It seems just about every stock is breaking out this year, and everyone wants to know … what’s the best breakout trading strategy?

Trading breakouts is one of my favorite strategies in 2023. But it’s important to recognize a good opportunity before jumping into a breakout trade.

With so much going on in the market, now’s a great time to talk about it…

What’s the best way to catch stocks BEFORE they break out? StocksToTrade’s Breaking News Chat. This add-on feature for StocksToTrade subscribers alerts members to catalysts that can move the markets. It’s run by two market pros who scan all the news feeds for items with breakout potential. Try it for 14 days — it’s just $17.

So, aside from news, how can you take advantage of breakout trading? Read on…

Table of Contents

- 1 Breakout Trading: What Is It?

- 2 How Does Breakout Trading Work?

- 3 Benefits of Breakout Trading

- 4 Common Breakout Trading Concepts

- 5 Breakout Trading Indicators

- 6 What’s the Best Breakout Trading Strategy?

- 7 Intraday Trading Breakout Strategy

- 8 Forex Breakout Strategy

- 9 Swing Trading Breakout Strategy

- 10 Tips For Breakout Trading

- 11 How to Find or Predict Breakout Trades

- 12 How to Start Breakout Trading

- 13 Breakout Trading: The Bottom Line

Breakout Trading: What Is It?

First … what exactly is breakout trading?

A breakout is when a stock price moves above a resistance level — often a level it hasn’t broken through in the past. It’s usually accompanied by increased volume or sparked by some sort of catalyst, like a news story.

The goal of breakout trading is to be able to recognize a good setup and ride a stock’s momentum as it begins to break above resistance and set new highs. There are many different indicators that can point to a good potential breakout setup.

