Low Float Stocks: Key Takeaways

- The lowdown on low float stocks…

- Top low float penny stocks to watch…

- How to find low float stocks…

Grab your 14-day trial of StocksToTrade here for just $7.

I love low float stocks because of their ability to MOVE. They can provide great upside opportunities for day traders. But with these stocks also comes risk. Read on to learn more about the pros and cons — and the low float stocks to watch right now…

Table of Contents

- 1 What Is a Low Float Stock?

- 2 Low Float Stocks Are Volatile

- 3 List of Low Float Stocks to Watch

- 3.1 Low Float Stocks #1: AMCON Distributing Company (NYSEAMERICAN: DIT)

- 3.2 Low Float Stocks #2: Biglari Holdings Inc. (NYSE

- 3.3 Low Float Stocks #3: Chicago Rivet & Machine Co. (NYSEAMERICAN: CVR)

- 3.4 Low Float Stocks #4: Regional Health Properties Inc. (NYSEAMERICAN: RHE)

- 3.5 Low Float Stocks #5: Wah Fu Education Group Limited (NASDAQ

- 4 Low Float Penny Stocks

- 4.1 Low Float Penny Stocks #1: American Shared Hospital Services (NYSEAMERICAN: AMS)

- 4.2 Low Float Penny Stocks #2: Antelope Enterprise Holdings Limited (NASDAQ

- 4.3 Low Float Penny Stocks #3: Data Storage Corporation (NASDAQ

- 4.4 Low Float Penny Stocks #4: Euro Tech Holdings Company Limited (NASDAQ

- 4.5 Low Float Penny Stocks #5: Recon Technology Ltd. (NASDAQ

- 5 Use StocksToTrade to Find Low Float Stocks

What Is a Low Float Stock?

A low float stock is a stock with a relatively small number of available shares on the market.

That doesn’t mean these companies don’t have a lot of shares. They often do. But they’re usually closely held by institutional investors, employees, or other major stakeholders.

For example, a company could have 50 million total shares but only 10% available for the public markets. This means traders only have access to five million shares.

That’s part of what makes low float stocks attractive … if you know what to look for.

Low Float Stocks Are Volatile

Day traders typically love massive price swings. Low float stocks often provide that.

Stock prices vary according to supply and demand. When good or bad news hits a stock that has limited supply, it doesn’t take much for it to leave an impression on the market.

A low float stock can make huge gains when demand skyrockets. It can also head the other way just as quickly if demand nosedives.

If you don’t act quickly enough, you could be stuck with a sinking stock. You have to be prepared.

I often review low float stocks during my premarket sessions. Join me live every morning at 8:30 Eastern to prep for the trading day.

List of Low Float Stocks to Watch

Many day traders and swing traders enjoy the power of low float stocks. Let’s check out some examples of low float stocks to watch…

And don’t forget to sign up for my NO-COST weekly watchlist of hand-picked stocks.

Low Float Stocks #1: AMCON Distributing Company (NYSEAMERICAN: DIT)

DIT has a float of approximately 152,000 shares.

It trades just a few thousand shares a day. So it’s prone to having major intraday swings…

Low Float Stocks #2: Biglari Holdings Inc. (NYSE: BH)

BH has a float of 913,000 shares.

It’s a relatively steady low floater. But it’s capable of some big intraday swings…

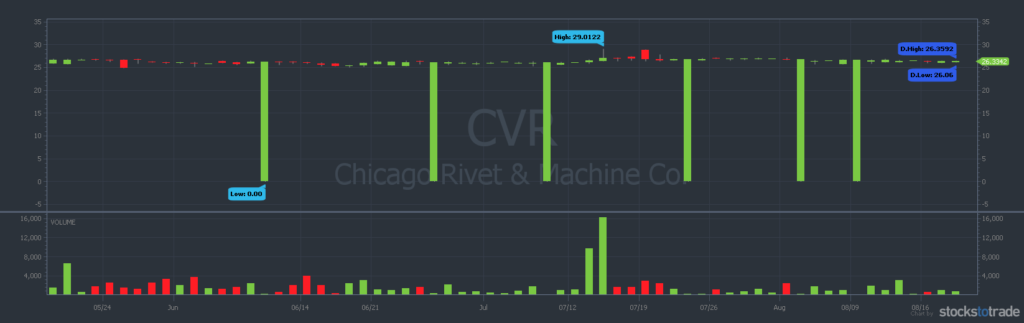

Low Float Stocks #3: Chicago Rivet & Machine Co. (NYSEAMERICAN: CVR)

CVR has a float of 786,000 shares.

