Most traders and investors have thought about buying dividend growth stocks … but is it right for you?

The appeal: You might earn passive income from the market. Who doesn’t like that, right?

Want to learn more about finding and holding stocks that pay a dividend, while both the stocks and dividends (hopefully) also grow over time?

We created this guide for to help you learn more about dividend growth investing. Read on to learn exactly what this strategy entails and how to approach it using trading know-how and stock scanning.

Let’s roll!

Download the key points of this post as a PDF

Table of Contents

What Is Dividend Growth?

Dividend growth is a financial metric that allows investors to measure the growth rates of a company’s dividends over time.

Sounds pretty dry, right?

Now the more interesting stuff: What is dividend growth investing and why should I consider it?

This investment style tends to be popular with people around retirement age or those who want to earn a dividend income while still growing their portfolio and dividends over time.

Dividend growth investors put money into stocks that pay a dividend, with the expectation that the dividends will increase in the future as the company (and their investment) grows in size.

A dividend growth strategy is for the longer term, so if you manage your 401k or hold long-term positions in stocks, this investing style might be your speed.

Advantages of Dividend Stocks

If you read this blog regularly, you’re probably familiar with short- to medium-term stock trading. But don’t overlook the benefits of holding stocks that pay a dividend. Here are a few:

- The ability to profit in two ways. If your stocks rise in value and you sell them, you can profit. If your stocks don’t move in price, but you earn a dividend, you can profit.

- The ability to keep your shares while still earning an income. When you place shorter-term trades, you generally have to close out winning trades to make a profit. With a dividend stock, you can retain your shares and earn income in the form of a dividend.

- The option to compound returns long term by reinvesting dividends. A common investing strategy is to take the dividends you make every year and reinvest them into the stock. As a result, returns can build up over time.

What Is the Average Dividend Growth Rate?

According to data collected by the NYU Stern School of Business dating back to 1960, the S&P 500’s average yearly dividend growth is 5.4%. In the same period, inflation averages 4.1%.

Across the broad market, dividend growth beats inflation. That means dividend growth investing is historically a good way to gradually build and maintain wealth.

Those figures are for the entirety of the S&P 500, but a little side note here … some investors with smart strategies have beaten these returns.*

More on that in a bit. Let’s keep rolling …

ROE and Dividend Growth Calculations

The ability for a company to grow its dividends over time is related to the company’s return on equity (ROE). The ROE is the return the company makes on capital held in the company (factories, machines, assets etc.).

Think about it: If a company wants to grow its dividends, the company has to grow and generate more free cash flow.

That means that you need to analyze factors such as ROE and have a solid grasp of fundamental analysis. If you still need to get up to speed with some basic fundamental analysis skills, head over to this post to get started.

Once you’re comfortable with fundamentals, the analysis for this strategy is quite simple.

Here’s a quick primer on how to find the dividend growth rate …

Let’s take for example a stock that’s paid out the following dividends:

- 2016: $2

- 2017: $2.20

- 2018: $2.50

To calculate the dividend growth rate, we first determine the growth for each year. In 2017, the dividend grew by 20 cents or 10%. In 2018, the dividend grew from $2.20 to $2.50 or 14%.

Now calculate the average of those rates, which is 12%. This company’s dividend growth rate is 12% over the past two years.

3 Examples of the Best Dividend Growth Stocks Right Now

Let’s get into what dividend growth stocks look like. We’ve compiled a list of three stocks with consistent dividend growth.

Use these real-life examples to better understand what a dividend growth investor looks for in a stock.

#1 Apple (NASDAQ:AAPL)

Interesting fact about Apple: It’s Warren Buffett’s largest holding in his dividend portfolio. And if Warren’s keen on the stock, it’s probably worth a look.

The market worries over Apple’s dependence on the iPhone, which accounts for about 63% of 2018’s sales. But on the plus side, Apple has a number of service businesses, such as the App Store and Apple Pay, that could be major growth centers in the future.

The company holds more than $230 billion in cash and capital holdings. That allows the company to make strategic acquisitions and return capital to shareholders.

In short: It can be a great position for dividend chasers.

