Table of Contents

Volatility Definition

Volatility is the amount a security price changes over a given period of time.

Think: When the market goes up, then down, then up, then down, and so on: that’s volatility.

Volatility in the stock market?

One word: YES.

Market volatility can become your close ally — if you know how to handle it. Here’s how to stop fearing and start embracing volatility … it’s time to shift your perspective NOW.

We know that when markets turn violently volatile, our first natural reaction as humans is to be afraid.

Do you know why people fear volatility?

Fear of The Dark

Fear of The Dark

- We fear volatility because it’s a sudden drastic change.

- We hate it because we are afraid. It’s an unknown.

- We fear the unknown—that which may lurk in the darkness, undetected.

It’s that proverbial monster under our bed that we feared in childhood.

And, no rational explanation from an adult could completely eradicate this fear. We just inherently fear what we don’t know, can’t see and don’t understand.

Volatility falls into that category.

We tell our rational brain that volatility provides a unique opportunity to capitalize on others’ fears.

It’s a unique opportunity to go where many fear to tread- with an unknown stock, a new IPO or even a major downturn in the overall market.

But, it’s still a hurdle to overcome this fear entirely, because we just don’t know what’s on the other side.

This is why we stress unemotional trading and always trading with a plan. It’s also why sticking with your plan, for better or for worse, is smart trading. This is also why we stress that individual failures are inevitable.

Ask yourself, what’s the worst that could happen?

Allow yourself to ponder worst-case scenarios, rather than the ostrich in the sand that is afraid to look up.

- Dwell on it.

- Face those fears head-on.

- Write down your fears.

When the market is extremely volatile, write down a list of all of the terrible things that could happen.

Most of the time, you’ll find that these worst-case scenarios are much scarier in our own minds. 🙂

We fear the unknown—and you take away much of that fear when you actually consider what those unknowns might be.

So, for example, ask yourself, if there really were a monster under my bed, what’s the very worst that could happen to me? What would my next steps be?

Download a PDF version for this post.

Fear of Failure

As our natural human inclination dictates, we fear failure or loss much more than we enjoy success or profit. This fear clouds our judgment and we make mistakes while trading with an attitude of fear.

As far as trading is concerned, fear often trumps greed as the single most decisive inner factor affecting our trading decisions.

Like that monster under the bed, face your fears head-on. Think about why failure is so scary to you.

What, really, are you afraid of?

If you were to fail, what would happen?

- Write it down.

- Think about all of the successful traders who went before you.

- They “failed” to make a profit on some trades.

- Are they “failures”?

- Did they live to trade another day?

- Think through it, rather than trying to trade around it.

Love Me Forever

But, you know what?

Volatility – those huge price swings- is actually a potentially infinite opportunity to profit off market uncertainty and off-the-chart price fluctuations.

This is why we love volatility.

And, we know you know this. But, like fear, let’s think about the pros of volatility for a minute.

#1: Volatility Means Opportunity

Check out this YouTube video showing how we use Oracle & our own stock trading algorithm to trade Volatile Stocks.

The sudden and frequent price changes in volatile markets mean increased ranges in stock prices.

That’s potentially a wider range to profit from.

There are also more opportunities to enter and exit positions and to make money with the right strategy.

Some might say, hey, risks are higher with all of the increased price swings and uncertainty.

True, risks are higher. But hey, every single investment in a stock and every single trade carries risk.

As you well know, any trade is risky, in any environment.

And, you became a trader knowing full well that it is a risky endeavor and, at times, a roller coaster ride.

With volatility, yes, the risks are greater, but opportunities abound.

#2: Volatility Helps You to Understand Risks Better

Is this stock too volatile?

Is that other stock not volatile enough to consider entering/closing a trade?

In times of volatility, by asking yourself these questions, you are gradually starting to quantify the risks that you’re taking (or willing to take) more quickly.

In day trading, a few seconds are sometimes crucial for a profit (or loss). A

nd, when you have protected your investment and are risking only the amount that you CAN afford to lose anyway, you’ll be trading without fear in the higher-risk volatile market.

The more you trade volatile stocks, the more you’ll grow to better understand risks.

This way, with a level-headed approach to getting to know opportunities, risks and potential losses better, you’re actually honing your analytical skills and training your mind to be more flexible and less fearful.

#3: Volatility Sharpens Your Trading Skills

Now that you trade without fear and have set your stop losses, stop orders or limit orders in your trading system, you have better risk judgment.

This causes you to pick your trades more wisely. It also helps you to choose those stocks that fit your trading strategy and goals.

It helps you to see where your risk tolerance lies and which limits you’re unwilling to cross.

It also allows you to understand which trades and strategies fit your own unique personality. Volatility prepares you to face adverse (and sometimes potentially highly profitable) situations on the markets.

Trading experience with volatile stocks readies you to face any swing in the market.

It’s safer to trade in a bull market, when we don’t have to give much thought to exits. But, because the risks are lower, so is the opportunity.

The fact is, the markets are not bullish all of the time. Volatility and uncertainty are part of the markets.

You’re there to make profits, regardless of the market sentiment and direction. Here’s where previous experience with volatility is your friend.

You’ll know what it’s like, even if you did not reap profits the very first time (or even your first couple of times).

You’ll face the ‘devil’ you know and will spare yourself at least part of the panic other traders (and your competitors) will be feeling.

When volatility grows on you, you’ll grow as a trader.

#4: Volatility Can Be Your Friend

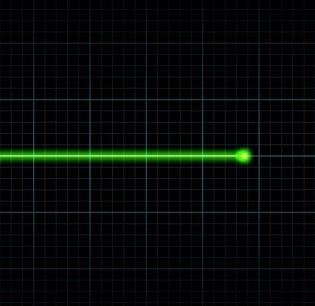

In fact, it has to be your friend. If there was no volatility, the stock would trade flat.

This would mean no risk. Yay!

This would also mean no profits. Boo!

In the medical profession, a flatline is a sign of death.

No movement means no reward. You need those blips—those highs and lows—to stay alive. And, if there were no lows, there would be no highs.

This is the law of the universe.

When you have the right strategy in place, a plan to stick to and the attitude to see potential profit opportunities, volatility can be a beautiful thing.

The risks may be higher, but money-making opportunities and stocks on sale at a bargain are also higher.

You can also set wider targets for choosing when to take your profit and exit.

With the right attitude, enough experience, sharpened analytical skills and an increased understanding of risks can help us all love volatility and see the opportunity, rather than the cloudy fear of loss (which is inevitable at some point).

This takes us another step closer to becoming successful traders, regardless of the current market trends.

With an eye on the opportunities, we can profit, even in stormy volatile markets and we make our bargain investments pay off in the longer run.

Hate volatility if you must. But you must also love it. We don’t fear volatility; we embrace it.