Congratulations — you’ve decided you wanna be a penny stock trader. Now for the big question: how to find penny stocks to trade?

To a newbie, getting from here (wanting to trade) to there (actually trading with some consistency) might seem like a total mystery.

Don’t worry, it’s not rocket science — all you need is a little know-how and the right tools, like a great stock scanner and the right broker.

If you’re looking for some direction as you embark on the wild world of penny stock trading, this post is for you. Keep reading to learn how to find penny stocks. And find out some of the safest and smartest ways to identify and track promising tickers.

Table of Contents

- 1 What Are Penny Stocks?

- 2 Benefits of Trading Penny Stocks

- 3 Risks of Trading Penny Stocks

- 4 What to Look For in Penny Stocks

- 5 How to Calculate Penny Stock Trading Costs

- 6 How to Find Penny Stocks to Trade in 7 Steps

- 7 How to Find Penny Stocks Before They Explode

- 8 Examples of High-Potential Penny Stocks

- 9 How to Choose a Broker to Trade Penny Stocks

- 10 What to Do After You Find Top Penny Stocks To Trade

- 11 4 Tips to Avoid Trading Scams

- 12 Scan. Plan. Trade!

What Are Penny Stocks?

Before we get into how to find penny stocks … what’s a penny stock?

The name is sort of misleading. The term ‘penny stocks’ actually refers to stocks that trade for under $5 per share.

Usually, these low-priced stocks are offered by small companies. They might still be in the developmental stage. It could be that they only make one or two products. Or they might be in a new or emerging industry.

How Do You Buy Penny Stocks?

Some penny stocks list on major exchanges like the Nasdaq or NYSE. But plenty of them trade through over-the-counter (OTC) exchanges.

OTC exchanges don’t have the same stringent standards as the major exchanges. While this means that it’s easier for a small company to get listed, it also means that there’s more potential for fraudulent behavior.

That’s part of what scares a lot of people off from penny stocks. But as you’ll soon learn, there are still opportunities to ride price spikes with penny stocks. And nope, you don’t have to actually trust the companies.

Benefits of Trading Penny Stocks

For some traders, penny stocks are a huge part of life. But in the scheme of things, they’re sort of under the radar. You need to know that to learn how to find penny stocks to trade. That’s actually one of their biggest benefits — but it comes with risks, too. Let’s talk about the good stuff first…

Potential volatility: Think about driving in a really small, dinky car on uneven pavement. You feel every bump, right? Similarly, you feel every bit of impact with penny stocks. Since they’re small, even a single news story can make the stock price skyrocket — or take a nosedive.

The good news is that if you’re smart about riding the potential monster moves, the earning potential can be significant. But there are no guarantees.

Lack of competition: When you trade large-cap stocks, you’re competing against pros: hedge funds, banks, and groups with billions of dollars. No offense, but you really don’t have much hope of outsmarting them.

With penny stocks, you’re often trading against unsophisticated retail investors. If you have even a basic trading strategy, it can potentially put you ahead of the competition.

Potential Payoffs

I’ll never forget my first ever SteadyTrade Team webinar in 2016 — the ticker I was focusing on spiked about 1,000%.

That kind of spike doesn’t happen every day, but it’s not unheard of. In recent months, we’ve regularly been seeing penny stocks spike 200%, 300%, or even more in the course of a single day.

The potential payoff of trading penny stocks can be significant. But there’s a flip side to that, too…

Risks of Trading Penny Stocks

We can’t discuss how to find penny stocks without mentioning risk. The same volatility and fast movement that can help you grow an account fast with penny stocks can also devastate your account fast if trades go against you.

Worth noting: Penny stocks are generally NOT suitable for long-term investing. Most penny stocks will eventually fail — it’s just the nature of these small and sometimes sketchy businesses.

However, before they eventually fail, they can have some big moves. If you’re ready, you can take advantage of those moves in the short term. That’s why most penny stock traders focus on short-lived moves, entering and exiting positions fairly quickly.

