5

- 7 Most Active Stocks Under $10

- 8 How StocksToTrade Can Help You Find the Most Active Stocks

- 9 Conclusion

What Are the Most Active Stocks?

People used to lose their minds over a stock trading half a billion shares. Now, there are like 10 stocks a day that do that. And we’ll have two or three that trade a billion.

This matters more for the most active stocks on NYSE or Nasdaq than it does for OTC stocks.

Listed stocks usually have bigger floats than unlisted stocks. The float is the supply…

And when demand exceeds supply, you know what happens. You get those awesome spikes.

That’s why with the SteadyTrade Team, we usually target low float stocks. These are stocks with 10–20 million shares or less publicly available for trading.

Stocks don’t need insane volume to reach these floats. When they do, they have the potential for big moves.

The most active stocks on the NYSE need to hit much larger targets to get our attention. But they occasionally get there.

Take AMC Entertainment Holdings Inc. (NYSE: AMC)’s late-May, early-June run. On its biggest day, it traded 500 million shares in the morning. This overwhelmed its float … although the company promptly issued new shares, killing the rally.

Nimble traders understand the relationship between volume and price. Check out this alert from our Breakouts & Breakdowns service:

Today there was an ABUNDANCE of opportunity in the market, and our moderator in the Breakouts and Breakdowns chat, @Jackaroo_Trades, took full advantage.

— StocksToTrade (@StocksToTrade) May 28, 2021

Check out this $AMC trade where Jack banked $230K … all alerted live in chat!

Join the room here:https://t.co/dvVTpia7Wr pic.twitter.com/Az51ExGZzy

Why Should You Search for the Most Active Stocks?

The most active stocks don’t get that way by accident. They’re active because they’re being traded…

And they’re being traded because something’s happening.

Now, I’m not saying that you should trade the most active stocks that come up on your premarket scan … It’s just one indicator we use to find good trades.

The SteadyTrade Team has worksheets students can use to evaluate their setups…

These are the indicators that good trades are built on.

While it’s possible to randomly trade a breakout and come out ahead, if you keep finding yourself buying at the top, you might want to give discipline a shot.

Every day, the SteadyTrade Team meets in premarket. We talk about the day’s most active stocks — but we don’t necessarily trade them.

I answer all the questions I can get to — particularly about trading plans. I want my students to build good habits. It’s not just about trading the next AMC.

We look for a combination of:

- Low float

- Price up more than 10%

- Unusual volume

- Former runner

- Catalyst

- Clear support to set risk

The most active stocks are no secret. Anyone can look them up on Yahoo or Finviz. The trick is knowing what to do when you find them…

Join us on the SteadyTrade Team to see how smart traders prepare for stock action.

How to Find the Most Active Stocks

We start scanning in premarket. That’s when many high-volume plays start building…

Remember, we’re not interested in just any high-volume stock. We start our custom scan by looking for the biggest premarket gainers. Volume comes second — but you can’t trade without it.

It’s exciting to see a penny stock up 50%…

But if only 20,000 shares are traded by the market open, you might have a hard time exiting your position.

If you can’t exit a trade in some sketchy stock, you’re gonna have a bad time.

The most active stocks in premarket are usually trending for a reason. If it’s because of a good catalyst, we’ll be looking at it.

I give a quick run-down of the stocks I’m watching on my NO-COST Pre-Market Prep live sessions. Sign up here to get my premarket briefings every trading day.

I won’t help you build a trading plan, but I will share my perspective … Read on for some tips on trading volume.

You Can’t Predict Volume, But You Can Prepare for It

You can’t predict high volume…

But you can look back at a stock’s charts and see when volume tends to come in.

Volume and volatility are intimately linked — and that’s good news for traders! We want our stocks to move. When they’re moving in either direction, we can potentially trade them.

New traders tend to only look at one-day charts. They have no frame of reference…

That’s why they can get faked out when the price doesn’t move the way they think it will.

Experienced traders are like historians. They look at past days, weeks, years. They can tell you what happened the last time the stock traded 100 million shares.

