Looking for hot stocks in big trading chat rooms is kind of like looking for love in all the wrong places … It’s probably not gonna end well.

It used to be that chat room pumps created opportunities for smart traders who understand how the stock promotion game works. But in the past month or so, I’ve noticed a trend of big chat rooms killing stocks fast — a mere mention is kind of like the kiss of death.

No matter how long you’ve been trading, adaptability is key. You’ve gotta be able to go with the current of the market no matter which way it goes. Remember: the market’s stronger than you. It can kill you (or at least your account) if you try to go against the current.

You’ve gotta be willing to change your strategy as needed. Especially in a volatile market like we’ve been experiencing lately.

So what’s the deal with chat rooms suddenly killing low-priced stocks? Let’s break it down — including what warning signs to look for and how to adapt your trading plan so that you can still take advantage of potential trading opportunities with these tickers.

Table of Contents

Trading Chat Room Pumps: How It Used to Work

Until recently, chat room pumps created waves of opportunities for traders. Well, traders who know what they’re doing — not the newbies who blindly follow chat room alerts.

You’ve gotta understand, the big trading chat rooms and/or promoters on Twitter who pump up stocks are not doing you a solid.

They’re hyping up these small companies, calling them ‘the next Google’ or ‘the next Amazon’ … but it’s all self-serving. They want to pump up the price so that they can leave someone else holding the bag.

Newbies can’t believe that they’ve found such an amazing opportunity. Of course they wanna buy shares at this crazy low price before this stock goes sky-high!

As more newbies pile in, more newbies take notice and pile in on top of them. The price goes up.

This can create trading opportunities…

There are yet more opportunities to trade as short sellers start getting in on the action, sensing an inevitable crash. Too many aggressive short sellers can create short squeezes that make the stock rebreak highs and ignite all-day moves on these things.

You’ve gotta respect the short squeeze!

But lately, things have changed. In the past month or so, big chat rooms have been like a bullet to the head for what used to be day-long movers.

Trading Chat Room Pumps: What’s Happening Now

Recently, chat room pumps have changed dramatically. It used to be that smart traders had a variety of opportunities and potential entries throughout the day following a big chat room mention. Now it’s like a one-way ticket to Loserville.

Here are a few examples…

Socket Mobile, Inc. (NASDAQ: SCKT)

Not long ago, on July 27, I was all hot and heavy about Socket Mobile, Inc. (NASDAQ: SCKT).

I was so excited about this ticker, in fact, that during a SteadyTrade Team daily webinar, I even said it could be a contender for premarket trading.

As you may know, I’m not a huge fan of premarket trading in general — especially for newbies. I think the premarket hours are best spent preparing and doing research…

I’m pretty much always on the side of waiting for 9:45 a.m. Eastern for the stock to ‘prove itself’ … I love a good dip and rip!

But this stock had already traded about 16 million shares at 9:01 a.m. The volume was so high that I even said it was among the “1% of times where I’m not against new traders trading premarket.”

But then StocksToTrade’s Breaking News chat announced that there was discussion about SCKT in a big chat room.

And just like that, I reversed course. No more premarket trading green light. I was back to 9:45 a.m. or even waiting for a potential afternoon play. As you can see on the chart, I was right to avoid this ticker…

Why I Reversed Course

Think about a Navy SEAL team that’s about to raid a small base where they’re targeting 50 bad dudes. Then they come over a hill and suddenly see 500 bad dudes — not the 50 they were expecting.

They’re not idiots. They’ll abort the mission, regroup, and figure out a new plan. It’s for their own survival because the situation changed.

It’s the same in the stock market. I always have the right to reverse my opinion — you do too. Don’t be so caught up in the FOMO that you can’t let go of a trade.

In this case, I reversed course because I’ve been observing in recent weeks that big trading room mentions like this are killing stocks. I didn’t let my ego rule me. I cut the cord and said goodbye.

