Boeing news has spread like wildfire. There’s a lot going on. We’ll break the latest news down for you here.

Boeing (BA) is the largest aerospace company in the world, and what they’re really known for is producing commercial jetliners. If you’ve taken a few commercial flights in your life, it’s likely you’ve been on a Boeing jet.

The current drama around Boeing stems from the fact that the company has seen two of its 737 MAX 8 jets have terribly tragic crashes in a short period.

First, there was the Ethiopian Airways crash on March 10, then there was the Lion Air Crash on October 29, 2018. In total, 346 people died in these terrible events.

Both these crashes involved the exact same model of Boeing jet, the 737 MAX 8. And there’s evidence of similarity between the two crashes. Investigators believe that Boeing’s MCAS, an anti-stall system, played a part in causing the crashes.

In response to these findings, the U.S. Federal Aviation Administration (FAA) grounded the entire 737 MAX 8 fleet on March 13. That made international waves.

The safety certification process that Boeing uses for these aircraft is under further investigation. Interestingly, this investigation has been going on since before the first crash.

That’s the situation it in a nutshell. Read on to find out how all of this is affecting the company’s financials and stock price.

Table of Contents

- 1 A Short History of Boeing’s Stock Price

- 2 Make Trading Easier with StocksToTrade

A Short History of Boeing’s Stock Price

Boeing is one of the original aerospace companies, dating back to July 15, 1916. The stock has traded on the NYSE since January 13, 1978.

Here’s a long-term chart for The Boeing Company (BA:NYSE):

It’s clear from this chart that the company has grown extensively over the years. Boeing is a major player in the global uptake of air travel and a dyed-in-the-wool blue-chip stock for decades.

The Boeing’s rise wasn’t without hiccups. In 2008’s global financial crisis (GFC) stock market crash, the stock dropped from a high of $107.83 in July 2007 to a low of $29.05 in March 2009. From that point, the stock took over four years to reach it’s all-time high once again.

In January last year, Boeing rallied and burst through a significant resistance level around $158, before making its climb to current levels of around $370 where we see the stock consolidate.

Surprisingly, after the Lion Air crash in October 2018, the stock suffered a pullback, but overall remained strong, gaining to new highs soon after.

Boeing’s Current Stock Price

As of this writing, Boeing’s stock price sits at $372. Our StocksToTrade proprietary algorithm is bullish on the stock. The team at StocksToTrade will update this price daily.

How Did the Ethiopian Airways Crash Affect Boeing’s Stock Price?

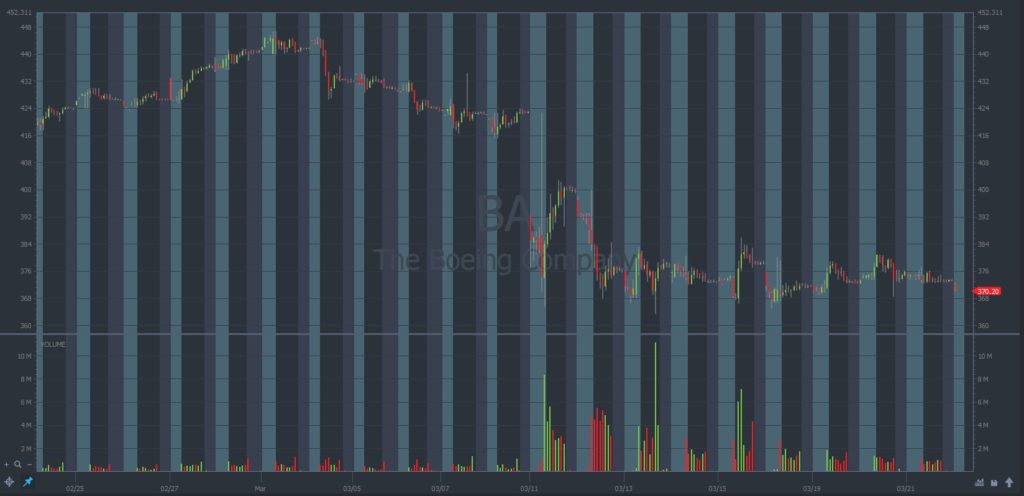

After any major plane crash, you generally see a decline in the related stocks. This held true for Boeing after the second plane crashed, with the stock quickly gapping down 16.82%.

The drama isn’t over just yet. Boeing and the FAA are now under a lot of scrutiny regarding any possible wrongdoing in causing these crashes. It’s an ongoing situation, making headlines all over the world. This has the potential to be disastrous for Boeing, and nobody knows how it’ll end.