And that helps them better prepare for what to do next time.

Compare to Average Volume

Every stock screener will tell you the average number of shares a stock has traded recently.

If a high-volume stock isn’t on your watchlist, this is one clue that the stock’s volume is unusual.

This can also help your trading plan. If a stock’s average volume is pretty low, it might be a day trade only.

Check the Float

Volume is always relative.

Is five million shares traded enough to get your attention? How about 50 million?

The answer: it depends. How many shares are out there? The float is the supply, and that’s how you can judge demand.

Most Active Stocks in the Last 30 Days

This is where your research comes in.

Even free scanners for most active stocks like Yahoo will show you a stock’s average volume. If the stock’s been running, its average volume might be inflated…

But it’s still a solid benchmark to judge unusual volume.

Looking at the previous month’s volume is useful for other reasons, too. The most active stocks in the last 30 days will tell you what’s been hot…

Have EV stocks had a good month? They’ll show up here. Is another hot sector emerging? Here’s your evidence.

If you’re collecting indicators for potential trades, hot sectors are another big one.

Most Active Stocks Today

Let’s take off our historian hats and put on our trader hats. As traders, the most active stocks today are what we care about.

When you add a catalyst to the mix…

And you see some price moves…

That’s when you start thinking about potential trades. You begin by looking for unusual volume in premarket.

For some stocks, that volume will hold up through the day.

When these most active stocks trade heavily after hours, they give you a clue for the next trading day.

Most Active Stocks Under $5

But before you start trading the most active stocks, you need to know what YOU are looking for.

What’s your price range? First, figure out your risk level and the volatility you’re comfortable with…

Then, you can scan for it.

I like to build my scans according to price. Scanning for penny stocks is a great way to access more volatility…

This can help small account traders with a good trading plan. Let’s look at an example of a stock under $5.

