If you want to trade stocks consistently, the bid-ask spread is key knowledge. It’s something every trader should understand inside and out.

Whenever you enter or exit a trade, the bid-ask spread will play a role. That’s why it’s so important to wrap your head around it.

The bid-ask spread is a very basic but highly useful trading feature that absolutely every trader should learn about. Let’s get right to it…

Table of Contents

What Is the Bid-Ask Spread?

When you look closely, the stock market is a collection of traders. And any of them can either want to buy a stock or sell a stock at any given point in time.

When traders want to buy a stock, they bid for it. And when they want to sell a stock, they ask for a bid. This is done by placing a buy or sell order at a certain price.

The bid-ask spread refers to the price quote of the current highest bid price and the current lowest ask price. This is how traders get an idea of a stock’s current price.

In the simplest terms:

- The bid is the current highest price a trader is willing to pay for a stock.

- The ask is the current lowest price for which a trader is willing to sell a stock.

For example, a stock that currently has a bid-ask of $10/$10.20, has an order to buy the stock at $10 and a seller selling the stock at $10.20.

The bid-ask spread can be useful for getting good entry and exit prices for your trades. And it can give you an idea as to the likely short-term direction of a stock.

Supply and Demand in the Bid-Ask Spread

The bid-ask spread is possibly the clearest way to determine the short-term supply-and-demand forces for a stock.

The stock market is a double-sided auction. This means that the price of a stock is found in an auction process where both buyers and sellers interact to find a fair price.

Think of a house auction where you have many buyers for a house and a single seller. All the buyers bid until they eventually reach the highest price for the house.

The stock market is similar, but instead a single seller, there are often multiple sellers trading against multiple buyers.

When buyers really want a stock, they’ll increase their bids and raise the price. When sellers really want to sell a stock, they’ll lower their ask prices until they find someone happy to buy.

This is where we get to see basic economics at play. When demand is greater than supply, price rises. And when supply is greater than demand, prices decrease.

If you’re able to see supply or demand outstripping each other through the bid-ask spread, you may be able to find an excellent trade setup before the stock price moves.

Examples of the Bid-Ask Spread

Now, let’s examine a few real-world, real-time examples of the bid-ask spread for some widely traded stocks.

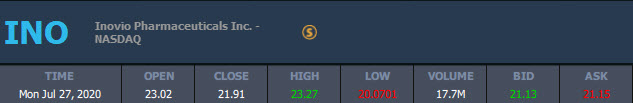

First, we have Inovio Pharmaceuticals (NASDAQ: INO), a popular stock during the pandemic.

INO has a market cap north of $3 billion and many traders are interested in the stock. And we can see that the bid-ask spread is 2 cents, with the bid at 21.13 and ask at 21.15.

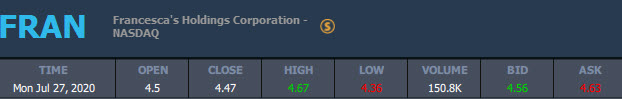

Next, we have a tiny penny stock called Francesca’s Holdings (NASDAQ: FRAN). This stock isn’t so popular and has a market cap of around $17 million. Unsurprisingly, its bid-ask is wider.

FRAN has a bid-ask spread of 6 cents, with the bid at $4.56 and the ask at $4.63.

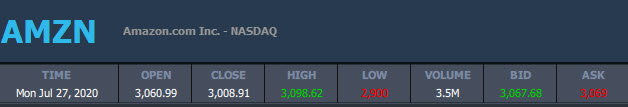

Last, we have Amazon (NASDAQ: AMZN), one of the world’s largest companies.

AMZN’s stock price is much greater than the other two stocks at over $3,000 per share.

There’s huge volume traded in the stock every single day, but the spread is $1.32 in the image below.

AMZN has a wider spread in total dollar and cents terms since its overall stock price is higher. In percentage terms, the spread isn’t that wide.

Why the Bid-Ask Spread Is Important for Day Traders

Analyzing the bid-ask spread is a smart thing for just about every trader and investor to do. But it can be especially useful for day traders.

Day traders buy and sell positions in stocks within a single day. That is, they enter and exit a trading position between the time the market opens and closes on the same day.

Keeping an eye on the bid-ask spread is important for day traders for a number of reasons…

First, it can give a trader an indication as to which way the stock price could likely move in the short term. That can help in finding better trades or avoiding losing trades.

Second, day traders need to be aware of costs. That includes brokerage fees and the entry and exit prices for trades. Keeping an eye on the bid-ask spread can potentially help day traders get better entry and exit prices and boost trading profits.

Last, it’s important for day traders to only trade stocks when there’s enough trading liquidity to get in and out of a position quickly. The bid-ask spread gives some indication as to how much liquidity the market currently has. And it can show how difficult it is to move size in the market.

How Traders Use the Bid-Ask Spread

The bid-ask spread can be used in many different ways. But to give you an idea of how a sensible day trader might incorporate bid-ask analysis into a trading strategy, here’s a quick example:

Imagine a day trader named Sarah who trades small-cap and penny stocks for a living.

Sarah’s trading edge is mainly in low float stocks that have low trading volume. So it’s super-important that she keeps an eye on the liquidity of the stocks she’s trading. She doesn’t want to get caught in a trade where she can’t exit quickly.

Every morning, Sarah runs her favorite stock scans to spot the best potential stocks to trade for the day. Next, she builds a watchlist and prepares for the market open.

