In this article, we’re going to into The Stock Market for Beginners, and 10 very important Things we feel you should know, such as:

- Are you new to stock marketing investing?

- Are you familiar with the potential benefits and risks?

- Are you concerned about implementing a strategy that puts you in position to succeed?

Remember this: even the most well known and successful investors were beginners at one point.

However, before we get into the finer details, let’s start with a quote frome Warren Buffett:

“When a person with money meets a person with experience, the one with experience ends up with the money and the one with money leaves with experience.”

In other words, experience is critical to becoming a successful investor.

However, there’s a problem with this: it’s difficult to gain experience when you’re new to the market.

In today’s day and age, there’s no shortage of places to turn for knowledge, advice, and guidance. With the help of the internet, you can learn from the top investors, while also using tools to guide your investments.

Download a PDF version of this post as PDF.

With all that out of the way, let’s get down to business.

Table of Contents

- 1 Stock Market for Beginners

- 1.1 1.) What sectors are you most interested in? What type of knowledge do you have?

- 1.2 2.) What system are you using to find tradable stocks?

- 1.3 3.) Is there any way to guarantee yourself of making money in the stock market?

- 1.4 4.) What should you look at when attempting to determine a company’s health?

- 1.5 5.) What can you learn by looking at the past 52 weeks of activity?

- 1.6 6.) What are the 12 basic data points to focus on when evaluating a stock?

- 1.7 7.) How important is it to stay current with news related to publicly traded companies?

- 1.8 8.) Does it ever make sense to review a 5 or 10-year chart?

- 1.9 9.) What is a dividend and why does it matter?

- 1.10 10.) Does it ever make sense to invest in exchange-traded funds (ETFs) instead of individual stocks?

- 2 In Conclusion

Stock Market for Beginners

Here are 10 questions you need to answer as a beginner.

(Also worth checking out, our 40 ‘Stock Trading Terms For Beginners‘ Article and Infographic!)

The information you collect will help you make more informed and confident investing decisions in the days, weeks, and months to come:

1.) What sectors are you most interested in? What type of knowledge do you have?

An important question to answer, as you’re much better off investing in companies within sectors that interest you.

For example, some investors are attracted to tech companies, such as Google and Apple, because that’s what they know. They use this technology every day, so they’re more comfortable investing in it.

Others, however, would rather turn their attention to consumer staples, healthcare, industrials or another sector.

Sticking with quotes from the great Warren Buffett, here’s one to live by:

“Different people understand different businesses. And the important thing is to know which ones you do understand and when you’re operating within what I call your circle of competence.”

Have you taken the time to identify your circle of competence?

2.) What system are you using to find tradable stocks?

Some people are old school investors. They don’t want or need “fancy” stock trading software to guide them.

Other investors realize the importance of taking advantage of every tool that’s available to them.

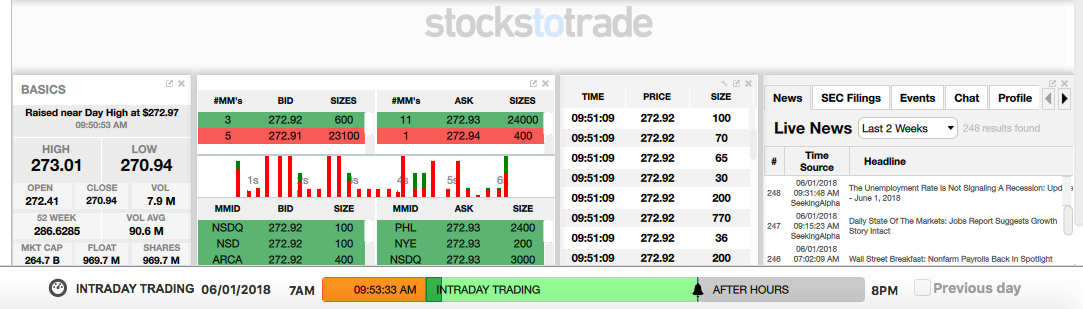

StocksToTrade, for example, is meant to help investors better understand the stock market, all with the idea of finding tradable stocks and hopefully making money.

It doesn’t matter what system you use to find tradable stocks, as long as you have something you can rely on.

It doesn’t matter what system you use to find tradable stocks, as long as you have something you can rely on.

3.) Is there any way to guarantee yourself of making money in the stock market?

Simply put, there is no guarantee when investing in stocks. This isn’t the same as buying a certificate of deposit or stocking cash away in a savings account. You’re taking a risk with your money, all with the hope of generating a positive return.

With that in mind, history shows that you can absolutely make money in the stock market if you do your homework and put your money in the right place.