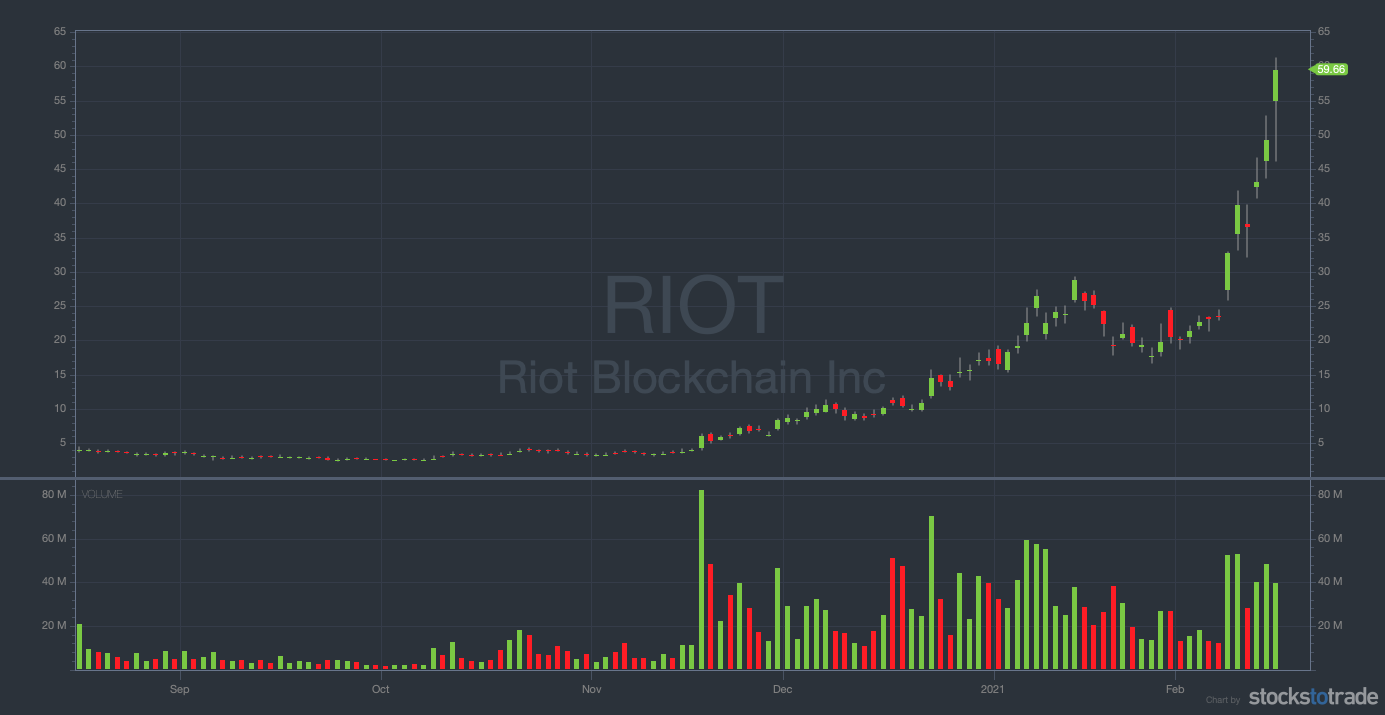

Here’s a perfect example of what a breakout trade might look like. It involved one of my favorite crypto-related plays, Riot Blockchain Inc. (NASDAQ: RIOT)…

If you’ve been tuning into the Pre-Market Prep, you know I’ve talked about this stock A LOT. If you haven’t been listening, check it out. I go live on Instagram daily at 8:30 a.m. Eastern.

With bitcoin hitting record highs in February, crypto-related stocks are hot. There are lots of potential breakout trade setups.

Check out the chart … you’ll see how, as bitcoin spiked to all-time highs, RIOT soared from the mid $30 range to almost $60.

How Does Breakout Trading Work?

Once you learn to recognize the signs of a breakout, the next step is finding the right entry and exit points. This comes from studying the charts, learning the patterns, and researching the setups.

The idea with breakout trading is to enter a trade just as a stock’s momentum is picking up and it’s breaking new highs. The last thing you want to do is jump in too late and stay for too long because of FOMO.

Stick to a trading plan. A good trading plan will include an entry/exit strategy and trading goals. It should cover anything that could possibly happen during a trade. No surprises.

Benefits of Breakout Trading

There are so many opportunities for trading these days. In the 15 years I’ve been at this, I don’t think I’ve EVER seen the market so hot!

That’s why breakout trading is one of my favorite trading strategies for this year.

At the same time, the 2021 market is volatile … It can be difficult to navigate, especially for newer traders. Newbies need to resist urges to fight the market trend. That’s a good way to blow up an account.

Breakout trading is confirmation of a stock’s momentum. It allows you to follow the trend. As a trader, you do NOT need to be first. In fact, you rarely want to be first. You want to be a follower. Follow the trends…

Common Breakout Trading Concepts

Support Level

When looking to trade a breakout, support and resistance levels are crucial.

When a stock price consolidates, it sets new support and resistance levels. These levels are where the bulls and bears duke it out…

The support level is where buyers tend to enter a trade. If a stock’s price maintains the support level, that could be a sign that it could break out soon.

But if a stock breaks the support level and continues lower, it’s usually a sign that the stock is no longer a good potential trade.

Traders use support and resistance levels to plan entry and exit points for trades.

Resistance Level

Resistance is the level a stock’s price must break for it to be considered a breakout. When breakout trading, traders look for stocks close to breaking resistance levels.

A stock that consistently breaks the resistance level is one sign that it may be a potential breakout. And when stocks break out of these areas — up or down — they often set new levels for new positions.

It’s important to understand these concepts. Especially when setting stop losses.

Breakout Trading Indicators

Let’s go over key indicators for spotting potential breakouts…

Volume

Volume might be the most important indicator for trading breakouts. If the volume is high, that could indicate a potential breakout trade. If a stock is trading with low volume, it’s less likely to break out.

