Paper trading allows traders to simulate real trading with virtual money. This risk-free environment is perfect for beginners to familiarize themselves with trading platforms, securities, and the mechanics of placing trades without the stress of potential losses. It works by using simulated trading platforms that mirror live market conditions, enabling traders to execute buy and sell orders, test trading strategies, and gain experience with the market’s volatility and dynamics.

Read this article for a quick-start intro to paper trading, which provides a risk-free platform for beginners to learn trading basics and test strategies without financial loss.

I’ll answer the following questions:

- What is paper trading?

- How effective is paper trading for beginners?

- Is paper trading real or fake?

- What are the pros and cons of paper trading?

- How can paper trading simulate real trading conditions?

- Are paper trading and stock simulators the same thing?

- How does paper trading help in understanding market psychology?

- How to transition from paper trading to real trading?

Let’s get to the content!

Table of Contents

- 1 What Is Paper Trading?

- 2 Pros of Paper Trading

- 3 Cons of Paper Trading

- 4 Example of Paper Trading

- 5 Reasons for Paper Trading

- 6 Paper Trade Accounts vs. Live Accounts

- 7 Why Use a Stock Market Simulator?

- 8 Top Paper Trading Simulators

- 9 How to Choose a Stock Market Simulator

- 10 Paper Trade the Right Way

- 11 How to Transition from Paper Trading to Real Trading

- 12 Paper Trading: The Bottom Line

- 13 Frequently Asked Questions

- 13.1 How Effective Is Paper Trading?

- 13.2 Is Paper Trading Real or Fake?

- 13.3 Are Paper Trading and Stock Simulators the Same Thing?

- 13.4 What Are the Key Components of Paper Trading and How Does It Benefit Beginners?

- 13.5 How Can Financial Tools and Resources Enhance Paper Trading Practice?

- 13.6 What Role Do Professional Development and Life Skills Play in Successful Investing?

- 13.7 In Paper Trading, How Important Are Analysis and Feedback?

- 13.8 How Do Fees and Loan Rates Impact Paper Trading Simulations?

- 13.9 What Resources and Considerations Are Vital for Effective Paper Trading?

- 13.10 How Can Traders Leverage Community Insights and Practical Applications in Paper Trading?

What Is Paper Trading?

Paper trading is simulated trading. It’s a way for anyone to test out trading and see how trades would perform in real time without risking a cent of capital.

You find and research stocks, set entries and stop losses, and choose order types. It’s just like trading with a live account…

But instead of entering trades in the live market, you watch them play out virtually.

And you learn by recording all the details. You could note them in a trading journal or use a spreadsheet. But the easiest way is to use a trading platform with a paper trading feature — like StocksToTrade.

As you follow along with the trade, you make the same decisions you would if you were trading with a real account. So be prepared to decide when to close the trade, when to buy more, and so on.

Paper trading is a no-risk, real-time education in the markets.

Pretty cool, right?

Pros of Paper Trading

- Risk-Free Learning Environment: Paper trading offers a safe platform for beginners to learn the basics of trading without the risk of losing money. This environment is perfect for understanding market mechanisms, price movements, and the impact of economic events on markets.

- Testing Strategies: It provides an excellent opportunity to test out trading strategies and see how they would perform in real market conditions without any financial risk. Whether it’s swing trading, day trading, or experimenting with bonds, crypto, or stocks, paper trading lets you refine your approach based on actual market data.

- Understanding Market Psychology: Engaging in paper trading helps beginners grasp how market psychology affects trading decisions and outcomes. It’s a chance to experience how news, earnings reports, and market trends can influence investor sentiment and price movements, all without the stress of real financial stakes.

- Learning Platform Features: Many brokerages, including platforms like Interactive Brokers, offer paper trading as part of their service. This feature allows investors to familiarize themselves with the brokerage’s trading platform, learning how to place orders, monitor trades, manage investment portfolios, and use analytical tools in a no-pressure setting.

