Nope, you can’t drink liquid stocks — but you can trade them!

Liquidity indicates how easily you can turn an asset into cash. That includes houses, books, and yep … stocks.

This is one key indicator of how tradeable a stock is. So you should absolutely know what it is, how it’s calculated, and why it matters.

Let’s explore why it’s so important to find liquid stocks!

Table of Contents

What Are Liquid Stocks?

These are stocks you can trade without substantially affecting their price.

You can easily enter and exit. And the quoted stock price is close to the price at which your trade orders will fill.

Liquid stocks have smoother charts. Each one-minute candle has a body. There are no razor-thin candles or long gaps between candles with no movement.

Most low-priced and penny stocks aren’t liquid … We call these illiquid stocks.

Why Is Liquidity Important for Trading Stocks?

There’s nothing scarier than being in an illiquid stock and seeing it drop 10% on the next tick.

And that drop isn’t because of any negative news. It’s because there aren’t enough traders to keep the price moving smoothly.

When stocks aren’t liquid, the price might take minutes or hours to move. Since there aren’t enough traders to keep things liquid, the price jumps a lot on each trade.

If a liquid stock is trading at $10, you can exit fairly close to that price — $10.10 for example.

However, if an illiquid stock is trading at $10, you can end up exiting fairly far from that price — $11, for example.

That kind of slippage can mean your losses rack up fast. That risk isn’t worth trading illiquid stocks over the long run.

Don’t trade illiquid stocks! They’re choppy, have high spreads, and are difficult to get in and out of.

When you analyze illiquid stock charts, it’s tough to see intraday chart patterns or support and resistance levels too.

It’s just smart trading to stick to liquid stocks.

How to Identify Good Liquid Stocks for Trading

Be aware that trading liquid stocks is key to finding consistency. You don’t want to be chopped around each tick.

Stock liquidity increases when stocks are hot and volatile. And it fades when they cool off and become less volatile.

And just because a stock is liquid today doesn’t mean it will be tomorrow. Interest in a stock can fade quickly. So you have to think about how volume might decrease with time.

A stock that was liquid a week ago might not be liquid today.

OTC Stocks

You’ll usually find illiquid stocks in the OTC markets. I rarely trade them since I prefer listed stocks. But it’s important to be aware of ‘em, in case you do.

Even when an OTC stock is very liquid, it can have liquidity issues during large price movements. For instance, it can be tough to sell during a panic and tough to buy during a squeeze.

Sometimes it might take minutes to fill your order. And there will be a large spread to boot … It’s a raw deal when seconds count.

OTC stocks will be slower to execute even if they’re as liquid as a listed stock.

It’s important to be very careful when trading OTC stocks. Always use Level 2 quotes when trying to time a trade during a squeeze or panic.

How Is Stock Liquidity Calculated?

Stock liquidity is measured using volume. Volume is how many shares are traded. More volume means more liquidity. You’ll find liquid stocks will typically have lower spreads too. Let’s look at how you can calculate stock liquidity.

Extrapolating Volume

Sometimes you wanna compare a stock’s current volume to a previous day’s volume. But the volume at the start of the day is typically a lot less than its total volume at the end of the day.

So to estimate a stock’s total volume at the end of the day, you have to extrapolate how much more volume it could make.

Keep in mind, premarket volume is usually lower than regular trading volume. And the first hour’s volume is usually the greatest of the day.

Dollar Volume

While volume shows how many shares were traded. We usually wanna deal with dollars. After all, our trading account is measured in dollars.

So, another way to calculate stock liquidity is dollar volume. This gives us a better idea of how many dollars were traded. It can be a more accurate representation of how stock liquidity relates to actual cash. Dollar volume shows how many dollars were traded over the day.

As a rough estimate — you can generally consider stocks over $10 million daily dollar volume as liquid.

These are more likely to be easy to enter and exit. But stocks close to that $10 million level might still be choppy and not as smooth. I think it’s smart to look for a dollar volume much greater than $10 million.

Keep in mind, you never want your trade to move the market significantly. So aim for a maximum position size of 1% of the dollar volume in the stock. This is especially useful with low-priced stocks that seem liquid. But because their prices are low, so is their dollar volume.

Dollar Volume Calculator

- Current Dollar Volume = Current Daily Volume x Current VWAP

- Dollar Volume = Total Daily Volume x Closing VWAP

VWAP stands for volume-weighted average price. It’s the average stock price throughout the day. More trades at a certain price will push VWAP toward that price.

