Ever wondered what the main differences are between the Nasdaq and the NYSE?

A stock trade is a stock trade, right? You click some buttons on your trading platform, you get filled, and no matter which exchange you trade on, it all seems the same to a trader sitting at home …

But, if you look closely, the NYSE and the Nasdaq have markedly different histories, listed companies, and trading processes.

This post should help you to understand the differences between the two major exchanges.

Table of Contents

Embed This Infographic!

A Brief History of the Two Exchanges

Let’s start with a quick rundown of how the two exchanges came about.

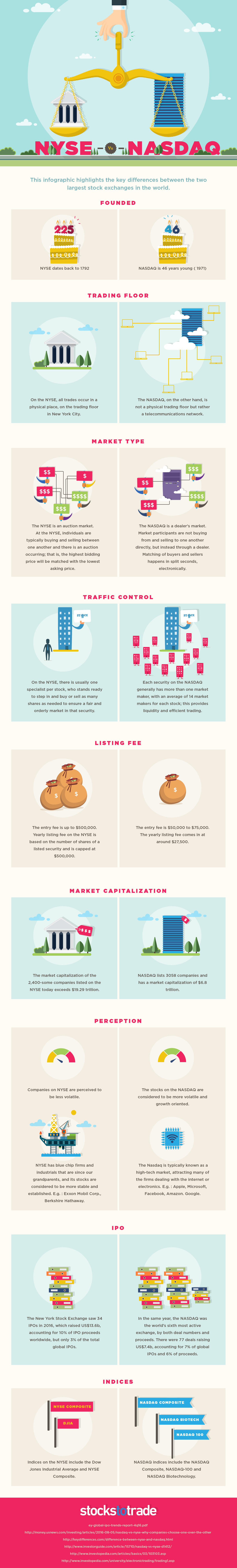

The roots of the New York Stock Exchange (NYSE) can be traced all the way back to 1792 when a group of brokers came together to form an agreement to trade with each other and set standard commission rates among other things.

Step by step, this created a central market for trading stocks and other securities, and through time it’s evolved to create the modern exchange we see today.

The Nasdaq has a comparatively short history, with the exchange being formed in 1971.

Back in the mainly analog days of 1971, the Nasdaq was a very technologically advanced exchange as it had a computerized quote system, effectively making it the first electronic stock exchange in the world.

Fun Fact: Both the NYSE and Nasdaq are publically traded companies. You can trade stock of each exchange on their own exchanges.

The Trading Floor

Have you ever seen stories on the news where traders in big colorful jackets are running around frantically buying and selling? That’s a physical trading floor.

While it may seem dated nowadays, the NYSE still has a physical trading floor. When you want to trade on the NYSE, your order is sent to the floor where a broker will go and get it filled in person.

On the other hand, the Nasdaq is entirely electronic. When you trade on the Nasdaq, your order is routed through a computer network to get filled, so no broker will ever have to shout your order out.

Market Type

Another very fundamental difference between the two exchanges is how buyers and sellers are matched up.

The NYSE is what’s known as an auction market. This is a market where individuals are generally trading between each other. When you place an order to buy a stock at $100, your broker will go and find another broker whose client is looking to sell at $100.

The Nasdaq is run as a dealer’s market. Your orders don’t go directly to be matched with the orders of another trader. Instead, your orders will be sent to a market maker whose job is to be ready to either buy or sell or at any time, effectively acting as a middleman.

Listing Fee

It’s not free to list on an exchange. Companies that want to be traded on these exchanges need to pay listing fees.

The NYSE is the more expensive of the two. Companies need to pay an initial fee of up to $500,000, then need to pay up to $500,000 per year to continue being traded on the exchange.

The Nasdaq is substantially cheaper, with the initial fee being in the range of $50,000 to $75,000. Ongoing fees are around $27,500 per year.

While these amounts wouldn’t mean much to major companies, the lower Nasdaq fees are a benefit to smaller, upcoming companies. This is one of the reasons you see many smaller listings on the Nasdaq.

Market Capitalization

The market capitalization of an exchange is the total value of all companies listed on the exchange.

The NYSE lists around 2,400 companies with a total value of close to $19.29 trillion.

The Nasdaq lists more companies than that with over 3,000 listings, but it has a lower market capitalization of around $6.8 trillion.

The reason that the NYSE has a higher market cap with fewer companies is simply that it attracts the listings of many of the world’s largest firms, think Home Depot, GE, Ford, etc.

Perception

There’s a general difference in perception regarding what type of companies trade on each exchange.

The NYSE is generally seen to trade very well respected, large companies. The types of companies your grandmother might like to invest her retirement funds in.

On the other hand, Nasdaq companies are generally seen as more volatile and growth-oriented, often due to many famous tech companies choosing to list on the exchange.

These perceptions have a lot of merits, but should only be used as a rule of thumb. Either exchange can list all kinds of companies.

IPO Activities

When companies first list on an exchange, they generally enter the market through an initial public offering (IPO) where the public is allowed to buy and sell shares of the company for the first time.

On the IPO front, the Nasdaq is substantially more active, mainly due to it attracting a greater amount of up-and-coming companies.

In 2016, the Nasdaq saw 77 IPOs. In the same year, the NYSE saw less than half that amount, with 34 IPOs.

Indices

While the Nasdaq and NYSE are reasonably correlated, they’re both made up of different types of companies, so can react differently to certain economic, political or industry events.

If you’d like to watch the broad action of either market, it’s a good idea to keep an eye on one of the indices that cover your chosen market or sector.

Indices are made up of a collection of underlying stocks and show you how they’re all acting on average.

For example, if you watch the Dow Jones Industrial Average, you’re watching the average action of 30 of the largest stocks listed on the NYSE. You could even drill down and watch the Nasdaq Biotech Index to see how biotech stocks on the Nasdaq are trading.

To learn more about stock market indices, check out our handy infographic.

What’s Next?

There are plenty of trading opportunities on both of the exchanges — you just need to find the right stocks.

Consider researching stocks on each exchange and keeping them on a watchlist so you can see how they trade. It might sound like a tedious process, but it doesn’t have to be …

The StocksToTrade platform can help make it much easier for you, with access to real-time quotes from both exchanges, unlimited watchlists, premium charting and more. Try StocksToTrade for 7 days for just $7!

The Bottom Line

Most people think the difference between the NYSE and Nasdaq is similar to the difference between Coke and Pepsi …

But now you now know that there are subtle but important differences — and this information can help you better understand the stocks you’re trading.

As a rule of thumb, if you’re looking for big blue chips, you’ll find them on the NYSE. If you’re in the market for a hot tech stock, the Nasdaq is likely a better hunting ground.

No matter which exchange you choose to focus on, be sure you start with the right trading platform for your needs. Check out StocksToTrade today. Happy hunting!

Nasdaq vs NYSE: Which exchange is your preferred market to trade on? Tell us below!