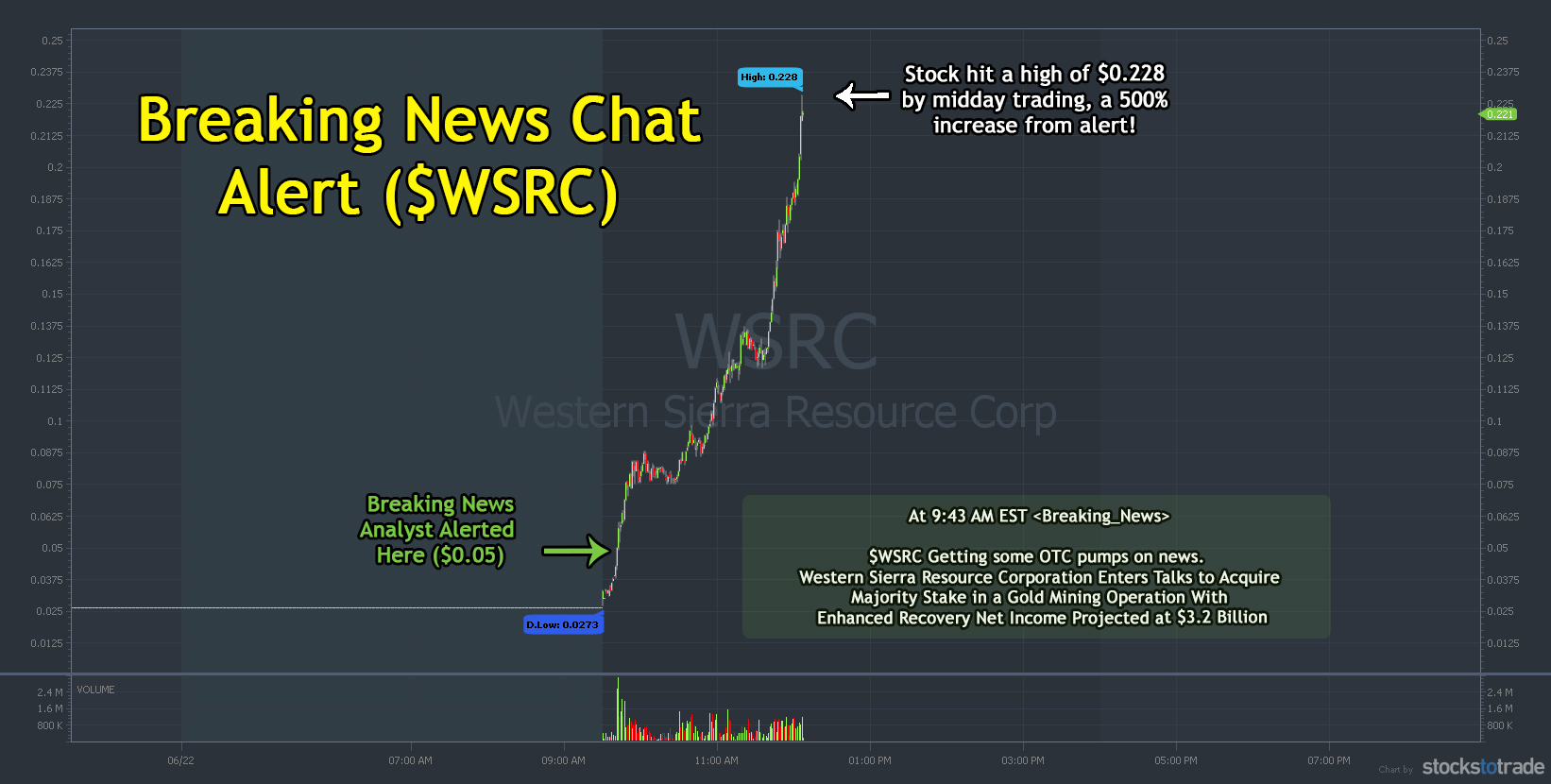

Western Sierra Resource Corp. (OTCPK: WSRC)

Like many pink sheet stocks, WSRC dabbles in a few hot sectors…

Whether you’re into hemp, green energy, or precious metals, they’ve got it. And in late June, people were buying.

On June 22, our StocksToTrade add-on, Breaking News Chat, alerted news of a mining acquisition…

It was probably just a Twitter pump, but it still sent the stock up 500% from the time of the alert. (Past performance is not indicative of future returns.)

At the end of trading that day, the stock had traded 192 million shares…

That’s textbook unusual volume. The stock’s average volume had been more like half a million. That’s the kind of activity we’re looking for.

Most Active Stocks Under $10

I’m more likely to scan for stocks in the $5–$10 range.

This scanner tweak helps me search for stocks that can have big price swings … And it eliminates the sketchier low-priced stocks that can blow up your account if you’re not careful.