How StocksToTrade Can Help You Find Liquid Stocks

One of the biggest features of StocksToTrade is its turbocharged screener. The custom-built scans will filter out the stocks you’re looking for. There are 40+ built-in scans included in StocksToTrade. And you can create plenty of more custom scanners tailored to your needs.

Add StocksToTrade to your daily trading plan — get your 14-day trial for just $7!

Here’s how you can use StocksToTrade to help you find liquid stocks…

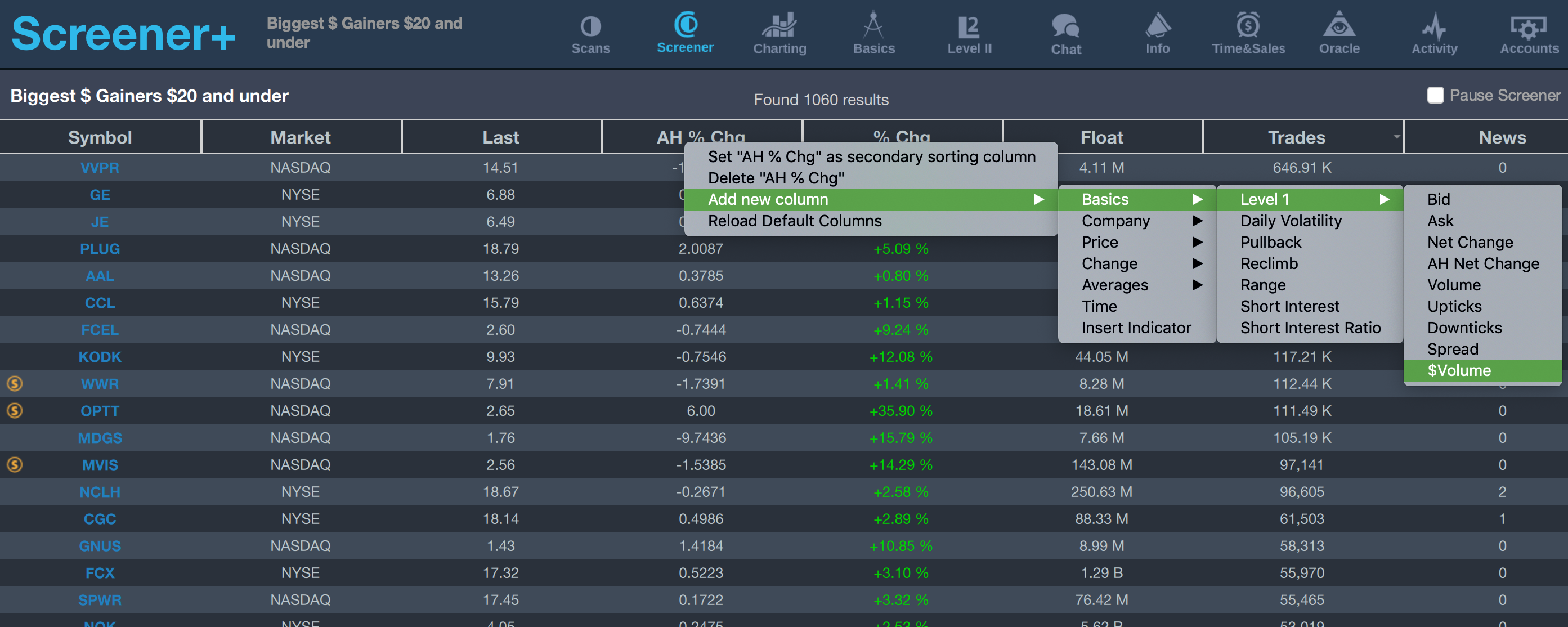

Screener Window

To enable dollar volume in the StocksToTrade Screener Result window:

- Right-click on a column header

- Select ‘Add new column’

- Select ‘Basics’

- Select ‘Level 1’

- Click ‘$Volume’

Click on the ‘$Volume’ column header to sort results in descending order. Click again to sort the results in ascending order.