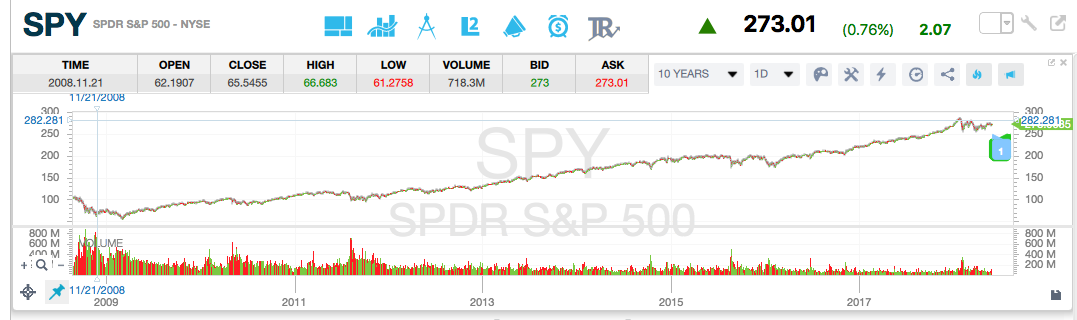

Here’s some historical data to back this up:

“According to historical records, the average annual return for the S&P 500 since its inception in 1928 through 2017 is approximately 10%.”

While some years will be better (and worse) than others, this statistic shows that the average annual return for the S&P 500 has been strong over nearly 100 years.

This doesn’t guarantee the same in the future, but if history is any indication there is money to be made.

Learn how StocksToTrade Pro Can Help!

(Try Stocks to Trade for 7 days for just $7!)

Pro Tip: the SPDR S&P 500 trust is an exchange-traded fund (more on this below) designed to track the S&P 500 stock market index.

4.) What should you look at when attempting to determine a company’s health?

The nice thing about publicly traded companies is that you don’t have to make educated guesses in regards to their finances. Instead, since every company is required to file quarterly earnings reports with the Securities and Exchange Commission (SEC), all the information you need is right at your fingertips.

Every investor has their own idea as to what’s most important when determining a company’s health, but here are some data points that will put you on the right track:

- Earnings per share, also known as EPS

- Price/Book ratio, also known as P/B

- Price/Earnings ratio, also known as P/E

You can’t learn everything about a company by reviewing these three data points (we share more below), but doing so will definitely give you a better feel for how it’s performing.

5.) What can you learn by looking at the past 52 weeks of activity?

There are companies that have performed well over the past 52 weeks, as well as those that have floundered and need to turn things around.

You can learn a lot by looking at the past 52 weeks of activity, including but not limited to:

- Momentum: is the share price on the rise, or has it taken a nosedive over the past year?

- Stability: if you want a steady performer, you can learn a lot by reviewing the past 52 weeks

- Correlation between share price and company news: take the time to seek out spikes and dips over the past 52 weeks, all with the idea of pinpointing when these occurred.

It’s good to get into the habit of reviewing a stock’s 52-week performance before making an investment decision. As a beginner, this data is easy to understand and powerful enough to help you make better investments.

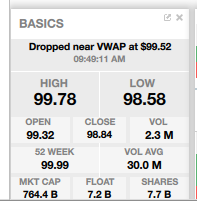

6.) What are the 12 basic data points to focus on when evaluating a stock?

We touched on this a bit above (see point #4), but you don’t want to stop there when the evaluation process begins.

There are 12 basic data points to focus on when evaluating a stock, with each one providing you with a better overall feel for the health of the company, where it stands, and whether it fits your investing criteria:

- High

- Low

- Open

- Close

- Volume

- 52 week

- Volume Average

- Market Cap

- Float

- Shares

- P/E

- EPS

This information is available for every stock, so you can use the data to search for the right investments and make decisions on where to put your money.

Let’s put it this way: you don’t have to read every story on every company, but you should pay close attention to news related to the stocks you’ve invested in or want to buy shares of in the future.

StocksToTrade has a news tab that allows you to search for stories by date. You can also access SEC filings, which as noted above, can have a big impact on a company’s health and market price per share.

Pro Tip: you can’t believe everything you read in the news, so be sure to rely solely on reputable sources. You don’t want to make an investment based on false news or bad advice.

8.) Does it ever make sense to review a 5 or 10-year chart?

We’ve already talked about the importance of reviewing the 52-week performance of a stock, however, you don’t necessarily want to stop there.

Depending on how long the company has been publicly traded, you may want to dig deeper for a better idea of how it’s performed over the long haul.

