Traders often ask me why I don’t like ‘true’ penny stocks…

There are two main reasons I stay away from them … And a recent runner just proved my point.

Today I’ll show you exactly why I don’t like stocks that trade for under $1…

If you’re struggling to find consistency trading ‘true’ penny stocks or OTCs … This could shine new light on your struggles…

Table of Contents

Three Reasons Why I Don’t Like ‘True’ Penny Stocks

I’m going to start with the number one reason I don’t like true penny stocks. It accounts for about 70% of why I don’t like them…

The $2.50 Rule

The $2.50 rule is a rule that affects short sellers. It basically means if you short a stock trading under $1, it doesn’t matter how much each share is — you still have to put up $2.50 per share of buying power.

That can eat up a lot of capital.

I mean, why would a short seller put up $2.50 in buying power to short a 40-cent stock down to what … 20 cents?

It doesn’t make sense.

And that’s why there are not as many short sellers in true penny stocks.

You know I love my short squeezes (this record one was incredible!)…

I can enter a long trade at key levels shorts use as risk … And I know there’s a greater chance demand and buyers will come in and push a stock higher.

But without the short sellers, you won’t see as big of moves on high volume

Another reason why I don’t like true penny stocks is…

Float Size

True penny stocks don’t have as volatile of moves.

I’ve seen $5 stocks double and go to $10 more often than I see 50-cent stocks go to $1.

Part of that is because there are no short sellers.

But another reason is that they have massive floats. They can have hundreds of millions of shares available to trade.

Some OTCs even have billions of shares.

It doesn’t matter how big of positions traders are taking — you need some serious volume to move a stock with that many shares.

And that leads me to my final reason…

Dilution

Penny stock companies are notorious for diluting their shares.

They can have a shelf offering which means they can dump shares at any time…

And if they don’t already have one filed, as soon as the stock price goes up they will likely dilute.

Because true penny stocks and OTCs are basically in business to sell shares.

They don’t have products or real services.

American Virtual Cloud Technologies, Inc. (NASDAQ: AVCT) is a great example that proves my point…

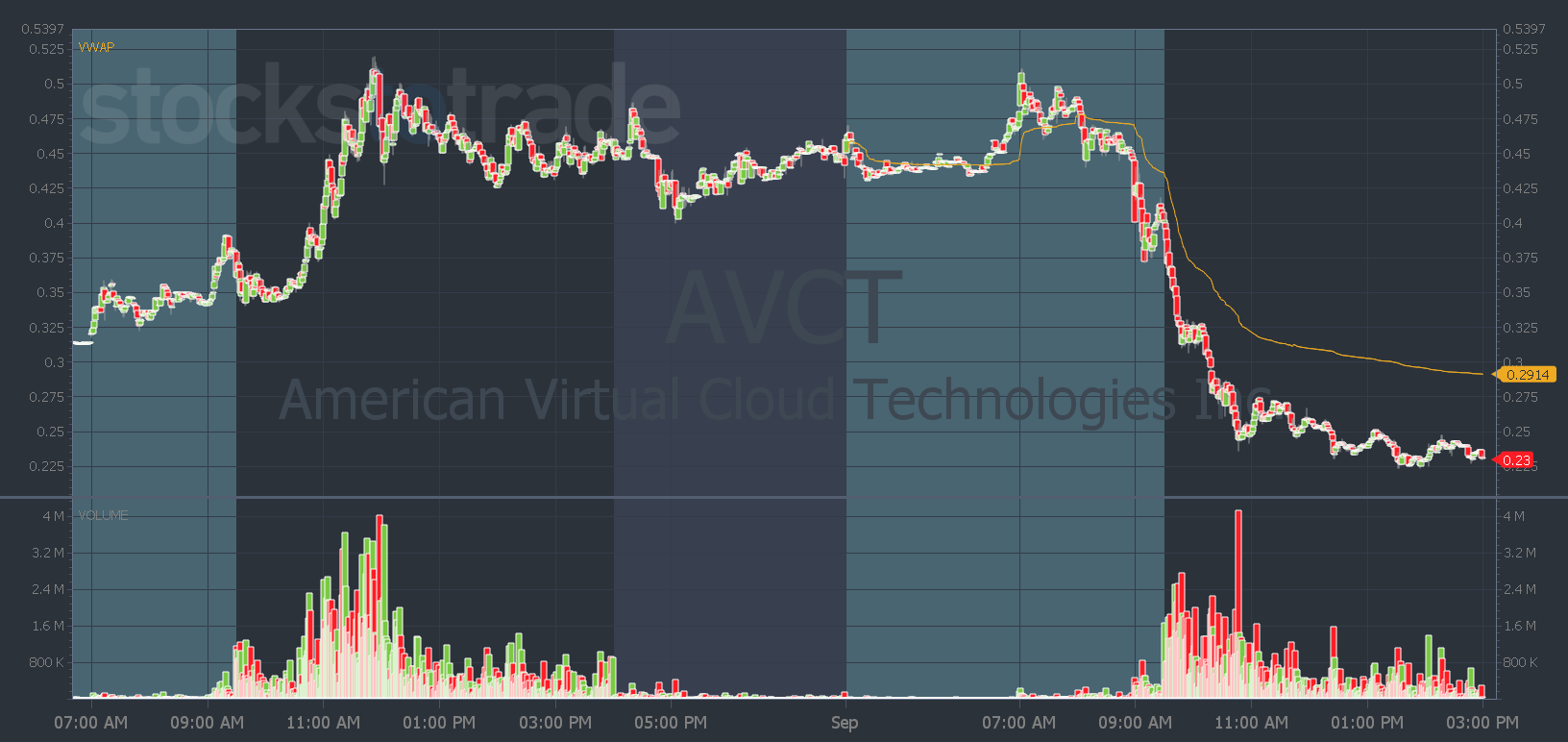

The stock has a float of 95 million shares. On Wednesday it managed to push from roughly 35 cents to 50 cents. And traders were losing their minds…

But that’s not even that big of a move. And what happened yesterday?

The company filed for an offering and the stock tanked back down to 22 cents.

If you traded it on Wednesday for a profit — congrats.

Stocks under $1 just aren’t my style.

And if you’re struggling to find consistency trading them, try something new…

You need to find what fits YOUR trading style.

Trading a higher-priced stock might mean you take a smaller position size. But I think you can get far more predictable moves and volatility to grow your small account.

Have a great day everyone. See you all back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade