If you trade stocks, you’ve probably heard of a reverse stock split.

There are different reasons a company chooses to go through one … and sometimes it can set a stock up for possible big price moves in the future.

Some traders even specialize in trading stocks that go through reverse splits in hopes of catching big profits.

But just what is a reverse stock split? And why do some traders focus on them?

Let’s take a closer look.

Table of Contents

- 1 What Is a Reverse Stock Split?

- 2 How Does a Reverse Stock Split Work?

- 3 Are Reverse Stock Splits Good or Bad?

- 4 A Bit of Reverse Stock Split History

- 5 Reverse Stock Split Examples

- 6 Why Would a Company Do a Reverse Stock Split?

- 7 The Impact of Reverse Stock Splits

- 8 How to Profit From a Reverse Stock Split

- 9 Conclusion

What Is a Reverse Stock Split?

Before we go into what a reverse stock split is, let’s start with defining a regular stock split…

Stock Split

A stock split— also known as a forward stock split— happens when a company increases its number of outstanding shares. It does that by issuing more shares to current shareholders.

That increases the number of outstanding shares by a multiple (usually 2-for-1 or 3-for-1). But the total combined price value of the shares stays the same. Let’s look at an example…

Say a company with five million shares at $10 each has a 2-for-1 stock split. That means shareholders receive an additional share for each share they own. That doubles the original shares outstanding from five million to a total of 10 million.

The share count increases — but the total value of the shares remains the same. So the price per share drops. In this example, the share price is cut in half to $5.

Why would a company split its stock? The main reason is to increase liquidity. It’s a way to make shares more affordable. That can lure smaller traders and investors. For example, if Amazon (NASDAQ: AMZN) wants more trading activity, it might go through a stock split. Then more traders could afford it.

Stock splits are primarily practiced by healthy companies with significant price growth.

Reverse Stock Split

A reverse stock split is the opposite of a stock split. It’s when a company reduces the number of its existing shares by a multiple. That could be 10 or 20.

Like a regular stock split, the number of outstanding shares changes, but the total value of the company’s shares stays the same.

How Does a Reverse Stock Split Work?

If a company reduces its outstanding shares by a multiple of 10, it’s called a 1-for-10 reverse split.

Again, the number of shares decreases, but the total value price remains the same. So the price per share increases.

In the example above, a 1-for-10 reverse split would increase each share price by a multiple of 10. So if the stock price was 30 cents before the split, it’s then worth $3 after.

Are Reverse Stock Splits Good or Bad?

Reverse splits are generally looked down upon in the investment community. Let’s face it, if a company was doing well, it probably wouldn’t need to boost its price.

Remember, a company uses a regular stock split to lower the stock price and make it more affordable. Reverse stock splits increase a stock’s price and — ideally — its perceived value.

A Bit of Reverse Stock Split History

Although reverse stock splits have a stigma attached to them, they’re sometimes necessary to help a company get healthy again.

Reverse stock splits were popular in the post-dot-com era when many companies fell victim to record low stock prices. In 2001 alone, more than 700 companies decided to do reverse stock splits.

Here are some examples where a reverse split helped a company become healthy:

In 2000, Laboratory Corporation of America Holdings (NYSE: LH) did a 1-for-10 reverse split after being stuck in low-price land for years. LH trades at over $170 per share 20 years later.

In 2003, Booking Holdings Inc. (NASDAQ: BKNG) did a 1-for-6 reverse stock split, lifting its stock price from $3.50 to $22. Now, 17 years later, the price for a single share is over $1,900.

