Right now, the hottest plays are all about coronavirus pandemic stocks and sympathy plays.

Even in a stone-cold stock market, there’s always at least one hot sector. There are always opportunities for savvy traders. It’s all about having a solid strategy.

Unfortunately, a lot of traders have the wrong strategy right now. They’re looking for opportunities to buy at the bottom…

The problem? The bottom keeps bottoming out. It’s impossible to know where it will end.

Smart traders make solid trading plans and build strong watchlists. Then they strike when the perfect play presents itself.

Right now, that means you need to keep up with coronavirus pandemic stocks and sympathy plays. It’s not just about virus stocks — several peripheral sectors are popping up. Due to the lockdown, life as we know it is shifting.

Read on for some coronavirus pandemic stocks and sympathy plays that are spiking now, and what to watch in the coming days and weeks.

Table of Contents

The Stock Market Right Now

Understatement of the century: it’s been a wild ride in the stock market lately.

We’ve experienced some massive market milestones in the past week or so. Here are a few biggies:

We’re officially in a bear market. After a bull market of over 10 years, we’ve reversed course in a BIG way.

It’s a real-life example of the 20% rule … If the market rises 20% over a sustained period, it’s a bull market. The opposite is true for a bear market. We’re down about 30% now. Learn more about bull and bear markets here.

Rates are falling. On March 3, the Fed cut rates by half a percentage point. This was the first rate cut since the financial crisis over a decade ago. Then on March 15, the Fed cut rates to nearly ZERO. It was meant to stimulate the market. It didn’t quite work out that way, which leads to the next milestone …

Crashing markets. In spite of the Fed’s aggressive move, stocks crashed hard on March 16. Trading was halted within moments of the market open. There wasn’t a big bounce after, either.

How bad was it? The Dow recorded the most dramatic single-day point drop ever and the worst performance since 1987’s Black Monday.

How to Approach the Market Right Now

By and large, the market is a grim place right now. The bear market has some people thinking they should just hibernate. Others are taking part in an idiotic frenzy of selling off.

Then there are the traders who want to short everything…

Here’s the problem: no one knows where or when the market will bottom out. And it’s making irrational moves in the meantime. So short sellers could get stuck in some pretty nasty places. And it’s not even necessary to go down that road…

There are plenty of hot plays right now.

Trading the hottest coronavirus plays requires plenty of diligence, a strong trading plan, stops of steel, and quick reaction times. Let’s look at how this sector is shaping up so far.

Check out this video for more on hot sectors…

Right now, anything related to curing or treating coronavirus could experience huge gains in very short periods of time.

How can you find these opportunities?

Use StocksToTrade to scan for potential trades. Search for stocks based on criteria that you set and that fits your strategy. This smart tool can help you identify the big gainers and create a strong watchlist. And when the right play comes your way, you’ll be ready.

Now, what types of stocks should you be looking for? Let’s break it down.

Virus-Specific Stocks

No big surprise here: the most prominent spikers are related to the coronavirus.

This includes a lot of biotech companies working on vaccines and home tests. It also includes companies that make products designed to treat or prevent the spread of the illness. Think masks, medical gear, and so. Let’s look at a few recent runners…

Applied DNA Sciences Inc. (NASDAQ: APDN)

A few days ago, this company had very interesting news. Along with a partner, it announced it was ready to start testing a COVID-19 vaccine. This stock RIPPED.

Check out the chart:

The stock went from the $2s to a high of $8.97 in the course of just a few days.

I know a TON of traders got in on this trade, including my friend and trading teacher Tim Sykes. Speaking of Sykes … Check out his latest appearance on the SteadyTrade podcast here.

