If you focus on lower-priced stocks, it can be easy to overlook the giants, like blue-chips and FANG stocks.

You might have heard the term FANG or FAANG but don’t really know the details…

These are the leading technology companies, and they’ve been on a tear. Today, we’ll take a closer look at FANG stocks and answer some common key questions:

- Will these stocks continue their strong growth in the new decade or lose steam?

- Are these FANG companies a good investment?

- Is there a FANG ETF?

These stocks get a ton of attention from mainstream media. And just because you don’t trade them, doesn’t mean you shouldn’t know them. Remember, to make smarter trading decisions, you need to understand the whole market. Yep, FANG stocks too.

Read on to learn more…

Table of Contents

What Are FANG Stocks?

FANG stocks include four tech companies on the Nasdaq exchange: Facebook (FB), Amazon.com (AMZN), Netflix (NFLX) and Alphabet (GOOG).

Apple (AAPL) is sometimes included in this group — that’s when you see FAANG instead of FANG. These terms are generally interchangeable. In this post, we’ll include Apple when we refer to FANG.

These companies have established dominance from the global spread of their products and services:

- As consumers around the world get internet access, they adopt these companies’ products.

- When new users subscribe to their products and services, company revenues increase.

- Revenue growth can entice more investors to buy company stock and the prices go up.

These companies are well known and still expanding. This is why FANG stocks are appealing to growth investors and traders in the blue-chip sphere. These companies rallied astronomically in the last decade. Check out the returns from the start of 2010 to the end of 2019:

- 590% for Facebook

- 970% for Apple

- 1,370% for Amazon.com

- 400% for Google

- … And 3,530% for Netflix

Nope, that’s not a typo.

Compare these to the Nasdaq return of over 390% across the same period. But … with these returns comes greater volatility compared to other blue-chips. We saw this when these stocks all had pullbacks of over 20% near the end of 2018.

So what’s in store for FANG stocks this year? Let’s dig deeper…

FAANG Companies

Facebook (NASDAQ: META)

This social media titan established itself as a profitable megalith FANG company. While the Facebook platform isn’t growing as it once was, growth from Instagram and WhatsApp helps compensate. The vast majority of its business comes from advertising revenue.

Apple (NASDAQ: AAPL)

This computer giant found its footing as a tech leader with the popular iPhone. Its sales make up the majority of Apple’s earnings.

Its products boast custom-made software for premium hardware. That’s created a loyal brand following that allows the company to maintain demand with a high profit margin. The high margins and innovation have grown on many investors as well. Apple’s allure to consumers and investors earned the company its place among the FAANG group.

Amazon.com (NASDAQ: AMZN)

The quintessential online retailer boasts an astounding variety of goods to entice stay-at-home shoppers. An Amazon Prime subscription includes free delivery and other perks like Amazon Fresh grocery delivery and the Prime Video streaming service.

Amazon purchased Whole Foods for $14 billion in 2017. That shows that it’s diversified beyond being an online-only business.

Netflix (NASDAQ: NFLX)

The pioneer of online TV streaming services has developed a massive subscriber base. Netflix’s venture into producing original series has made it even more popular.

Netflix established itself as an alternative to cable TV. It revolutionized the way consumers watched on-demand shows. Using one subscription, multiple users can stream content on an assortment of devices — TV, laptop, smartphone, or gaming console. This FANG company disrupted the entire TV industry with its explosive growth.

Alphabet (NASDAQ: GOOG)

This search engine trailblazer diversified itself into many products and services. Google restructured itself to form Alphabet in 2015. The conglomerate is now Google’s parent company and owns products like YouTube. It leverages its services to generate the majority of its income from advertising revenue.

Alphabet is a staple for internet users. Just think of everyone who’s visited Google.com. Include all its other essential services, and it’s a critical component of the FANG stocks.

The History of FANG Stocks

Not all FANGs are created equal. It’s important to know the humble beginnings of all these companies.

Facebook (META)ef="/quote/META/" data-stock="META">META)

College whiz-kid Mark Zuckerberg founded this social media company in 2004. It started turning a profit when it started running ads by marketers. Cost per click went up as advertisers began to prefer Facebook over traditional media. This supercharged Facebook’s growth over the decade.

Facebook’s strategic purchase of Instagram for $1 billion in 2012 and IPO that same year caused investors to hesitate. When it broke out past its IPO price in 2013, investors quickly saw its potential.

Its 2014 acquisition of WhatsApp for $19 billion solidified its position among the FANG stocks. Facebook has since stood strong against competition and government antitrust lawsuits in 2019.