Reverse Stock Split Examples

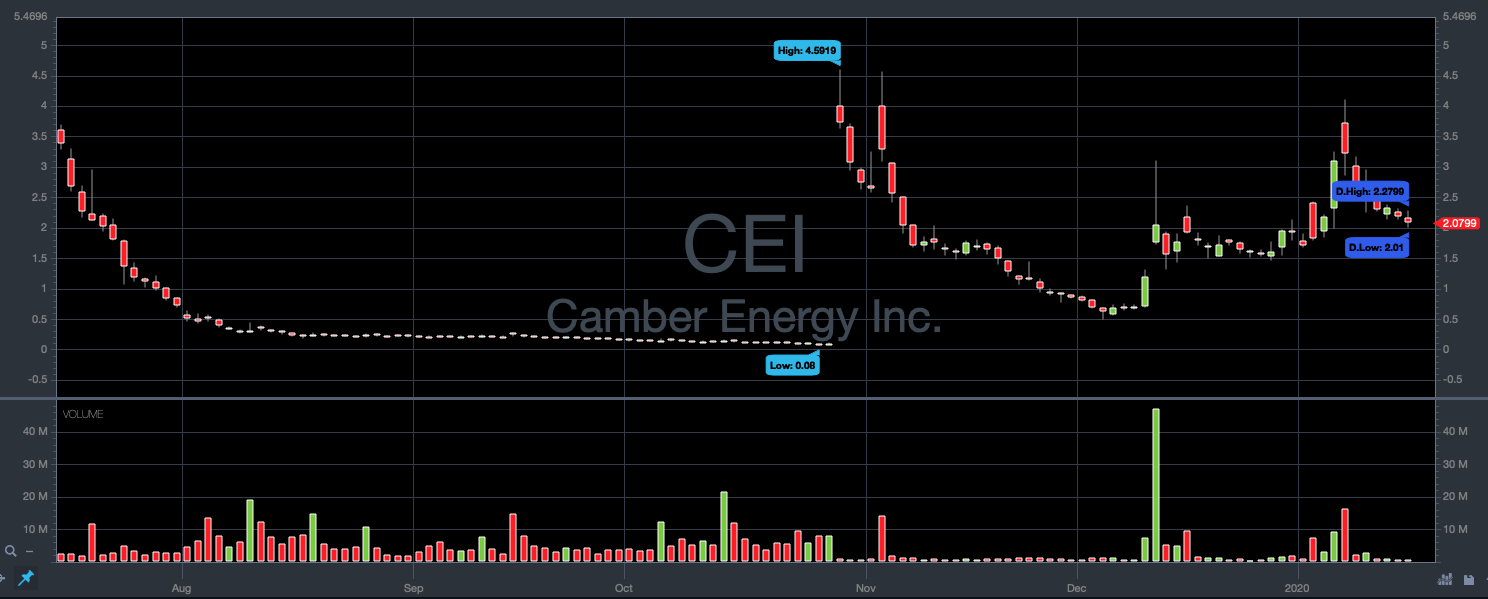

Let’s take a look at more recent reverse splits. Here are some examples along with charts. Notice the jump in price after the split.

On October 22, 2019, Nano Dimension Ltd. executed a 1-for-10 reverse split.

On October 29, 2019, Camber Energy Inc. executed a 1-for-50 reverse split.

On November 18, 2019, DarioHealth Corp. executed a 1-for-20 reverse split.

Why Would a Company Do a Reverse Stock Split?

Let’s look at a couple of reasons for a reverse stock split.

Increase perceived value: Low stock prices tend to evoke negative emotions in a lot of big traders and investors. Larger investors and major research firms just aren’t that interested in low-priced stocks. So some companies think that by increasing the share price, it can help them attract the right kind of attention.

Prevent delisting: The major stock exchanges have minimum price requirements for the stocks they list. If the stock price falls below the minimum for a certain period, the stock could be in danger of being delisted from the exchange.

This could be disastrous. Especially if the company doesn’t make enough revenue. These companies often make public offerings and rely on the market for capital. Without that capital, the business can sink.

The Impact of Reverse Stock Splits

A reverse stock split can greatly impact the float.

Remember … when a company has a reverse split, it decreases the number of outstanding shares available. That results in a significantly lower float.

Without diving too deep into the significance of low floats, it’s important to be aware that they can greatly affect pricing behavior. So a reverse split increases the share price … And it increases the chances of major price volatility.

That volatility can be dangerous to trade. But it can still attract traders willing to risk losses for the chance of profits.