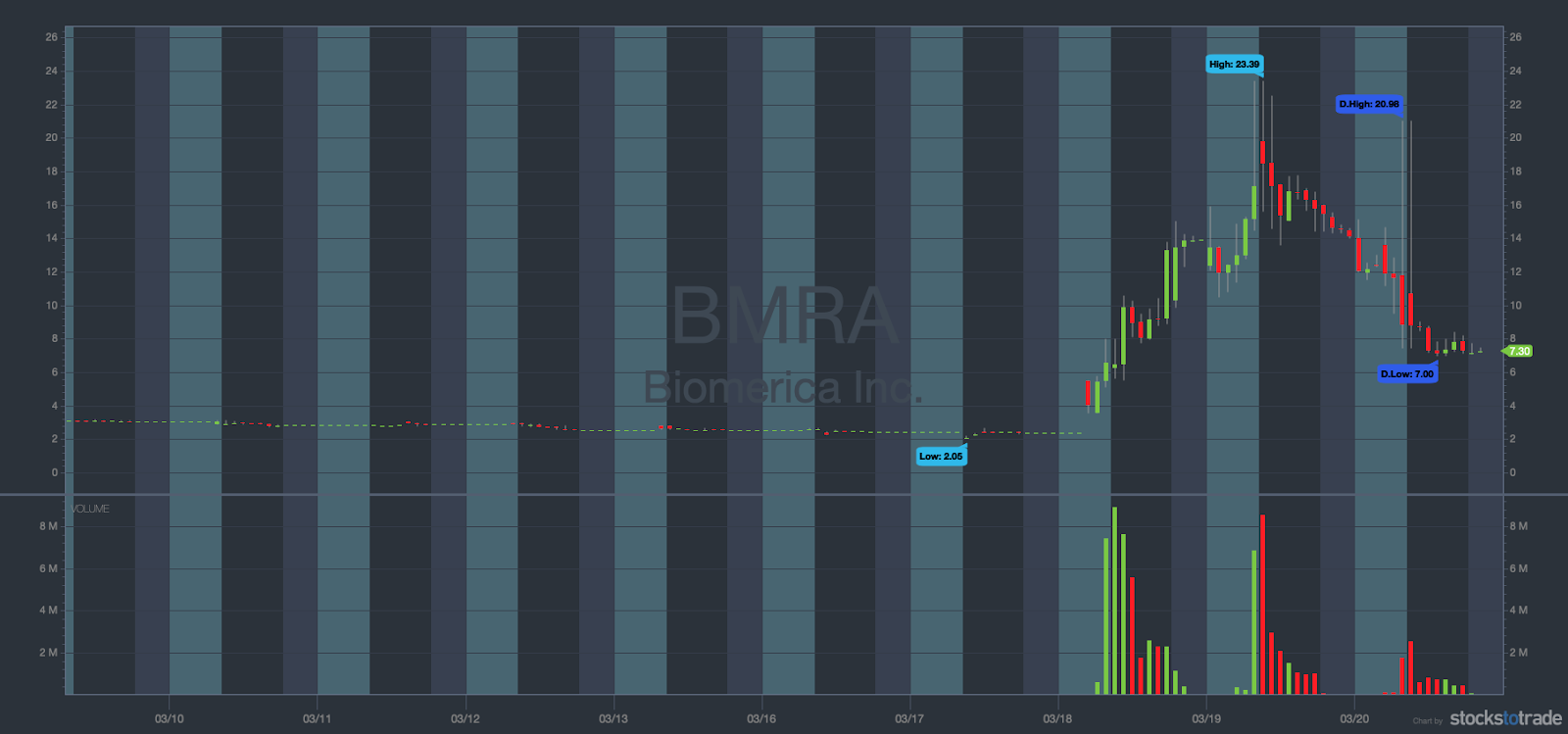

Biomerica, Inc. (NASDAQ: BMRA)

Following a press release about a new 10-minute coronavirus test, this stock started climbing fast. Here’s the chart…

On March 17, it was trading for $2.05 … By March 19 it hit a high of $23.39.

This shows you how crazy fast things can move in the market right now. But there’s also a cautionary tale here. While that stratospheric growth was impressive, it was short-lived.

At the time of this writing, a day after the recent high, it’s already down to the $8s again. Take that as a lesson and don’t get greedy.

