Getting started in the trading world can be daunting. Throw in a complicated, hard-to-use trading platform, and some would-be traders end up throwing in the towel before they ever even make a single trade.

Good news: It doesn’t have to be like that.

We created this post not to give you a simple, one-size-fits-all answer, but to give you the framework to analyze a trading platform and determine if it’s exactly what you need.

Download the key points of this post as a PDF

Table of Contents

The Best Stock Trading Platform For Beginners?

There’s no clear-cut, perfect solution for every trader — you have to go with what’s best for YOUR unique trading needs, not some other trader’s needs.

There are traders of all stripes and different strategies. They have different preferences, skill sets, amounts of capital, technical abilities, and so on.

For example, the best penny stock trading platform might not be the best choice for large-cap investors …

With that in mind, let’s talk about what might be the best platform for you. Here’s how to analyze trading platforms and quickly determine which one matches your needs.

What Is a Stock Trading Platform?

A stock trading platform is a piece of software that acts as a sort of command center for your trading activities.

Great trading platforms — those worth your time and money — provide charts, information about stocks, news feeds, scans, watchlists and much more.

A trader uses a platform to monitor interesting stocks, find new ones, analyze them, build watchlists, and more, depending on the capabilities of the platform.

If the platform has broker integration, you can even use it to enter your buy and sell orders directly to their broker.

StocksToTrade has broker integration for many of the major brokerages for trading stocks. Come and check out how easy we can make placing trades with a 14-day trial for just $7.

How to Choose the Best Online Brokerage

While having the right trading platform is important, you also need a stockbroker to place your trades through.

A stockbroker acts as an agent, placing trades on your behalf into the market.

Not all brokers are created equal, and there’s never simply one best broker. Instead, each trader should look for the broker that meets their specific needs.

Some brokers are cheaper than others, but that may be due to the brokerage firm cutting costs in other areas and producing a subpar service.

Some brokerages may have a range of amazing features but require large initial account balances, due to the company only wanting to deal with more serious traders.

Whichever brokerage you choose, it’s important to consider all the aspects, costs, features and risks. You definitely want to do your research before opening an account and depositing funds.

We have more specific information regarding brokers further in this article, but if there’s one rule of thumb to follow, stick with American-based brokers because you’ll have the benefit of U.S. regulatory protection.

What to Look for in a Stock Trading Platform

Let’s revisit the idea that there’s never any single best stock trading platform for beginners.

Let’s revisit the idea that there’s never any single best stock trading platform for beginners.

Different traders have different requirements depending on their trading strategy, account balance, level of skill and so much more.

We wish we could give you a one-size-fits-all answer, but instead, we’ll share with you a bunch of pointers to consider when determining if a trading platform is right for you.

#1 An Easy-to-Use Trading Platform

Some trading platforms look like they haven’t been updated since the 1980s and feel like you need a PhD in computer science to operate. They can be torturous to get the hang of if you’re a new trader.

Instead, today’s traders are fortunate to have a range of easy-to-use, point-and-click style trading platforms that can allow newbies to be up and running in mere minutes.

When trying out a trading platform, you’ll often have a large amount of time to read the FAQs and training material to work out how to use the platform’s features.

Beware though, when the markets are open and you’ve got real money on the line, you’re placing real trades and likely won’t have the luxury of time to search the FAQs.

That’s why it’s smart to stick with well-designed, easy-to-use trading platforms.

At StocksToTrade, we work hard to streamline our platform and make it amazingly simple to use. It’s designed by real traders, for real traders. We’ve got skin in the game, and we’re in the trading trenches every day — just like you.

Come and check out how simple we can make the trading process with a 14-day trial for just $7!

#2 Paper Trading Capabilities

If you’re just starting out, or if you have some experience but want to try out a new strategy, then you want to be able to paper trade.

Paper trading is fantastic. It’s basically pretend trading. You make all the same trading decisions you’d make with real capital, but don’t actually make trades. Your capital stays safe.

You record the results of all these trading decisions, wins, breakevens or losses and the paper trading module allows you to see how your strategy performs.

If you’re new to trading, make sure to paper trade first. Get at least a few weeks (or more) of experience paper trading before ever risking a cent of your capital with a real trade. This allows you to get the hang of watching the market, using the platform and making trades.

With StocksToTrade, you can paper trade for as long as you need. You’ll click the exact same buttons and look at the exact same things as you will when you trade with real money. Take advantage of this incredibly useful feature!

This means that by the time you make your first live trade, you’ll have practiced exactly what to do and it’ll hopefully be second nature by that time.

#3 Real-Time Data

If you plan to actively trade, you need the most up-to-date stock prices. That means you need real-time price data.

Real-time price data is information on price and trading volume that comes almost instantly from the exchange. With real-time data, you’re getting a real-time view of what’s happening in the markets.

That’s opposed to delayed-data feeds, which means the price and trading volume information is a snapshot of what happened 20 minutes or more ago. This type of data is more appropriate for longer-term investors who don’t need to be active and ready to trade quickly.