What’s considered high volume in today’s market? These days high volume stocks trade hundreds of millions of shares in a single trading day — I know, crazy!

Any number of things could cause a stock’s volume to spike. It could be any kind of catalyst, like news of a merger or a big contract. That’s why it’s important to keep up with the news.

Volatility

The best breakout trading opportunities usually come with increased volatility.

But volatility can be good or bad when breakout trading. In today’s market, you need to be especially careful. Stocks move fast — and I mean FAST!

That’s why it’s so important to use a great trading platform. If you’re looking for one, check out StocksToTrade. It’s got all the indicators you need, plus beautiful charts, scanners, and more! It has a TON of tools and resources that will make even the most experienced traders happy. Grab a 14-day trial for only $7.

Resistance and Support

Resistance and support levels are key price points a stock must break to be considered a breakout.

If a stock continually tests and breaks resistance or support levels and then consolidates, there’s a good chance it’s a candidate for a breakout trade.

If a stock continues to climb past resistance points, the buyers are in control.

New Highs

As a stock’s price climbs, it could continue to break new price records. Highs for the day, multi-month highs, or one-year highs can indicate key breakout points.

Once a stock passes a previous high, it typically continues to climb until it establishes a new high or a new resistance level.

In breakout trading, traders keep an eye out for these possible breakout signals.

Patterns

History doesn’t repeat itself exactly — but it does rhyme. You may have heard me say this…

Breakout trading is a perfect example. One key indicator for determining a potential breakout trade is a stock’s chart history.

Previous chart patterns can help traders predict a stock’s next moves. If it’s a former runner with a history of breaking out, that could be a strong indicator for another breakout. The pattern could repeat — and likely will. Yet another reason to learn chart patterns.

What’s the Best Breakout Trading Strategy?

It’s whatever strategy works best for you. Every trade is different. There’s no single ‘best’ strategy that works for everyone or every breakout trade.

A smart trader approaches every potential breakout trade like a sniper — analyze the situation, create a plan, and execute. They’ll watch a stock’s price action as it tests new levels and build a trading plan based on that.

With any strategy, it’s important to study the charts, learn the patterns, determine support and resistance, watch the volume — and be patient. Then, they wait for the right moment and always stick to a trading plan.

Intraday Trading Breakout Strategy

Intraday trading is trading within the same day, during regular market hours.

With intraday breakout trading, the approach is the same as for a breakout swing trade or position trade — just condensed. Instead of trading over days or weeks, you’re entering and exiting a trade within a single day. Traders still need to go through the same steps, look for indicators, and create a trading plan.

Same concept, same approach, same plan — same-day timeline.

Forex Breakout Strategy

Forex, or foreign exchange, trading is different from stock trading. The forex market is available 24 hours a day. It could also be riskier, given the size of this global market.

Forex trading isn’t available on the StocksToTrade platform, nor is it something we focus on in the SteadyTrade Team.

But breakouts can happen in forex, just like in any other market. If you decide forex trading is something you’re interested in, do your research. Learn how breakouts play out and hone your strategy.

Swing Trading Breakout Strategy

Swing trading involves holding a trade over a longer period — a few days to several weeks.

It’s common for traders to swing trade breakout trades. Because they’re holding a stock for much longer than in a day trade, they pay more attention to the stock’s chart history. They need to recognize which way a stock’s trending and where it may go over the next several days, weeks, or even months.

But just like any other trader, swing traders build detailed plans to enter and exit trades based on support and resistance, patterns, and trends. You gotta be ready to hold through volatility and not get stopped out. Learn more about swing trading here.

Tips For Breakout Trading

Now let’s get into some top tips for this strategy…

#1: Wait for High Volume

A surge in trading volume is one of the best ways to confirm a breakout.

If a stock on your watchlist has been consolidating and volume is low, then all of a sudden you see a big spike in volume, that can be a solid breakout confirmation sign.