Apple (AAPL)ef="/quote/AAPL/" data-stock="AAPL">AAPL)

Founded in the 1970s as personal computers were entering the market, Apple has since turned into a tech icon. It almost went bankrupt in the 90s but reinvented itself in the new millennium. It flourished under the leadership of its maverick founder Steve Jobs.

The release of the iPod music player in 2001 kicked off Apple’s rise to popularity. The iPhone release in 2007 only accelerated its fantastic growth. CEO Tim Cook continues that growth by developing new products with broad appeal.

Amazon.com (AMZN)ef="/quote/AMZN/" data-stock="AMZN">AMZN)

The company that began as a humble online bookstore in the dot-com boom quickly turned into the leading online retailer.

Amazon.com ascended from the ashes of the fiery dot-com crash at the turn of the millennium. It began selling more and more retail products on its website.

It now owns a vast diversification of businesses including the expanding Amazon Web Services cloud storage. Under the leadership of CEO Jeff Bezos, Amazon signed a contract with the U.S. government in 2014. The $600 million deal means AMZN provides the CIA with AWS cloud storage.

Netflix (NFLX)ef="/quote/NFLX/" data-stock="NFLX">NFLX)

Netflix has had meteoric user growth since the company began to focus on streaming.

The company was founded in 1998 when CEO Reed Hastings saw the potential of Amazon’s business model. He predicted the emergence of DVDs replacing clunky VHS tapes. Aiming to disrupt Blockbuster, Netflix began renting DVDs through the mail. The company eventually innovated its business model into a monthly subscription service.

Inspired by Youtube, NFLX added streaming TV shows and on-demand movies in 2007. That’s when the business started to take off. That move compounded as consumers saw the convenience of streaming video on multiple devices. That growth accelerated as more consumers started cutting cable subscriptions.

Alphabet (GOOG)ef="/quote/GOOG/" data-stock="GOOG">GOOG)

Larry Page and Sergey Brin founded the Google search engine in 1998. It quickly caught on with its superior indexing capabilities.

Alphabet made strategic acquisitions and invested heavily in developing internet services. Those services became an intricate part of the business model. While not every venture paid off, they had a few wildly successful home runs. A few lucrative acquisitions include Android Inc. in 2005 for over $50 million and YouTube for $1.6 billion the following year.

Free services like Gmail or Chrome helped GOOG amass loyal users. This heavily diversified company is a pillar of the internet. It’s not going away anytime soon.

FANG Stock Fundamental Analysis

Let’s look at FANG stock fundamentals from a growth-investing perspective. We can use these growth metrics to get a better idea of how the FANG companies can grow in the future.

Growth Metric Analysis

Indicators like earnings growth, PEG, and profit margin can help you compare how the FANG companies performed over the past years. These indicators aren’t perfect, but a lot of growth investors look at these metrics in deciding whether to invest in these companies.

Earnings Growth

The first metric we’ll look at is year-over-year earnings growth. This indicates how fast a company’s earnings grow compared to last year.

It appears most growth is slowing somewhat across the FANG stocks. In Apple’s case, it’s even reversing. Here’s the earnings growth rate from 2018 to 2019:

- –7% for Apple (this negative rate doesn’t mean the company is shrinking — only that its earnings grew less than last year)

- 37% for Netflix

- About 10% for the other FAANGs

PEG

To further analyze these FANG companies, let’s use a metric called PEG. This takes the P/E ratio and divides it by the earnings growth rate we reviewed above. Analysts use P/E to determine how fairly valued a stock price is compared to its earnings. We used the average yearly P/E for this calculation. Ideally, this metric is just under 1.

Most of the FANG stocks are overvalued. Here’s the PEG for FANG stocks in 2019:

- –4 for APPL

- 8 for AMZN

- Under 3 for NFLX, GOOG, and FB

Apple’s negative ratio is a direct result of its negative year-over-year earnings growth. We can leave it out of the comparison for this reason.

Now, we take the stock market’s massive bull run into account and compare the FANGs relative to each other. All the companies show a solid ratio … But Amazon’s is fairly high, so it appears overvalued.

Net Profit Margin

Growth investors also look for companies to produce large net profit margins. That’s the percentage of money the companies take home after accounting for expenses.

Facebook is the clear winner here, with margins of 36% in 2019. Apple and Alphabet have margins of around 21%.

Amazon and Netflix have margins under 10%. That’s understandable as Amazon has a lot of overhead expenses with physical inventory. And Netflix spends a ton on original shows and TV license fees.

Future Business Outlook

Apple investors eagerly anticipate the expected release of the 5G iPhone in 2021. They also think its subscription services and wearables business will grow quickly. That includes recently released products like Apple TV+ and AirPods.