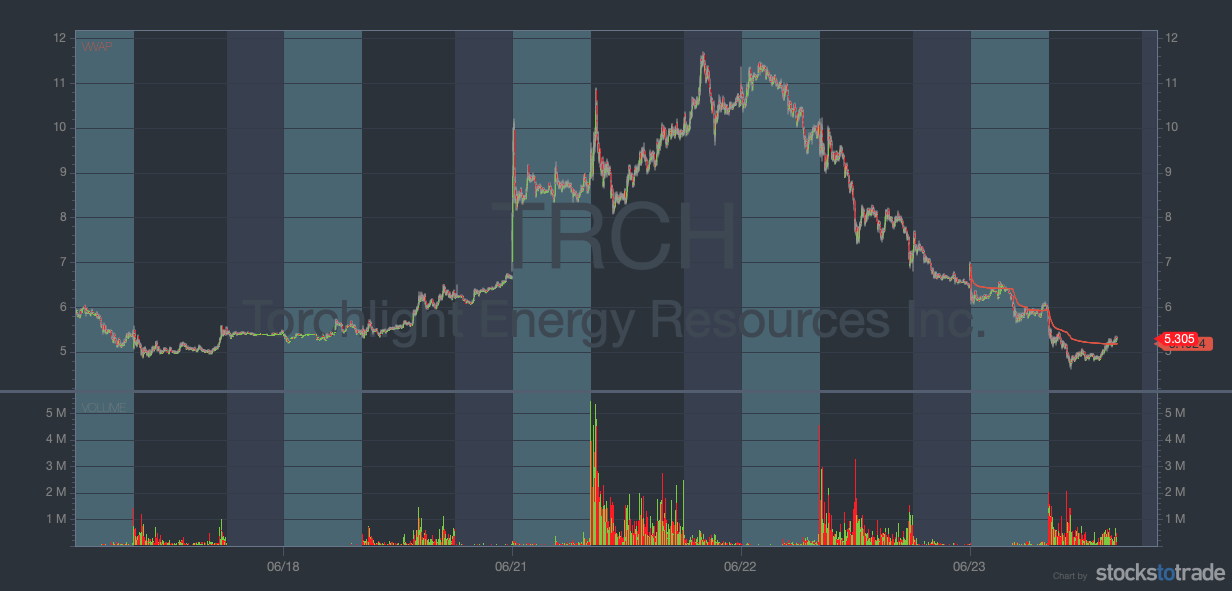

Torchlight Energy Resources, Inc. (NASDAQ: TRCH)

TRCH was in the energy sector…

It merged with high-tech materials maker Meta Material, Inc. (NASDAQ: MMAT) at the end of June. Before that happened, it went on a meme-fuelled run.

Check out this Pre-Market Briefing from June 21, the start of its run:

That day, it traded about 400 million shares. Its 30-day average? Under 50 million, even with the recent boost.

I recommended it as a possible dip and rip. Traders who caught the bottom and top of the swing could have made 45%…

TRCH wanted to profit, too, so they sold off $100 million in new shares, ending the rally.

It fell by about 30% the next day while trading over 200 million shares. Some traders made money by shorting it.

How StocksToTrade Can Help You Find the Most Active Stocks

Tapping into the potential of the most active stocks starts with your stock scanner.

Any free site will tell you what’s been trading big on the day.

StocksToTrade gives you the to-the-second volume info you need to make better-informed trades.

StocksToTrade has some of the cleanest charts out there. They show you where volume is coming in … and its relationship to price. It also comes with several built-in stock scans. These trader-designed scans target indicators with the highest trading potential.

For instance, if you’re only interested in the most active stocks on Nasdaq, StocksToTrade can scan for that. Want your results to stay below $10? It’s a simple tweak.

StocksToTrade also has major advantages on the preparation front. Its news scanner funnels in breaking news, earnings reports, tweets, and more. It’s your one-stop shop for the catalysts behind the most active stocks.

If you want an upgrade in your preparation, there’s also a range of add-on alerts…

Breaking News Chat, for instance, which I mentioned earlier, can help you prep for intraday volume spikes.

Small Cap Rockets is there to help OTC traders.

And Breakouts & Breakdowns alerts you to the other side of the volume equation: price moves.

Because it’s about preparing for volume spikes, not predicting them … Ideally, your trading platform can help you do both.

Grab your 14-day trial to see how StocksToTrade can help every day — only $7 here.

Conclusion

Like a lot of things in trading, knowing the most active stocks isn’t a silver bullet. It’s one of several indicators that smart traders use.

There are a number of things that high volume can tell you…

For one, it tells you that traders are paying attention. If a stock has high volume, you know they’re trading it…

But if that were enough for successful trades, every day trader would be rich. And we KNOW that’s not the case!

Smart trading isn’t about following the crowd. It’s about figuring out your strategies and using them to ride the momentum wave as long as you can…

That’s what we practice on the SteadyTrade Team. New traders — I don’t want you getting lost in the crowd. I want to offer you community. If these heavily traded stocks keep coming up on your radar, and you’re wondering what to do…

Join the SteadyTrade Team today — we’ll be there to help you build your plans.

How do watch the most active stocks? Which stock has the highest volume today on your watchlist? Let me know in the comments — I love hearing from my readers!