If you’re looking for the simplest way to find smart day trades, then we have one word for you …

… Scan. That’s it. Just scan.

Knowing how to efficiently scan the market for your ideal day trades in the shortest time possible takes a lot of stress out of your mornings, allowing you to be in the zone when the market finally opens.

New to scanning? Already scanning but need to learn more about how to kick your scan skills into high gear? We cover it all here, and more.

Here’s your fast-track guide to day trading with stock scanners.

Table of Contents

What Is Day Trading?

First, let’s do a quick primer on day trading.

Day traders open and close stock trades within a single trading day, in an attempt to profit from the intraday movement of the stock in a single trading session.

They may go long or short, depending on which way they expect the stock price to go.

For example, a trader may see MSFT hitting an intraday resistance point of $100.00 at 10 a.m., so they short the stock before watching it move down to $99.00 by 2 p.m., then close out the trade and count their profits.

Sure, it doesn’t always go that smoothly. There’s no 100% guaranteed rule that tells you what every stock will do in every situation (and if you find something like that, give us a call!). But stock scanning can help you map things out in advance to help you decide if a trade’s even worth attempting.

Long story short, if you open a position then close it later on the same day, then congratulations, you’re a day trader.

Why Day Trade?

There’s a lot of information out there regarding how to trade stocks for beginners. Be wary of the stuff that tells you it’s ridiculously easy and you’ll win big every time. It’s not true!

If you’re a newbie and interested in day trading, know that it requires an extra level of skill due to the high speed, commission-intensive, and mentally demanding nature of battling the stock market while it’s open and actively traded.

When day trading, you’re attempting to profit from relatively small moves in stocks, often multiple times per day. This means that you need a broker commission structure low enough that commissions won’t eat up all of your profits.

As you day trader, you’ll see gobs of stocks moving up and down, prices ticking up and down, and buzzing activity. Since you’re human, it will likely be overwhelming if you haven’t trained your brain to focus on exactly what you’re looking for.

That might day trading sound a bit scary, but it doesn’t have to be. And since you’re able to make so many trades each day, in theory, it’s possible to make returns on relatively small amounts of capital.

If you want a chance at succeeding as day trader, you need to have your trading and scanning strategy locked down so strongly that it’s almost second nature when it comes time to execute a trade.

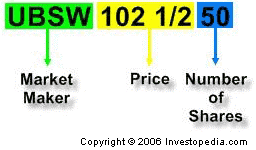

You’ll probably want access to Level 2 quotes that will allow you to see the raw bids and offers in a stock, giving you a closer view of supply and demand.

Source: Investopedia

You’ll then want to work on your trading psychology, training your mind to execute your strategy as close to perfect as possible, no matter if you’re losing money or the market’s going haywire.

If you need more info about trading basics, you’ll find lots of info here on our site. Your goal is to never stop learning, so be sure to study every day.

Now let’s move on scanning. Here’s where it starts getting really fun …

7 Day Trading Tips for Your Stock Scan Strategy

We can’t emphasize this enough: Having a structured scanning strategy can make day trading stocks so much easier.

With the right strategy, you can focus on stocks that have a much higher likelihood of having favorable moves in the coming trading session.

We’ve put together seven easy-to-follow tips on how to formulate an effective strategy to help you get started …

#1 Identify Entry Criteria

Before you enter into a trade, it’s important that you see that the stock first meets your entry criteria.

Your entry criteria could be whatever situation you need to see in a stock that gives you the opinion that placing a trade could be profitable.

Some traders buy breakouts of all-time-highs. Some buy pullbacks to previous swing highs. Some short strong stocks when they hit key levels. These are all examples of entry criteria

#2 Gather Insights With Technical Indicators

While we recommend that you use basic price action analysis to determine your initial entry criteria, many traders also find a huge amount of value in using certain technical indicators to help filter through trading opportunities.

Technical indicators are things such as moving averages, MACD oscillators, and Bollinger bands. They take price and/or volume data and manipulate it in useful ways to give insight into things such as recent price momentum compared to historical price momentum.

Even if you’re not picking your own trades and simply receiving stock trading tips through a stock-picking service, you could use a set of well-researched technical indicators to try and improve the odds of achieving ideal trades.

#3 Practice With Paper Trading

No list of day trading tips would be complete without shouting the benefits of paper trading, especially when you’re a beginning trader or when you’re testing out a new strategy.

Paper trading is basically pretend trading where you make all the same decisions you’d make in a real account, then you get to see how your trading performs without having to risk a cent of your capital.