One day before the market open, she sees movement in four stocks on her watchlist. Sarah only wants to be in one trade at one time. She has to figure out the best trading setup of the bunch.

The charts look good, with potential for the dip and rip…

That’s where the Breaking News Chat tool on the StocksToTrade platform comes in. Two of the stocks have news — there are some hot news catalysts. Great sign … but now Sarah has to decide which stock is best to trade.

She looks at the bid-ask spread and volume of each stock. One has a 10-cent spread, and the other seems highly illiquid with a 40-cent spread.

Sarah decides to trade the stock with the tightest spread, a great chart setup, and a hot catalyst.

This example demonstrates how traders can use bid-ask analysis as one step in the multi-step process of finding potential trades. Make sure to have something similar in your own trading plan.

When to Watch the Bid-Ask Spread

The bid-ask spread can give you a powerful yet simple advantage in trading stocks. But thankfully, you don’t need to watch the spread all day.

Instead, you only really need to watch the bid-ask spread when a stock is at a pivotal point. That’s when a stock is trading at a price with above-average significance.

Here are a few possible scenarios:

- When a stock is trading around the daily high or low.

- When a stock is trading around a key support or resistance level.

- When a stock is trading at VWAP.

- When a stock is trading around a key area for a common chart pattern.

Make it as simple as possible. Don’t worry about the bid-ask spread until the overall price action looks interesting, which can draw traders into or out of a stock.

Factors That Affect Bid Price And Ask Price

Let’s get a little more technical and explore some common factors that can affect the bid-ask spread.

This is in no way a comprehensive list, but these are the most obvious ones you should be aware of when placing trades.

#1 Liquidity

Liquidity, also known as trading volume, refers to the number of shares available to buy and sell, as well as the number of shares that have been recently traded.

Liquidity varies between stocks. For large-cap stocks, you’ll find that they’re almost always highly liquid. Small and penny stocks often have irregular liquidity. Trader interest can build and fade in relation to the amount of hype around the stock.

Generally, the more liquidity in a stock, the tighter the bid-ask spread will be.

#2 Volatility

Volatility refers to how much stock price moves in a given period. Small-cap and penny stocks are often substantially more volatile than larger companies. Small tickers are often the biggest daily movers, with certain stocks putting in moves of 20%, 50%, 100%, or more in a day.

Volatile stocks generally have wider bid-ask spreads, as traders are less confident about the very short-term price movements.

#3 Time of Day

The market is open between 9:30 a.m. and 4 p.m. Eastern, Monday through Friday. But the bulk of trading activity is often around the market open and the close.

During the middle of the day, stocks are normally much less liquid. This generally causes the bid-ask spread to be wider in the middle of the day compared to the open and close.

#4 Catalysts

A catalyst is hot, new information about a stock. This could be a news article, an SEC filing, a company announcement, or even just a widely spread rumor.

Catalysts will often cause traders to become interested in a stock, with many placing buy or sell orders. That causes prices to go up or down.

Catalysts often cause changes in the bid-ask spread. Sometimes the spread will decrease. That’s because more traders are in the stock, and there’s now more liquidity. On the other hand, sometimes you will see greater volatility come from a catalyst, resulting in a wider bid-ask spread.

#5 Stock-Related Hype

Like catalysts, the hype around a stock can have an effect on the bid-ask spread.

Hype is generally found in hot sectors or around stocks that are exciting to traders and investors.

One example is the hot virus plays throughout the pandemic and lockdown period. The market can get overly excited at anything virus or vaccine related. That would cause traders to flood into these stocks, often narrowing the bid-ask spreads.

#6 The Stock Price

Stocks with a higher price generally have a wider spread in terms of dollars and cents, but as a percentage of total price, the spread may be lower.

Think of a stock priced at $10 with a 10-cent bid-ask spread. That’s a spread of 1%. Now think of a stock priced at $1,000 with a $1 spread … The bid-ask is wider in dollar terms but is actually only 0.1% of the price.

Use StocksToTrade to Supercharge Your Stock Trading

Watching the bid-ask spread can be useful. But at the end of the day, it’s just one piece of the puzzle for smarter trading.

If you want better results from your trading, make sure you have all the other pieces…

Use StocksToTrade.

Our trading platform can help you find stocks to trade each day. We have powerful built-in StocksToTrade scanners, our proprietary Oracle scanner, or even have our team of market pros to alert you in real time in our Breaking News Chat.

And you’ll need to analyze stocks to determine whether it’s a setup that matches your trading strategy. Inside STT, you can quickly check stock charts, indicators, company fundamentals, social media mentions, news, and even analyst stock ratings.

I could go on and on about the power of StocksToTrade’s tools … but I think it speaks for itself. Check out why many of the world’s top traders use StocksToTrade every day. Grab your 14-day trial for just $7!

Conclusion

The bid-ask spread is a fundamental factor of trading. It’s where the rubber meets the road and trades are made.

All traders, no matter their experience level or trading style should be comfortable with how the bid-ask spread works. This post can help you with that.

But again, it’s just one factor. Learn how you can put together a trading plan and strategy that fits YOUR needs. Join our SteadyTrade Team mentorship community today!

And make sure you have a powerful, well-equipped trading platform to make your trading process as streamlined as possible. You can check out the awesome features of StocksToTrade with a 14-day trial for $7.

How does the bid-ask spread factor into your trades? Tell me in the comments below!