Real-time data might cost a bit more, since the trading platform needs to pay the exchange, but it’s completely worth it. Don’t even bother trying to trade actively without real-time data!

#4 Charting Tools

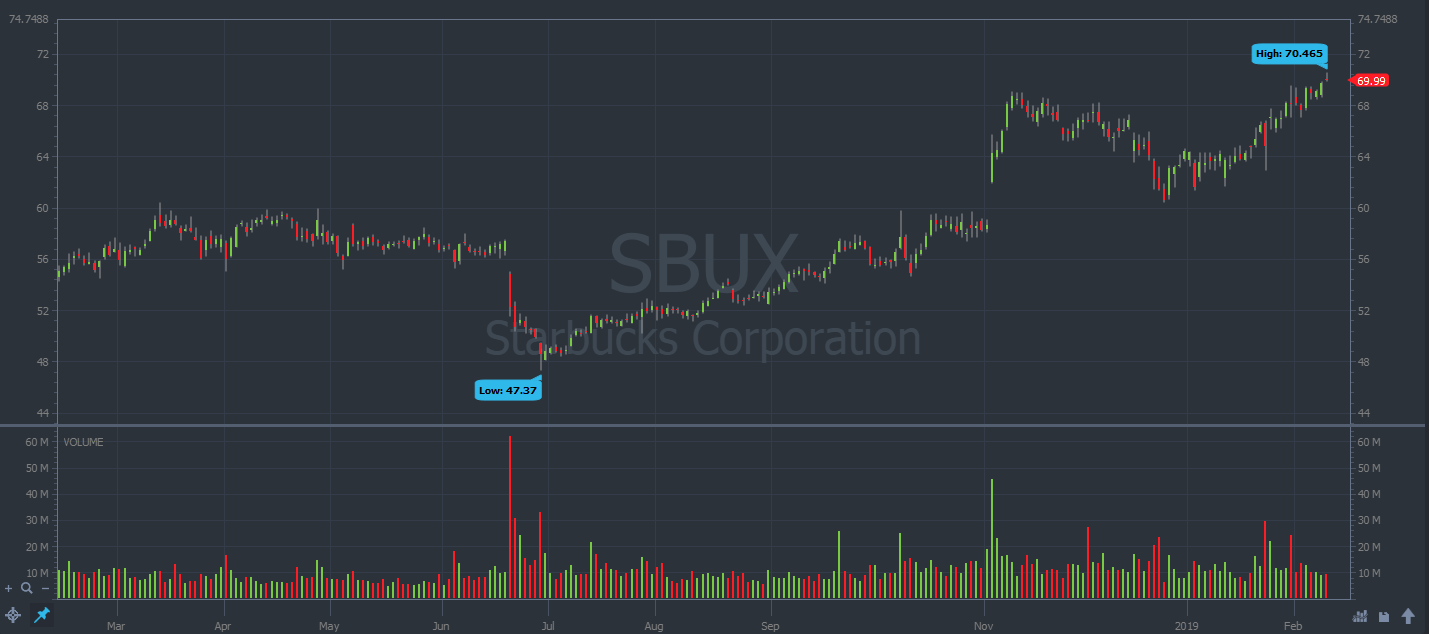

Many successful traders base the bulk of their trading decisions off of information on the price chart.

On the chart, you can interpret the actions of all the traders in the market in the patterns presented in price. With that information, you can anticipate the likely next move of a specific stock.

With charting analysis being such an important tool for many traders, it’s important to choose a trading platform with great charting facilities.

Charting facilities should look simple, yet elegant enough that you’ll be comfortable staring at the screens for hours each day. They should also include enough information so that you barely need to glance at the chart to get a full view of what’s going on.

At StocksToTrade, we strive to make the most well-balanced charting platform on the market.

We’ve put an insane amount of hours into determining the right way to display as much information on the charts as possible while keeping them as clean as possible.

On the StocksToTrade platform, with just a click of a button, you can place almost any indicator you can think of onto the chart. With another click, you can have high/low data, key swing points or even news story overlays.

If you’d like to come and see the fighter-jet of charting platforms, come and grab a 14-day trial of StocksToTrade for just $7.

#5 Trading Chatroom Access

Trading can be a lonely endeavor …

You’re often sitting there alone in front of your screen(s). Stocks are ticking up and down all over the place. You have winning trades, losing trades, and no one to bounce ideas off of, or share in the good and bad times.

But it doesn’t have to be that way.

Today, thanks to the internet, you can join a trading chatroom populated by traders just like you who are on the same journey.

A trading chatroom can be a great source of ideas and a place to get feedback on your trades. At the very least, it can even just break up the boredom of a dull trading day.

With some chatrooms, you can even peer over the shoulder of a successful trader.

That’s the case for our StocksToTrade Pro members. They get to view the screens of our lead trainer and seasoned stock trader Tim Bohen. It’s a bird’s-eye view of how a successful trader approaches the market each and every trading day — plus plenty of opportunities to interact with Tim and ask questions.

