Why are outstanding shares so outstanding?

Or are they?

What impact do outstanding shares have on a stock? And how can traders use them in their trades?

Keep reading to find out about this key stock metric!

Table of Contents

- 1 What Are Outstanding Shares?

- 2 How to Calculate Outstanding Shares: Formulas

- 3 Where to Find Outstanding Shares

- 4 Can I Buy Outstanding Shares?

- 5 Are Outstanding Shares Stable?

- 6 How Many Outstanding Shares Can a Company Have?

- 7 What’s the Difference Between Shares Issued and Outstanding Shares?

- 8 Is It Good to Have Outstanding Shares?

- 9 Why Are Outstanding Shares Important?

- 10 Outstanding Shares: Conclusion

Outstanding shares — or shares outstanding — aren’t as extraordinary as their name implies.

They’re simply the total amount of shares currently owned by a company’s shareholders.

This includes preferred, common, and restricted shares but excludes shares owned by the company.

The number of outstanding shares isn’t fixed. It fluctuates … but more on that later.

Floating shares are shares that can be publicly traded. They’re also known as stock float and include both common and preferred shares.

Stock liquidity depends on the stock float because they’re the only shares that can be freely traded on the market.

The lower the number of floating shares, the less volume is needed to pump the stock’s price. That’s why low float stocks can be so explosive…

It’s why you don’t see companies like Apple Inc. (NASDAQ: AAPL) making 200% gains on the day. Their stock float is very large. Plus, that’s a blue-chip stock, meaning most investors hold AAPL’s floating shares for the long run. So, the volume will likely never be high enough to make big moves like low float stocks.

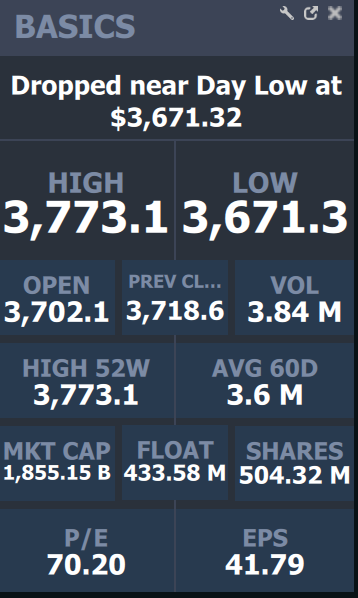

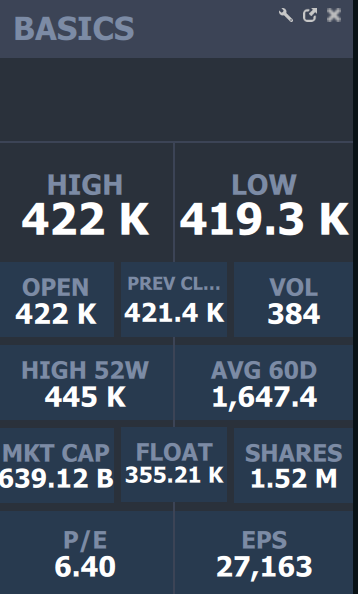

StocksToTrade makes it easy to view both a company’s stock float and shares outstanding. And you can customize your view with any other fields you need.

That’s just one of StocksToTrade’s many awesome features. See how our platform can help you streamline your trading day … Try StocksToTrade today for only $7!

Restricted shares are the shares outstanding reserved for employees and insiders. These shares cannot be traded freely.

But they can become unrestricted under certain conditions. These conditions are up to the company so they vary. Examples include once a specified period of time passes, if the company meets a set earnings goal, or once an employee has worked a number of years.

Whatever the condition, once the restricted shares become unrestricted, they become part of the company’s floating shares.

Treasury shares are shares a company buys back from the open market.

The company can’t sell them into the open market unless it issues new shares with a dilution or stock split.

Treasury shares don’t come with voting rights or a dividend. They’re pretty useless to traders.

Authorized shares are the maximum number of shares a company can issue according to its articles of incorporation.

Shares outstanding can never be more than the number of authorized shares.

To issue more shares, the company would have to first increase the number of authorized shares. But this rarely happens and requires shareholder approval.

It may be easier to understand these share concepts with the math behind them…

The number of authorized shares should be the largest. This is followed by the number of issued shares and then the number of shares outstanding.

Issued Shares = Floating Shares + Restricted Shares

Outstanding Shares = Issued Shares – Treasury Shares

Market Cap Formula

Market Capitalization = Current Price x Outstanding Shares

You can usually find the number of shares outstanding in the stock details section of your charting software.

