Stock splits can be confusing. Sometimes newer traders are shocked to see their stock position cut by 50% — or even as much as 85% — overnight.

They think they lost or gained money fast. But in reality, the stock split.

What does that mean? I’ll break it down. Read on to find out about the different kinds of splits and what they can mean for your trading strategy. I’ll also show you some examples.

Table of Contents

- 1 What Is a Stock Split?

- 2 How Does a Stock Split Work?

- 3 Why Do Stocks Split?

- 4 When Do Stocks Split?

- 5 How Often Do Stocks Split?

- 6 What Happens When a Stock Splits?

- 7 Split Ratios

- 8 The Stages of a Stock Split

- 9 Stock Split History

- 10 Different Types of Splits

- 11 Reverse Stock Split vs. Stock Split: What’s the Difference?

- 12 Are Reverse Splits Good or Bad?

- 13 How to Profit From a Reverse Split

- 14 Stock Splits: Examples

- 15 Frequently Asked Questions About Splits

- 16 Stock Splits: The Bottom Line

What Is a Stock Split?

A split increases the number of outstanding shares of a stock using a split ratio. The price of each share is lower, but the company’s market capitalization doesn’t change. And the total market value remains the same.

How Does a Stock Split Work?

A company announces a split with an effective date in the near future. Then, on the ex-date — the execution date or day the split occurs — the company divides the stock price by the split ratio. The split ratio is relative to the number of additional shares issued.

Why Do Stocks Split?

A split is a result of strong performance. Typically, a company doing a split is growing earnings fast, and the stock is a sector leader trading near a 52-week high.

A company may decide to split its stock to:

- Increase its liquidity

- Join a price-weighted index like the Dow Jones Industrial Average

- Attract more buyers

- Signal that the company is growing fast

When Do Stocks Split?

A company announcing a split usually sets an effective date of 10–30 days after the announcement.

All shareholders who own the stock the trading day before the ex-date will take part in the split. The shares might take another few days to settle. Ask your broker if you have questions about how they handle splits.

How Often Do Stocks Split?

A company generally won’t split its stock more than a few times. Typically there’s more than a year between splits. That’s because a company will only declare a split when there’s a clear benefit to doing so.

What Happens When a Stock Splits?

When a stock splits, the total market value of the outstanding shares remains the same. But the number of shares increases by the split ratio, and the stock price decreases by the split ratio.

So a 2-for-1 split would give each shareholder double the number of shares, but it would also halve the price of each share.

Again, the dollar value of each shareholder’s position doesn’t change…

Split Ratios

Any ratio is possible: There are no rules. But…

The most common are:

- 2-for-1

- 3-for-1

- 3-for-2

- 4-for-1

The least common are:

- 4-for-3

- 5-for-2

- 5-for-4

Split Ratio 2-for-1

A 2-for-1 split means shareholders get an additional share for each share held. The stock price is halved.

Split Ratio 3-for-1

A 3-for-1 split means two additional shares are given for each share. The stock price is divided by three.

Split Ratio 4-for-1

A 4-for-1 split means shareholders get three additional shares for every share held. The stock price is divided by four.

Split Ratio 5-for-1

A 5-for-1 split means four additional shares are given for each share. The stock price is divided by five.

The Stages of a Stock Split

Understanding a split’s typical timeline can help traders time their entries and exits…

Pre-Announcement

Share value soars. This is usually in the 30–60 days prior to a split announcement.

Announcement

The announcement attracts a large number of new buyers, causing the stock price to rally for a few days.

Dormancy

The initial interest subsides. The stock levels off as it consolidates its recent gains.

Pre-Split Run

Buyers bid up the stock price, usually in the five to 15 trading days before the execution date.

Split Execution

The day the stock splits. The price rises as the shares begin trading at the post-split price. New buyers who want to get in at a lower price will often push the stock even higher.

Post-Split Depression

The price retreats as excitement fades and traders sell their shares to lock in profits. This period could provide short sellers with a low-risk opportunity.

Stock Split History

Stocks that have split traded at higher prices in the past. These historical prices have all been adjusted to the current price.

