Think fast — what’s your trading edge?

Have you mastered the basics but still struggle to hit a stride? You might be missing your trading edge.

It’s the difference between following the crowd and finding your own winning formula.

You know how I always warn you about chat rooms … and when I talk about a stock, I always tell you to do your own research. If you listen to my daily premarket briefings, you know I only want to help you find your own way…

I want you to listen to my thought process on the way to developing your own. You know, give someone a fish vs. teach someone to fish…

Why is that?

There’s a Warren Buffett quote I love: “Be fearful when others are greedy, and greedy when others are fearful.”

Buffett says this because the market is just a complicated system of supply and demand. If you aren’t trading with an edge and you’re hunting for random stocks on Twitter…

Chances are you’ll be late to the supply side of things.

Table of Contents

What Is a Trading Edge?

I think of a trading edge in simple terms.

This is my formula: Strategy + Rules = Trading Edge

Strategies are essential in the stock market. But when everyone’s using the same strategy, it ceases to be effective. It may be a fine strategy, but if you’re looking for an edge in your trading, you’ve got to make it unique.

The human brain tends to understand the idea of supply and demand on a one-to-one level. If I have something that someone wants, it’s a sellers’ market, right?

The market expands supply and demand to thousands, even millions, of people. But most people are still thinking on that individual level.

What does it mean when millions of people have the same thought about a stock being in demand … and then they all make similar trades?

Those people are what we call lemmings. And sooner or later, they’re gonna get burned.

(Psst! Have you signed up for the no-cost StocksToTrade weekly watchlist? Do it now to find out which stocks and market trends I’m watching every week!)

What Is an Edge Ratio?

An edge ratio in trading is a critical measure that quantifies your trading advantage. Think of it as a formula that helps you understand the balance between your winning trades and the losses you can afford while still being profitable. It’s not just about the frequency of wins but the magnitude of those wins versus the losses. This ratio is paramount because it directly impacts your trading decisions, guiding you on when to enter or exit a trade based on the calculated risk versus reward.

Incorporating my years of trading and teaching, I’ve seen firsthand how understanding and applying an edge ratio can transform a trading career. It’s about more than just numbers; it’s a reflection of your trading strategy’s effectiveness. By analyzing your past trades, including both the winners and losers, and calculating your win rate and average returns, you can refine your approach. This process of evaluation and adjustment is what separates successful traders from the majority. It’s not just about having a trading system; it’s about having one that consistently works for you, adapting to market conditions and your trading style.

Trading Edge vs. Trading Strategies

Understanding the difference between trading edge and trading strategies is crucial for both day traders and swing traders. Your trading edge is your unique advantage in the market, a combination of skills, knowledge, and insights that allow you to make profitable trades more often than not. It’s about identifying opportunities where the odds are in your favor, whether through technical analysis, understanding market momentum, or recognizing the impact of market conditions on securities and commodities.

On the other hand, your trading strategy is the plan you follow to execute trades, encompassing your entry, exit, and position management rules. It’s the methodology behind your decisions, shaped by your trading edge. My experience in the trading world has taught me that a solid trading strategy without a clear edge is like sailing without a compass. You might move, but not necessarily in the right direction. The key to a successful trading career lies in aligning your trading strategy with your edge, ensuring that every decision is informed by a deep understanding of the market and a clear methodology aimed at maximizing profitability and minimizing risk.

Example of a Trading Edge

You see a stock going up. It’s human nature to want in. But every time you jump in on the rally … it falls.

What you’re employing here is a strategy of buying breakouts … just like a ton of other traders.

But a lot of these traders are booking profits, and you’re not. What are they doing differently?

In the video below, I give you some of the rules I put on my breakout strategy.

This is how you can find your edge in a stock … It’s the way to narrow down the biggest percentage gainers into potential trades.

I look for four things:

- Earnings winners: This is one of the most important news catalysts out there. Think about the difference between a stock breaking out on earnings and one that’s up on a dumb tweet.

- Revenue and positive cash flow: Multi-day and multi-week moves are more likely for quality stocks. How can you tell if you’re looking at a quality stock? A good sign is that it’s actually making sales.

