Market cap is a key benchmark you can use when you’re looking for the best stocks to trade.

Listen, if you’re gonna trade the stock market you gotta do your research. In fact, knowing certain facts about a company can help you choose the right stocks to watch.

It’s also smart info to know when it comes to making solid trade plans.

One thing you want to research about a company is its size. The simplest way to do this is by looking at its market cap…

But what exactly is a market cap and how do you use it in your research?

I’m glad you asked. Today, we’ll dig in and spend some time answering those questions.

Table of Contents

What Is a Market Cap?

A market cap — short for market capitalization — is the total market value of a company represented in a dollar amount.

Traders and investors often use this metric to size up corporations. And there’s a bonus: it’s super easy to calculate. All you have to do is multiply a stock’s current market price by the total number of outstanding shares of the company.

There are different categories for market cap, and each is based on size.

Let’s take a look at the three main categories…

The Three Main Market Cap Categories

The market generally classifies stocks into three groups: large-cap, mid-cap, and small-cap. Let’s take a closer look at each.

Large-Cap

Large-cap stocks have a market cap of $10 billion and over. Some of the best-known companies in the world, such as GE and Tesla, are in this category.

Large-caps generally have well-developed business models and generate significant revenue. These stocks are more stable, secure than small- and mid-cap companies. Long-term investors tend to gravitate to these stocks for their potential long-term value and gains.

Mid-Cap

Mid-cap stocks have a market cap between $2 billion and $10 billion. Compared to large-caps, they tend to be growth stocks. They could potentially return stronger gains in a shorter time frame…

But mid-caps aren’t as stable as large-caps. They also face the difficult task of competing with and catching up with larger rivals in their industries.

Small-Cap

These stocks have a market cap between $300 million to $2 billion. These tend to be newer companies. And a lot of them go public in an effort to raise capital quickly. That’s not always a good sign.

A lot of these companies struggle. And because they have a shorter track record, you can’t always find lengthy financial history to analyze.

You might think you should avoid these at all costs, right? Not so fast. A lot of traders hone in on small-cap stocks. Yeah, they’re risky, but they can also have a high potential for growth and volatility.

Market Cap vs. Market Value

This is an important distinction … Don’t mistake market cap for another measure, the market value.

(Need to brush up on your market vocab? Check out this post.)

You can use both to measure a company’s standing, but they have very different calculations.

A market cap reflects a company’s equity value only … but it doesn’t necessarily reflect its true market value.

Remember how I said that you calculate the market cap by using a stock’s current market price and the number of outstanding shares?

Well, market value calculations are much more complex. They include many metrics such as price-to-earnings, price-to-sales, stockholder’s equity, and return-on-equity.

That’s a subject for another, though. Let’s get back to market cap and look at a few examples…

Market Cap Examples

You can look up a stock’s market cap by searching for that information on different financial websites…

Or you can easily look it up right from the StocksToTrade platform. Key company information is all in one place to help you speed up your research.

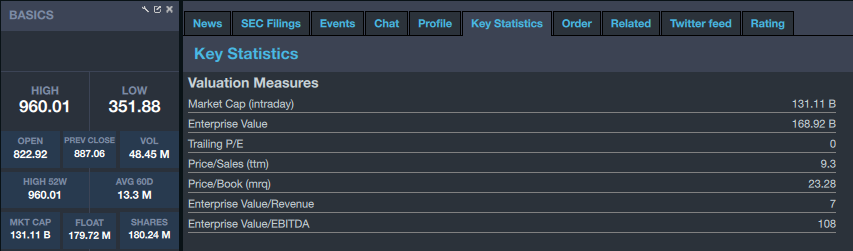

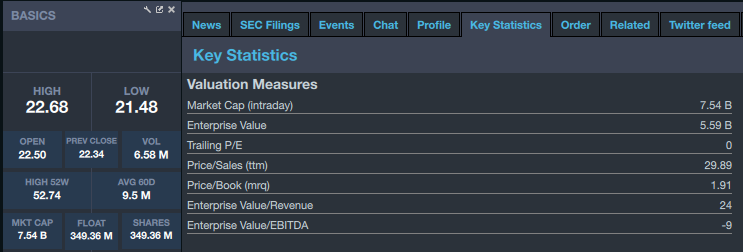

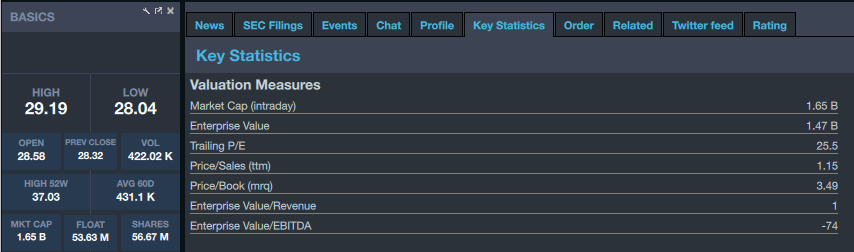

Under the Key Statistics tab, you’ll find the market cap information. Let’s take a look at an example for each category size.