Apple raised its dividend each year since 2012. It has a strong balance sheet and consistently generates huge amounts of cash. Make sure to add Apple to your dividend watchlist!

#2 Boeing (NYSE:BA)

The demand for commercial airplanes is booming in recent years, and Boeing is profiting wildly as a result.

Boeing is the world’s largest aerospace manufacturer. Currently, demand for their planes exceeds supply, and the company is seeing earnings grow at double-digit numbers for years.

The company has increased their dividend by at least 20% for each of the past three years. Keep an eye on this one.

#3 McDonald’s (NYSE:MCD)

McDonald’s is in the landholding and franchising business, much more so than the hamburger business.

Translation: The company owns many of the properties that McDonald’s restaurants sit on, earning both rent and royalties based on the restaurants’ sales. Franchisees are responsible for the costs and headaches of running the actual restaurants.

This setup means the company can maintain an operating margin of close to 40%.

McDonald’s also adapts its brand and menu to match the evolving consumer tastes, and the company has grown decade by decade. This consistent growth supports McDonald’s capacity to increase their dividend — for 43 consecutive years.

With management claiming ambitious plans to deliver sales growth and margin improvements going forward, this could be a fantastic stock to keep in your dividend growth portfolio.

How to Trade Dividend Growth Stocks With a Stock Screener

Using the trading expertise we’ve developed here at StocksToTrade, we’ve compiled a list of tips and techniques for a dividend growth strategy.

Follow these steps to help you hone your own strategy.

Follow Key Chart Patterns

The first step to being a dividend growth investor is usually looking at a company’s fundamentals. But we’re all about starting with chart patterns.

Chart patterns can show you the movements of other traders in the market. They can indicate things like price levels, the overall trend, and the momentum of the stock.

Once you find a promising dividend growth candidate, you can use the chart to enter into stocks that are in sustained uptrends. That can allow you to ride the wave as market momentum pushes the price higher … all while earning a dividend.