Apart from the daily chats and webinars, there are also weekly strategy webinars where Tim shows cutting-edge strategy developments and ideas into what’s working right now.

If you’d like to speed up your learning process and see how a professional trader goes about his day, check out StocksToTrade Pro now.

What to Look for in a Broker

Picking the right trading platform is half the battle — you also need to pick a brokerage to trade through.

There are a huge amount of brokerages out there. Some are better than others. Make sure to thoroughly research all companies.

When you’re deciding on a broker, here are a few things to look for …

Quality and Customer Support

Imagine you’ve placed an order to buy some shares in a fast-moving market …

Suddenly, your internet crashes. You’re stunned. You must make sure you’re completely out of the trade and don’t have any more orders sitting in the market …

You frantically call your brokerage hotline, hoping to speak to a customer service agent to sort the problem out for you as soon as possible …

Bad news: The call center is busy and you’re placed on hold for 15 minutes. In that time, maybe the markets hit your order and started moving in the wrong direction.

You’re losing money by the minute, while sitting on the phone, waiting for customer service to pick up!

That’s why you need a brokerage with a mastery of the art of customer service. You’ll appreciate it when you really need it.

And it’s not just when something goes wrong — it can even be times when you’re simply trying to withdraw some profits from your account, or even just have a simple question.

Before you start actively trading, do this: Test out a broker’s customer service capabilities by doing a test call or two before fully committing to them.

Affordable Commission Rates and Fees

Here’s a mistake that almost every newbie trader makes: not caring about the fees and commission rates they pay with a broker.

Newbie traders often think that the commissions and fees they pay are only a tiny percentage of their trading volume — that they don’t matter. They’re dead wrong.

The more active you are, the more you’ll pay, due to increased turnover. They can be in commissions for simply making a trade, fees for shorting a stock or interest for holding a margin position.

You’ll even sometimes find hidden little fees for things like withdrawing money from your trading account.

Think about it: Every single cent you pay your broker is a cent that doesn’t end up in your pocket. Those cents here and there add up to big money over time.

Trading should be approached as a business — so make sure you run the numbers on how much you’ll have to pay to run your trading strategy before picking a broker.

Safety of your Funds

There are some offshore brokerage houses that try to entice traders to use them by offering rock-bottom commission rates or other exciting perks.

Some offshore brokerage houses are scarcely regulated. There are plenty of horror stories about those that closed-up shop overnight. When that happens, clients often don’t have a hope of getting back their account funds.

Don’t fall into that trap! Make sure you use a broker that follows FINRA guidelines, and that’s preferably located in the United States. With that, you’ll have government regulatory protection to provide you with some piece of mind, knowing the funds in your account are likely safe.

StocksToTrade Tradier Integration

On the StocksToTrade platform, we have trading integration with a number of major brokerages, meaning you can place trades directly from StocksToTrade. No more frantically clicking between STT and back!

As an added benefit to our valued members, we’ve partnered with Tradier, a major online stock brokerage.

Through our partnership with Tradier, we’re able to offer our members a very cost effective and transparent brokerage situation.

Use Tradier through StocksToTrade and you’ll receive:

- Unlimited trades for only $14.99 month, so you can keep more of your trading profits for yourself.

- The ability to open an account with as low as $500, so you don’t need to spend an arm and a leg to get started trading.

- Amazing customer support with Tradier staff always on hand to answer your questions and requests in a timely manner.

This offer is only available through the StocksToTrade application. If you’re not on board yet, what are you waiting for? Grab your 14-day trial for just $7 today!

Take Advantage of Advanced StocksToTrade Features

At this stage, you probably know all about how great StocksToTrade is for charting, paper trading, broker integration, and ease-of-use.

All of these are important, but as your trading develops, you’ll probably want to start using some more advanced features.

We’re talking about real-time scanning capabilities that quickly scan for your favorite price action, news stories, or social media buzz — all alerting you to exciting potential trades.

There’s also our powerful proprietary algorithm called Oracle, which we developed to help you quickly determine high-potential trades and intelligent stop-loss areas.

StocksToTrade is a heavy duty trading platform that’s simple enough for beginners to use, but also powerful enough to keep even the most advanced traders happy. Your trial offer is waiting.

Conclusion

As you’ve learned here, the right platform can make your trading journey easier and more enjoyable — so take the time to consider the pros and cons of all platforms that seem a good fit for you.

Narrow it down to your best 2–3 options, then slowly follow the above steps to determine which platform to choose.

The work doesn’t stop there though — make sure to pick the right broker, as well. Having everything set up and perfectly tailored for you shouldn’t take too long, and it’s well worth the effort.

If you’re still having trouble deciding, maybe it’s time to dive in and test a platform. We warmly invite you to check out StocksToTrade for 14 days for just $7. Our members love us, and we think you will, too.

Have you ever traded without a trading platform? Did you find much success? We’re interested to hear what happened — leave a comment and share your story.