- High volume and price action: These are the two most important indicators. You want your stock to be breaking key resistance levels, like 52-week highs. And you want it to be in demand — trading at unusual volume.

- Hot sectors: This is another key sign that a stock is going to continue to attract interest.

Most other traders aren’t thinking on all of these levels. When you start putting this kind of work in, you start to take the gambling out of trading.

Here’s one more example — over-the-counter (OTC) stocks. OTC stocks can be a goldmine for traders equipped with the right knowledge and tools. These stocks, often overlooked by the mainstream, can offer unique opportunities for significant gains. However, finding and trading OTC stocks successfully requires an understanding of their unique market dynamics and risks. To learn how to find an edge with OTC stocks and leverage their potential to your advantage, explore how to find an edge with OTC stocks.

The Importance of Having an Edge in the Market

A lot of traders use technical indicators to give them confirmation. And a bonus — they cut down on competition.

I won’t get too deep into indicators here. You know I like to keep it simple. You need to understand what it means when a nine-day EMA crosses a 20-day EMA. But remember, this is just one more sign.

What’s another sign? When a stock breaks a 52-week high … and this one might be a bit easier to understand.

You might figure on there being ‘bag holders’ that bought it back in that case. This is the kind of thing I teach traders NOT to do. Staying in a losing trade is one of our big no-nos.

Guess what happens when a stock regains its previous high? A lot of those bag holders sell.

So we want to wait to see if the stock continues to break above that previous high. If so, that gives us confirmation that our idea was right.

Now everyone on the long side of a trade is making money. Even shorts might cut their losses, which can give the stock an added bounce.

Traders with an edge have a lot of these little tricks. They buy a stock for more than the fact that Elon Musk said something about it. Although that might be the exception…

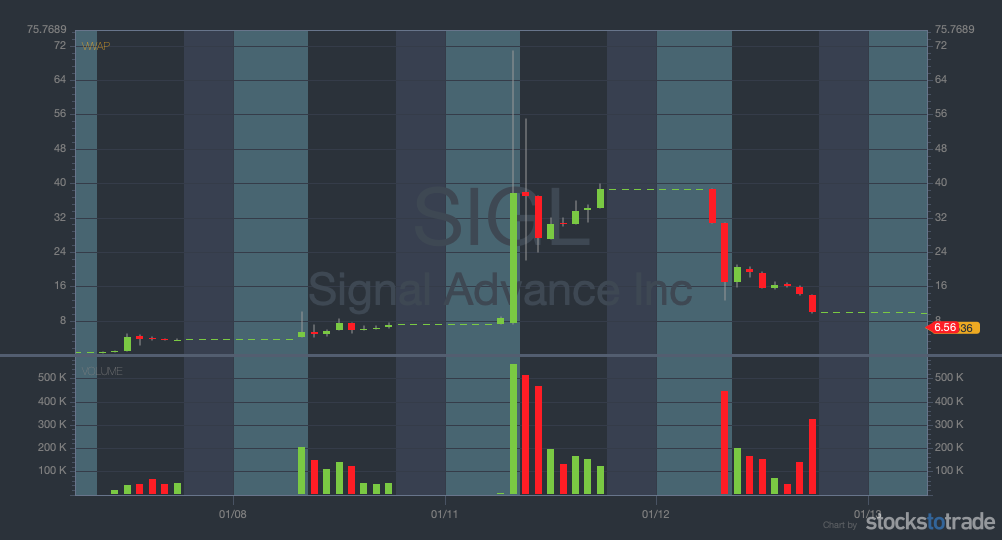

Check out the crazy move Signal Advance (OTCPK: SIGL) made in January 2021 after traders mistook it for the stock behind the Signal app!

How to Develop Your Trading Edge

Everyone wants to sell you a trading edge. Merrill Edge Trading, Winners Edge Trading, Schwab’s StreetSmart Edge … these platforms stick the word on like it’s magic.

But your edge in trading has to be something that makes sense for YOU.

If you’re a math type, some of the more technical styles might make sense.