If your software doesn’t list it, or if you think it’s wrong, you can look at the company’s financial statements. The company balance sheet lists the number of outstanding shares along with the total authorized shares and total floating shares.

You’ll find the number of common and preferred stock issued under the shareholders’ equity section. Add the preferred shares outstanding to the common shares outstanding to get the total number of issued shares.

This tells you how much of that stock was issued but not how much there currently is.

Next, find the treasury stock outstanding. This is sometimes listed as shares repurchased. If it’s not there, don’t worry — some companies don’t have treasury stock.

Finally, subtract treasury stock from the issued shares. Outstanding work! You just found the company’s amount of shares outstanding.

If the company doesn’t have treasury shares, the number of issued shares should be the same as the number of shares outstanding. And if there’s a difference between the number of shares issued and the number of shares outstanding — the difference is treasury stock.

Yes. When you purchase a stock, you buy the shares outstanding from the company’s floating shares. Restricted shares and treasury shares are off limits to everyday traders and investors.

The number of shares outstanding varies depending on the company’s actions…

Stock splits and dilutions increase the number of outstanding shares.

Reverse splits and share buybacks decrease the number of shares outstanding.

Let’s see why…

Stock Split

A stock split increases the number of shares outstanding. The company issues shares and the price drops accordingly to preserve the stock’s market cap.

Why do companies do this? It’s to make their stock more liquid. It also can make the stock price more appealing to retail traders and investors.

Stock splits are the most common way that shares outstanding change. They’re viewed as bullish catalysts.

Want to cut through the fluff catalysts to get to the news that can really move stocks? StocksToTrade has two Wall Street pros to help you do exactly that in our Breaking News Chat add-on. Start your 14-day trial of STT + BNC for only $17 today. Fair warning … you’re gonna love it!

Dilution

Stock dilution includes offerings, warrants, and other convertible derivatives. When these are executed, the number of floating shares increases … and so does the number of shares outstanding.

Dilution lowers a stock’s price if the company issues a lot of shares quickly.

Some traders like to look at the fully diluted shares outstanding. These are the shares outstanding if all the dilutive derivatives were executed. They can then compare this number to the outstanding shares to see how much of a risk dilution poses.

Reverse Split

During a reverse split, the shares outstanding decrease, and the price increases to preserve the stock’s market cap.

Companies usually do this because they’re struggling and want to prevent delisting. Reverse splits are typically a negative catalyst.

During a share buyback, the company buys its own shares from the shares outstanding and turns them into treasury shares.

Share buybacks are most common among blue-chip stocks. A buyback announcement usually gives stocks a boost because traders tend to view buybacks as bullish catalysts.

Companies usually have millions of outstanding shares. Some even have billions.

But the number of shares outstanding can’t exceed the number of issued shares. And the number of issued shares can’t exceed the authorized total number of shares.

It’s crucial for traders to understand the concept of shares outstanding and so much more. All traders can benefit from increasing their knowledge account. And to do so, they need the best education. That’s what we’re all about with the SteadyTrade Team. We teach you what you need to know and how you can apply it to your trading. Join us today!

Shares issued include the total amount of shares the company issues — restricted shares, public shares, and so on.

Shares outstanding are the current number of those shares that aren’t treasury shares. This is important to know because the number of shares outstanding can be far lower than the number of shares issued. Just be aware that they’re not the same thing.

Outstanding shares vary by company. Big companies don’t need a lot of shares outstanding. Their market cap might be large simply because the share price is high.

Look at Berkshire Hathaway Inc. (NYSE: BRK.A) as an example…

At the time of writing, the company has 1.52 million outstanding shares and 355,210 floating shares. Sounds like a low-floater right?

The company has a market cap of around $600 billion…

That’s because each share is worth over $400,000!

Other companies might have a lot of outstanding shares but a low price. This means a smaller market cap.

Remember, the more shares outstanding a company has, the smaller ownership of the company each share represents.

Shares outstanding are key for fundamental analysis. They’re used to find market cap and earnings per share.

They also help traders classify stocks based on how liquid and volatile they are. Larger market caps tend to be far more liquid and less volatile than smaller ones.

Traders can also use shares outstanding to estimate a stock’s floating shares. While this estimate isn’t perfect, it’s usually close to the stock’s actual shares outstanding.

Outstanding shares are a fundamental component of the stock market. Many financial calculations use it. They’re made up of issued shares less any treasury shares.

Issued shares are made up of floating and restricted shares. And a company can’t issue more shares than there are authorized shares.

Knowing how shares outstanding affect stock price and volatility can help traders make better trades.

How do you consider a stock’s outstanding shares when trading? Does knowing a stock’s float make you trade it differently? Let me know with a comment below!