This stock trades a couple of hundred shares on most days. That makes for an interesting-looking chart…

Low Float Stocks #4: Regional Health Properties Inc. (NYSEAMERICAN: RHE)

RHE has a float of 1.62 million shares.

Some days it trades millions of shares with nice swings. But most of the time, it’s pretty quiet…

Low Float Stocks #5: Wah Fu Education Group Limited (NASDAQ: WAFU)

WAFU has a float of 1.18 million shares and trades fewer than 10,000 most days… When that volume kicks in though, it can offer some great trading opportunities.

Low Float Penny Stocks

Oh boy. Penny stocks are where the fun really begins…

AMS has a float of 4.8 million shares. This is another slow-chugger that can move up or down quickly with the right catalysts…

Low Float Penny Stocks #2: Antelope Enterprise Holdings Limited (NASDAQ: AEHL)

AEHL has a float of 3.41 million.

It doesn’t see a lot of trading activity on most days. But it had a day in July with over 40 million traded shares…

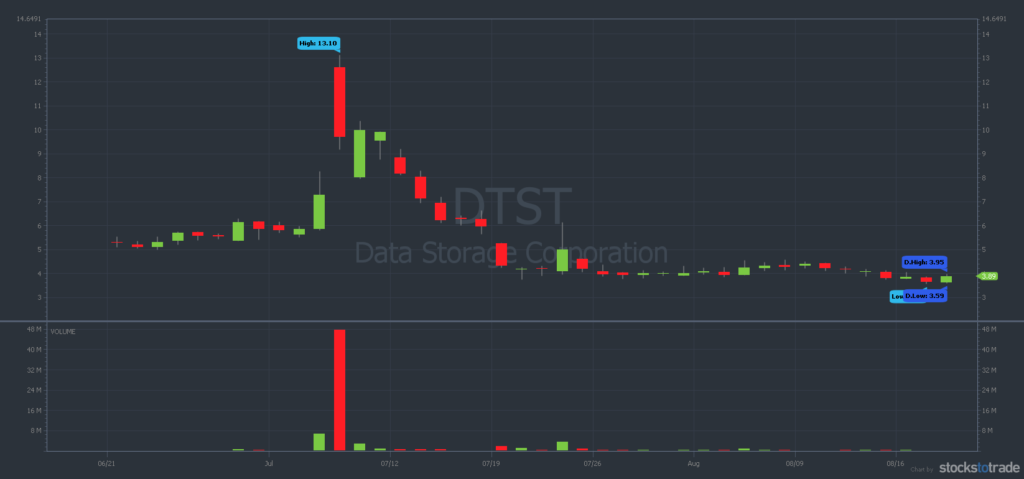

Low Float Penny Stocks #3: Data Storage Corporation (NASDAQ: DTST)

DTST will raise AEHL one higher … It had a trading day of 48 million shares in July.

The stock has a float of just 4.14 million shares.

Low Float Penny Stocks #4: Euro Tech Holdings Company Limited (NASDAQ: CLWT)

CLWT has a float of 1.37 million shares.

The stock’s had some big runs in the past few months, trading a few million shares.

Low Float Penny Stocks #5: Recon Technology Ltd. (NASDAQ: RCON)

RCON has a float of 2.38 million.

It saw a major selloff in June with over 120 million shares traded…

Use StocksToTrade to Find Low Float Stocks

If you wonder how to find low float stocks, I have plenty of tips for you…

I use StocksToTrade to find great low float trading opportunities. With built-in scans, great charts, tons of indicators, and more, it makes finding stocks to trade that much easier. Try a 14-day trial for just $7!

And you can add on our Breaking News Chat to get alerts to news and catalysts that can move low float stocks BIG … Grab your 14-day trial of STT + BNC today for $17!

Read for pro-level guidance? Join the SteadyTrade team! It’s a great way to hone your chart skills and strategies alongside veteran traders — including me.

How do you trade low float stocks? Let me know with a comment below!