Biggest Stock Gainers

Here at STT, with lead trainer Tim Bohen, we start the day in the wee hours of the morning (say, 4:30am) looking for the biggest stock gainers.

That’s Step 1 of Tim’s strategy, and it’s worth getting into a bit more detail, especially for those of you who don’t have the advantage of live action with Tim on STT Pro, or through his webinars.

First, percentage gainers are the biggest dollar movers, and STT has built-in scanners to pinpoint these for you, taking a lot of the guesswork out it—and doing a lot of the legwork for you, every day.

We also have more refined scans in the STT Pro program that can locate the biggest moving stocks.

Download a PDF version of this post as PDF.

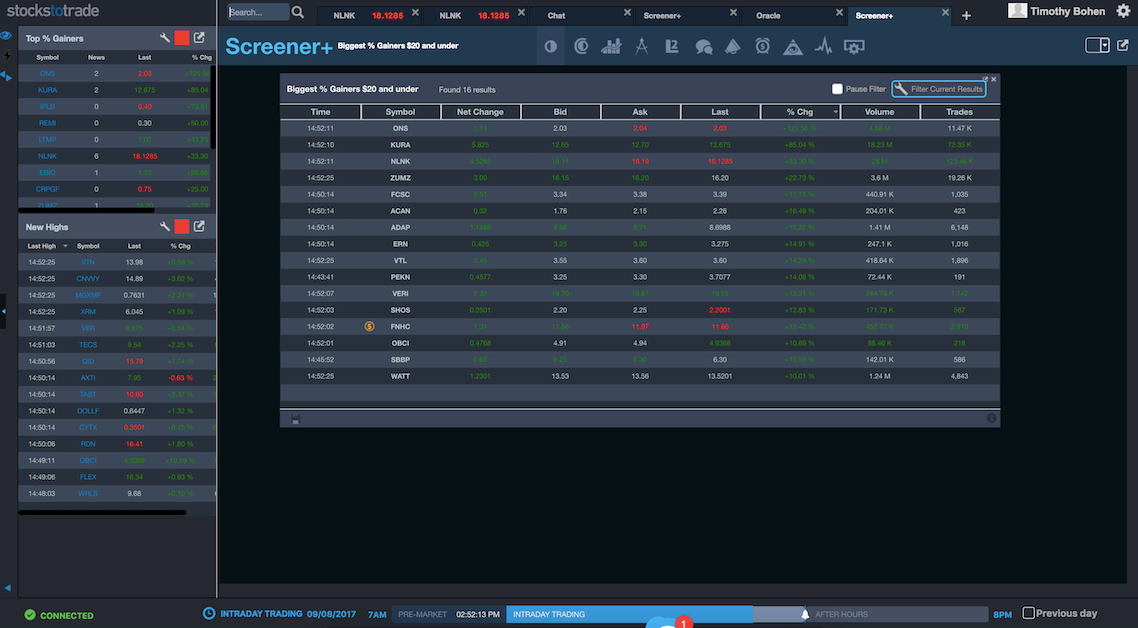

This is what a pre-market (7 am) STT scan on 8 September looked like: It features the biggest percent gainers for stocks priced at $20 and under:

