Momentum stocks are the kind you buy high and sell higher.

I know, it’s confusing. Shouldn’t you buy low and then sell high? Well, yes, you should — sometimes.

Sometimes buying the dip is a good, repeatable strategy. Other times you’re just trying to catch a falling knife.

Sometimes, you go long on a stock when it’s already overbought. Other times you’ve got a multi-day breakout on your hands.

What’s the difference? It all comes down to screen time and studying. You have to know a stock’s momentum indicators when they come up.

The following momentum stocks list will give you a head start.

Table of Contents

- 1 What Are Momentum Stocks?

- 2 How to Find Momentum Stocks

- 3 17 Top Momentum Stocks to Watch

- 3.1 American Eagle Outfitters Inc. (NYSE: AEO)

- 3.2 Ally Financial Inc. (NYSE: ALLY)

- 3.3 Applied Materials Inc. (NASDAQ: AMAT)

- 3.4 Advanced Micro Devices (NASDAQ: AMD)

- 3.5 Aptiv PLC (NYSE: APTV)

- 3.6 Mr. Cooper Group Inc. (NASDAQ: COOP)

- 3.7 Insmed Inc. (NASDAQ: INSM)

- 3.8 Morgan Stanley (NYSE: MS)

- 3.9 Match Group Inc (NASDAQ: MTCH)

- 3.10 Nike Inc (NYSE: NKE)

- 3.11 Quanta Services, Inc. (NYSE: PWR)

- 3.12 R1 RCM Inc. (NASDAQ: RCM)

- 3.13 Square Inc. (NYSE: SQ)

- 3.14 Stellantis NV (NYSE: STLA)

- 3.15 Twilio Inc. (NYSE: TWLO)

- 3.16 XPO Logistics (NYSE: XPO)

- 3.17 Zendesk Inc. (NYSE: ZEN)

- 3.18 Get the Stocks on Our Watchlist, Free of Charge

- 4 Conclusion

What Are Momentum Stocks?

The best momentum stocks are easy to spot. They’re the tickers that keep coming up on my Pre-Market Prep sessions. Catch these sessions every day on Instagram or YouTube at 8:30 a.m. Eastern. And you never have to miss the action — sign up here for daily updates!

The top momentum stocks keep coming up because they’re winners. They’re the stocks that are making new highs, breaking 52-week highs. They’re on multi-week or multi-month breakouts. They’ve been outperforming the S&P by a MILE!

Momentum stocks also have decent chances of continuing the trend.

What Are Potential Advantages of Momentum Stocks?

When high-momentum stocks are rallying, it can seem like there’s no stopping them. That’s because:

- They’re hitting 52-week highs, with bag holders mostly out of the picture.

- Institutional investors are picking them up. They like to stock their portfolios with winners.

- Many are in hot sectors and benefit from sympathy plays.

What Are the Downsides of Momentum Stocks?

Like every stock, high-momentum plays have downsides. Keep in mind:

- Momentum trading tends to work better in bull markets than bears.

- When momentum stocks fade, they can fall fast.

- The January effect can further hurt these stocks. Investors often dump the previous year’s losers for tax purposes.

- Momentum trading requires a lot of screen time to keep an eye on price action.

- Momentum trading strategies can involve a lot of work on a stock’s technical side.

Do Momentum Trading Strategies Work?

Let’s translate the theory of how to trade momentum stocks into concepts we use every day.

Momentum traders look for stocks that are up, just like breakout traders do. They construct a tight trading plan, just like we all should. They’re rigorous in their risk evaluation. And when they hit their stop, they cut losses quickly.

How to Find Momentum Stocks

The first thing you’ll need is a good momentum stocks screener. I use StocksToTrade.

StocksToTrade has built-in screens for longer-term momentum stocks and for overnight gappers.

Looking for momentum using technical indicators? StocksToTrade has a great array of tools.

Technical indicators like Relative Strength Index (RSI), MACD, and Bollinger Bands® were built to gauge momentum.

You want to look at low float stocks to make sure the supply isn’t keeping pace with demand.

