Today, let’s get into the details of trailing stop orders … For certain traders, they can be really valuable.

But every trader needs to know about them.

They should be part of your kit, whatever your trading strategy. You never know when they’ll come in handy. Every trader wants to protect against losses … and no trader likes to see their gains reversed.

And no trader likes to get stopped out, either … but it’s part of the game. We all have to play by the rules or risk the consequences.

One thing we do with our SteadyTrade Team mentorship program is discuss how these rules can work for or against traders. The biggest part of this is education.

Consider this another tool in your kit…

Table of Contents

- 1 What Is a Trailing Stop Order?

- 2 How Does a Trailing Stop Order Work?

- 3 Why Should You Use Trailing Stop Orders?

- 4 When Should You Use Trailing Stop Orders?

- 5 How to Use a Trailing Stop Order: 5 Strategies

- 6 How to Place a Trailing Stop Order

- 7 Trailing Stop Order vs. Stop-Loss Order: What’s the Difference?

- 8 What Are the Risks of Trailing Stop Orders?

- 9 Trailing Stop Order Example

- 10 Are Trailing Stop Orders Good?

- 11 Frequently Asked Questions About Trailing Stop Orders

- 12 Bottom Line on Trailing Stop Orders

What Is a Trailing Stop Order?

First, we need to define stop orders.

A stop becomes a market or limit order when a stock hits a predetermined target price. You need to set a stop point for a trade, even if it’s only written on your trading plan.

If you’re entering a trade without a stop, it’s not a trade. You’re just gambling.

Stop market orders are sometimes called stop-loss orders. But stop-limit orders can potentially lock in a price better…

Market orders get filled at whatever current price the market offers. And if you’re willing to take whatever the market is offering, you probably won’t get the best price.

I use limit orders. This makes it so my order will only get filled if it comes in above or below a certain price

Buy-limit orders only execute if the price is below or equal to your limit. Sell limits do the same thing in the other direction.

This can get a bit tricky when you’re dealing with the volatile stocks that can really build your account! Volatility is awesome … if you know how to use it to your advantage.

Stop-limit orders become limit orders once they reach the stop’s execution point. But they’ll only execute if the stock price matches the limit.

The trailing stop you set will follow a stock in a profit-making direction. That way, you’re protected if the trend reverses … but the same issue with limits applies.

How Does a Trailing Stop Order Work?

Trailing stops are a powerful tool for part-time traders and swing traders… or anyone who can’t spend every minute watching the market.

Let’s say you’re in a great trade, and everything’s working. Your stock is up and trending in the right direction.

You don’t want to keep your original stop loss set and end up losing money. So you set a trailing stop.

It tracks the peak price of your stock, moving the stop within whatever range you’ve set.

If the stock starts trending down, your stop will stay at its highest position.

Why Should You Use Trailing Stop Orders?

Like I said, I think these are most useful for part-time traders and swing traders.

There are times that life calls you elsewhere during market hours. If you can’t use the flexibility that trading affords, then what’s the point?

I don’t recommend trailing stops as part of an active trading strategy. There are better ways to lock in your profits…

The best way is to learn chart patterns. That’s one of the things we focus on with the SteadyTrade Team. We do twice-a-day webinars, with an archive of all our training sessions for you to explore.

Every day, I’ll take you through the charts that have the best potential for trading. We’ll create trading plans together in our amazing chat room.

One of the most valuable things we do with the SteadyTrade Team is put in screen time. It’s easy to look back on a chart and realize the best entry and exit points. Hindsight is 20/20, right? The hard part is learning to develop your own plan, and execute it better than an automated order. But that’s the way you grow as a trader.

Join the SteadyTrade Team here!

When Should You Use Trailing Stop Orders?

Let’s say we’re in a trade that made a nice move in the morning…

Now it’s settled into a consolidation pattern. It’s still working for our trading plan. It’s just taking a little longer than we’d like.

This is the perfect setup for a VWAP-hold high-of-day break.

It could fail, and we can’t be around to watch it.

So we play it safe with a trailing stop order. This way we protect ourselves, while still giving our trade a chance to hit its goal … or maybe better!

How to Use a Trailing Stop Order: 5 Strategies

So you know the basics. And really, a trailing stop order on Robinhood looks pretty much like a trailing stop order on E-Trade.

The trick is in the strategies you apply.

