Knowing stock market sectors is one of the biggest keys to knowing which stocks to trade.

It’s the reason I’ll like one breakout and not another. We don’t look to trade every breakout. We want the ones that can continue pulling in volume.

And what’s the best way to find that? You have to understand the different sectors in the stock market. And you’ve got to know which ones are HOT.

If you watch my daily Pre-Market Prep sessions, you’ve heard me talk about stock market sectors. What do I mention at least 50 times a day? Hot sectors!

Why is it so important to know which sectors are performing well?

In a recent strategy session, someone on the SteadyTrade Team said it better than I ever could. Sorry, trader, I forget who you are! But the fact that we can collaborate like this is one of my favorite things about SteadyTrade.

Here’s what this trader said: “News follows the trend.” And that’s exactly right. We know that news moves stocks, and what do people write news about? They write about things that people are interested in.

Look at the recent runs in the electric vehicle (EV) sector. It’s a great example to learn from a hot sector’s big news and sympathy plays. And with EVs, of course, you can see how Elon Musk’s tweets can spark even more action.

I know I’ve given up 10 times in the last 5 years.

— Timothy C. Bohen (@tbohen) November 19, 2020

But I’m officially done trying to help you $TWTR weirdos

If you are shorting hot sector plays at 52’s because of what a Fintwit wizard says, you deserve what you get.$FCEL $KNDI $SOLO etc etc etc etc pic.twitter.com/VuUKxZBIRd

Table of Contents

- 1 Stock Market Sectors: What Are They?

- 2 What Are the 11 Sectors of the Stock Market?

- 3 What Are the Best Stock Sectors to Trade In?

- 4 Stocks to Watch in Each Stock Market Sector

- 4.1 VAALCO Energy Inc. (NYSE: EGY)

- 4.2 American Battery Metals Corp (OTCQB: ABML)

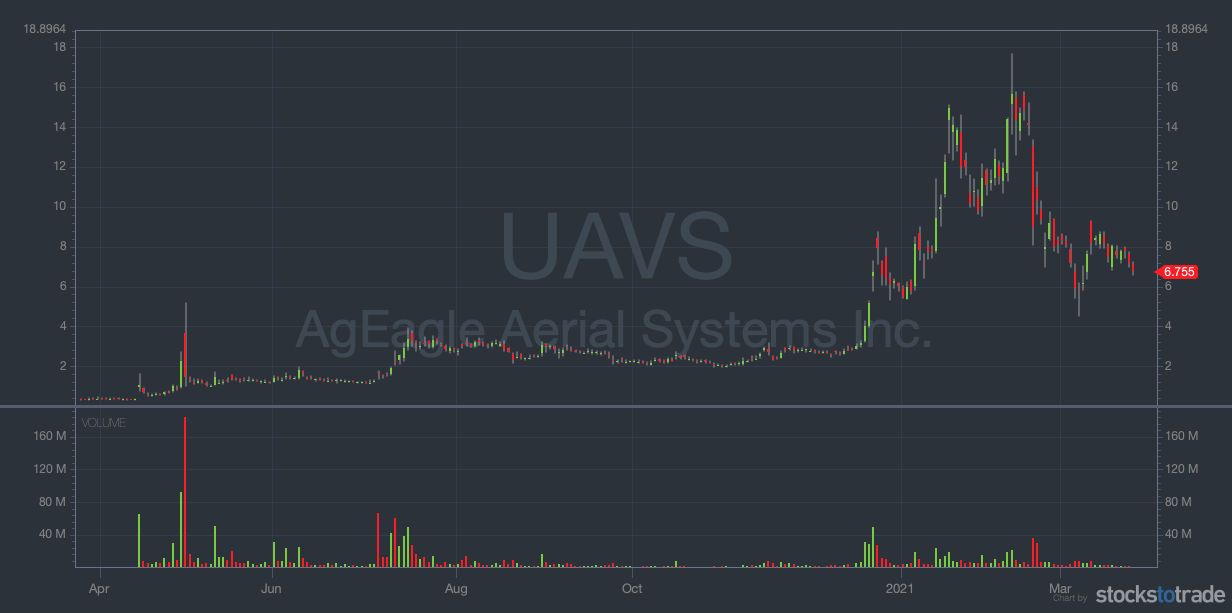

- 4.3 AgEagle Aerial Systems Inc. (AMEX: UAVS)