What to Look For in Penny Stocks

What are some characteristics of a promising penny stock?

Hype

Penny stock spikes are usually fueled by hype and media buzz. Say, for instance, there’s a sneaker company that just signed a licensing agreement with a famous designer.

Something like this could make a penny stock move bigtime. Any media mention could move a stock, though an actual news story versus say, Twitter hype, will usually have a little more staying power.

Pro tip: StocksToTrade makes it easier to follow stock hype with our built-in social media and news scans. Check it out with a 14-day trial for $7 today!

Increased Trading Volume

When you see a penny stock’s volume start to increase, it means more people are taking positions. This can indicate something big is about to happen. This is essential for learning how to find penny stocks to trade.

Recent Runner

Smart traders scan for the top percentage gainers of the previous session — the stocks that have gone up the most in price. These big recent moves often mean there’s been a lot of excitement around a stock. Follow the action!

How to Calculate Penny Stock Trading Costs

The exciting thing about penny stocks is that they’re inexpensive. However, the cost of the actual stock isn’t the only thing to consider.

There may also be fees associated with buying or selling penny stocks — that depends on your broker and how you’re selling (for instance, there may be additional costs or borrow fees for short selling, etc.)

Also, it’s worth considering making an investment in your education and the right trading tools. You can look at day trading strategy courses, mentorship, and a great stock screener as added expenses. But by investing in education and the right tools, you could save yourself from unnecessary losses.

How to Find Penny Stocks to Trade in 7 Steps

Once you understand the rules of the game, you might find you actually enjoy the hunt. Here, we’ve broken the process down into seven easy steps to help you start finding potential stocks to trade.

#1 Set Up a Stock Scanner

There are literally thousands of penny stocks traded in the U.S. each day. You’ve gotta narrow it down somehow. You need to know how to find penny stocks with potential.

That’s where your all-important stock scanner comes in. With the right scanner, you can quickly search the entire universe of penny stocks (or other stocks depending on your trading preferences) to look for the criteria that fit your trading plan.

Over time, you’ll develop your own criteria for filtering down stocks. Some common things traders look for include volatility spikes, news stories, increased volume, or previous big movers.

StocksToTrade members understand the power of a great scanner — get a 14-day, $7 StocksToTrade trial now and see for yourself what’s got traders talking!

#2 Analyze Chart Patterns

Once you’ve narrowed the many stock choices down to a short, manageable list, it’s time to get down to business. Your job now is to find the trades that offer the most favorable risk level, or that let you put up the smallest amount of money possible with the biggest potential gain.

To do this, most traders hit the charts and try to find patterns.

Price and volume patterns on the chart can give you clues about what’s going on with a stock. As you learn to read charts more efficiently, you’ll start to see how excitement, greed, and key levels tend to make traders react.

Chart patterns can help you build a trading plan so that you’re ready to jump on an entry point if and when the stock meets your expectations.

#3 Choose Technical Indicators

If you ask 10 traders about how to pick penny stocks, you’ll get 10 different answers. Fun!

Most traders will start by looking at chart patterns. But to build an even better case for a trade, it’s a good idea to use technical indicators to try to make a little more sense of the chart.

Technical indicators take price and volume data and manipulate it in ways to show things like momentum, recent strength, volatility (or lack thereof), and more.

That might sound like some serious smart people stuff … But really it boils down to simple things like showing the average price over a set time period (moving average or MA). Or it could be showing the difference in volume traded between up days and down days (OBV indicator).

Every trader has favorite indicators. Check out as many as you can and figure out which ones work best for you.

#4 Look For News Catalysts

Most traders want to know how to find penny stocks before they reach those killer highs.

So how do you do that? Easy: watch out for news catalysts.

A news catalyst is anything in the news that could potentially move a stock’s price. For instance, maybe a company just signed a big contract or was featured on the news.