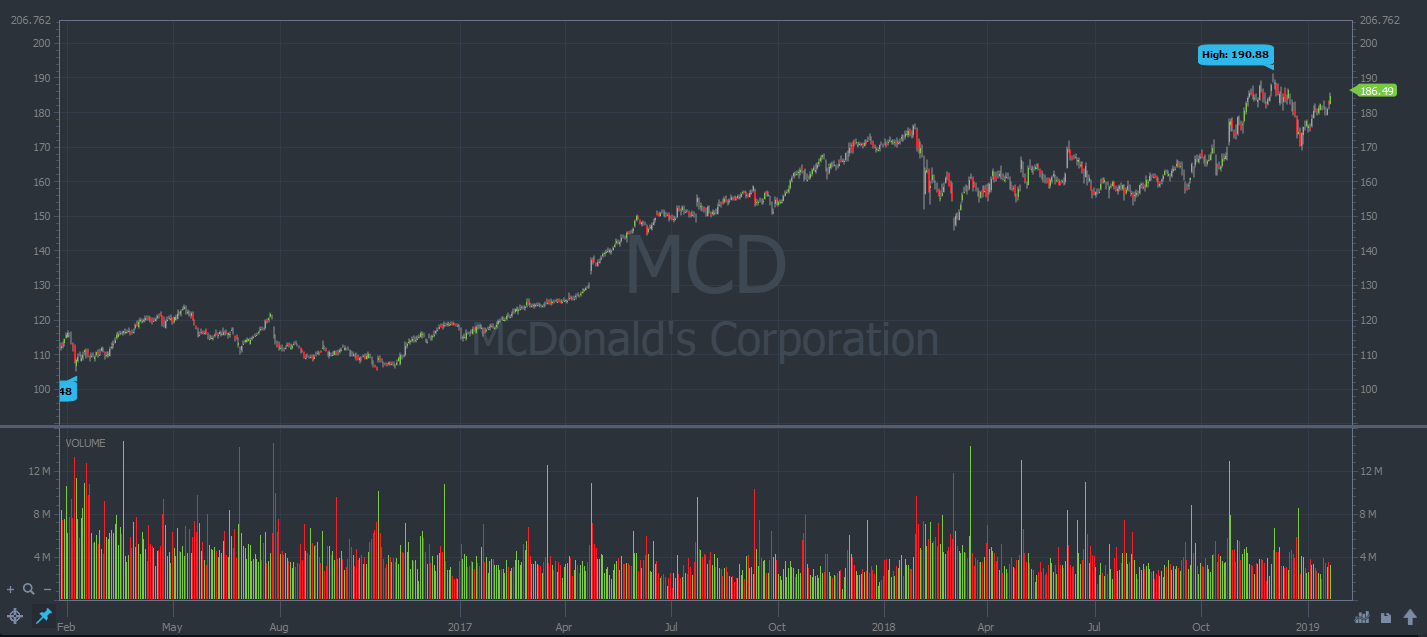

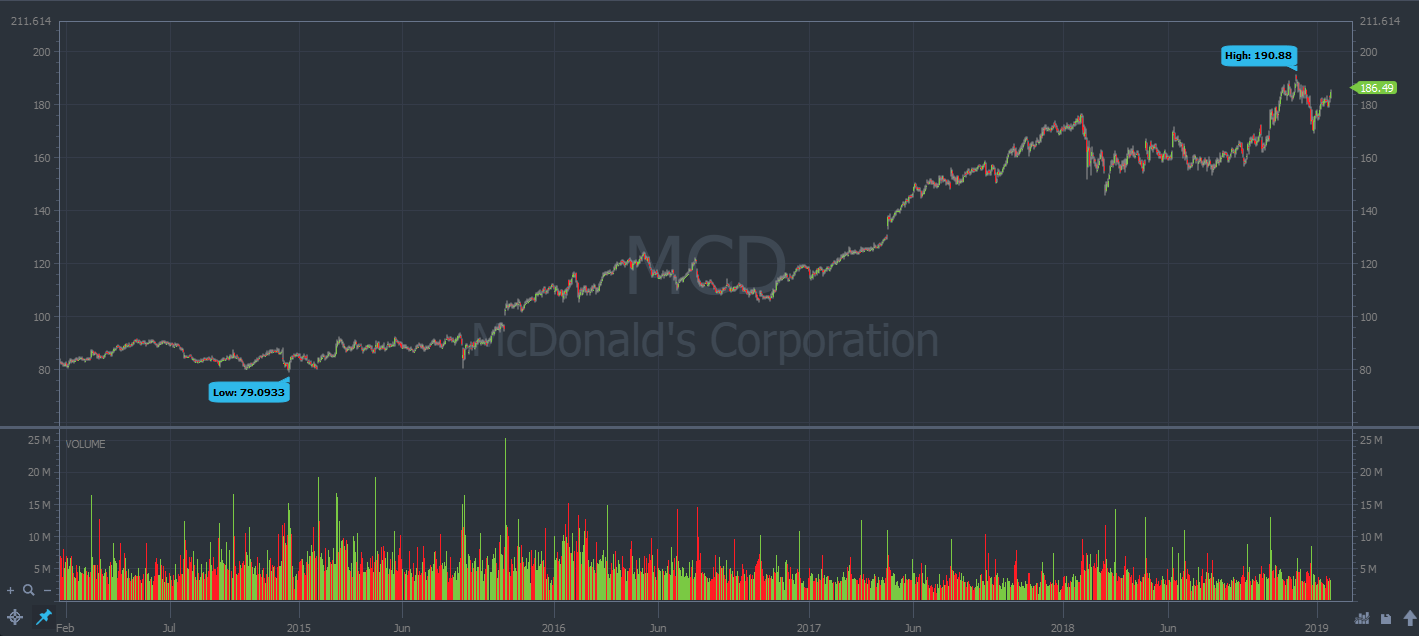

(NYSE:MCD) McDonald’s Corporation showing a clear uptrend with higher highs and higher lows. (Source: StocksToTrade)

Keep a Stock Watchlist of Your Favorite Names

A stock watchlist is a collection of stocks that you track because, due to your research, you think they show potential.

When you’re vetting dividend growth candidates, it’s wise to wait before investing right away.