In the world of low priced momentum stocks, float size is something you ALWAYS need to take into consideration. Tim Bohen is covering the #FloatChecker, one of #StocksToTrade‘s most useful #TradingTools! https://t.co/SemQQksEhK

— StocksToTrade (@StocksToTrade) July 1, 2019

StocksToTrade’s technology also works on the demand side of things. It has a robust news scanner to cover all types of news catalysts, from earnings reports to Twitter scoops. StocksToTrade makes finding momentum stocks a little easier.

See for yourself — grab your 14-day trial for just $7!

17 Top Momentum Stocks to Watch

The best of the current crop of momentum stocks are all recognizable names. Tesla (NASDAQ: TSLA), FuelCell Energy Inc. (NASDAQ: FCEL), and GameStop Corp. (NASDAQ: GME) can all be thought of as momentum stocks.

And I talk about these stocks almost every day in my twice-daily SteadyTrade Team webinars.

These momentum stock picks are some of the most intriguing momentum stocks today. And maybe in the year ahead as well.

American Eagle Outfitters Inc. (NYSE: AEO)

AEO has tripled in the past year, from an April 2020 low near $7. It’s approaching a two-year high, with a three-year high in sight.

Value seems to be a driver here. It’s been closing money-losing stores. And aggressive expansion is on the plate for its Aerie brand.

Ally Financial Inc. (NYSE: ALLY)

From all-time lows in March 2020, Ally Financial has almost quadrupled in value. And this current peak represents an all-time high.

Its sector, consumer loans, has been performing well. But ALLY has outperformed the rest of the sector handily. This sector comparison is a good way to judge a stock’s staying power.

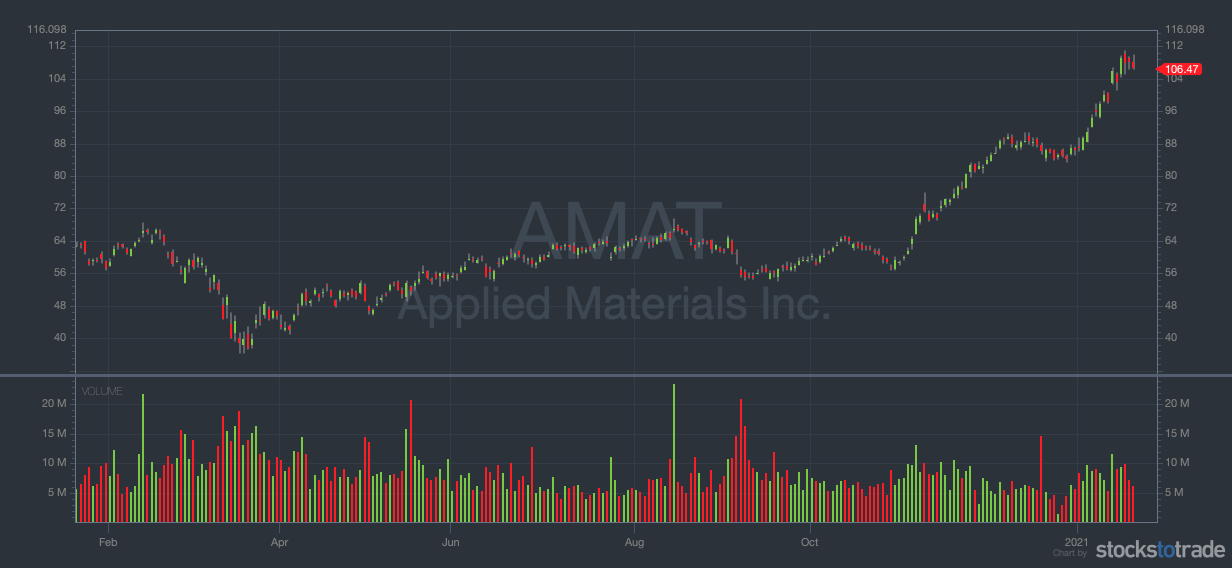

Applied Materials Inc. (NASDAQ: AMAT)

Applied Materials has been a hot name for a while … even before nearly tripling in value in 2020.

