Finding good day trading setups helps you trade with a plan — not just a hope that a stock will go up.

It’s the difference between being a well prepared trader and a gambler…

Day trading setups are a HUGE part of trading … and identifying which ones work for you can change everything.

So what are day trading setups — and how can you use them? Let’s dive in…

Table of Contents

What Is a Day Trading Setup?

You probably already know that day trading is executing a trade in a single day.

A day trading setup helps you identify trading opportunities, trends, and entry points.

Smart day trading setups require smart technology. While it’s possible to day trade using just a smartphone, a more sophisticated setup involves a reliable computer (like these systems). A trading platform can help simplify things too.

Why Use a Day Trading Setup?

To trade, you need to know patterns, price action, and how to spot YOUR best plays.

That all helps you make informed decisions and take strategic action.

What’s not to like, right? Here are a few setups that rank high among many day traders’ favorites. This is a great starting point to introduce you to top day trading setups.

4 Favorite Day Trading Setups

There are many trade setups. So it’s important to choose the strategy that best suits your trading style.

The following four setups can help you manage risk and allocate resources. Mastering just one of these setups can help you trade with more confidence — and hopefully better results.

1. Day Trading Breakout Setup

The breakout can help you monitor potential losses because you can often see immediately when things go south. And in trading, you always want to cut losses quickly!

You can also apply breakout trading concepts to many securities, from stocks to cryptocurrency.

This strategy relies heavily on technical analysis, aka support and resistance.

Traders aim to buy when the stock breaks above a failed resistance level and sell when the market breaks below a failed support level.

Beware of those false breakouts and always do your research before you trade.

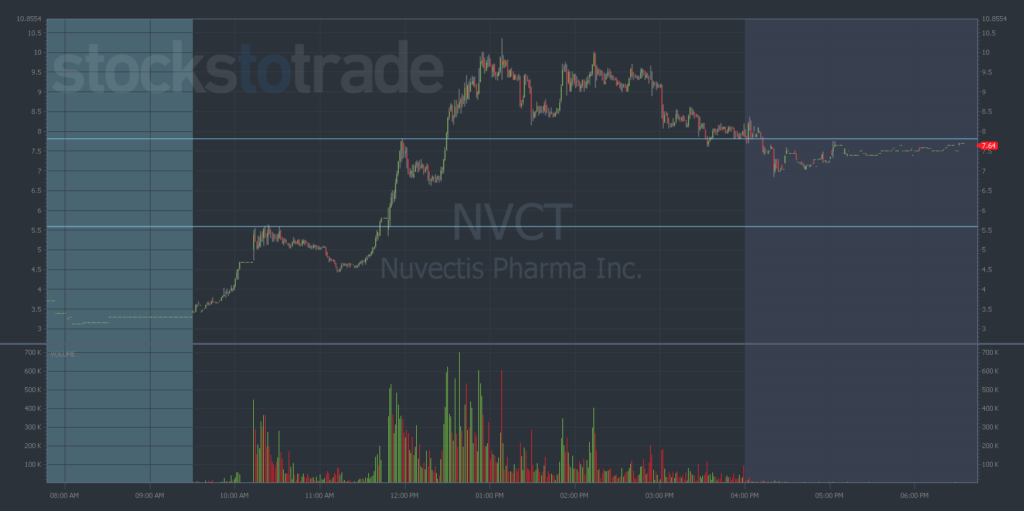

Check out this February 7 example from Nuvectis Pharma, Inc. Common Stock (NASDAQ: NVCT) … It broke resistance twice for a HUGE breakout!

Considering the potential for fast returns and the excitement of surfing stock momentum, you can see why breakout trading is such a popular technique.

Read more about breakout trading here.

Now let’s take a look at ranges…

2. Trading Ranges Setup

A range-bound trading strategy focuses on stocks with sideways price action between two prices. These are referred to as “range-bound” stocks.

Fun fact: Range trading is especially popular among forex traders.

The range trading strategy takes advantage of the percentage of the market that’s non-trending. For example, if the market only trends 30% of the time, this leaves 70% of the market to experiment with.

Trading ranges also consider support and resistance. Why? Because fluctuating price levels create support and resistance levels.

First, confirm the price range. Check for at least two similar highs and lows for a range-bound setup.

One of the trickiest parts of range-bound trading is finding those two points that represent support and resistance levels.

Unlike many setups, trading ranges don’t offer the opportunity to ride a stock trend — but the highs and lows involved can be fairly predictable.

So once you get the hang of them, trading range-bound stocks could be a great strategy.

There are many approaches to range-bound trading, but the simplest is to buy near support and sell at resistance. You don’t be on the wrong side of the breakout, so keep an eye out!

Range trading is a lot easier over a longer period of time. But you can find these setups intraday as well…

It’s important to note here that tracking trading volume is just as important as watching support and resistance patterns. At the end of the day, range trading relies on the assumption that a price will fluctuate between certain highs and lows.

Many traders use indicators such as relative strength to help identify entries, exits, support, and resistance.

Now let’s talk flags…

3. Trading the Flag Setup

There are several types of flag patterns, like bull flags and bear flags. The main differences are the trend direction.

Flag trading can be great for new traders since they can be easy to spot and trade.