Alphabet is hyping investors on its growing advertising business and Stadia game console. The resignation of its CEO might give pause, but its core business is strong. Its cost-per-click rate continues to increase as more marketers invest in mobile advertising.

Amazon recently posted blowout 2019 holiday sales spurred by a larger-than-expected holiday shopping season. Investors focus on the company’s continuous improvement of Amazon Prime benefits. These include quicker shipping and grocery delivery to more cities.

Netflix has held a solid monopoly in its lucrative niche since becoming a FANG stock. Yet streaming services such as Disney+ and Apple TV+ mean more competition. Netflix’s market share is still over 80%, but competitors might eat into it as the market saturates.

Facebook has strong mobile advertising growth due to its rising cost-per-click rate. Investors expect revenue to continue to grow rapidly for the company. It also has plenty of cash on hand to acquire other businesses.

FANG Stock Technical Analysis

FANG Stock Historical Performance

Are the FANG stocks overextended? That depends on the company. Let’s dive into some technical analysis to explore the FANG companies deeper. We’ll review the four-year charts of each.

Apple’s been on a huge rally ever since it broke out above 2018 highs of $230 this past October. Riding a Santa Claus rally, the stock blasted 34% over this former resistance. It’s in the $300 range as of early January 2020.

Alphabet was fairly choppy throughout 2019. It tried to break out over 2018 highs of $1,270s, but this quickly turned into a fake-out last April.

It finally broke out in November after some volatility and is currently about 8% over these levels.

Amazon also had a somewhat choppy 2019. It tried to break out over 2018 highs of around $2K, but this quickly turned into a fake-out last July. It then went to trade below that price level and used $1,700 as support. It’s currently starting to climb back up out of its range.

Facebook is currently at its 2018 highs of $218 … slowly recovering from the 2018 sell-off. Its recovery formed a solid cup & handle pattern, which should lead it to break out to new highs. It’s not overextended at the moment.

Considering some of the stock metrics we reviewed earlier, this might currently be the best FANG company. It boasts a low P/E and great profit margins.