Or maybe it’s more indirect, like a big company in a hot sector has positive news and other companies in the sector see renewed interest by association. That’s called a sympathy play.

Catalysts can entice traders to jump in — or out — of a stock and create big price moves. The action can be short lived. But if you can react fast, you can potentially take advantage of the move.

StocksToTrade has an awesome resource for finding catalysts — the new Breaking News Chat feature. This chat room is all about cherry-picking the catalysts that have the most potential to create massive spikes. If you don’t necessarily have the time to keep on top of all the news that could move stocks, this is an incredible add-on to the platform.

Curious about what a hot sector is and what that means? Check out this video:

#5 Identify Trends

Stocks are always either in a range (bouncing up and down) or in a trend (making consistent moves in one direction).

As you might imagine, a trend creates more dramatic moves that can present more profit potential.

Think about surfers catching waves. They want to jump onto waves while they build momentum, ride it until it starts to crash, then jump off before the crash. That’s what you want to do with momentum or trend trading.

On a stock chart, trends show up as consistently higher highs for an uptrend or consistently lower highs and lows for a downtrend.

For new traders learning how to find penny stocks, it’s smart to stick to obvious up- or downtrends.

#6 Check the Trading Volume

Picture this: you find a penny stock with awesome potential. It’s got a beautiful chart, the technicals look good, and there’s a solid news catalyst.

You’re raring to go, so you queue up an order to buy 10K shares … Only to find that there aren’t enough shares available.

On the flip side, maybe you’ve made a nice gain and want to sell a stock … Only to find out there are no buyers. You’re stuck.

This is common — but there’s a way to bypass it. Always check the volume before you trade.

Volume refers to how many shares are changing hands. In general, high volume is good. It means that shares are changing hands and you can have an easier time buying or selling.

Be sure to filter based on volume before you get too attached to any stock — it can save you a lot of time and potentially money.

Learn more about volume here:

#7 Use Financial Ratios

Think about a jeweler examining a diamond. They use a magnifier and look at it from every angle possible. That’s how they get the most well-rounded view and search for imperfections.

Looking at a stock is similar. You want to look at it from as many angles and get as much information as you can. So if you really want a gold star, check out some common financial ratios.

One common financial ratio is earnings per share (EPS), which measures the net income per share of stock. Others include the price-to-earnings ratio (P/E ratio), which measures the current share price relative to the EPS. And the return on equity (ROE) measures net income relative to shareholder equity.

Ratios like these can give you a better idea of a company’s well-being and long-term prospects. And in some cases, it can help you make a better case for a trade.

How to Find Penny Stocks Before They Explode

Want to find penny stocks before they explode? Slow down and adjust your mindset! An explosion is usually preceded by a spark. You want to look for those sparks first, rather than trying to make guesses about what could explode.

Put a different way — react, don’t anticipate. It’s less about trying to predict spikes and more about being quick to act when they start happening.

That way, you can ride the meat of the move. You don’t have to be the first one in to take advantage of a spike. And it doesn’t matter if you’re out too early and leave profits on the table. It’s all about staying safe.

Examples of High-Potential Penny Stocks

Enough theory … Let’s look at some real-world examples to help you learn how to find penny stocks.

Here are some examples of penny stocks that show some interesting price behavior…