In my experience, the best thing about paper trading is it will give you the space to figure out the trading style that best suits your personality, risk tolerance, and investment horizon. Position trading and swing trading are two strategies that offer alternatives to the fast-paced nature of day trading. Position trading involves holding trades for weeks to months to capitalize on expected trends, while swing trading focuses on capturing gains in a stock within a span of a few days to weeks. Understanding the differences between these styles can help you develop a more rounded trading strategy. For a comprehensive comparison of position trading vs. swing trading, check out our article on position trading vs. swing trading.

Cons of Paper Trading

- Lack of Emotional Investment: While paper trading removes financial risk, it also lacks the emotional weight of real trading, which can lead to a disconnect in how decisions are made. The fear of loss and the thrill of making a profit play a significant role in trading, impacting decisions and strategies. Without this emotional involvement, the experience can be less instructive.

- No Real Money Gain: The flip side of not risking real money is not being able to make any real profits. While seeing paper profits can be encouraging, it doesn’t match the satisfaction or financial benefits of successful real-world trading.

- Misleading Results Due to Slippage: Paper trading often doesn’t account for slippage — the difference between the expected price of a trade and the price at which the trade is executed in a live market. This discrepancy can lead to overly optimistic results in a simulated environment.

- Overconfidence: Successful paper trading might lead to overconfidence for beginners, who may not fully appreciate the complexity and risks of real-market trading. This false sense of security can result in harsh lessons when transitioning to live trading with real money.

There’s a lot more to real-money trading than buy low, sell high — especially when navigating the pattern day trader (PDT) rule with an account balance under $25,000. Understanding how to effectively day trade with a smaller account is crucial for new traders looking to make the leap without hitting regulatory snags. Strategies such as swing trading, using a cash account to avoid PDT restrictions, and focusing on quality trades over quantity can help in maximizing the potential of a smaller account. For detailed strategies and tips on day trading with an account under $25K, explore our article on day trading rules under $25K.