Reverse Stock Split Calculator

If you trade reverse stock splits, it’s important to determine the stock float after the split.

Take note that the float is a changing number. You probably won’t be able to find the exact number. But you can use the following formula to calculate a number close enough to determine if it fits your particular trade setup.

(Total Number of Shares Before Split – Insider Shares Before Split) / (Multiplier Stock Is Decreased by) = Float

Here’s an example … Say a stock has 50 million shares with 10 million insider shares. If the stock goes through a 1-for-10 reverse split, the calculation is as follows:

(50,000,000 – 10,000,000) / 10 = 4,000,000

So after the reverse split, the new float is 4 million.

Determining the right float range for your setups takes research and practice. But it’s an important element that you should track to help you determine which stocks to trade. You’ll find that different float ranges have different pricing behaviors. That’s especially true with reverse stock splits.

We talk about some of these things in our StocksToTrade Pro mentorship community.

How to Profit From a Reverse Stock Split

Like I said before, trading reverse stock splits can be dangerous. It’s not a strategy for newbie traders.

Some of these companies are on their last legs. They might only do a reverse stock split in an attempt to just survive. That said, there can be opportunities for seasoned traders.

Let’s take a look at an example.

On October 23, 2019, Cellect Biotechnology Ltd (APOP) executed a 1-for-5 reverse stock split. The company was attempting to bring its share price over Nasdaq’s $1 minimum price requirement. If it didn’t, it risked being delisted from the exchange.

On January 7, 2020, news came out that Cellect Biotechnology received “Intention to Grant” for patents from the European and Israeli patent offices. This news was enough to attract traders’ attention. The stock shot up to $6.89 that day. Check out the chart…

For some traders, that move was an opportunity. But notice that APOP finished much lower for the day. That means some traders bought the stock near the top of the move and lost a lot of money.

Again, this strategy is not for beginners. Even experienced traders can lose big with these setups.

Junk stocks with low floats can come down just as fast as they went up. Those who trade them must be diligent with research, understand risk/reward, and be skilled in executing trade plans.

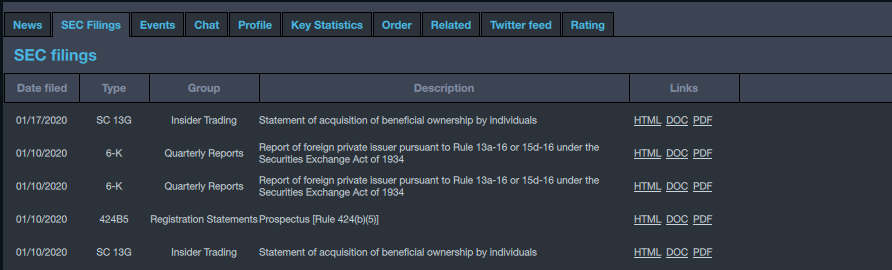

SEC Filings

One key part of your research for reverse stock splits is reading through the company’s SEC filings.

SEC filings are registration statements and forms that companies provide to the U.S. Securities and Exchange Commission (SEC). They can give you a lot of information about the company’s history and progress. You can access important information such as outstanding and insider shares, warrants, and offerings, and so on.

Reading SEC filings correctly and knowing what to look for are skills in and of themselves. It takes repetitive practice to understand and improve.

StockToTrade has an awesome feature that allows traders to access some of the SEC filings right from the platform.

To learn more about SEC filing basics, listen to this recent podcast we did with our good friend Michael Goode.

Conclusion

There you have it! A good introduction to reverse stock splits.

This isn’t enough to make you an expert. But it should give you a better understanding of what they are and why they’re so volatile.

I urge you not to trade these particular setups until you’re more experienced. Too many traders have blown up their accounts from moves like these.

If you’d like help understanding how to trade low-float penny stocks, come join the StocksToTrade Pro community. We spend every trading day learning how to trade them, including reverse split stocks.

Also, follow our SteadyTrade podcast where we talk about all things stock trading. Not only is it informative, but it’s free!

I love hearing from you. If you’re ready to dedicate yourself to trading smarter, comment below!