- 4.4 Tesla Inc. (NASDAQ: TSLA)

- 4.5 Cronos Group (NASDAQ: CRON)

- 4.6 Insmed Inc. (NASDAQ: INSM)

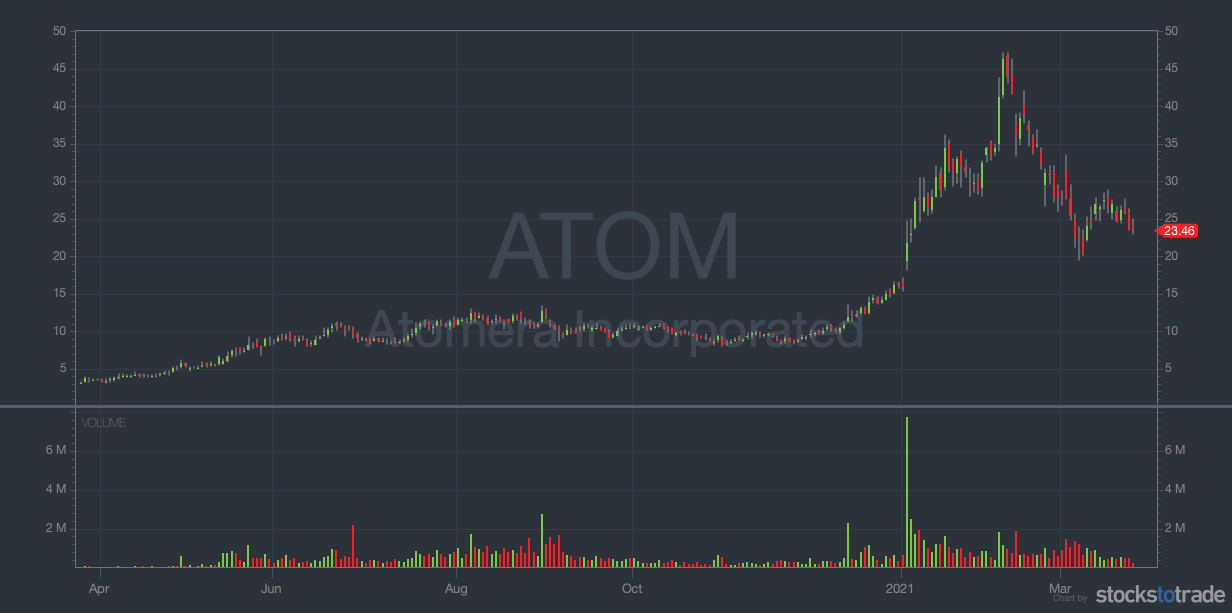

- 4.7 Atomera Inc. (NASDAQ: ATOM)

- 4.8 Qualcomm Inc. (NASDAQ: QCOM)