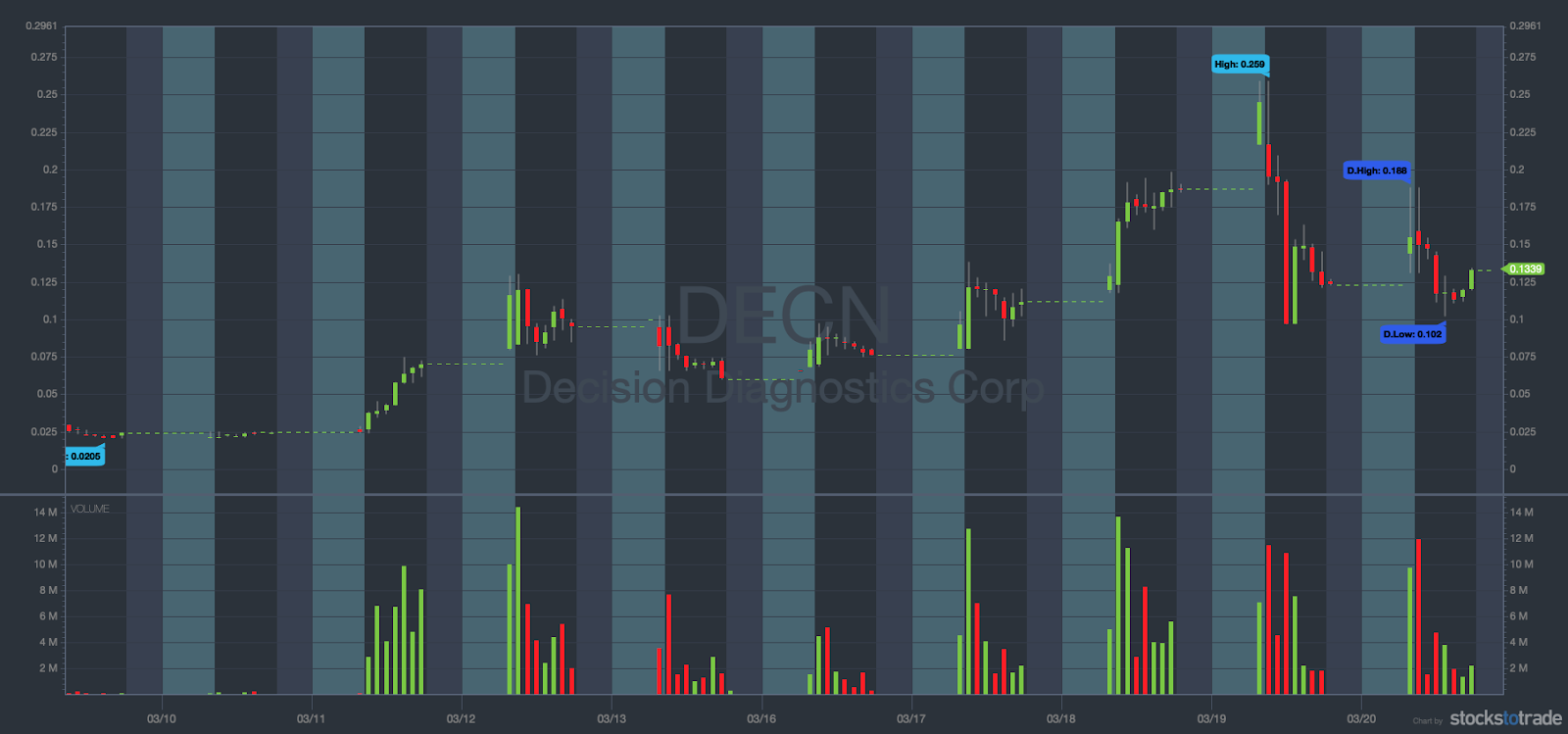

Decision Diagnostics Corp. (OTCPK: DECN)

This company makes smartphone-based electronic medical record technology … And it recently spiked on coronavirus test news. Check out DECN’s chart:

What a difference a week makes. On Monday, March 16 it was trading for less than a dime per share. By Thursday, it was peaking at close to 30 cents. It’s already on the way down now, but that’s insane growth…

It’s also a good reason to keep stocks like this on your watchlist.

Sign up for my free weekly watchlist here.

A ton of sectors and stocks are spiking right now as a direct result of the coronavirus … But they’re not as obvious as the virus plays we just talked about.

As the coronavirus phenomenon unfolds, the effects are rippling out across the nation — and the globe. Suddenly, everyone’s stuck at home.

And now stocks related to at-home convenience, entertainment, or improving self-isolation quality of life are seeing action. Makes sense, right?

Not all of these stocks are super low priced. But they can provide some inspiration for sectors and sympathy plays to watch.