The semiconductor sector it’s part of is still hot. And the stock hasn’t become too expensive, even as earnings grow.

Advanced Micro Devices (NASDAQ: AMD)

AMD is another entry in the hot semiconductor sector. Its stock is even hotter, with a P/E ratio sitting well above 100 in January.

It’s managed to take a bite out of Intel’s server business. Trader enthusiasm might be rewarded with AMD’s next earnings report.

Aptiv PLC (NYSE: APTV)

Speaking of hot sectors, the electric vehicle (EV) sector might have been 2020’s hottest. And the EV sector is bringing parts suppliers like Aptiv along with it.

Its fundamentals are solid too, bringing the investor class along for the ride. Things have been pretty good so far, with the stock more than quadrupling its March value. It’s now just slightly off its all-time high.

Mr. Cooper Group Inc. (NASDAQ: COOP)

Mr. Cooper has used its killer 2020 momentum to regain a five-year high. It’s been riding momentum from the home improvement sector. This mortgage provider has seen its value multiplied by a factor of six in 2020.

Many analysts say it still has room to grow.

Insmed Inc. (NASDAQ: INSM)

Insmed has been on a tear in the past year, and analysts see more of the same for 2021.

Insmed is focused on treatments for serious and rare diseases. It’s in the hot biopharmaceutical sector. And it’s been outperforming the sector, tripling in value since its March low.

Morgan Stanley (NYSE: MS)

With the stock market thriving, investment banks like Morgan Stanley are seeing gains. Earnings expectations were high after JPMorgan and Goldman Sachs beat analysts’ projections. Then Morgan Stanley left them in the dust.

The firm received a boost from acquiring online broker E-Trade. And brokerage stocks are hot as traders look forward to Robinhood’s upcoming IPO.

Match Group Inc (NASDAQ: MTCH)

You know I like those at-home plays … but also I know that people are getting stir-crazy! Match has a solid handle on the dating app market. It has Tinder, Hinge, OkCupid, and its namesake in its portfolio. And it’s tripled in value since March.

When people can finally go to bars again — watch out.

Nike Inc (NYSE: NKE)

The pandemic is killing retailers, but big names like Nike are cashing in on direct sales. And people need sneakers for jogging, which kind of counts for the at-home fitness category.

The recent ESPN series on Michael Jordan has proven big for Nike’s Air Jordan line. Nike’s taking advantage, with the recent self-tying edition retailing for $500!