When you’re a newbie trader, it’s common to start out getting in over your head and making a lot of unprofitable trades. This is especially true for the fast-paced, high-commission world of day trading.

Think of paper trading as similar to how golfers use the driving range to practice their swings before eventually heading out for a round of golf. Paper trading can help you learn how to use your trading platform, get into the swing of how the market moves, and get that all-important screen time before you start making real trades.

#4 Never Trade Too Big

No matter what day trading techniques you use, you should always manage your risk by never trading too big.

Smart day trading requires that you never risk your entire capital on one trade. Instead, you risk a fraction of your total amount. As a rule of thumb, never over 2% and probably much less than that. You’ll learn your comfort zone — stick to it.

The reason for this is that many of your trades will be losers — it’s the case for even the most expert traders. Don’t be surprised if you experience strings of many losing trades in a row; it happens to all of us. That’s why you need to make sure no single trade can ever knock you out of the game.

#5 Cut Your Losses Quickly

Any decent list of day trading strategies wouldn’t be complete without mentioning the absolute need to cut your losses quickly. This is extremely important!

No matter how big your profits are, if you don’t keep your losses small, you’ll either be a losing trader, or at the very least, your losses will wipe out a huge percentage of your profits. Don’t let this happen to you!

Determining where to place your stop is key to keeping your losses small. When you plan to place a trade, aim to use the smallest stop possible while still leaving enough room for price to fluctuate before it hopefully produces a big, rewarding upside.

#6 Stick to Your Trading Plan

The next one of our day trading tips is to always make sure that any trading decision you make is always in line with your trading plan.

Things to cover in your plan should include:

- Whether you’ll go long or short

- If and when you’ll add more

- When you’ll exit the position

- And more (find out the rest now)

Successful day trading means making a large number of trades over time that, on the whole, add up to a profit. If you don’t have a trading plan that standardizes your trades, you’re trading randomly.

Without a plan, you’ll never actually know which types of trades are winners or losers and you won’t have the data you need to optimize your trading strategy.

Bottom line: Never make a single trade without first mapping out your plan.

#7 How to Find Stocks to Day Trade

There are thousands of stocks traded on the two major U.S. stock exchanges every single day.

Not long ago, traders had to spend hours looking at charts to find the best day trading opportunities. And they weren’t in one place — you had to visit up to two dozen websites to get all the info you needed. It was awful!

Fortunately, we now live in a golden age for day traders. Thanks to modern day trading software, you don’t have to pore over hundreds of charts before every trading session. That’s where scanners come in.

With a great scanner, you can find volatile stocks (which are our favorite, but you might have different preferences, which your scanner can also help you find), filter down to the opportunities that best meet your needs, then — boom! — go straight to the charts of only your prime targets.

Sounds a lot better then how it was done in the old days, right?

The StocksToTrade Advantage

By now, you probably realize that if you want a good shot at being a solid day trader, you need a great stock scanner and learn how to use it. It’s a must.

It’s your fast track to superfast connections to the stocks that meet your criteria and gives you the ability to trade any of the thousands of stocks traded each day.

With a premium scanner like StocksToTrade, you get access to dynamic charts to help you search for your favorite price and volume patterns and overlay them with your favorite technical indicators. It does so much of the work for you!

With a few simple clicks, you can scan massive amounts of stocks to help you find trading opportunities. Whether you seek top percentage gainers or losers, stocks breaking out to new highs, stocks that have a sudden surge of volume, or otherwise, StocksToTrade can help you find them faster and easier than you probably imagine.

No longer do you need to visit 10-15 websites to keep up with all the most in-play stocks. With StocksToTrade, you get charting, news feeds, quotes, watchlists and more — all within one easy-to-use piece of software.

If you want to jump into the day trading ring with a powerful, supercharged trading weapon in your arsenal, then check out a StocksToTrade 7-day, $7 trial now!

The Bottom Line

With a structured stock scanning process, your trading day can be smooth, calculated, and hopefully more lucrative.

Once the market’s open, you have to be ON. You can’t still be scrambling to do research and chase down stocks — you need to have all your daily trading plan information locked and loaded. Otherwise, you shouldn’t trade that day.

Always start prepared. A good scanner can help you get there. Choose a platform that lets you filter the stocks you see based on custom criteria, such as volume, volatility, market capitalization, and more. You’ll be glad you did.

What are some of your favorite trading criteria you scan for each day? Share your comments and let us know!