Biotech stocks can come with a lot of volatility … and that can potentially mean opportunity.

Yet, it can also mean more risk.

Some traders and investors love this sector … high risk sometimes means high reward. And the very nature of this sector means that there’s often a lot of exciting moves to play. That’s not to mention the pump and dumps, either…

Biotech stocks are far from easy to trade. Some people love to trade them, and others loathe this sector. But no doubt you can find a lot of big percent movers in the biotech world…

So where to start? And what do you need to know about biotech? We’ll get to all of that. Let’s dive in.

Table of Contents

What Is a Biotech Stock?

First, let’s cover what exactly a biotech stock is.

Biotech companies do a lot of exciting, cutting-edge work for the healthcare industry, such as:

- Researching new medical procedures

- Creating new drugs

- Developing new vaccines

Healthcare and the treatment of diseases is BIG business … So when a biotech company can develop something that works AND get it approved for sale, the company and its investors can see the potential for huge profits.

But there’s a downside … These companies often have a tough time in the early years. They’re often unprofitable and can blow through investor money while in the research phase. And there are no guarantees these companies will stumble upon a winning product.

Overall, biotech stocks can make for an exciting and volatile stock market sector — and that can make for great trade setups.

The Drug Approval Process for Biotech Stocks

In the United States, if a company wants to develop and sell a drug to the public, they need to pass stringent testing by the government’s Food and Drug Administration Agency (FDA).

If you’re going to trade biotechs, it’s always a good idea to know where the company’s drug (or drugs) is in the FDA approval process.

Here’s a brief rundown of the FDA’s three-phase approval process:

- Phase 1 (Safety Testing): In this phase, the product is tested on 20–80 healthy individuals to determine whether the product is safe and the appropriate dosage. This phase will often take around one year.

- Phase 2 (Efficacy): In the second phase, the product is tested on 100–300 patients who suffer from the ailment that the product is designed to treat. This phase also explores the effectiveness and potential side effects of the product and can take between one and three years.

- Phase 3 (Clinical Testing): This where things can get really exciting. The product is tested on between 1,000 and 5,000 patients who suffer from the specific ailment. That means more safety testing, controls (certain patients will receive placebos), and strict product testing. This phase often takes two to three years.

After a company successfully passes a phase, its stock can spike in price. The good news can draw trader and investor interest in the company’s prospects for future profits.

Of course, these spikes in price can and do often fail. So it’s critical to do thorough research and stick to your trading plan. If you pounce on a price spike, you need to know when it’s smart to exit your position…

Tips and Tricks for Trading Biotech Stocks

It’s easy to open an account and trade stocks, but you need skills and knowledge to trade stocks well.

Here are some simple but powerful tips and tricks for trading biotech names.

Keep an Eye Out for News Catalysts

A lot of great trade setups in the biotech tickers can come on the back of a press release, SEC filing, or even a widely spread rumor. News, rumors, social media mentions, and SEC filings are collectively called news catalysts.

It’s smart to keep up with news catalysts no matter which sector you’re trading. But it’s even more useful with biotechs due to the big unknowns, like test results.

Use Charts for Timing

No matter how great the story behind a stock is or how much it’s hyped on Twitter … when it comes to finding where to enter, place your stop loss and exit, it’s wise to use charts.

It’s a go-to tool for some of the most seasoned and successful traders. Stock charts can help give you insight into trends, momentum, key levels, and more. Need a little help? Check out STT’s guide to chart basics here.

Keep a Watchlist

When you’re searching for hot stocks, you can end up with a big list of stocks that offer some trading potential. It happens to everyone.

You can maintain your list of favorite stocks by hand. But it’s a tedious process … punching in each ticker every day, checking the chart, and watching for news stories and company announcements. That’s so inefficient, you’d probably start to hate trading.

Instead, use a trading platform like StocksToTrade to keep watchlists of your favorite stocks. Yep, you can keep multiple watchlists on the same platform. So you can break down your hot stocks by industry, sector, or whatever works for you.

With StocksToTrade, it’s just a click of a button, then you can stay up to date with your favorite stocks.

4 Biotech Stocks to Watch

Now let’s dig into the real dirt: Which biotech tickers are growing and worthy of your attention?

That’s a loaded question. But let’s check out what a biotech company looks like in the real world and look at a few interesting names in the sector.

Celgene Corporation (NASDAQ: CELG)

CELG is based out of New Jersey and specializes in developing medicines for cancer and inflammatory disorders. It’s a big name in the sector with a current market cap north of $60 billion.

The firm has an impressive portfolio of products, such as Focalin to treat kids with ADHD and Vidaza for the treatment of refractory anemia.

Ligand Pharmaceuticals (NASDAQ: LGND)

LGND is a biotech company based in San Diego that’s been around since 1987. The company focuses more on acquiring existing drugs and developing partnerships, rather than developing new drugs from scratch.