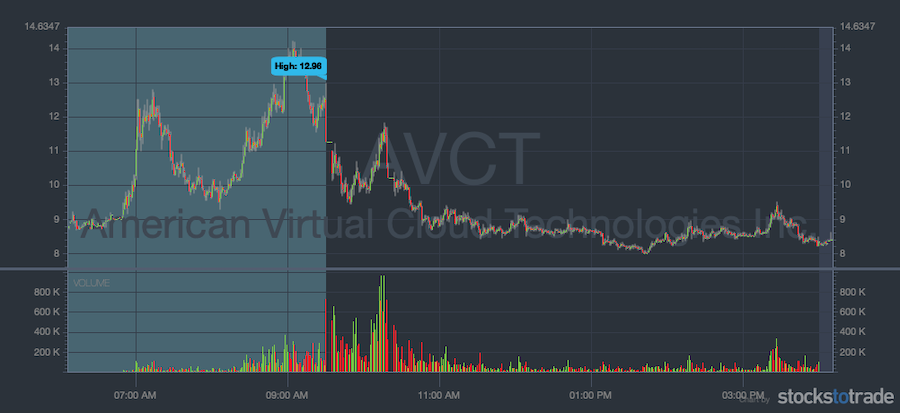

American Virtual Cloud Technologies Inc. (NASDAQ: AVCT)

American Virtual Cloud Technologies Inc. (NASDAQ: AVCT)

On August 6, the trend continued. I was all excited about American Virtual Cloud Technologies, Inc. (NASDAQ: AVCT) — it was a top watch. Hot sector, good volume…

But once again, in the premarket, there was a mention of the ticker in a big trading chat room.

Before the chat room mention, I would have said this stock was on its way up. But after the mention … nope.

This stock was mostly dead.

Once I found out it had been talked up in a big chat room, I knew I had to change course and focus on other stocks.

Here’s what I wrote in my SteadyTrade Team webinar notes: “Now that $AVCT got killed by the big chat room, I’m gonna pivot to hoping $PLUG has a good call at 10 AM and we get some EV breakouts this afternoon.”

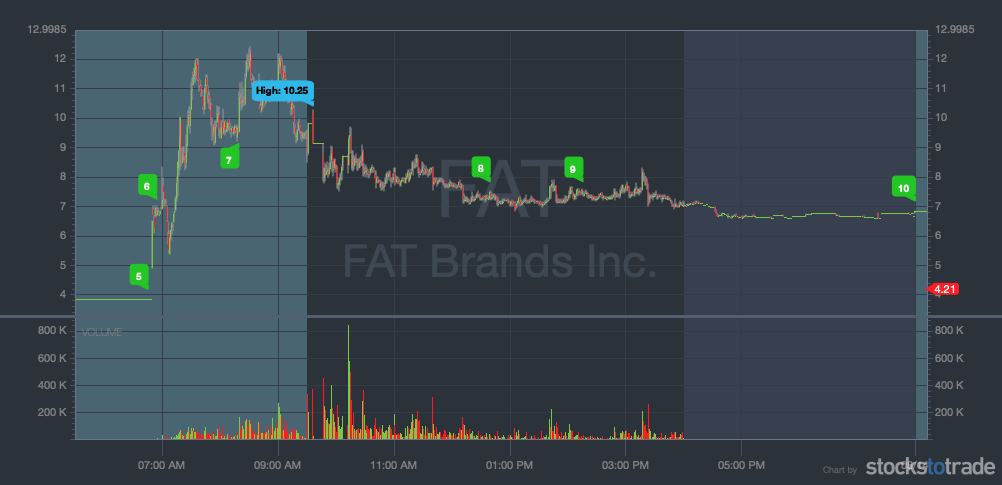

FAT Brands Inc. (NASDAQ: FAT)

It just keeps happening. On August 13, FAT was my #1 watch.

The 60-day average volume was 8,000 shares per day. On the day in question, it had already traded five million shares. I had a strong indication something was up.

Now, ‘unusual volume’ can be a vague term. So is ‘insane volume.’