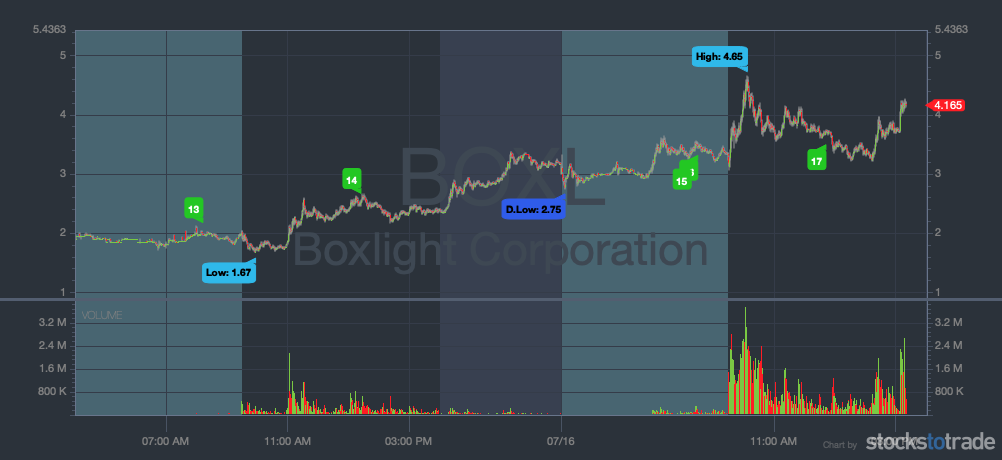

Boxlight Corp (NASDAQ: BOXL)

This company is related to distance learning … a pretty hot topic in the face of the ongoing global pandemic.

Boxlight started spiking based on news of awards for a few of its products. That, paired with the general interest in the sector, created some huge price moves. Over the course of two days, it spiked from the $1.60s to the $4.60s. Great opportunity for traders who were quick to react.

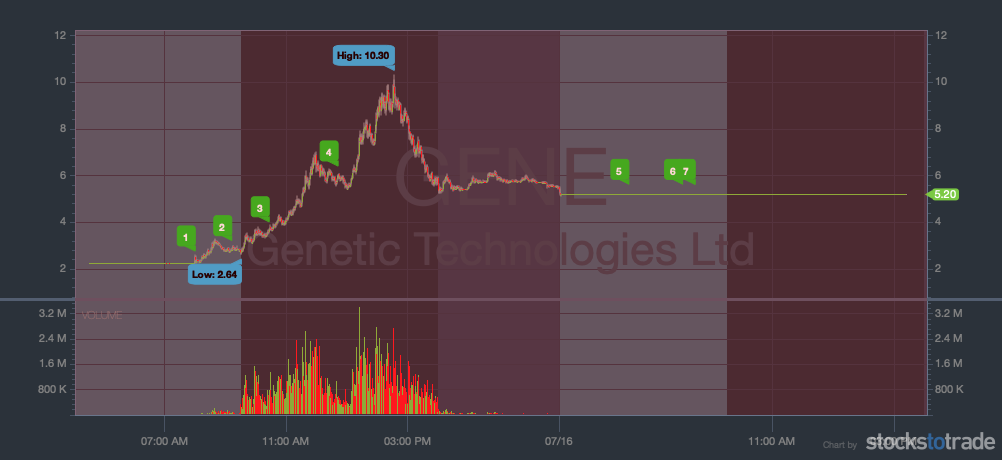

Genetic Technologies Limited NASDAQ: GENE

Here’s an interesting ticker that showcases both the potential of penny stocks and the risks.

On filing a provisional patent for a COVID-19 risk test in Australia, this ticker started spiking bigtime. Within the course of two days, this little-known company went from the $2.60s to as high as $10.30.

Of course, it quickly crashed and then got halted — which just goes to show, for penny stock traders it’s all about riding the wave of the trend and not trying to ride it out in its entirety.

How to Choose a Broker to Trade Penny Stocks

You don’t actually buy shares of penny stocks directly from the companies or from exchanges … You need a broker to facilitate the transaction. Since your broker is the getaway between you and trades, you want to make sure you’ve got a good one!

This post offers an in-depth look at brokers. Read it to learn what they are, how they work, and how to find one that will work well with your trading style.

What to Do After You Find Top Penny Stocks To Trade

A great stock screener and careful research are important when you’re looking for stocks to trade, but your work doesn’t end there.

You also need to make the trades, manage your risk, determine your exits, and manage your trading psychology.

Here a few key tips for turning your stock scan results into your top plays…

Stick to Your Trading Plan

Sports teams have their playbook … traders have a trading plan.