A midrange player in the industry, they have a current market cap of below $2 billion. The company has endured a lot of turbulence in the past related to sketchy accounting, stock manipulation, and overpaid CEOs.

You can trade the price action … But with smaller companies, be extra careful in your trade research.

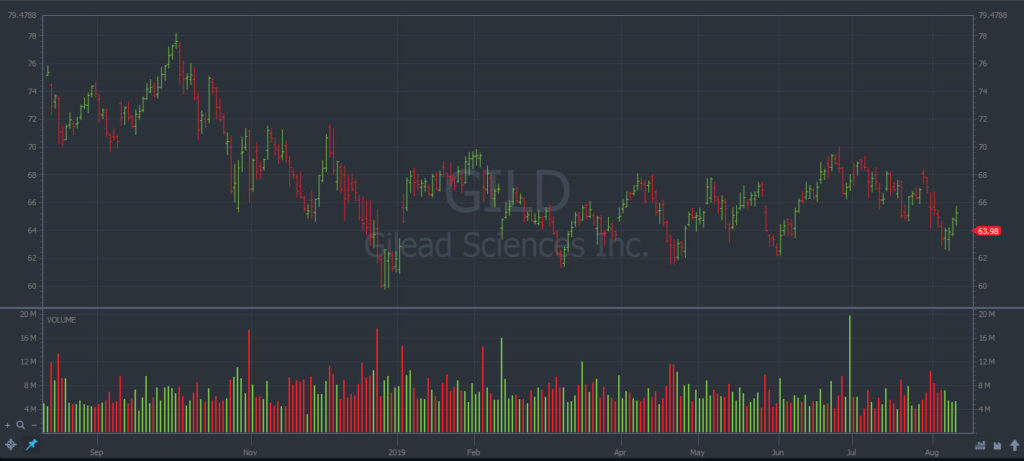

Gilead Sciences (NASDAQ: GILD)

GILD is the biggest company on this list, with a current market cap of over $80 billion. The company focuses on the research and development of antiviral drugs to treat things like influenza, HIV, and hepatitis. Those are some major ailments and a huge market…

GILD is very much a biotech conglomerate with a long history of acquiring smaller firms over the years.

Obalon Therapeutics Inc (NASDAQ: OBLN)

OBLN is a tiny firm that focuses on developing medical devices to assist in weight loss for overweight and obese people. When I say tiny, I mean it — they currently have a market cap of just over $15 million.

Many stocks at this end of the market can be super sketchy … But these stocks can offer some pretty great trade setups.

We recently mentioned OBLN on the StocksToTrade Weekly Watchlist. It’s where we share some hot stocks to watch each week and it’s completely free of cost. Click here to sign up!

How StocksToTrade Can Help You Trade Biotech Stocks

Biotech tickers can often be volatile. That can mean good trading opportunities, but it can also mean more risk. So you have to stay on top of a number of things…

- News catalysts

- Social media hype

- The stock float

- The chart pattern

- Which research phases a company’s prominent drugs are in

That’s just to name a few…

And you need to check all those factors well before you enter a trade…

Here’s where StocksToTrade can help. In one trading platform, you can keep your finger on the pulse of your favorite stocks. It’s the go-to platform for so many traders. And it’s made BY traders FOR traders.

We designed it to help make our busy trading days as simple, streamlined, and stress-free as possible. On the platform, you’ll have access to a number of awesome features:

- Clean, powerful, and functional charting.

- Highly customizable, easy-to-use scanning capabilities to help you quickly find your exact trading criteria, whether technical or fundamental.

- Scanning for news and social media for your favorite stocks. Be in the loop when the hype starts to build.

- The ability to access nearly every listed stock in the U.S. — NYSE, Nasdaq, OTC, and even pink sheets.

- And much, much more…

Some of the best and brightest stock traders in the world start every trading day by loading up our platform. See what a difference it can make in your trading day. Get your 14-day trial of StocksToTrade for just $7 now!

Conclusion

Biotech stocks are consistently one of the most exciting sectors with many volatile stocks. If the sector clicks with your trading style, there can be plenty of trading opportunities.

But remember, as always, to do your homework.

Analyzing biotechs can be a little different, especially given the different testing phases and the FDA approval process. Be sure you really understand the ups and downs that can come with these stocks before you start trading them.

A trading plan and a watchful eye can go a long way in trading smart, especially in this volatile sector. The tips above are a great start, and you can also find more educational posts on this blog…

But if you’re ready to shorten your learning curve…

If you’d like to see how a professional trader approaches the market every day…

And you crave interaction with traders who understand the journey you’re on…

Join us at the StocksTrade Pro community — traders of all levels are always welcome!

How do biotechs play into your trading — love ‘em, or is this sector way too volatile? Leave a comment! I want to hear from you.