But this stock was up BIG. It was like a really bad baseball team’s stadium where most of the seats are usually empty … But then one day, all of a sudden, every single seat is full. You know something’s up.

So it’s all relative. Millions of shares trading might not always be a big deal. But in a case like FAT, where it goes from thousands of shares trading to suddenly millions? That’s what I’d call ‘insane volume.’

Learn more about why volume is king here:

Locate fees also went from $15 to $137 — a good sign the stock is being heavily shorted. Locate fees tend to go up based on supply and demand.

But then, Breaking News announced a big trading chat room mention. As fired up as I was about the stock, I turned cold just as fast. And once again, I was right. Check out the chart…

Why Are Trading Chat Rooms Killing Stocks?

Like I said earlier, adaptability is key to trading. No matter what the market gives you, you’ve gotta respect it. You might not like it, but you’ve gotta accept it.

This isn’t just advice for newbies. It’s for veteran traders, too. Once you get set in your ways as a trader and can’t be nimble, you’re headed for trouble.

That’s kind of a long-winded way of saying it. But ultimately, there isn’t a single easy answer to why chat rooms are suddenly killing stocks.

Part of it could be the huge influx of new traders. It could be that everything’s just happening faster now. Or maybe the market just needs to adjust to all the new day traders out there…

It could be that people are getting wise to some trading chat rooms and dumping stocks when they see mentions.

There’s a lot we don’t know. What we do know is that it’s now happening on a regular basis. Starting to understand the change is the first step toward dealing with it.

There’s been a distinct shift. I talk about it in my Daily Market Briefing from August 20 — check it out here.

Why Not Short ‘Em?

If the big chat rooms are killing stocks … why not adapt your strategy and short every single one?

It’s not a bad thesis — and I get why you might think it’s a good idea. But there are a few problems.

For one, a lot of these stocks are low floaters. That tends to make them very hard to borrow.

So for those of you out there with traditional brokers — Interactive Brokers, Schwab, etc. — you’re probably not gonna have a borrow.

Sure, you could look at other brokerages and open multiple accounts. But is that really where you want to put your attention?

Plus, if you’re a new trader, you’ve gotta be really careful. That’s true in this volatile market in general, but especially with short selling.

If something goes wrong and you short the wrong runner, you can wipe out six months of gains on one trade. A single mistake could get bad FAST. Be very careful when shorting.

StocksToTrade’s Breaking News Chat Tool

StocksToTrade’s Breaking News Chat Tool

As I’ve mentioned, I’ve been alerted to several of these big trading chat mentions that are killing stocks via StocksToTrade’s Breaking News chat.

I can’t recommend using this add-on service enough.

Breaking News chat features a team that monitors big chat rooms and news so you don’t have to. It’s freed up a lot of my time. Instead of looking at all of these chat rooms myself, I can just watch for these alerts to know when it might be time to change course.

Breaking News chat is part of STT — it’s not a stand-alone product. But there are a ton of reasons why you should consider having both!

A good stock screener helps you narrow down the thousands of stocks out there to a manageable watchlist. And it helps you figure out your entry and exit points based on price action and indicators.

STT is loaded with indicators, custom scans, and even social media mentions. That means you can do all your prep work from one platform. It’s well worth it — see for yourself how STT can revolutionize your trading. Try it for 14 days for just $7!

Stay Smart, Keep Adapting

Stay Smart, Keep Adapting

Albert Einstein reportedly said, “Once you stop learning, you start dying.” Whether or not he actually this statement, the sentiment is true. You’ve gotta keep growing and adapting or you risk becoming obsolete.

This is very true in the world of day trading and swing trading. Traders who thought the old chat pump plays were gonna last forever are currently having a rude awakening. Don’t be one of the traders who can’t adapt.

The market is ever-changing. You’ve gotta be able to change with it if you want to survive and hopefully thrive. So stay smart, be safe, and keep adapting!

Have you noticed this trend with tickers? Have you traded any trading chat room pumps lately?