Example of Paper Trading

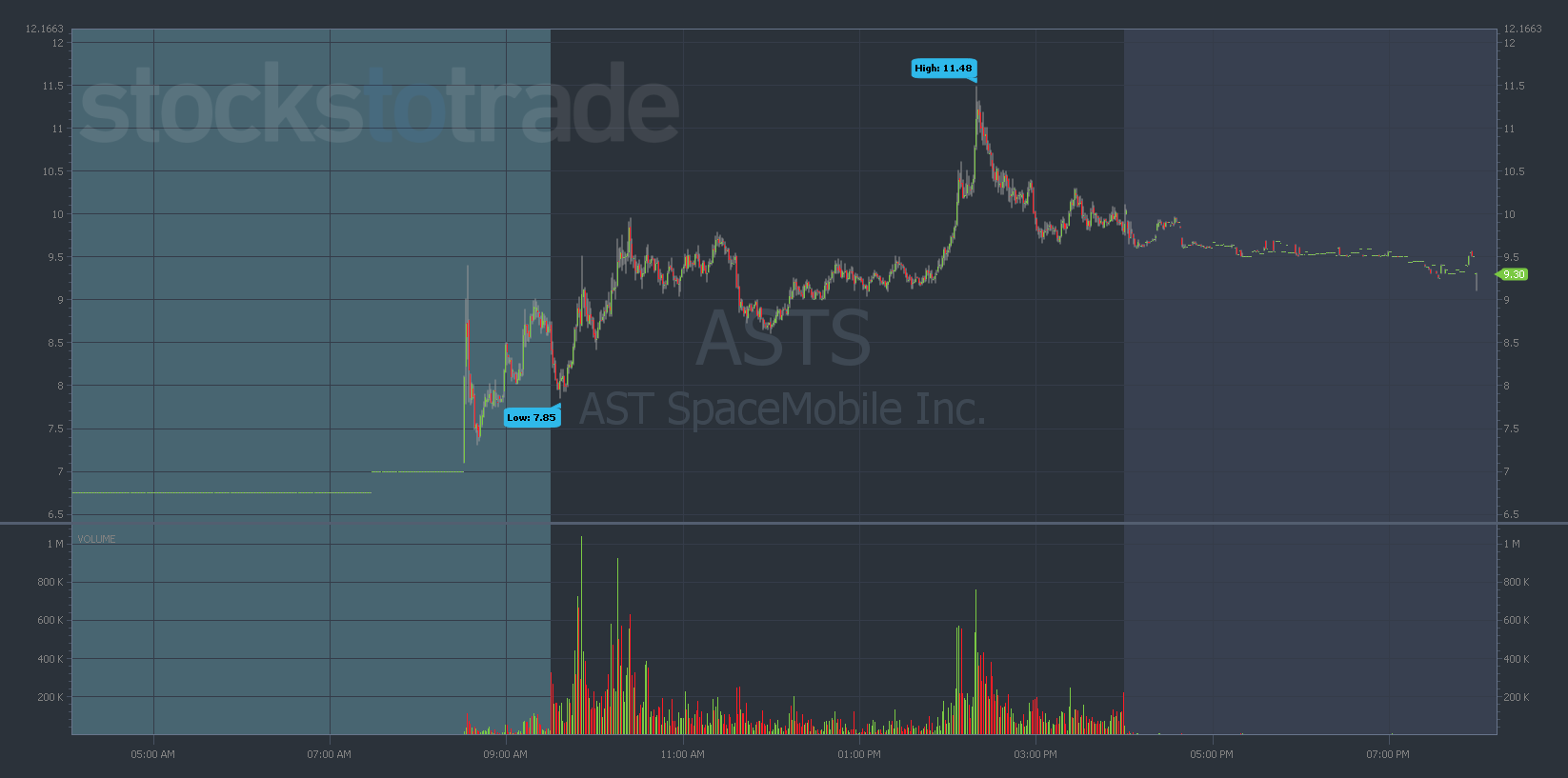

© StocksToTrade

Let’s look at an example of a paper trade…

AST SpaceMobile, Inc. (NASDAQ: ASTS) just agreed to a deal with SpaceX and jumped in premarket trading. You want a piece of the action…

ASTS traded sideways once the market opened, and because you’re smart and listen to me, you wait for the stock to break premarket highs. A little after 2 p.m., it does just that and begins to soar.

Your time to cash in is now. You place a limit order in your paper trading module at $10.25 per share, snatching up 10,000 shares because … you can!

You see the potential to gain $1 per share and set your sights for $11.25. The stock gets to about $11.50 per share, meaning you left a little on the table…

But you can’t complain. You just made a 10% gain!

Now, since this was a paper trade, you didn’t actually make $10,000. But you got great practice and put some skin in the game, even if it was artificial.

I went a little big on this example, but really, you want to make sure that you’re using realistic stock picks and position sizes for your account and strategy. More on that in a bit.

Reasons for Paper Trading

Here’s how traders of all skill levels can benefit from simulated trading…

Gain Real-Time Experience

When you’re a beginner, you have so much to learn. Just like anything, you need to practice.

You’ll need to balance things like finding your best strategies, scanning trade opportunities, entering orders, managing trades, cutting losses … The list goes on.

Don’t expect to get it all right when you’re starting. That’s unrealistic. And it’s why I tell newbies to paper trade before they fund a live account.

Paper trading allows new traders to learn the ins and outs of watching the stock market and placing orders. They also get screen time, experience, and practice executing a strategy.

It’s a no-risk, high-upside activity. If you’re new, it’s smart to paper trade first.

Test and Master New Strategies and Setups

Maybe you have some experience under your belt and discover a new setup to try. The problem?

You don’t have any stats on how you’ll perform with this strategy.

You could trade the setup and hope for the best … But if you want to trade smarter, why risk the capital?

In this case, many traders do what’s called forward-testing. They trade their normal strategy with real money, while paper trading new setups.