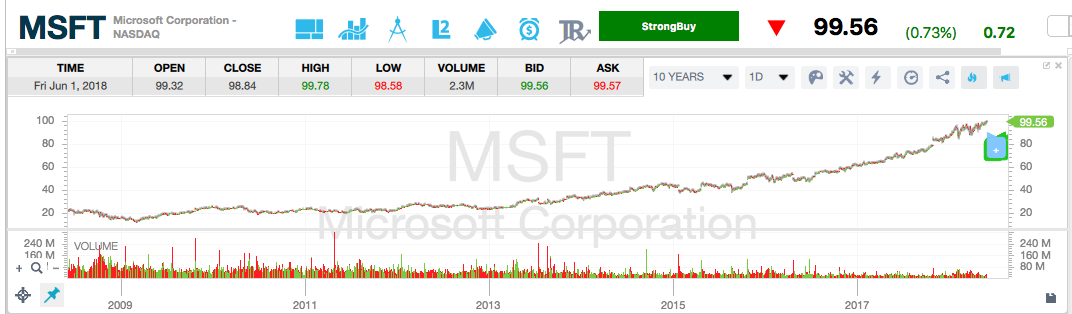

Take Microsoft for example. When you review its performance over the past five years, you can’t help but notice a slow and steady incline.

It’s not a top gainer over the past five years, but it’s slowly and steadily climbed from around $30/share in 2013 to approximately $99 (as of 6/1/18).

Of course, you can take this one step further by pushing your search out to 10 years. In the case of Microsoft, you’ll once again see a steady ship.

Of course, you can take this one step further by pushing your search out to 10 years. In the case of Microsoft, you’ll once again see a steady ship.

9.) What is a dividend and why does it matter?

The first thing you need to know is that not all companies pay dividends to shareholders. Instead, a dividend – which is nothing more than a portion of a company’s profits paid back to investors – is issued based on the discretion of the company.

Generally speaking, whether or not a company pays a dividend is a good indicator of the company’s health.

A company that pays a quarterly dividend, while also increasing the payout year over year, is one that is likely on stable ground.

Tip: don’t lose sight of the fact that companies use dividends as an extra incentive for individuals to invest. You should never invest in a company based solely on its dividend payout.

Kiplinger recently broke down the 50+ best dividend stocks of 2018.

3M is an example of a company that made the list, with a dividend yield of 2.7 percent and 60 consecutive annual dividend increases.

Upon review of other data points, as well as its five-year chart, you’ll see that 3M combines long-term stability with a solid dividend yield.

10.) Does it ever make sense to invest in exchange-traded funds (ETFs) instead of individual stocks?

This is an important question to address as a new investor, as combing ETFs with individual stocks can be a solid strategy.

Let’s start with a basic definition, as shared by Fidelity:

“An ETF is a basket of securities that you can buy or sell through a brokerage firm on a stock exchange. ETFs are offered on virtually every conceivable asset class from traditional investments to so-called alternative assets like commodities or currencies. In addition, innovative ETF structures allow investors to short markets, to gain leverage, and to avoid short-term capital gains taxes.”

The benefits of an ETF run deep, including but not limited to:

- Less risk. With a preselected group of stocks or bonds, you’re in better position to minimize your losses. Even if one stock or bond is performing poorly, chances are that another is able to pick up the slack.

- Hands off investment. ETFs are managed by a fund manager, meaning you don’t have to actually select the stocks and bonds that you invest in. This means less work for you, as well as the ability to rely on a fund manager with a long track record of successful investments.

- Ability to save money. When you buy a stock or bond through a brokerage account, you’re probably going to pay a commission or trading fee. With ETFs, you can find a brokerage account that allows you to invest without paying a commission.

U.S. News & World Report shares a list of top performing ETFs over the past one year and five years. These are far from your only options, but they provide a good overview of what’s available and potential returns.

Direxion Daily Semiconductor Bull 3X ETF, for example, has achieved a return of more than 66 percent over the past five years.

As a beginner, you may not be confident in your ability to achieve the same level of results as an ETF. In this case, an ETF may help put your mind at ease.

In Conclusion

In Conclusion

I know what you’re thinking – that’s a lot to take in. There’s no denying that it’ll take some time, thought, and effort to answer all of these questions in great detail. But if you go down this path, you’ll end up in a better place in the end.

(Try Stocks to Trade for 7 days for just $7!)

Soon enough, you’ll be the type of person who can’t take your mind off of stock trading. Who knows, you may even find yourself watching trading movies in your spare time!

Will you take the time to answer these questions in greater detail?

Do any of them have you stumped?

Would you add others to the list?

Share your thoughts in the comment section below.