If you want to build your trading edge on psychology, work on your mental edge. Check out books like “The Psychology of Trading: Tools and Techniques for Minding the Markets” by Brett N. Steenbarger. It’s one of my favorites.

(As an Amazon Associate, we earn from qualifying purchases.)

Learn Different Strategies

Diving deeper into trading strategies can significantly enhance your market understanding and trading performance. It’s not just about knowing a few tactics; it’s about mastering a wide array of approaches to navigate the stock market’s complexity. Whether you’re looking to refine your approach to momentum trading or explore the nuances of swing trading, a comprehensive exploration of strategies can provide the edge you need. For an in-depth look at various trading strategies that can elevate your stock market game, consider exploring trading strategies in the stock market.

When you find a strategy that fits you, it’s like trying on the perfect pair of jeans. You never want to take it off.

But that’s a good way to lose your edge. No strategy works forever. The reasons are the typical ones leading to a dulled edge in trading. Other traders catch on.

When that happens, you need to adapt.

Practice With Paper Trading

Before putting real money on the line, paper trading offers a risk-free environment to test strategies, hone skills, and understand market dynamics. This practice is invaluable for both beginners and experienced traders looking to experiment with new techniques. By simulating trades without financial risk, you can assess the effectiveness of your strategies and make adjustments as needed. To get started with paper trading and experience a platform that uses real-time data for a realistic trading experience, check out paper trading.

What is the best paper trading site or platform? I’m biased, of course, but I think it’s StocksToTrade. StocksToTrade uses real-time stock quotes and volume. A lot of other platforms out there don’t.

This means you’ll get more accurate order fills as if you were trading with real money.

One of the big problems with paper trading is that it’s not the same as actually trading. The delay in market data is one reason. That’s why StocksToTrade gets you closer to the real thing.

In this video, I demo StocksToTrade paper trading on a short sale. Short selling allows you to trade a whole different side of a price move. But it also gives you the potential for unlimited losses.

That’s exactly why it’s a good example of strategy to paper trade before you try it for real. But you can use paper trading to take many strategies for a spin, whether you’re a new trader or testing a new pattern.

Check out our paper trading feature and so much more. Take STT for a two-week test spin — it’s just $7.

Find Trading Software You Like

When you’re ready, you can switch over to StocksToTrade’s actual trading side.

I think it’s one of the best platforms out there for building a trading edge. It can help traders find trades that fit their criteria.

It has a wide range of indicators to apply to stocks on your watchlist. And it gives you some of the cleanest charts out there.

Maybe you’ve honed your edge on news catalysts … Its robust news scanner can help you find news for stocks.

And if you’re serious about your edge, StocksToTrade has a suite of customized alert services. The pros moderating Breaking News Chat and Small Cap Rockets identify trade indicators others miss.

Try StocksToTrade for 14 days for only $7. Or get your trial with Breaking News Chat for just $17.

Refine and Improve Over Time

This step is key to discovering what your edge ratio is. Your edge ratio, or ‘e-ratio,’ calculates how often trades go in your favor.

You need to write this down to know what the most profitable trading strategies are for you. If you don’t study your past trades, you won’t improve.

You can do this by keeping a trading journal.

Journaling all your trades is key for your discipline. It’ll show your strengths and weaknesses. And it will give you evidence of when your trading edge no longer gives you an edge.

Find a Team to Help You

Our Daily Income Trader mentorship program connects experienced traders with traders just starting out.

One of the things that makes our team special is that we actually show our work. We don’t just tell you about our trades, we share the strategy behind them.

We’ve even got worksheets to help you break down the rules we put on our strategies. Your rules might end up different. But you’ve got to learn what something looks like before you can create it yourself.

How Do You Get an Edge in Forex?

I don’t trade Forex, but it’s never a bad idea to learn more about the market.

Gaining an edge in Forex requires a blend of analytical skills, market understanding, and a disciplined trading process. Forex markets are known for their volatility, offering numerous opportunities for traders who can read the signals and act with precision. To get an edge, focus on developing a deep understanding of currency movements, leverage technical and fundamental analysis, and stay updated on global economic indicators that influence currency values.