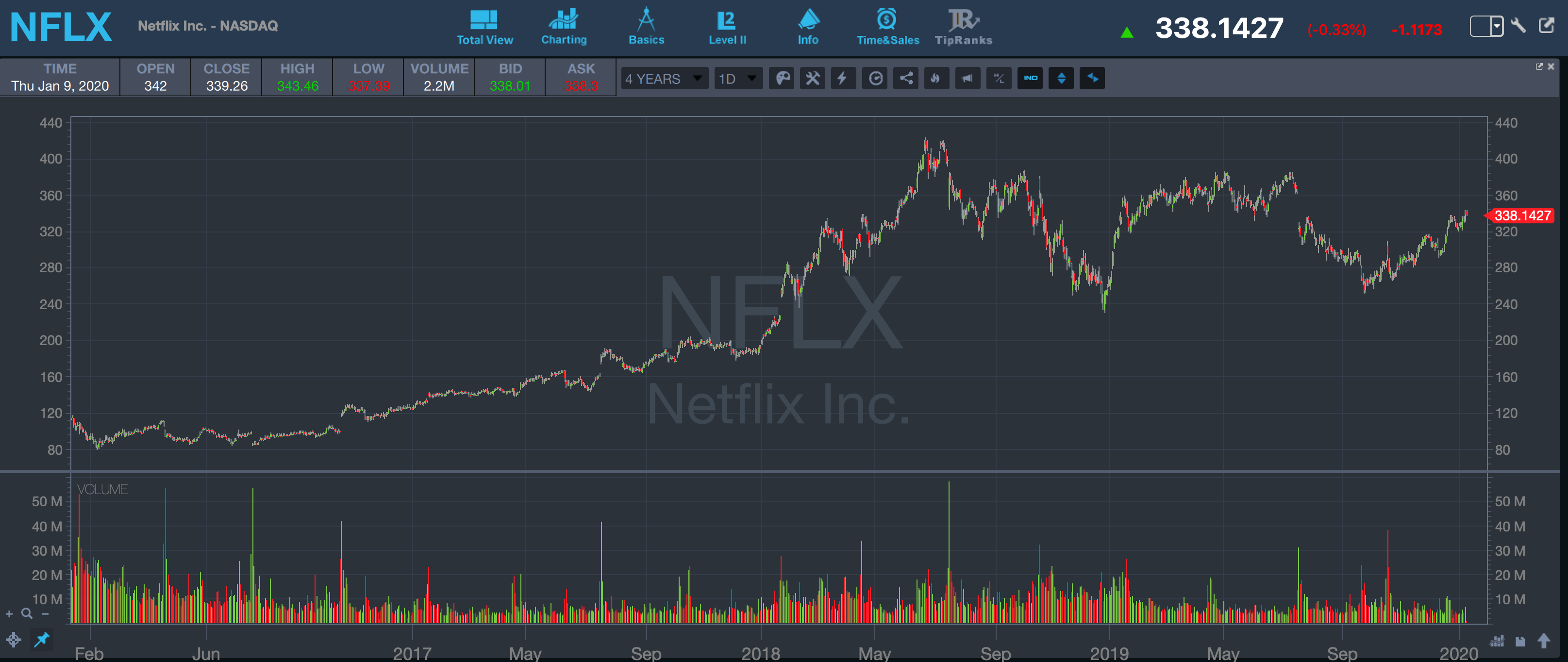

Netflix has yet to reach its 2018 highs of $420. It’s also down from a 2018 sell-off and choppy throughout. It formed a double bottom at around $250 and has since been midrange.

This might currently be one of the weakest FANG companies, but it boasts the strongest 2019 earnings growth.

Why Track FANG Stocks?

Even if you prefer trading lower-priced stocks, it’s can still be smart to track the FANG stocks. It’s just good practice to know what’s going on in the overall market. And who knows? Maybe one day you’ll want to trade or invest in FANG stocks.

You can easily build a FANG watchlist. That way you can watch the chart develop. How? Use StocksToTrade’s advanced charting and custom watchlists.

StocksToTrade is an all-in-one trading and analysis platform for all the major U.S. stock markets. We spent a lot of time in building the exact trading platform that’s perfect for serious traders and investors.

At StocksToTrade, we’re real traders. We built what we know we need. We not just marketers trying to sell trading software.

Some of the world’s best stock traders start each trading day by firing up our platform. But you should see it for yourself. Get your 14-day trial of StocksToTrade for just $7 today!

Is There a FANG Stocks ETF?

There’s no specific ETF for only FANG companies. That said, there are many ETFs with fairly large exposures to FANGs.

FNG was a large ETF with high exposure to companies related to FANG stocks, but it went defunct in 2019. Since then, there are surprisingly few ETFs with large exposure to the FANG companies.

There are still ETFs related to FANG stocks, but the exposure varies. Be sure to do your research. Here’s a quick list of ETFs and their exposure to FANGs:

- 34% for QQQ

- 32% for PNQI

- 30% for FDN

- 29% for ENTR

QQQ has the most exposure to the FANGs and is also a vehicle for the NASDAQ-100 Index. So it includes exposure to all the tech-centric companies as well. Its exposure to Facebook and Netflix is lower than the other funds. But it’s the only FANG ETF that carries Apple.

PNQI has the most exposure to Facebook and Netflix. FDN has the most exposure to Amazon.com and is fairly high in Alphabet as well. ENTR has the most exposure to Alphabet.

Unfortunately, not all these ETFs are liquid. That’s not necessarily a huge concern for most investors and traders, it can be an issue if you need to exit a position quickly.

How to Invest in FANG Stocks

Keep in mind, this is not investment or trading advice. This is simply to offer a perspective into these companies. Make sure you do your research and due diligence before you risk your hard-earned money.

FANG-Exposed ETF

One way to invest in FANG stocks is to buy a FANG-focused ETF. Check out our list above for more details on how these ETFs work.

Dip Buying FANG Stocks

If you only want to hold a select few FANGs, you can pick individual stocks. Some of these stocks could rally to new all-time highs … so it can be tough not get FOMO here. You can watch and wait for a dip to enter if you want a long-term entry.

These massive companies are heavily scrutinized … There can be a negative catalyst or lawsuit to knock the price around. If you think a dip is due to a short-term catalyst, it might be a good time to buy.

Here’s an example: Facebook’s data scandal in 2018. There was a period of time through 2019 where a dip buy would’ve worked. The scandal didn’t affect its fundamentals and long-term prospects. So, the stock rebounded back to former highs in the latter part of the year.

Conclusion

FANG stocks are still very popular with investors and traders alike. While they have huge rallies, they’re also risky in their volatility. Barring a recession or large market drawdown, they should continue to rock.

But always do your research before investing in or trading any company. Investments carry inherent risk, so do your due diligence.

The better you know how the market works, the better you can spot those perfect setups when they come along.

Make sure to stick around on the blog, our YouTube videos, and our SteadyTrade podcast. No matter what level of trader you are, the market is always evolving. There’s always something new to learn.

Here at StocksToTrade, we love to focus on stocks with even more amazing volatility than the FANG stocks. It takes a thorough education to trade these setups. In StocksToTrade Pro we offer top-notch mentorship to teach you the ins and outs of these plays.

If you’re serious about leveling up your trading, join us today!

How do you feel about trading FANG stocks? Leave a comment and let us know!