Your trading plan is a predetermined plan for your trade. It’s where you think about things before you execute, including your intended entry and exit strategy. You want to prepare for the best-case scenario (when to take profits) and the worst-case scenario (when to cut losses.)

Your trading plan is everything. You should develop it before you risk a single cent in the market.

But believe it or not, the hardest part about a trading plan isn’t making it … It’s sticking to it.

Know that the market will play tricks on your mind and you’ll often feel like deviating — don’t do it! Trust the research that you’ve put into the plan.

Create Stock Watchlists

There are thousands of stocks out there. You can’t trade everything.

We talked earlier about how to narrow down the many stock choices. Once you’ve filtered it down to a relatively small list, it’s time to build a watchlist.

A watchlist is simply a list of stocks where you focus on the ones with the greatest potential for your strategy.

You can keep one master watchlist. Or you can keep watchlists for certain sectors like pot stocks or biotech companies. You can also keep watchlists showing certain chart patterns or stocks with increasing volume. It’s all about finding the process that works for you.

It’s common for a trader to act like a kid in a candy store when first using watchlists. You could end up with a list of hundreds of stocks … Try not to do this.

This is all about narrowing down your focus. Be very selective before you add a stock to your watchlist. Every stock should fit your criteria. With a watchlist, less is definitely more.

With StocksToTrade, you’re able to keep unlimited watchlists. If you’re not on board yet, come and check out a 14-day trial for $7 to see what you’re missing.

Minimize Your Risks

If you were jumping out of an airplane, you’d want to do everything you could to minimize risk.

You’d make sure your parachute was working. You’d take the time to learn how to open the parachute. You’d probably look at the weather to make sure the conditions are good. Bottom line: you’d do all you could to reduce risk.

Be just as cautious with your trading. You can never know what a stock will do. But you can do as much research as possible to make educated decisions. That’s just smart when it comes to your money.

Consider multiple different variables. And consider your comfort level with risk.

It’s not bad to trade conservatively. Sticking with clear chart patterns like the dip and rip and take small positions, at least at first.

4 Tips to Avoid Trading Scams

Don’t believe the hype. It’s an age-old penny stock trick: promoters pump up a stock price with fluff news … Then there’s a massive sell-off. And traders who believe the hype (usually newbies) are left holding the bag.

Don’t make the mistake of believing in these companies. Most of these stocks fail — never forget that. You can still ride the brief spikes. But for the most part, these companies won’t change the world.

Avoid get-rich-quick scams. If a trading guru you see on a YouTube ad promises you can get rich quick if you just follow their strategy, be cautious. If it sounds too good to be true, it probably is.

Be careful with social media. Social media is a hotbed for scams. In fact, I’ve had my fair share of scammers creating accounts designed to look like mine. If anyone slides into your DMs with a great “investment opportunity,” be extremely wary.

BEWARE scammers! @tbohen is my one and ONLY Instagram account … Don’t respond to any DMs or messages from anyone else claiming to be me.

— Timothy C. Bohen (@tbohen) July 5, 2020

Offshore brokers can be bad news. Offshore brokers can be tempting with low fees of bypassing the PDT rule. However, they can be super shady too. It’s worth it to go with a more reputable broker.

Scan. Plan. Trade!

With the many stocks out there, finding potential trades can be intimidating. A scanner like StocksToTrade makes the hard part easier. That’s how you can filter down the many options into a manageable list.

From there, it might take a few steps to figure out which stocks are the most promising contenders on your watchlist. But once you go through the process a few times, it starts to become second nature — really!

The methods in this post have proven helpful to many traders. So try everything and take the time to figure out what works for you.

It all comes down to scanning, doing your research, having a plan, and sticking to it! The most successful traders keep it simple and aren’t afraid to do the hard work.

What are your tips on how to find penny stocks? What kinds of scans do you run and what type of research do you do? Leave a comment below!