Let’s check ‘em out:

Blue Apron Holdings, Inc. (NYSE: APRN)

A year ago, my stance on Blue Apron was a firm stay away. But what can I say? The stock market is full of surprises. Look at the chart, then I’ll break it down…

A little over a week ago, this stock was an undeniable loser, trading in the $2s…

Then, President Trump issued an official warning about gathering in large groups … More and more cities started shutting down bars and restaurants … Suddenly, at-home meal prep seemed like a great idea.

On March 16, it closed at $3.95 and opened the next day at $5.50. It kept rising to $6, $7, then $19. The next morning it was $25.

That’s a lot of room for meaty trades. And there are still opportunities to get in again if it keeps running.

BTW, Jack Kellogg played this trade. And I recently interviewed him on the SteadyTrade podcast. Check out the episode now!

Peloton (NASDAQ: PTON)

This stock definitely wins the “crazy catalysts” award in recent memory. First, there was that infamous commercial … Now it’s coronavirus!

If you’re an active person like me, one downfall of being stuck inside is that you can’t get much exercise. Suddenly, at-home fitness options are all the rage. Could PTON lead the way?

The chart seems to think so. As trading started on March 16, PTON was holding steady in the $18s. At the end of the trading day, it was at $22. On March 18, it even hit the $27s.

Yes, this stock is a little higher in price, but it’s worth watching to see if other fitness stocks follow.

Here’s Kim Ann Curtin and I getting into PTON and the outrage culture on SteadyTrade…

Waitr Holdings Inc. (NASDAQ: WTRH)

This is a GrubHub–like service for cities in America’s heartland. That’s not typically a hot sector or fast mover… But now, everyone’s way more interested in takeout. So a company like this is hot in ways it probably never anticipated.

Check out the massive moves on the chart:

On Friday, March 13, this stock was trading for under 30 cents. As the closures ramped up in the following week, it started climbing. On March 16, it started rising. By March 19, it hit a high of $4.40.

It didn’t hold, but savvy traders had plenty of opportunity before the drop.