Does the Market Still Feel Bullish on Boeing?

Now, it’s time to use a bit of our StocksToTrade knowledge to break down our perspective of how the stock market as a whole views the Boeing stock.

After the rapid decline from $440, we’ve seen BA find a consistent bid in the $370s. This is an interesting zone … the stock found resistance at this level before.

Boeing: The Dividend-Paying Blue-Chip

Boeing consistently pays a solid dividend and is a staple for many people who require a steady portfolio income, such as retirees.

Boeing has seven years of consistent dividend growth, with the most recent dividend increase of December 2018 at 34.5 cents per share. Solid stats for a dividend stock.

The Current Boeing Dividend

As of this post, Boeing currently pays an annual dividend of $8.22 per share. That’s about a 2.2% dividend yield. Let’s break down what that means:

Your Dividend Income if You Invested $5,000 in Boeing Stock

Let’s do a few calculations to show you how much you’d receive in dividend income if you made a small investment in Boeing.

Let’s work off the current price of $376.16. If you bought $5,000 worth of stock, you’d receive 13.29 shares in Boeing (we’re ignoring fees and commissions). Really, that’s 13 shares since you can’t buy a fraction of a stock. But for the sake of simplicity for this calculation, let’s imagine that you can own a fraction.

So, with Boeing currently paying a dividend of $8.22 per share, you’d receive a yield of $109.24 on your invested $5,000.

$109 may not seem like a lot of money … but when you compound returns over time, meaning you reinvest profits back into the stock, you can potentially end up with a huge amount of capital.

Stock Splits in Boeing’s History

Since going public in 1978, Boeing stock has split six times.

Companies split their stock for a variety of reasons. The most common is to lower the price in an effort to lure more investors.

Often, the stock split at a ratio of 1.5 to 1 shares. That means that for every two shares you hold, after the split, you hold three.

The Financial Health of Boeing

While Boeing’s most famous for commercial airliners, it’s not all they do. They’re a massive company involved in other areas such as defense, space, logistics, light rail, and more.

In terms of the 737 MAX air crash drama, it’s clearly bad for the company. But investors can feel assured that the company is diversified with profit centers away from the problematic jets.

And here’s interesting fact: Boeing airplanes are in such high demand, they have a huge backlog of orders. Plus, they have major multibillion-dollar defense contracts.

Boeing Financials as of December 31, 2018

Ready to delve deeper into understanding Boeing’s fundamental health? Here’s a list of current fundamental metrics:

- Earnings: $10.46 billion

- Revenue: $101.13 billion

- Total Assets: $117.36 billion

- Total Liabilities: $116.95 billion

- Earnings per share: $17.85

- P/E ratio: 21.20

What Analysts Think of Boeing Stock

Ask ten different analysts their outlook on a stock, and you’ll get ten different answers. You can’t rely on analyst recommendations alone.

You have to do your own research.

That said, the StocksToTrade TipRanks widget currently lists Boeing as a moderate buy. TipRanks compiled 21 analysts recommendations and shows that there’s an average price estimate of $432.53 per share.

See what the analysts say about your favorite stocks. Check out TipRanks when you grab a 7-day trial of StocksToTrade for just $7.

Make Trading Easier with StocksToTrade

Boeing isn’t the only exciting stock out there at the moment. At any given time, there are hot sectors full of promising stocks making big moves.

You can better position yourself to find those hot sectors and stocks, and it’s easier to do so when you equip yourself with reliable tools.

That’s exactly what StocksToTrade is — a top-of-the-line trading and research platform. What do you get with StocksToTrade? Here are just a few features:

- Access to all major U.S. markets: NASDAQ, NYSE, AMEX, OTC, and even pink sheets.

- Unlimited use of our strategy scans to help you find trades that fit YOUR criteria and strategies.

- Clean, dynamic charts with overlayed indicators. See all you need to know with just a quick glance.

- Chart Drawing tools, indicators, and studies to help make charting easier and more streamlined.

- Real-time scanning for news stories, SEC filings, and even social media mentions to help you spot the hype early.

Many of the top stock traders in the world start their trading day by loading up our platform. Don’t you think you should too?

Grab a 7-day trial of StocksToTrade for just $7 to see what you’re missing!

What do you think of the Boeing drama? What about the investigation into Boeing and the FAA? Do you see opportunity in this stock — why or why not? Share your thoughts below!