When used right, trailing stops can help your trading mindset. So much of trading is the mental game. You need to understand the markets, and you have to understand yourself.

If you keep getting stopped out of trades, that might be an issue with the risk you set. If you can’t sleep while holding a stock overnight, you might not be using the strategy that’s right for YOU.

All these things matter. And trailing stops can help get you there.

Watch Out for Low Volume

This applies to any stop-loss order.

A stock that’s trading at low volume can whipsaw like crazy…

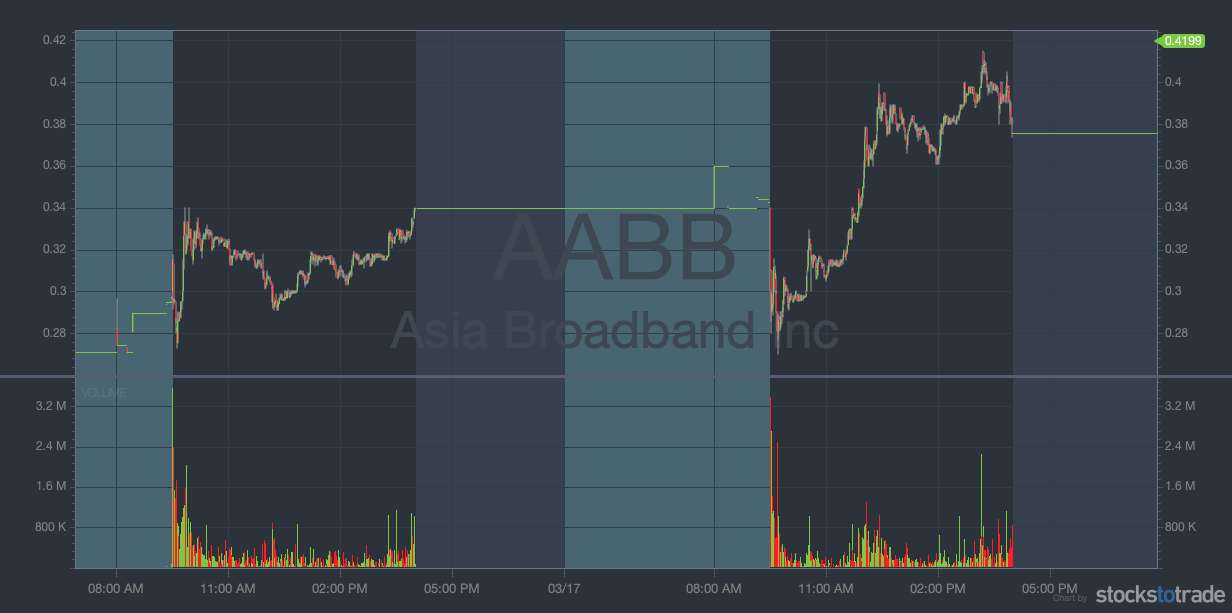

This is especially true when you hold an overnight position. Just take a look at this chart.

This stock was in the middle of a multi-day run. It was a hot stock, trading at a low price point. Volume wasn’t a constant.

Look at that big sell-off at the market open on the second day. There was a big panic at the start … It had an early dip, then continued on its multi-day run.

It would have been really easy to set your stop too tight on this stock.

Fit Your Trade Strategy to Volatility

This is another way a tight trailing stop can stop you out of a trade.

Your trading plan needs room to develop. It’s normal for a stock to swing between support and resistance before it makes a move.

This goes double for volatile stocks.

Watch the chart. Notice the range. If you want to stay in the trade, you’ll need to work this into the risk you set.

Pay Attention to How Support Levels Change

This is one of the hardest things to get right on a trailing stop order. That’s because support will change with a stock’s chart.

If you look at the first day, you’ll see the support level fall around 2 p.m. Eastern time. With too tight a stop, you would have gotten shaken out of the position…

And you’d miss the nice gap up if trying to play with an overnight hold.

Tweak Your Risk to Take Profits

You want to exit your position with a profit, right?

Once your trade is profitable, you can tighten your risk to lock in profits. You may get stopped out more easily — but no one ever went broke taking profits!

Work It Into Your Trading Plan

A trading plan only works when you stick to it. Changing your risk halfway through? That’s not sticking to the plan.