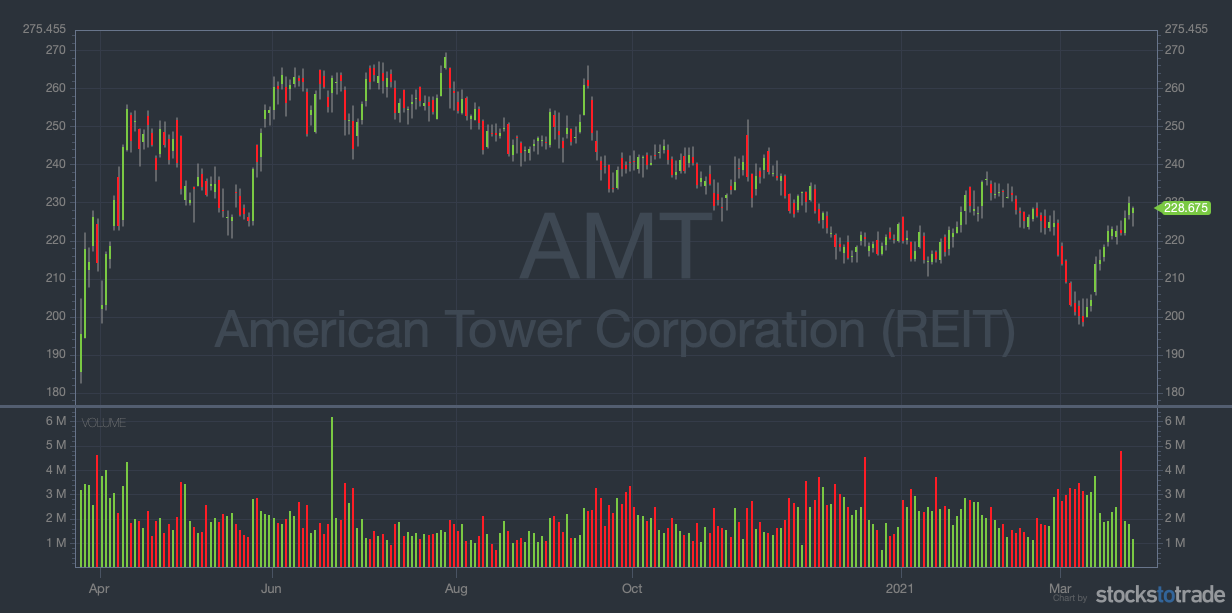

- 4.9 American Tower Corp. (NYSE: AMT)

- 5 How Do You Trade Different Stock Market Sectors?

- 6 Why Should You Trade Different Stock Market Sectors?

- 7 Frequently Asked Questions About Stock Market Sectors

- 8 Conclusion

Stock Market Sectors: What Are They?

What are the different sectors of the stock market?

We’ll have to get technical for this one.

The 11 traditional sectors are determined by the Global Industry Classification Standard (GICS). GICS was developed by index providers MSCI and Standard & Poor’s.

When someone asks, ‘“What are the 11 S&P 500 sectors?” this is what they mean.

A better question is, “How many industries are there?” Then you’re getting closer to what traders care about.

The 11 stock market sectors have a lot in there. There are 24 industry groups, 69 industries, and 158 sub-industries.

Traders have to go even deeper than that. We’re not investors, trying to diversify our portfolios to set and forget. We’re active participants in the market and trying to ride the hot momentum.

We go where the action is, like EV plays when they’re hot. And some categories that we talk about, like at-home plays, map to several sectors.

That said, you need to know where this all fits in.

What Are the 11 Sectors of the Stock Market?

Again, this is a bit of a rough fit for the way we talk about stocks. So keep your eyes open and know this is good background information to have.

When we talk about the marijuana stock sector, we’re talking about a few different sectors. Pot stocks involve the consumer discretionary sector, consumer staples sector, and healthcare sector. They involve real estate and the financial sector. And they even involve other new ‘sectors’ like AgTech.

Knowing these broad categories helps us to understand what affects a stock’s movement.

Energy

When we’re talking about energy, we’re not talking about things like EV stocks. We’re not even talking about energy producers and traders — they’re in utilities.

Here we’re only talking about companies that mine, drill, and refine energy products like oil, gas, and coal.

This is still enough for a multibillion-dollar sector. Plenty of the stocks also pay dividends.

Materials

The materials sector focuses on the production, refinement, and mining of raw materials. We’re looking at gold, silver, and steel. Rare earth metals. Chemicals. Paper. Packaging.

This sector’s products go in a million different directions. You need them for cellphones and computers. As well as everything that requires chemicals and metals.

Industrials

Industrials is a catch-all for defense, machinery, aerospace, airlines, construction, and manufacturing companies.

Many large-cap companies call this sector home. But they also rely on construction and manufacturing demand from other sectors.

Consumer Discretionary

OK, we all know consumer discretionary. We’re talking about clothes, entertainment, cars. The mighty EV sector goes in here, as well most of the at-home plays that have been hot in 2020.

It’s filled with things that you buy when you have extra money. It’s been uneven in the past year, with hotels, restaurants, and movie theaters hurting. But the streaming entertainment, fitness, and food delivery sectors are booming.

Consumer Staples

This is the stuff you can’t do without. Stocks here are historically pretty recession-proof. I’m even talking about the alcohol and tobacco stocks in this category! Many companies that sell these products even perform better in weak economies.

But if they don’t come down, they can’t go up. These steady stocks aren’t the best for traders who like volatility.

Healthcare

The healthcare sector contains everything to do with healthcare — facilities, services, equipment, technology. It also includes pharma and biotech.