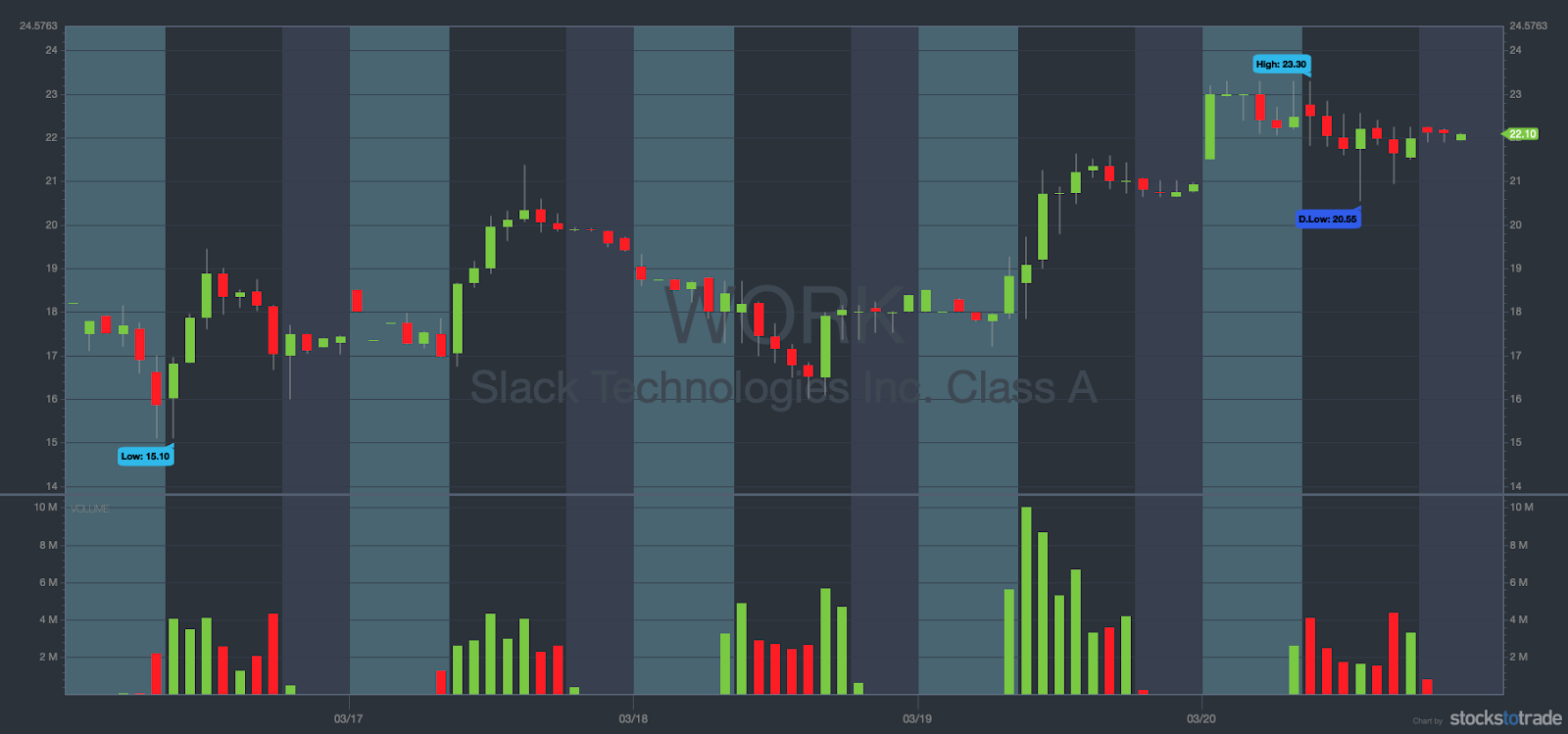

Slack (NYSE: WORK)

Ever wonder what it’s like to work from home? Well, a lot of Americans are finding out right now.

With everyone suddenly working remotely, stocks like Slack and Zoom (NASDAQ: ZM) could be poised to explode.

Slack opened the week of March 16 in the $15s. By Friday, March 20, it was trading for over $23.

As more and more people get their bearings in the sudden work-from-home revolution, stocks like this could see more growth and action.

History Rhymes

I’m fond of saying that history doesn’t repeat itself, but it rhymes. Looking at past pandemics won’t tell you exactly how the coronavirus will play out. But it can clue you in on patterns that could repeat. That’s key for finding pandemic stocks and sympathy plays.

Case in point: some of the same stocks spiking now also spiked during the previous SARS and Ebola scares. So look at the past. It can give you ideas for what kinds of stocks and trends to look for in the future.

Have Realistic Expectations

The coronavirus is creating some crazy spikers. But keep your expectations in check. Remember: this is a crazy market…

For example, say you’ve got a coronavirus stock that you bought at $2. And now it’s up to $24…

What kind of trader are you? Do you think, “Hey, I better take some profits here” … or do you hold out for even bigger gains?

The reality is that this stock will fade back to $2. That’s how these plays seem to be going.

Don’t get greedy. Stick to your plan and be realistic.

Look for Sympathy Plays

A sympathy play is when a stock spikes because of an indirect catalyst.

For example: if Peloton gets press because it’s growing during the coronavirus quarantine, then other at-home fitness stocks could spike too … All because they’re associated with the sector.

You need a strong watchlist to trade — especially for pandemic stocks and sympathy plays. So be sure to run your StocksToTrade scans daily. It’s a smart way to find those gainers and sympathy plays.

Don’t have StocksToTrade? Get your 14-day trial for just $7. See why some of the top traders use this scanner every day!

No doubt — we’re living in some very uncertain times. The coronavirus has changed life as we know it. And there’s no indication of how long it will last. Who knows how the world — and stock market — will look when it’s over.

But for now, smart traders are taking advantage of the opportunities in the market. Those setups are out there. So keep an eye out for those pandemic stocks and sympathy plays.

Think you’re ready?

Remember to do your research. Build those watchlists and trading plans. Set your entries and exits. And also be responsible and study the past.

And if you need a mentor and supportive trading community, come join at StocksToTrade Pro. We look for those meaty trades and focus on smarter trading techniques every day. Get mentorship, twice daily webinars, and much more. Sign up today!

Don’t try to guess what will happen in the future. Trade the opportunities you have now. Can’t find trades? That’s OK. Take that time to understand what’s going on now. And you can always catch up on the SteadyTrade podcast where we get into all things trading.

It’s an insane market … Always have a trading plan and stick to it. Stay safe!

How are you approaching the market right now? Leave a comment and let me know!