Any kind of catalyst — earnings, a merger, a new product, a management shakeup — could spark a spike in volume. It’s another great sign for a potential breakout trade. But it’s important to be patient. Wait for the volume to increase before you jump in.

#2: Scan for Potential Trades

The scanner is one of the best trading tools out there. A scanner can sort through a huge number of stocks for a certain set of criteria.

And the earlier you can recognize the pattern on a potential breakout opportunity, the better.

If you’re looking for an easy-to-use trading platform with great trading tools, check out StocksToTrade. It was built by traders, for traders, and it’s loaded with customizable scanners and screeners with almost infinite search criteria. Try StocksToTrade for 14 days for only $7.

#3: Build a Watchlist

Building a watchlist is a must for every trader. It’s your list of stocks that you monitor for potential trading opportunities.

With so many stocks breaking out, hitting new highs, and trading ridiculous volume every day, how can you possibly determine which are the right setups for you? Without a watchlist, you can’t.

Run the scans, find the stocks that best fit your trading setup, and add them to your watchlist. That helps you stay focused. Need help finding the top stocks to watch every week? Sign up for my no-cost weekly watchlist and get my picks every Sunday!

#4: Trade With the Trend

As a general rule, you should always stick to breakouts that flow with the trend, especially if you’re new to trading. Keep it simple. Focus on breakouts that go in the direction of the market trend.

Don’t try to short a stock in a hot sector with momentum, trending up, with high volume. And don’t go long on a low-volume stock in a dying sector that’s losing momentum.

#5: Focus on Hot Sectors

In a constantly changing world, there are always new hot sectors. Sometimes big news can make a whole sector hot.

With breakout trading, focus on the hot sectors. That’s where you can find the most stocks with the most volatility and volume.

So far in 2021, we’ve seen hot sectors in electric vehicles, weed stocks, solar stocks … heck, even meme stocks! Learn from all the action now so you can be ready for the next hot sector.

#6 Set Limits

It takes time to learn breakout trading. You will have ups and downs.

Set realistic goals, as well as limits on the amount of money you’re willing to spend — and potentially lose — when trading breakouts. In a volatile market, you need to be prepared with a trading plan and set trading limits.

Limiting your losses and maximizing your gains will help you develop your trading skills. Remember, sometimes a small loss is a win.

#7 Have a Trading Plan

When you’re planning to enter into a breakout trade, think about it like building a house…

If you want your house built just as you imagined it, you stick to the plan. A solid trading plan will include every decision you could make. It could include what setups to look for and what types of stocks you’d like to trade. Then there are the indicators you’ll watch, how much you can risk, and how you plan your entries/exits.

No matter how wild the markets get, stick to your trading plan!

How to Find or Predict Breakout Trades

One of the easiest ways to find potential breakout trades is to use a scanning tool. Being able to predict potential breakout trades is more difficult. It takes studying, research, and practice to be able to recognize good breakout setups.

How to Start Breakout Trading

Start small, or start with paper trading.

Remember, practice makes perfect. Take your time, study the charts, learn the patterns. Be patient. Wait for the right setups. Don’t force trades. Take all the tips from this article and put them into action. Remember to trade smart.

And remember the thousands of free resources available to you from StocksToTrade … There are videos, blog posts, and the Pre-Market Prep, to name a few…

Breakout Trading: The Bottom Line

Well, there you have it … top tips and strategies to use for breakout trading.

Remember to trade with the trends and go with a stock’s momentum when trading breakouts. Continue to develop your skills!

The best traders know that a market education is never over. It’s constant. Markets are always changing and developing — so as a trader, you need to grow too.

If you’re ready to level up your training, consider joining the SteadyTrade Team. It’s a great community of serious traders who support each other as they find their way in the markets .

And if you need a solid trading platform, I don’t think you can’t go wrong with StocksToTrade.

Try StocksToTrade for 14 days for only $7.

What do you think about breakout trading? Have you traded breakouts? Let me know in the comments!