Backtesting your strategies against historical data can provide invaluable insights, allowing you to refine your approach based on actual performance. Moreover, maintaining consistency in your trading decisions, coupled with effective financial management, enhances your ability to capitalize on the Forex market’s dynamics. Remember, the key to success in Forex trading lies in your ability to maintain focus, adapt to changing market conditions, and execute your trades with confidence and precision. My trading career has been built on these principles, emphasizing the importance of knowledge, planning, and execution in achieving long-term success.

How Do You Find Edge Stocks?

Finding edge stocks involves a meticulous process of research, analysis, and evaluation. Start by identifying sectors with growth potential or industries experiencing significant changes. Use technical analysis to spot momentum and volatility patterns that signal opportunities for entry or exit. Fundamental analysis also plays a crucial role, as it helps assess the underlying value and potential of a security beyond its current market price.

Incorporating tools like simulation and backtesting can further refine your ability to identify high-potential stocks. These methods allow you to test your strategies against historical data, providing a clearer picture of potential performance. Remember, the goal is not just to find stocks that will win but to develop a comprehensive understanding of why and how they fit into your overall trading strategy. My approach has always been about leveraging every piece of information, from market signals to financial reports, to make informed trading decisions that align with my trading style and objectives.

Conclusion

Traders with an edge see a different level of trading than the average trader. They avoid tunnel vision. They work to try to consider all the angles that might play out.

Even if you can’t ‘see the field’ like this yet it’s good to look ahead. The more you study, the more you can understand how stocks and the market move.

The right tools and mentorship can help you day by day. It’s your job to dig in and find what suits you. You can start with my YouTube lessons for no cost.

When you’re ready to craft your trading edge, you can join a live webinar. And if you want killer tools for the job, I think you can’t do better than StocksToTrade.

Just know this: I’m rooting for you. I don’t want you to approach the market like a gambler, blinded by unrealistic hopes. Instead, think about how you can improve — even a little bit — each and every day.

What’s your trading edge? Has this article made you think you need to cultivate one? Let me know in the comments!

Trading Edge FAQs

What Defines a Trading Edge in Day Trading and Crypto?

A trading edge in day trading and crypto refers to a consistent advantage that allows a trader to achieve better than average results over time. This can stem from various factors such as superior market analysis, access to faster information via advanced computer setups, or a well-tested trading setup that has proven successful in different market conditions. Understanding the probability of outcomes and managing positions with precise timing are critical aspects of maintaining this edge. Learning from each trade, whether a success or failure, and adjusting strategies accordingly helps in refining this advantage.

How Do Market Participants and Budget Impact Your Trading Edge?

Market participants, including retail traders and institutional investors, play a significant role in shaping market dynamics and potential trading edges. A well-planned budget is essential for sustaining your trading activity and can influence the asset and instruments you choose to trade, such as commodities or crypto. Competitive edges often come from recognizing how different participants behave and aligning your trading strategies to exploit these patterns effectively. Continuous learning and adapting to the changing nature of the market and its participants are crucial for maintaining and enhancing your trading edge.

Are There Any “Holy Grail” Setups?

While no single “holy grail” setup guarantees success in trading, focusing on developing a setup that consistently offers a competitive edge is crucial. This involves combining elements like asset selection, understanding market timing, and leveraging technology for better access to information. A setup that aligns with your trading style, risk tolerance, and budget can significantly improve your probability of achieving favorable outcomes. Remember, the effectiveness of any setup should be evaluated through continuous learning and adaptation to the evolving market conditions.

For beginners, navigating the commodity trading game involves understanding the unique place commodities hold in the financial markets. Success in commodity trading requires a strategic approach, focusing on market analysis, timing, and risk management. Beginners should start by learning the fundamentals of commodity markets, including the factors that influence prices and how to read market signals. Practicing with simulations or games that mimic real trading scenarios can offer invaluable experience without the risk. Over time, this preparation can lead to improved results as beginners become more adept at identifying profitable trading opportunities and managing their positions effectively.