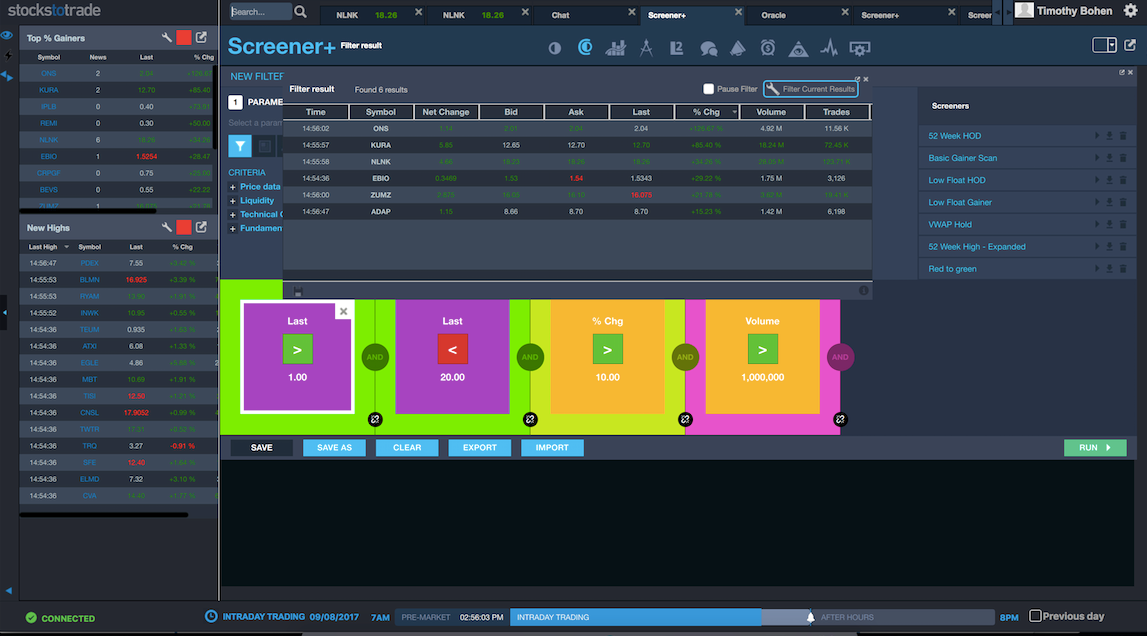

And this is an alternate gainers scan:

Tim discussed all of this in a recent webinar that you might have missed if you’re not an STT Pro member, so we’ll give you some of the highlights here…

Tim discussed all of this in a recent webinar that you might have missed if you’re not an STT Pro member, so we’ll give you some of the highlights here…

The key is to find stocks that are up big on the day. Very seldom does Tim look for losers in the market—especially in this bull market.

“Dip-buying in my opinion … buying junk to try to bounce stocks, is not a viable strategy,” says Tim. “It very seldom works.”

Instead, STT focuses on the biggest movers as a starting point—and this is only the first of five steps that must be followed before you jump into a trade.

StocksToTrade gives you the opportunity to create pre-market scans & find those pre-market movers, but for right now, we’re going to focus on Step 1 for this series.

As Tim advises, “Always focus on the biggest percent gainers each day, the stock market is about supply and demand. Big gainers bring eyeballs, and more eyeballs mean more demand.”

If you have ever had a basic economics class you’ll already know that the more demand, the more likely the price is to dramatically rise.

As day traders we target big moves; the more traders that rush into a stock, the more likely it is to continue to move higher–these are the stocks we want to target.

STT also offers an after-hours gainers scan.

The STT stock screener has nearly infinite configurability, with hundreds of criteria. And since 50% of STT users favor technical analysis, these criteria are hugely important to us.

Personally, Tim uses the STT after-hours percentage gain criteria and sets it to greater than 5%, because he typically trades momentum stocks. He doesn’t really care if something is up a couple percent after hours; it’s got to really be running after hours to get Tim’s attention.

The scan will give Tim all the stocks that are up more than 5% after hours, and then Tim sorts them by the percent change, top to bottom. Then he filters by price and volume and looks for liquidity.

This is what he gets:

You can learn more about the after-hours gainers scan here, and learn how to use it step-by-step with Tim.

As a day trader, there is nothing worse than a sideways stock.

Tim almost always prefers a stock that goes against him. That way, at least he will be stopped out and move on to the next trade. Sideways stocks are a sort of purgatory for traders. They burn your mental and physical energy and tie up your buying power.

Only trade stocks up-trending on big volume; ignore stocks that are not moving or are trending down.

Next week, we’ll be back with a detailed look at Tim’s Step 2—further filtering out the biggest percentage gainers by a catalyst.

Stay tuned!