The flag formation is a result of a stock making a strong move upward on high volume. That forms the pole shape. Then it consolidates at the top of the pole on lighter volume, forming the flag.

This trend continues when the stock breaks out of consolidation — again on high volume. The direction in which the flag is “blowing” indicates the primary trend.

To identify a strongly trending flag, look for patterns with less than 23.6% retracements.

Flag patterns stay above the 23.6% threshold. You place your purchase on the break of the high.

It’s also important to watch for impulsive moves that have little to no retracements.

Flag trading can follow a momentum trading strategy, and these stocks are normally traded on two- and five-minute time frames. It isn’t just a day trading setup either. Swing traders can use it.

This setup can be simple to learn, but identifying flags can be tricky. That’s where a scanner can help find stocks that are surging then consolidating to form a flag pattern.

Once the price breaks out above the consolidation pattern on high volume, it’s time to strike.

Volume is key with flag trading too. It confirms the pattern.

Learn more about the bull flag pattern here.

Now, last but not least, it’s triangle time…

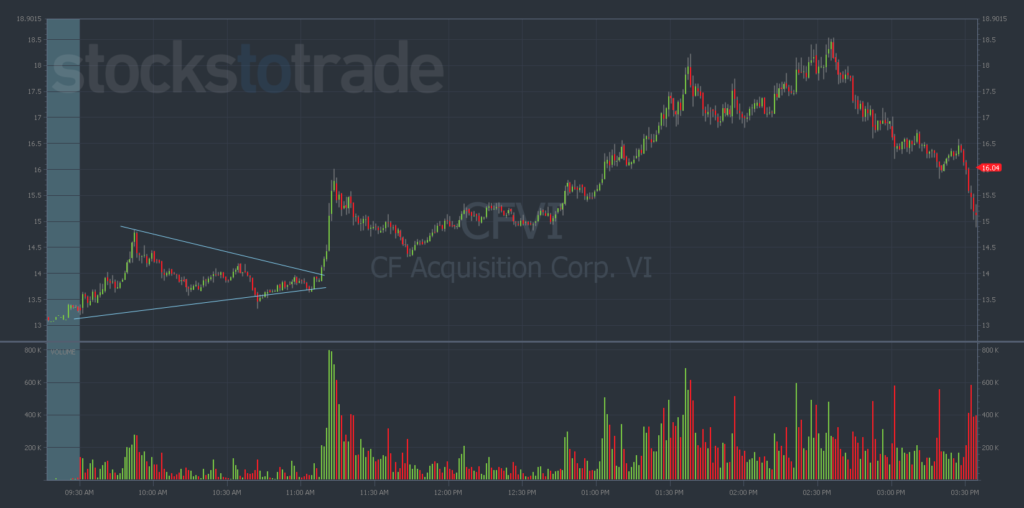

4. Triangles Setup

Triangle trading occurs with highly volatile stocks.

A triangle pattern needs a minimum of two swing highs and two swing lows that both connect to trend lines that extend to the right.

There are three different types of triangles — symmetric, ascending, and descending. And you can trade them all using the same breakout strategy.

Always make sure that strong movement and volatility precede the triangle formation, then draw the trendline once you see the triangle pattern forming.

With the triangle setup, you buy below the most recent swing low and sell above the most recent swing high.

Another fun fact: Potential profit is always calculated based on the triangle height.

If you’re interested in triangle trading, try it with a paper trading account first. It’s a no-risk way to hone your skills before you start trading real capital.

When using a triangle setup, remember that your target — as with all trading in general — isn’t an exact science. A good rule of thumb: aim for a reward of at least three to four times as much as your risk.

Brush up on the ascending triangle pattern here.

Key Points for Day Trading Setups

Remember these four points…

1. Follow Chart Patterns

Before you can find great trading setups, it’s crucial to learn to read charts and identify chart patterns.

As traders, we can never predict price action with absolute certainty. But once you start gauging historical price action from chart activity, you’re taking steps to make smarter trades.

So whatever day trading setup you decide to follow, make sure you’re confident in following chart patterns.

2. Identify Trends

The trend is your friend! Seasoned traders know this well.

Identifying trends (like support and resistance) in chart patterns is necessary for all day trading setups. To avoid risk and unnecessary losses, keep it simple and trade with the trend.

Determining trends comes with trading experience. Be willing to do the work and stick with it.

3. Stick to Your Trading Plan

Your trading plan defines which stocks you plan to buy and sell, which day trading setup you’ll follow, and which resources you’ll use to keep you on track.

Without a solid trading plan, you’re just gambling. It’s that important. Learn to create a trading plan now.

4. Use a Great Stock Screener

To find the best trading opportunities each day, you need the right software.

StocksToTrade is a one-stop shop for scanning, charting, watchlists, news feeds, and more. Ready to start trading at a higher level? Start your StocksToTrade trial now!

And for more in-depth help, check out the SteadyTrade Team!

The Bottom Line

Trading setups can improve your ability to read charts, identify patterns, and understand trends in the market.

Try out different setups and see what works best for you!

Once you get into the swing of a setup that works for you, see how far you can go to perfect your technique … You might be surprised by how far it takes you.

What are your favorite day trading setups — and why? Leave a comment below and tell me!