One of the hottest large-cap stocks right now is Tesla Inc. (NASDAQ: TSLA). On February 6, the share price was $727.40. It has 180.24 million outstanding shares and its market cap is $131.11 billion.

For a mid-cap example, let’s look at a weed stock. Canopy Growth Corporation (NYSE: CGC). is a Canadian company that cultivates and sells medicinal and recreational cannabis.

On February 6, the share price was $21.57. With 349.36 million outstanding shares, the market cap is $7.54 billion.

For a small-cap example, we have Skyline Champion Corporation (NYSE: SKY). This company is based in Indiana. It operates as a producer of factory-built housing in the U.S. and Canada. As of February 6, the share price is $29.09. With 56.67 million outstanding shares, its market cap is $1.65 billion.

Why Is Market Cap Important?

A stock’s market cap matters when you’re doing stock research. Why? It speaks to which stage a company is in its business development.

This information can help you determine if a stock has the potential to fit certain setups … and it can also help you gauge risk vs. reward.

I’ll explain that further in a bit.

How Does Market Cap Affect Stock Price?

Large-cap stocks tend to be more conservative than the smaller ones. These companies have strong brands with a number of resources to help keep them stable. These companies might also be market or sector leaders.

They generally have less drastic stock price drops … but also less aggressive price increases. Some traders find these types of stocks slow and boring.

Mid-cap companies are more developed than small-cap companies. These companies are at a stage where they’re looking to increase market share and boost their competitive edge. On the risk/reward spectrum, they fall between large and small caps.

Small-cap companies have very limited resources compared to mid- and large-caps. This can make them vulnerable to both economic downturns and the uncertainties that come along with doing business. That means way more risk for traders and investors…

But there’s that volatility that day traders love. Small-caps can offer aggressive growth potential with very volatile stock price movements. But you gotta be savvy and know how to play them…

That’s exactly what we focus on in StocksToTrade Pro. That’s our mentorship community. I lead two webinars every day, plus share my screens and thoughts on the market. You can also access tons of educational videos and network with traders who are learning the markets just like you. Join us today!

What Factors Affect the Market Cap?

Like I said before, the market cap is a product of both the current price of a stock and the outstanding shares of the company. So anything that affects either of these things can impact the market cap.

The following factors can affect a stock’s price:

- Supply and demand for the stock

- The company’s fundamental strength

- News that affects the specific company, its sector or the overall market

- Competitor performance

- Politics, new laws or regulations, global events

The number of outstanding shares can be affected by the following:

- The company issues new shares

- The company buys back some of its shares

Now let’s take a look at the calculations…

How Does a Market Cap Calculator Work?

The formula for calculating market cap is as follows:

(Current Stock Price) x (Outstanding Shares of a Company) = Market Cap

If Company XYZ has three million outstanding shares and a current stock price of $2.00, the market cap would be $6 million…

($2.00) x (3 million shares) = $6 million

Let’s look at a real-world example.

ServiceNow, Inc. (NYSE: NOW) is a California-based company that provides enterprise cloud computing solutions for business worldwide.

According to its last form 10-Q, it has 188.6 million total outstanding shares. The stock price is $338.50 as of this writing.

Using the formula, the market cap for ServiceNow is $63,841,100,000 — that makes it a large-cap stock.

($338.50) x (188.6 million) = $63,841,100,000

Pros and Cons of Using Market Cap

Market cap isn’t the only way to measure the value of a company … and there are both pros and cons to it. Let’s take a look at a few…

Pros:

- The formula is simple and easy.

- It’s a way to determine a company’s size.

- You can use it to understand a company’s development stage.

Cons:

- There are more complex ways to get a more accurate value of a company.

Conclusion

Now you know what market cap is and how to use it.

Remember, this is just a piece of the puzzle. There are a lot of other things you should research when it comes to trading opportunities. The smartest traders remember to look at the big picture … That can help them make better trading decisions.

Market cap is a great tool to determine a company’s size and developmental stage. But there’s so much more to trading.

If you want to hear me talk about how market cap fits into my trader checklist, listen to this SteadyTrade podcast episode. I talk about the advantages of small versus large market caps.

Also, if you haven’t subscribed to my SteadyTrade updates, do it right here!

If you want to hear more about what to research before entering a trade, comment below!