You may need to wait for a lower price so that you can snatch the right dividend yield. Or maybe you think that the company needs to improve their business model before you’re ready to invest.

When you find a potential dividend growth stock, put it on your watchlist.

You can use pen and paper for this, but we recommend you put technology to use. StocksToTrade is a platform designed to help you build and track your watchlist, and it’s super easy to use.

You can use StocksToTrade to create highly customizable watchlists. See what you’re missing … grab a 7-day trial for just $7 now!

Follow News Catalysts

Another key to finding dividend growth stocks is by watching news catalysts. These catalysts can alert you to stocks that are about to move.

This can be anything that could affect the price of a stock. Catalysts can be as bland as news stories, SEC filings, or company announcements or as spicy as online rumors running amok.

Just as it helps you spot the movers in trading, you can find the action on your favorite dividend growth names. And by doing so you can set yourself up to grab the stock as it begins a new uptrend. You can be in a better investment position while waiting for the dividends.

Need an easy way to track news catalysts for your watchlist stocks? Check out StocksToTrade. Its real-time news-scanning features alert you the moment a news catalyst drops. Try it out with a 7-day trial for $7.

Key Dividend Growth Skills and Techniques for Traders

To follow this strategy, you need certain analytical skills. If you’re not yet comfortable calculating dividend rates or using a stock screener to find stocks, read on to learn how.

How to Calculate Dividend Growth Rate in Excel

Following this investment strategy requires a means to calculate the dividend growth rate.

Here’s what you need: The dividend amounts for previous years and a spreadsheet program such as Microsoft Excel or Google Sheets.

Here’s a quick video on how to calculate the dividend growth formula in Excel:

Use a Stock Screener to Find the Best Dividend Growth Stocks

With over 18,000 stocks traded each day in the U.S. alone, finding trading and investing candidates can be a massive chore.

But thanks to modern technology, you can use a stock screener to scan the markets for you — and you set your exact investment criteria. Your parameters can include chart patterns, technical indicators, or other fundamental analysis metrics.

Once you set the software to run the scan, you’ll quickly have a list of stocks to focus on and research further.

Don’t overlook this valuable tool! Stock screeners are useful time-savers. They allow you to focus your precious mental energy on the trading and investing opportunities that fit your strategies.

That’s exactly why we put so much time into developing the StocksToTrade screener.

Our screener interface is so easy to use, it’s suitable for traders of all levels. Just drag and drop your criteria — no programming skills required.

We’re confident we built the best stock screener on the market. Nab a trial of StocksToTrade for only $7 and see why many traders won’t start the day without it.

Take Advantage of All the Other StocksToTrade Features

To better navigate the markets, you need to take advantage of every available tool.

The StocksToTrade platform is designed to be the best friend to both newbies and elite-level traders. We’ve built something so powerful that many of the world’s best stock traders use our platform daily.

With StocksToTrade, not only will you have an extremely powerful stock screener, but you’ll also have access to:

- Top-of-the-line charting for every stock traded in the U.S., including pink sheets and OTC markets. You can use it spot opportunities in a massive universe of stocks.

- Real-time market scanning for news stories, SEC filings, Twitter, and more. The software can alert you to anything happening regarding your favorite stocks.

- Streamlined paper trading so you can practice trading without risking a cent.

- And many more premium features right at your fingertips, to help traders and investors of all experience levels.

Haven’t signed up yet? Get a 7-day trial for just $7 and try it now.

Conclusion

A dividend growth investment strategy can be a great option for investors looking to grow their capital while earning returns on their holdings.

By no means is this a riskless strategy — nothing is. Stock prices can decline, companies can falter, and the economy can fluctuate.

Always look before you leap. Understand the risks involved with this investing style. Know it inside and out to get the best out of the strategy. Use the research and scanning tools that work for you.

Follow this guide to help you develop a powerful approach for finding investing and trading opportunities.

If you’re not comfortable with any of these steps — scanning, fundamental analysis, or chart patterns — delve deeper into those topics until it’s second nature. Then keep going. There’s always more to learn.

And stay tuned to the StocksToTrade blog. We’re here to help you on your trading education journey.

What’s your favorite dividend growth stock, and why? Share your comments!