There were many hot stocks throughout this sector in 2020. And the sector will continue stirring the drink for other sectors for a while.

Financials

The big money stocks go here. I’m talking about companies like JPMorgan Chase & Co., Bank of America Corp., and Wells Fargo & Co. These are companies whose business is literally money.

They’ve been better prepared for this crisis than they were in 2008. And they’ve actually been doing all right in the mortgage business, as second homes drive a housing boom.

Information Technology

The technology sector has been home to the hottest stocks ever since I’ve been trading. And a new generation of traders is pushing it to new heights.

Upgrade cycles are typically a time of growth for these companies. But they’ve been among the most reliable gainers, regardless.

Telecommunication Services

Telecom is the sector that all of our technology runs on. So it’s only getting more important.

Wireless, internet, and cable providers are the backbone of this sector. Watch out for 5G action and expansion.

Utilities

Electric, gas, and water utility stocks are the old, dependable stocks. They’re recession-proof but highly regulated. They only operate regionally, so they can’t grow too much.

Real Estate

No, we’re not talking about the house you live in — unless it’s a company-operated rental.

Stocks in this sector are either real estate developers or companies. Operators span apartments, malls, offices, and senior living communities. They give out most of their profits in dividends, so they’re not ideal for traders.

What Are the Best Stock Sectors to Trade In?

Again, I’ll give you the magic words: Hot sectors.

I think the best stock market sectors to trade in are the ones that have been going all year. You can hear all about them on my premarket briefings or the SteadyTrade Team.

Or find them yourself by watching the market. StocksToTrade’s powerful stock screener will turn up some of the same stocks in volume scans. And you might start to see the same names in the percent gainers scan.

StocksToTrade even has an add-on alert service that specializes in breaking news. The Breaking News Chat is great for finding the most important news. And, like we all know, ‘news follows the trend.’

Try StocksToTrade for 14 days for only $7. Or get it with that game-changing Breaking News Chat add-on for $17.

Stocks to Watch in Each Stock Market Sector

There are enough stocks to fit every watchlist. I’ll give you a rundown of some interesting picks in different stock market sectors. And I’ll tell you how they fit into the way I trade. These stock picks are for educational purposes only. Do your own research before you trade — every single time.

VAALCO Energy Inc. (NYSE: EGY)

EGY made my December 2020 oil penny stock watchlist … and it’s been climbing ever since. At its peak, it was back near its pre-March 2020 levels.

It’s a Texas-based energy company. It explores, develops, and produces oil and natural gas for export.

The past few months have been especially good. Since a trough at the end of October, the stock has almost tripled in value.

American Battery Metals Corp (OTCQB: ABML)

This lithium and battery-grade metal producer is part of the EV sector. It’s gone wild over the last few months, surging almost 2,000% from mid-December.

The big December news was a lithium-ion battery recycling plant. But let’s not kid ourselves — the real catalyst will probably always be Tesla.

AgEagle Aerial Systems Inc. (AMEX: UAVS)

Drone technology and unmanned aerial vehicles (UAVs) are what this company does. And they’ve catapulted UAVS to the top of the civil defense heap.

What a rise it’s had! At its peak, it was up around 4,000% from where it sat in April.

Our Breaking News Chat guys caught this one at the beginning. They alerted subscribers as it spiked from near $1 all the way up to $2.69. (Past performance is not indicative of future returns.)

Tesla Inc. (NASDAQ: TSLA)

OK, let’s get this out of the way. If we’re talking hot sectors, we need to mention Tesla one more time.

Tesla was the star of 2020. It burned through the year like a penny stock. And I think it’s still got room to grow.

Now it’s back in the mid-$600s. Guess what — I still like it.

Cronos Group (NASDAQ: CRON)

Let’s fudge this one a bit and connect it with consumer staples. The CBD products that CRON produces could arguably be a consumer staple, depending on who you ask. But its financial benefactor, cigarette maker Altria (NYSE: MO), is definitely a consumer staple stock.

Listen — I’ve been watching pot stocks since they first blew up. And that’s why I always rag on them. There are a lot of bag holders. But CRON can make some nice moves.

Insmed Inc. (NASDAQ: INSM)

There are a ton of healthcare sector stocks we could look at here. But I like INSM’s chart.

The company concentrates on the global treatment of serious and rare diseases.