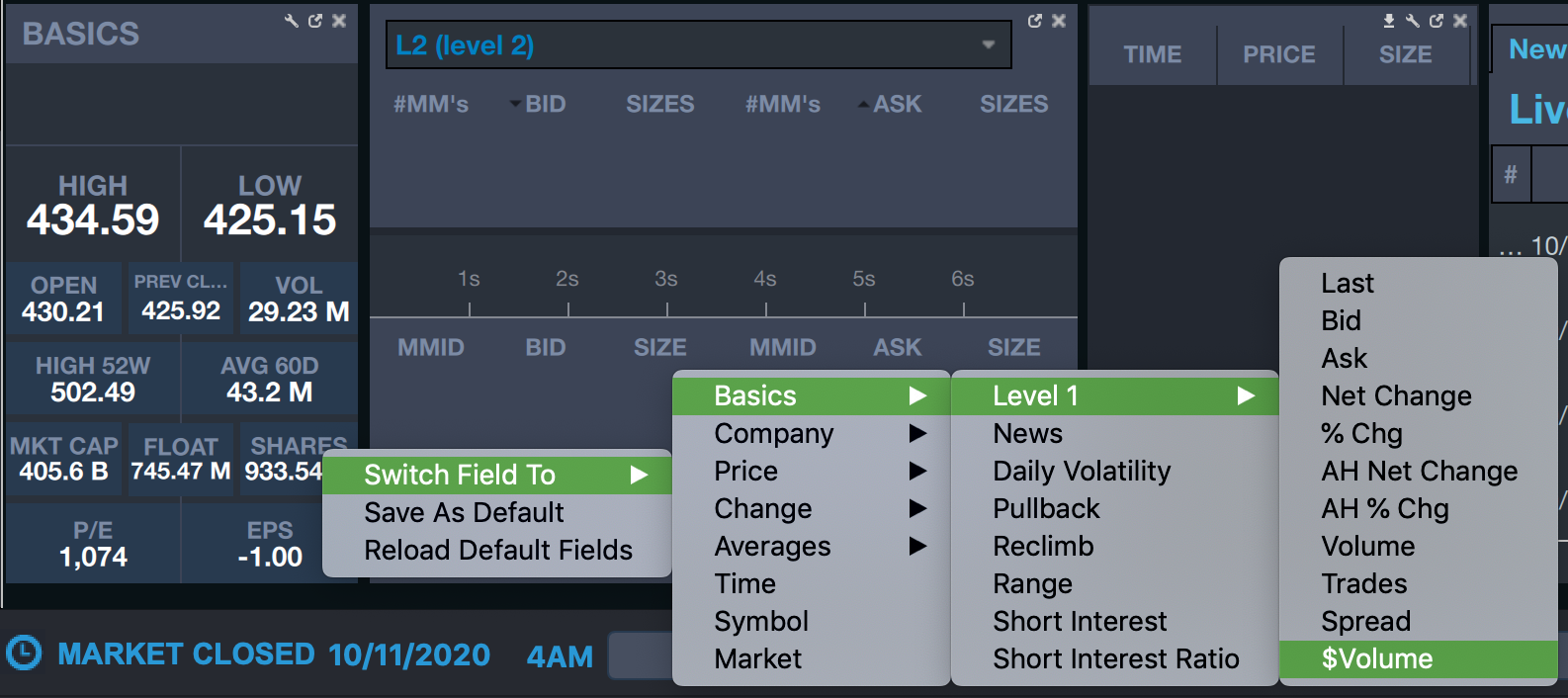

Chart Window

To enable dollar volume in the StocksToTrade chart window:

- Go into the ‘Basics’ toolbox and right-click on a field

- Select ‘Switch Field To’

- Select ‘Basics’

- Select ‘Level 1’

- Click ‘$Volume’

‘$Volume’ will display as ‘Turn’ in the field.

Are Liquid Stocks Good for Trading?

While you should only trade liquid stocks, not all liquid stocks are good for trading. The setup needs to be there. Stock liquidity is only a piece of the puzzle.

You gotta consider the whole picture and make a case for the stock. Is there a catalyst? Is it in a hot sector? Is it the right pattern? Is it the right time of day?

This way, you will find only the best stocks to trade.

Time of Day

Premarket Hours

Premarket trading occurs from 4 a.m. to 9:30 a.m. Eastern. It’s usually much less liquid than regular trading hours.

You can watch premarket action to get a feel for potential plays. You’ll see some liquid premarket runners that appear look great, but then they end up fading the rest of the trading day.

It’s easy to get FOMO and think you should get in before the market opens for a head-start. But I would avoid these trades at all costs.