In this case, many traders do what’s called forward-testing. They trade their normal strategy with real money, while paper trading new setups.

If you’re excited about a new setup, paper trade it until you feel confident that the setup can work for you.

Adapt to a Changing Market

Even the most hardened, experienced traders can — and should — paper trade at times.

Every trader can go through losing streaks. It’s tough on any trader. You can take a hit in your confidence.

It can happen for several reasons, and it’s totally normal. Maybe the market shifts and your setups aren’t working.

If you’re an experienced trader struggling in the current market, it’s smart to step back and paper trade for a while.

Think of yourself like a pro athlete taking time away from competing to practice and ultimately get back to the game.

Paper Trade Accounts vs. Live Accounts

© StocksToTrade

The main benefit of a paper trading account is the ability to test different setups without risking real money.

The road to success in anything includes lots of mistakes. Paper trading allows traders to make those mistakes without hefty losses.

But there’s a drawback … These accounts aren’t real — and that can diminish traders’ needs to manage their emotions.

Yes, there’s value in learning different setups without worrying about blowing up your account.

But emotions can affect decision-making drastically. They can cause you to enter trades you have no business being in and scare you out of trade plans that need more time to work.

When real money’s on the line, your emotions can take hold — fast.

And you can’t grow your capital until you start trading for real.

Why Use a Stock Market Simulator?

A stock market simulator offers a blend of education and practical experience. It’s an essential tool for understanding market mechanics, testing investment strategies, and learning how to manage investments effectively. Simulators provide a hands-on learning experience, presenting an opportunity to practice without financial repercussions. They’re particularly useful for familiarizing oneself with the platform’s features, from placing orders to monitoring positions, in a controlled environment.

The success of day trading strategies often hinges on selecting the appropriate time frame. Whether it’s the fast-paced action of scalping, where trades last minutes, or the more extended periods of momentum trading, choosing the right time frame can significantly impact your trading outcomes. Each time frame has its unique set of challenges and opportunities, and understanding these can help you tailor your strategy to better fit market conditions and your trading style. For insights into how to select the optimal day trading time frame for your strategy, visit day trading time frames.

Top Paper Trading Simulators

Not all platforms offer a paper trading feature, but here’s a list of the top simulators…

StocksToTrade

Yep, I’m biased. To me, StocksToTrade has the best paper trading platform out there.

For one, it was created by traders for traders with easy-to-read charts and user-friendly tools. It’s all to help you build watchlists and scan for your best trading opportunities.

Our analysis tools work in tandem with our paper-trading program. They use real-time data to help traders like you prepare for live trading.

A common complaint with paper trading is that all trades get filled. But that’s not realistic.

Well, with StocksToTrade you can customize your paper trading account for execution delays or PDT restrictions to mimic real-world challenges.

You can also change commissions settings to simulate trading with different brokers.

You can even practice shorting!

I use StocksToTrade to scan for news, tweets, earning reports, and more — all covered in its powerful news scanner. It has the trading indicators, dynamic charts, and stock screening capabilities that traders like me look for in a platform. It also has a selection of add-on alerts services, so you can stay ahead of the curve.

Grab your 14-day StocksToTrade trial today — it’s only $7!

TradingView

TradingView is a charting and analysis platform that can be easy and intuitive for beginners to use. It can also be powerful enough for advanced traders.

Because it’s web-based, the platform is super light. It has a paper trading module so you can learn before you risk real money.

When you’re ready to trade with a live account, you can connect your TradingView account to supported brokers.

Charles Schwab (Post-TD Ameritrade Merger)

TD Ameritrade, the broker that was formerly associated with the leading paper trading platform thinkorswim, merged completely with Charles Schwab as of 2023. Thinkorswim’s paperMoney paper trading platform is now available solely to Schwab users (and former TD Ameritrade users whose accounts have been absorbed by Schwab).

Schwab’s trading platform StreetSmart Edge will be discontinued sometime in 2024.