Atomera Inc. (NASDAQ: ATOM)

If you’ve been paying attention, you’ll know that I’m bullish on the 5G sector. I think it will change everything.

ATOM is a semiconductor company that will figure into the 5G era. What I like most about it? Check out its recent 300% spike from December.

Qualcomm Inc. (NASDAQ: QCOM)

QCOM has partnered with Swedish telecom Ericsson to develop a 5G network. This has already shot the stock well past all-time highs.

American Tower Corp. (NYSE: AMT)

Real estate investment trusts (REITs) like American Tower are also getting into the 5G groove.

AMT owns and operates close to 180,000 cell towers worldwide and will be instrumental to the 5G rollout. AT&T, T-Mobile, and Verizon make up 88% of AMT’s client base.

How Do You Trade Different Stock Market Sectors?

When traders look for the best stocks to buy or sell right now, a good catalyst is on top of the list.

This catalyst can be as simple as Elon Musk tweeting one word to give a stock a short-term boost. Or it can be something that creates a trend. Just look at pot stocks after President Biden’s election and the Democrats taking control of the Senate.

These two catalysts led to price spikes across the sector. But if you look at the difference in volume from November on, you’ll see a more subtle trend.

Just look at the volume similarities across the sector:

When you trade different stock market sectors, you get a sense of volume. You develop a feel for stocks in the sector. And you see the signs when they start moving.

That’s why I always talk about hot sectors and former runners. When they start making moves, it’s the best sign that volume will return.

This feel for the sector sets you up for good trades when new catalysts come in. Randomly trading pot stocks after you’ve heard that other people are doing it is a good way to blow up your account.

Focusing on a sector also helps you with your studying. If you like pot stocks, you might want to check out Mike “Huddie” Hudson’s webinars on the SteadyTrade Team.

He’s been following sub-penny pot stocks for the last few months. He can show you things on a chart that can be easy to miss.

Why Should You Trade Different Stock Market Sectors?

If you understand the whole of the market, you can be better prepared for whatever it throws at you.

We’ve seen a great example of that in the last year. We’ve all been sitting at home way more than we’re used to.

This past year has changed how we think about things. A vaccine could cause stocks in consumer sectors to go up. And it could have the same effect on the industrial sector’s airline stocks.

More than ever, everything is connected. And if you can learn to think ahead, you might find some pretty solid plays waiting.

Frequently Asked Questions About Stock Market Sectors

What Are the Different Sectors of the Stock Market?

According to the official count, there are 11. They pretty much cover everything, from consumer goods to heavy industry.

What Industries Are Doing Well Right Now?

‘Industries’ has an official meaning, according to the GICS classification system. There are 69 industries in all. As for what’s hot — check the news. STT’s Breaking News Chat and its built-in news feed help you stay on top of the hottest stocks and sectors every day. Get your 14-day trial now.

What Are Some Top Stocks to Watch Right Now?

Watch my premarket briefings and scan the market every morning using STT’s built-in scanners. You’ll see some of the same names come up. Chances are they’ll be worth a spot on your watchlist.

Which Sectors Should I Trade in 2021?

I think this market can continue to go in 2020’s direction. We’ve seen so much action already, from EVs to NFTs and much, much more. Need a mentor to help you find what’s hot? Get in the SteadyTrade Team now.

Which Stock Sectors Will Perform Well in 2021?

I have some guesses, but the only way to know is to watch how the market unfolds. Show up every day, keep an eye out for big catalysts, and be ready for any potential action with your trading plan.

Which Sectors Will Grow in the Next 10 Years?

There’s plenty of potential. But I don’t like to predict. I go to what’s hot NOW and build trading plans for that. When a hot sector cools off, I’m already on to the next thing. That’s how smart traders do.

Conclusion

Hope this helps you to see the big picture.

There are roughly 16,000 stocks out there, and they all fit in somewhere … You’ve got to see the whole field, but just throw the ball to one receiver. And make sure they’re in a hot sector!

This shouldn’t overwhelm you. Sign up for my no-cost weekly watchlist and Pre-Market Prep daily digest — I’ll tell you what I’m watching. Your job is to find what suits you and your strategy.

And remember, when all else fails, watch the hot sector.

How are you navigating stock market sectors? Do you have a favorite, or do you switch it up? Let me know in the comments, I love hearing from my readers!