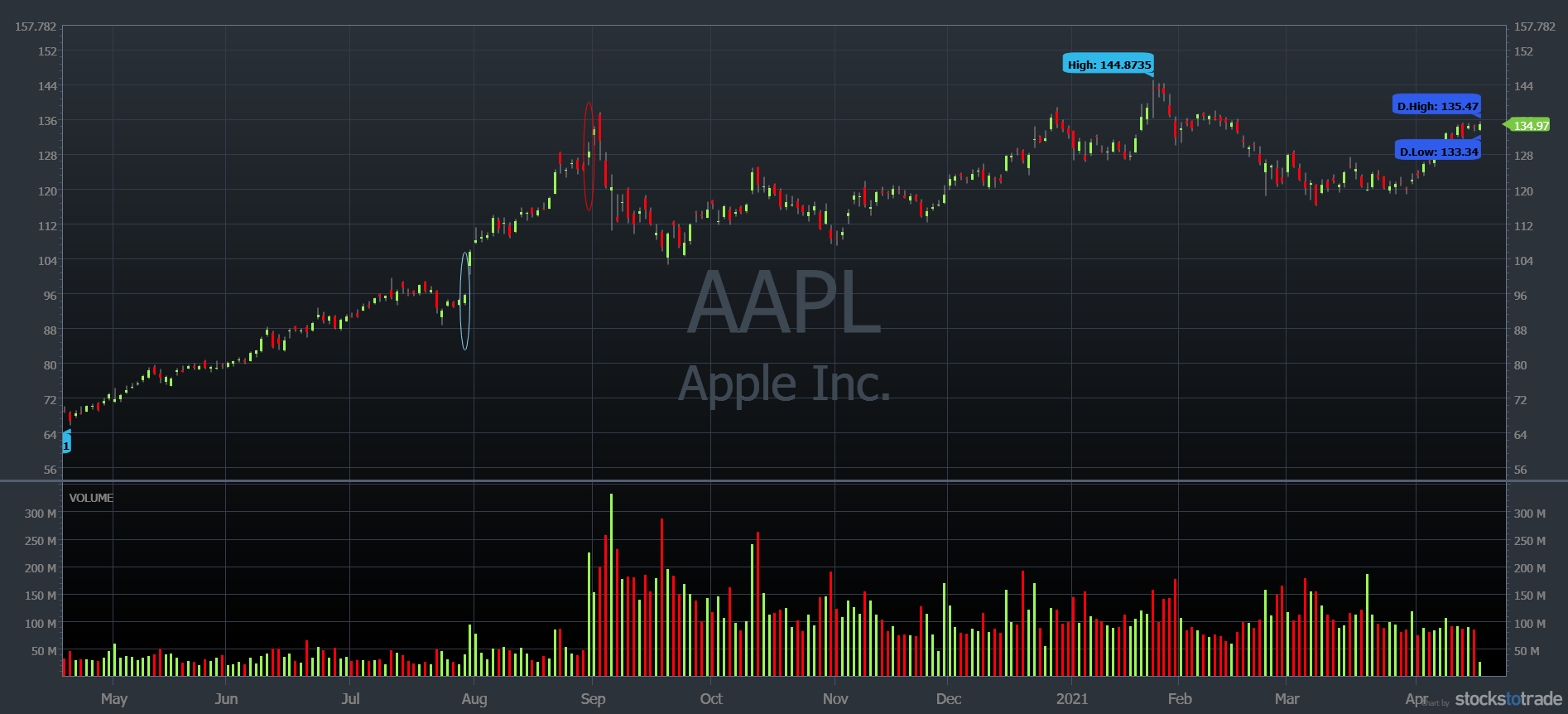

Apple Inc. (NASDAQ: AAPL) would appear to have traded under $1 in 2004. But that’s because it’s had three splits since then: a 2-for-1 split in 2005, a 7-for-1 in 2014, and a 4-for-1 in 2020. Taking those into account, Apple traded under $60 for most of 2004.

You can view stock split history in Yahoo Finance. A split is noted as a boxed ‘S’ in the volume part of the chart. Hovering over it will tell you the ratio and date. Stock Split History is another site that lists historical splits.

When looking at a stock’s chart, remember that the historical price gets adjusted after each split. If you want to see beautiful charts — and killer scans, news feeds, and more — check out StocksToTrade. Try it for 14 days for only $7!