TD Ameritrade

TD Ameritrade is a large online brokerage that offers a variety of resources and tools to its members.

Its downloadable trading platform, thinkorswim, is pretty robust and allows users to paper trade the market.

E-Trade

E-Trade is another well-known online brokerage that offers several resources and tools.

Its Power E-Trade platform allows members to practice trading stocks, options, and more without committing real money.

Webull

Webull is a U.S.-based discount broker…

Because it’s a newer company, it only covers U.S. stocks and ETFs. It’s limited in resources and support compared to other companies on this list. But it does offer paper trading through its platform.

TradeStation

Tradestation is considered a trading technology leader and attracts casual to seasoned traders.

Its desktop-based platform TradeStation 10 is robust and includes a simulated trading mode.

The downside of TradeStation is that you can’t access the platform unless you have an account, but you can make an account and access its baseline tools with no deposit required.

How to Choose a Stock Market Simulator

© StocksToTrade

Like I said, not all platforms offer paper trading. And not all platforms are equal. Some may be faster or more customizable.

You want to pick one that can bring you as close to the real-world experience as possible. That way, you don’t get caught off guard when you go live.

Check out the StocksToTrade paper trading feature. You can get a 14-day trial for just $7!

Paper Trade the Right Way

Do you see the value in paper trading? Good. Now let’s look at how to do it correctly, so you can get the most benefit from it.

To paper trade, you need a way to record all of the details of the trade.

As mentioned earlier, if you want to keep it basic, you could write everything down in a notebook. Using a spreadsheet is even better. But if you want to get the best experience, we recommend you use a trading platform with a paper trading feature, like StocksToTrade.

Be Realistic

There’s no point in fudging data. Be sure to keep accurate, realistic data. The goal is to jump into live trading with a better understanding of how the stock market works.

So try to simulate exactly what you’d do with real money at stake. Follow your trading strategy as closely as you can. And be sure to record all losses, commissions, and costs.

Analyze Your Performance

After you gain some experience, you’ll have a better idea of how your strategy should work. At this point, you’ll probably want to work on refining.

This could mean examining losing trades and looking for ways to cut losses. Or it could mean looking at big winning trades to find consistency.

There are many ways to analyze and improve your trading. Make sure you’re thorough. Look at all the angles and run all the numbers.

Adjust Your Expectations

Remember to keep your paper trading as real as possible. Almost every trader performs worse in the switch to live market trading.

I already mentioned that you have to wrestle with many psychological forces when actual money’s on the line. Using fake money is good practice, but there’s ultimately no risk…

It’s easy to be risky with someone else’s money (or fake money) and not worry about downsides. This can mean great “returns” if you’re a good enough trader.

But you must remember that these gains aren’t real — and that you’ll be trading with smaller money in the real world.

Go Live

If all things go well, your strategy shows solid potential and you feel confident in your abilities. It’s time to consider trading with real money.

Many traders then start risking small amounts of capital and slowly increase in size.

Review as you go along. Compare your performance with how you did when paper trading the strategy. If there’s a massive difference, it could mean execution issues. Or maybe you weren’t realistic when paper trading.

It’s also possible that the markets changed.

And remember that it’s OK to go back to paper trading for a while.

How to Transition from Paper Trading to Real Trading

Transitioning to real trading involves gradually introducing real money into your trading practice while maintaining the disciplined strategies developed during paper trading. Start with small investments, and as your confidence and skills grow, you can increase your trading volume. It’s vital to continuously analyze your trades, learn from your successes and mistakes, and adjust your strategies based on real market feedback.

Paper Trading: The Bottom Line

You can see how paper trading can be beneficial to developing your trading skills.

But we hope you realize how important it is to keep your goals realistic and maintain a trading journal. Here are just a few things you should track:

- What was your trade thesis?

- Did you set a plan with entries and exits for potential loss and profit?

- Did the trade hit a stop loss?

- Would you have gotten filled at your limit order?