If you know you can’t actively trade a position, plan for it. Is there a price point where you’ll want to adjust your risk? Plan for it.

How to Place a Trailing Stop Order

Let’s say you want to place a trailing stop order through TD Ameritrade.

You go to the trading menu and select ‘buy’ or ‘sell.’ Then select ‘trailing stop,’ with or without a limit. Queue up the number of shares. Then enter the percentage or price at which the stop will trail the stock’s peak.

You get a trailing stop order on Schwab by going to the trading menu, order type…

Notice a pattern?

It’s easy enough to enter a trailing stop order through any broker. It’s one of the standard operations that brokers perform.

How would I do it? I use StocksToTrade.

StocksToTrade is a powerful trading platform that integrates with many major brokers. With your subscription, you get access to software designed by traders.

You know what that means? No more navigating clunky, legacy software. No more clicking between multiple windows to check on breaking news. StocksToTrade has it all right there!

It also has:

- Clean and customizable charts

- Several built-in trader-designed stock scans

- A powerful news scanner with hot news, Twitter mentions, and earnings reports

- Your choice of add-on curated alerts

StocksToTrade has changed the way I trade. Try it yourself — get your 14-day trial for just $7.

Trailing Stop Order vs. Stop-Loss Order: What’s the Difference?

We covered this before … you’ve really got to know this stuff.

Make sure you know the order types before you do any kind of trading. If you don’t already have them down, learn more about order types here.

And remember, practice makes perfect.

What Are the Risks of Trailing Stop Orders?

There are a few big differences between trailing stops and other order types. And they’re important to know for your trading plan.

There are the issues it has in common with other stop-loss order types…

And then it has some more.

You can’t track new support levels. And you can’t pin risk to the whole-dollar and half-dollar levels that are so important!

The market is made up of all different kinds of traders. But you’ll notice patterns if you pay attention.

Traders tend to set their stops around whole-dollar and half-dollar levels. This means that stocks hit these points like magnets … They either attract or repel price action.

Let’s say a stock is trending down and looking for support. It will likely fall through the whole-dollar and half-dollar levels first. That’s where a lot of other traders set their stops.

It helps your trading plan to set your risk above or below these levels. This is a good reason for active traders not to use trailing stops.

Trailing Stop Order Example

In our trailing stop order example, we place a trailing stop limit order on Stock X. (We could also have put a trailing stop market order on it.)

We enter the trade at the high of the day, which is $6.50. We’re risking VWAP at $6. Our goal is $8.

This is a solid plan, and it seems to be working. Stock X is up at $7, and just chopping through the afternoon…

We can tighten up our trailing stop order percentage or price once the trade becomes profitable. This calculates risk from the peak price the stock has hit.

Instead of risking 7.5% in the initial setup, we can set it to 5%. That way we’ll stay in the trade if the stock keeps going up…

And we’ll exit with a small profit if that trend reverses.

Are Trailing Stop Orders Good?

You have to figure this out for yourself.

No one can tell you what kind of trader you should be. You have to figure out the tools and strategies that work best for you.

If trailing stop orders work for your strategy, use them!

You’ll definitely know if they don’t.

Frequently Asked Questions About Trailing Stop Orders

What Is a Good Percentage for a Trailing Stop?

That’s up to you to determine, based on your account size and risk tolerance. Traders often use trailing stops to lock in profits. They might adjust the percentage as their trade becomes profitable. They’ll usually go a bit tighter than the initial risk.

What Is the Difference Between a Trailing Stop Loss and Trailing Stop Limit?

A trailing stop loss is a stop order that executes as a market order, while a trailing stop limit will execute as a limit order. Using limit orders is a better way to get the price you want.

Do Professional Traders Use Stop Orders?

There’s no one-size-fits-all for traders. But every smart trader will have a stop in their trading plan, even if they don’t send it through their broker.

Bottom Line on Trailing Stop Orders

Trailing stop orders are a basic tool that you’ve gotta know.

I want you to be equipped when you trade. That’s your foundation. If you don’t have your trading basics covered, you can fill in the gaps with the StocksToTrade blog archive.

When you’re ready, I’d love for you to join the SteadyTrade Team. We build on the basics by looking at charts and building trading plans.

That’s the real work that’s ahead of you. And it lasts for your whole trading career.

What do you think about trailing stop orders? Do you ever use them? Let me know in the comments — I love hearing from my readers!