Why Should You Look at the Biggest Stock Losers?

Could the biggest stock losers actually help you make winning moves in the stock market?

When it comes to trading, investors are obsessed with following the biggest gainers of the day. But there are plenty of lessons that you can learn from the biggest decliners, too.

Here, we’ll look at how underperforming stocks can tell you a lot about the market at large, and how they can potentially present some great investment opportunities.

Table of Contents

What are the biggest stock losers?

Many traders are familiar with keeping tabs on the biggest gainers — aka the stocks that have had the biggest price increases within a time period (such as a trading day).

Stock losers are just the opposite — these stocks had the biggest decline in price within a time period.

Download a PDF version of this post as PDF.

What can you learn from the biggest stock losers?

The biggest decliners of the day can reveal important trends in the market. If you’re able to evaluate the declines and figure out the reason, it could offer invaluable information for future trades.

For example, if you notice that many of the ‘biggest loser’ stocks are within a certain industry, you might be able to identify a trend that could have a greater effect on the market at large.

Armed with this information, you could potentially sidestep a bad investment.

Keeping track of the biggest losers

How can you keep track of the biggest losers? StocksToTrade has a tool for that.

In the program, you can set alerts to keep track of the top percentage gainers and losers. This gives you a quick overview of the stocks within your chosen price range at any given moment.

You can also filter the results by percentage descending or ascending, respectively. It’s a quick and easy way to help hone your tracking method.

Can losers be winners?

In traditional stock market investing, the wisdom is to buy low and sell high. If a stock is a loser, there could be a chance to do just that.

You’ll need to evaluate various things such as the company’s fundamentals, the industry, the news, and the stock’s history. Only you can decide if it’s a worthwhile investment. It won’t always be the case, of course.

How to analyze stock losers

What should you look for when analyzing declining stocks? Here are some examples of data and information to examine when considering the biggest stock losers.

Look for catalysts

As a trader, you’re probably familiar with looking for positive catalysts such as a big contract, a product release, or notable new hire that can make a stock’s price go up.

However, catalysts can work in the opposite direction, too. If a contract has been lost, a CEO got fired, or something else happened within the company, it can cause a decline in stock price.

By determining what the catalyst is/was, you can determine if it’s a temporary situation or more permanent.

Analyze Earnings reports

Any relevant news about company earnings can reveal a lot about why a stock might be a big loser. For this reason, taking a look at the most recent earnings report can be a great way to evaluate why a stock might be losing value.

Earnings reports are only released a few times a year. Even so, they can offer some insight about the lowered price.

For example, if an earnings report — or if the buzz around an earnings report — is negative, there can be a downturn in the stock price.

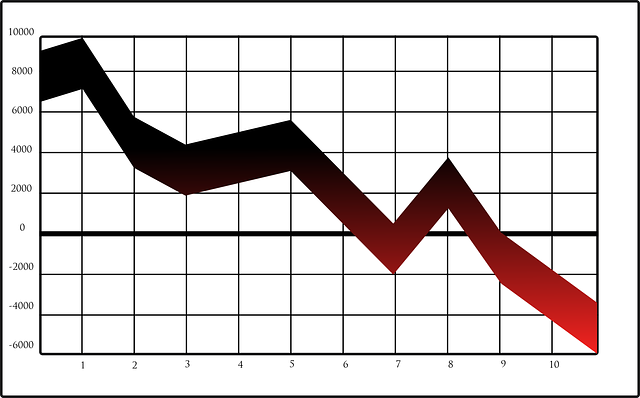

Evaluate stock charts

Looking at a stock’s chart over time can be a great way to determine the reason behind a stock becoming a loser.

Stock charts help you monitor how a stock in question is being traded. When you look at a stock’s chart, you can identify a stock’s patterns (such as The Dead Cat Bounce) over time.

For instance, if a stock has been on a steady decline and doesn’t have any positive catalysts, it might become even more of a loser if time goes on.

However, if you notice that the stock in question has a tendency to become a loser at times but has always regained momentum later on, it might be something worth looking at. Referencing a stock’s movement over time will give you a bigger-picture type of view.

Check various sources

Don’t just do one of the things listed above to determine why a stock is a loser — do all of them, and be sure to check different sources.

The more research you do (and the more angles you observe) to determine the story behind a stock, the better. When you’re obsessive about researching stocks, you can get the fullest possible version of the story.

Learning about the biggest stock losers can be a winning move for traders.

When doing your routine research, if you include the gainers AND the losers, you can give yourself a head start on choosing the best stocks to trade using your favorite setups.

How about you, Do you research the biggest stock losers?