Wait until after 9:45 to trade a stock. That can help you avoid major price swings at the open. But definitely watch the price action. Let the stock prove itself.

I love getting up early to get a feel for the market. You can join me every morning in my daily premarket live sessions on Instagram. There’s also a live session at noon when the market’s usually slower.

Join me for these sessions. It’s a great way to see how I filter through stocks and how I do overall market research. You can also see how I focus on the most liquid time of day…

Regular Trading Hours

Regular trading hours are from 9:30 a.m. to 4 p.m. Eastern. That’s when stocks are the most liquid. The first and last hours are the most liquid times of the trading day. It’s where the vast majority of trades occur.

I know many successful traders and they all focus on trading during regular trading hours. Keep this in mind and focus on doing the same any time you’re tempted by premarket or after-hours trading.

Midday is the least liquid part of regular trading hours. You can watch midday price action, but be careful trading it. It tends to be choppy.

After-Hours

After-hours trading occurs from 4 p.m. to 8 p.m. Eastern. It’s also a lot less liquid than regular trading hours.

Sometimes you’ll see stock news come out after-hours and be tempted to buy. I recommend staying away. You have the following day’s premarket to worry about before the market opens.

There’s often a dip buying opportunity during the following day’s regular trading hours.

I think it’s best to avoid the times of day when trading is overall less liquid times. Yep, you may spot opportunities in premarket and after-hours … But not nearly enough to justify trading during these times.

I always focus on the most liquid time of day.

If you follow my tips, you focus on big percent gainers in hot markets regardless. These usually have plenty of volume and are super liquid.

You can follow my tips and learn my thought process by joining the SteadyTrade Team mentorship community. You’ll receive twice-daily webinars from me, plus expert guidance from Michael “Huddie” Hudson and trading coach Kim Ann Curtin. Join us today!

Examples of Liquid Stocks

The following are some examples of how liquidity affects chart price action. All these charts are from Friday, October 9, 2020.

Tesla Inc. (NASDAQ: TSLA)

Tesla has been one of the hottest stocks in the market this year. But here it’s currently in a period of consolidation.

This stock is extremely liquid. The chart is smooth, even from premarket at 7 a.m. Eastern. There’s substantial volume on every 1-minute volume bar. You can see the increased volume in the first hour and last hour of regular market hours.

The total volume for the day was 29.23 million shares. And the total dollar volume for the day was $12.6 billion.

ElectraMeccanica Vehicles Corp. Ltd. (NASDAQ: SOLO)

SOLO was a hot stock during the summer. But it’s been consolidating for a while. It was fairly illiquid in the morning, but it picked up volume into the close.

Note how choppy and illiquid premarket and after-hours are. The total volume for the day was 5.65 million shares. The total dollar volume for the day was $14.4 million.

CytoDyn Inc. (OTCQB: CYDY)

CytoDyn was a hot OTC in the summer as well. But it’s now downtrending. Note again how choppy the price action is…

Some minutes don’t have any trades. These lack volume bars and have razor-thin candles. Unless this stock gains more volume, it’s too illiquid to trade. The total volume for the day was 1.79 million shares. The total dollar volume for the day was $5.9 million.

Conclusion

Stock liquidity is an important indicator of whether a stock is tradable. Even if the setup is there, if the stock isn’t liquid enough — it’s not worth trading it.

It’s important to realize that either a stock is liquid enough … or it’s not. And it’s better to simply miss the trade if it isn’t. Even if it works out, it’s not worth the risk. There will always be a more ideal stock eventually.

There are many dangers in trading in illiquid stocks — big, choppy price movements, high spreads, and tough executions. All those reasons should be enough to stay away!

Here at the SteadyTrade Team, we only focus on liquid stocks. We know how important it is to get in and out quickly. If you would like to see us in action… Huddie, trading coach Kim Ann Curtin, and I look forward to mentoring you. Join me and an amazing group of traders at SteadyTrade Team now!

As always, listen to the SteadyTrade podcast and check in on the StocksToTrade blog to keep up to date on the latest developments in the stock market! The market is always evolving. Stay on top of it so you can live on to trade another day.

Trading liquid stocks is important to finding your market stride. It’s vital to be aware of stock liquidity so you can find the best stocks to trade. Liquid stocks tend to have the biggest and best moves. So keep an eye on the volume and make sure to focus on the most liquid stocks!

Do you trade liquid stocks? Leave a comment below and tell me what you think!