Different Types of Splits

The split has an evil twin … the reverse split. Sometimes companies do the opposite of a split. They reduce the number of shares available while increasing the price per share.

Reverse Stock Split vs. Stock Split: What’s the Difference?

Splits usually happen at blue-chip companies and other companies with bright futures. Reverse splits generally happen in penny stock land. These companies often struggle to keep their stock prices up — and their lights on.

A reverse split boosts a stock’s price. A company may do that to appeal to more buyers. A stock over $1 seems to have more credibility than a stock under $1.

A reverse split lowers the number of outstanding shares. The price goes up so the company’s market capitalization stays the same. And the shares’ market value remains the same.

A reverse split usually occurs the trading day after the company announces it.

A company might do a reverse split to keep from being delisted. Stock exchanges give companies the boot if their stock prices fall below a certain level.

The penny stocks we trade are more likely to have reverse splits, as opposed to regular splits. Remember, these are junk companies that are fading into oblivion!

You can trade super low-priced stocks with the right plan and preparation. Check out how you learn from the Small Cap Rockets specialists. Find out how you can gain an education in small-cap trades.

Are Reverse Splits Good or Bad?

Reverse splits are usually bad for a company. They imply the company doesn’t believe the market can push its stock price higher. Companies that do reverse splits are usually losing money fast. So they try to raise the price of their shares, even though the value stays the same.

How to Profit From a Reverse Split

A company will sometimes try to boost its stock price by issuing a positive press release — like a new executive appointment — after a reverse split. Since the number of tradable shares is lower post-split, it takes less demand to push the stock higher.

Some traders like to take advantage of the news boost. So they dip buy the stock after the strong price action that follows the news release, then sell into the rally.

Traders have to keep up with the news. StocksToTrade’s Breaking News Chat add-on feature alerts you to the news with the potential to move markets — and you don’t have to sort through the fluff. Get a 14-day trial for just $17!

Stock Splits: Examples

Enough theory. Let’s look at an example of a regular and reverse split…

Apple Inc. (NASDAQ: AAPL) — Regular Split

The blue oval shows when AAPL announced a 4-for-1 split. The stock gapped up the following day. It then rallied until just after its ex-date (red oval). The company got a big price boost from this split.

A position of 10 shares at $300 each became 40 shares at $75 each after the split.

Guardion Health Sciences Inc. (NASDAQ: GHSI) — Reverse Split

The company announced a 1-for-6 reverse split (blue oval). This led to a gap down the following day, which was also the ex-date (red oval). While the company was no longer under threat of delisting, the reverse split led traders to turn negative on the stock. The price trended lower in the following weeks.

A position of 60 shares at $1 apiece became 10 shares at $6 each after the stock split.

Frequently Asked Questions About Splits

Are Stock Splits Good or Bad?

Splits are usually good. They indicate that company management believes the stock price will continue to rise. Split announcements tend to rally the stock into the split date. After Tesla (NASDAQ: TSLA) and Apple announced their splits in 2020, their prices ran up over 80% and 30%, respectively. Splits usually add a big boost to already popular companies.

How Does the Split of a Stock Affect Your Trading Strategy?

Split announcements tend to push a company’s stock price higher. This creates a potential swing trade. In penny stock land, a company doing a reverse split may issue a positive announcement to boost its stock price. These are potential day trades. Splits and reverse splits are different, but there are trading strategies for each.

What Are the Pros and Cons of a Stock Split?

A split increases liquidity, keeps the price low to attract investors, and signals confidence. But there are downsides ... A split comes with overhead expenses, like legal and accounting fees. Analysts and brokers also need to adjust their price data, which can cause confusion.

Stock Splits: The Bottom Line

Splits tend to confuse newer traders. But once you know how they work, they’re easy to understand.

Blue-chip companies sometimes split their stock to make their shares more accessible. These can be swing traded after the stock split announcement.

Reverse splits are usually in junk penny stocks, as the companies try to keep from being delisted. Day traders might take advantage of a rally related to the press release. But don’t believe the hype … Ultimately, these companies will trend lower.

If you love diving deep like we did here, check out the SteadyTrade Team. I do daily live webinars and review the setups that are working right now. Smart traders are always hungry to learn … If you want to feed your trading knowledge, join the SteadyTrade Team today!

Do you trade splits? How about reverse splits? Leave a comment below!