- Would you have seen the setup in time?

There are a ton of ways to build day trading careers… But all of them start with the basics.

Before you even think about becoming profitable, you’ll need to build a solid foundation. That’s what I help my students do every day — scanning the market, outlining trading plans, and answering any questions that come up.

You can check out the NO-COST webinar here for a closer look at how profitable traders go about preparing for the trading day!

What paper trading platform do you use? Write “I won’t trade without a plan” in the comments if my advice has taken hold!

Frequently Asked Questions

How Effective Is Paper Trading?

Paper trading is highly effective for learning and testing trading strategies without financial risk. However, its effectiveness can be limited by the lack of emotional pressures found in real trading scenarios.

Is Paper Trading Real or Fake?

While paper trading simulates real trading experiences, it uses virtual money and doesn’t incur real financial loss or gain. This makes it a risk-free way to practice trading.

Are Paper Trading and Stock Simulators the Same Thing?

Yes, paper trading and stock simulators refer to the same concept—using a simulated trading environment to practice trading without risking actual money.

What Are the Key Components of Paper Trading and How Does It Benefit Beginners?

Paper trading involves using a simulation to practice buying and selling financial instruments without risking real money, allowing beginners to understand the process and mechanics of the markets. It works by replicating real market conditions, enabling users to execute paper trades and monitor their hypothetical profitability and performance. This approach offers significant advantages by providing a risk-free environment to develop trading strategies, understand market dynamics, and gain confidence before engaging in real investing.

How Can Financial Tools and Resources Enhance Paper Trading Practice?

Access to demo accounts on platforms endorsed by regulatory bodies like FINRA, combined with comprehensive financial services and finance guides, can significantly enhance the paper trading experience. These tools offer realistic market simulations and a wide range of financial instruments, from credit cards to loans and investment products, for practice. Additionally, privacy choices ensure personal information protection, making these platforms safe for users to experiment and learn.

What Role Do Professional Development and Life Skills Play in Successful Investing?

The intersection of career development, professional advice, and life skills plays a crucial role in successful investing. Paper trading allows individuals to explore careers in finance or investing by applying theoretical knowledge in a practical, risk-free environment. The process nurtures a disciplined mindset, critical for navigating the complexities of financial markets and making informed decisions based on investment advice from seasoned professionals.

In Paper Trading, How Important Are Analysis and Feedback?

Analysis and feedback, derived from reviewing articles, statistics, and professional reviews, are crucial in paper trading. They provide insights into market trends, trading strategies, and the effectiveness of simulated trades. This information helps traders refine their approaches, set realistic objectives, and understand the circumstances under which different strategies succeed or fail, ultimately enhancing their skills and knowledge for real-world investing.

How Do Fees and Loan Rates Impact Paper Trading Simulations?

In paper trading, understanding the impact of fees, including those associated with transactions, money market operations, and loan rates, is crucial despite not incurring actual costs. Simulations can include mortgage rates, auto loan rates, and student loans to provide a comprehensive view of financial markets and asset management. This practice helps traders grasp the long-term implications of fees and interest rates on investment profitability and strategy.

What Resources and Considerations Are Vital for Effective Paper Trading?

Effective paper trading relies on various resources and considerations, such as life insurance policies and certificates of deposit (CDs), which introduce traders to a wide range of financial products and asset classes. Utilizing links to educational topics and articles allows traders to explore different aspects of finance, from basic terms to complex strategies. Understanding the purposes behind different investment types and recognizing the disadvantages or drawbacks of certain financial decisions are key learning outcomes of this practice.

How Can Traders Leverage Community Insights and Practical Applications in Paper Trading?

Engaging with writers and professionals within trading communities through sites dedicated to paper trading can offer valuable insights and name recognition in the field. By examining instances of successful trades and discussing various entry points, traders can learn from others’ experiences. This communal learning, coupled with simulations that accurately represent how markets work, equips traders with the knowledge to navigate real-world investing with greater confidence and understanding.