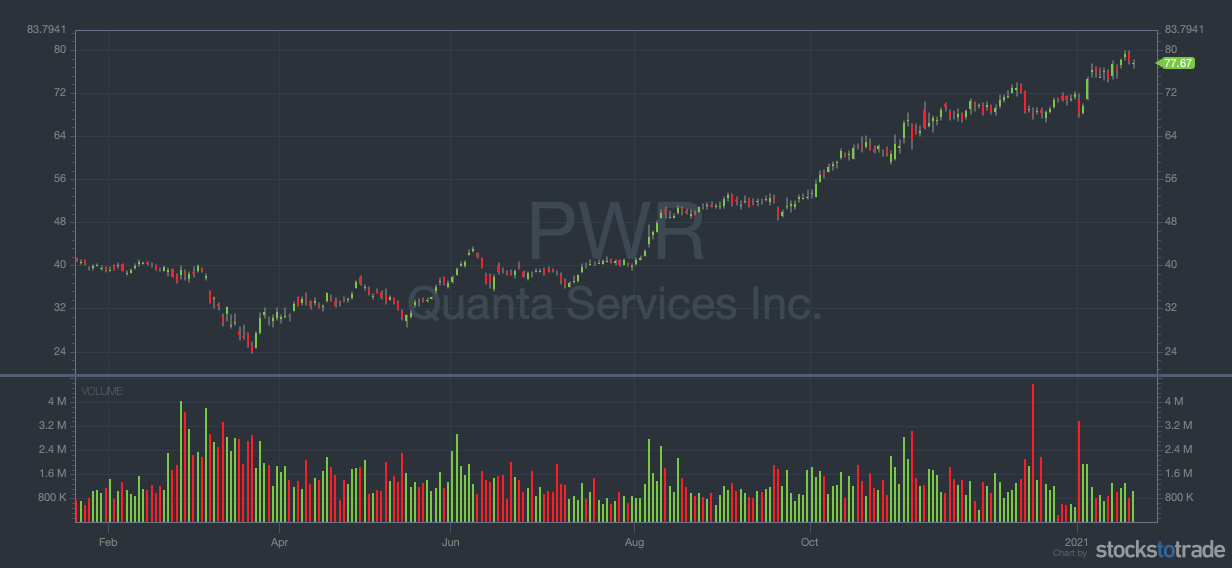

Quanta Services, Inc. (NYSE: PWR)

Quanta handles the back end of a lot of industries. It straddles the electrical, industrial, and communications sectors. As the infrastructure the company supports has taken on more demand, its price has shot up.

Analysts are eyeing more gains in 2021. They’re betting it keeps ahead of comparable stocks in the struggling capital goods sector.

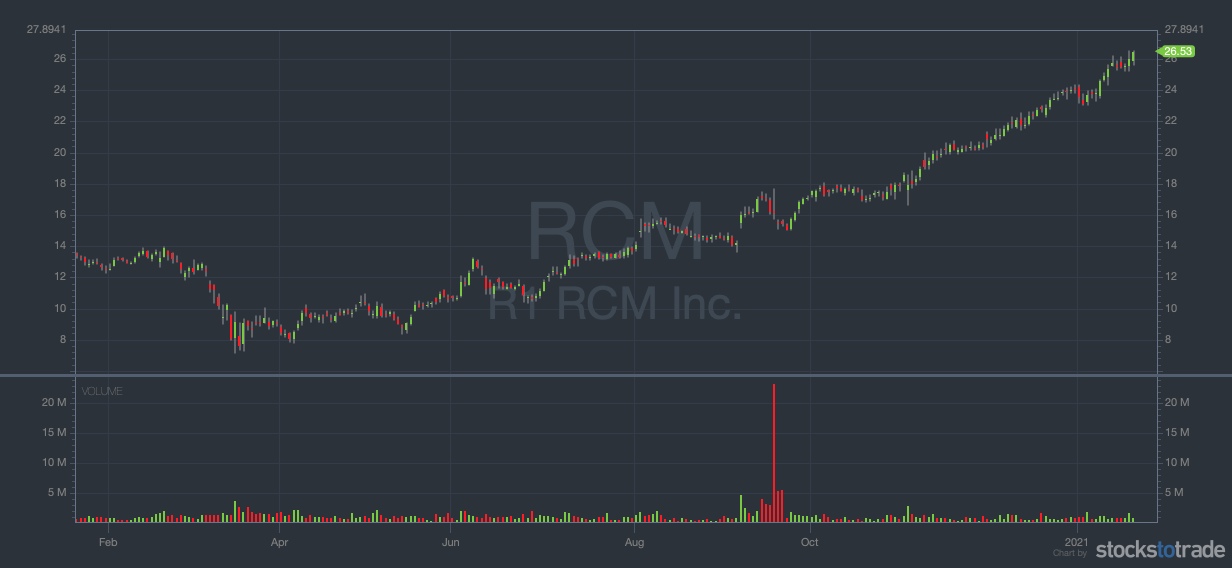

R1 RCM Inc. (NASDAQ: RCM)

This healthcare stock has been attracting decent attention. It’s another stock nearing all-time highs. And it’s in a red-hot sector.

Though the talking heads still like it for 2021, its RSI is in overbought territory. Use caution, but don’t be surprised if RCM continues its tear.

Square Inc. (NYSE: SQ)

Fintech is another sector benefiting from increased online buying. Even so, Square has rampaged through the sector like a bull in a porcelain shop. It’s up over 700% since March.

Square has its fingers in Bitcoin, e-commerce, and of course its payment business. It’s had a cool journey from a momentum penny stock to an industry leader. I’m guessing it isn’t done yet.

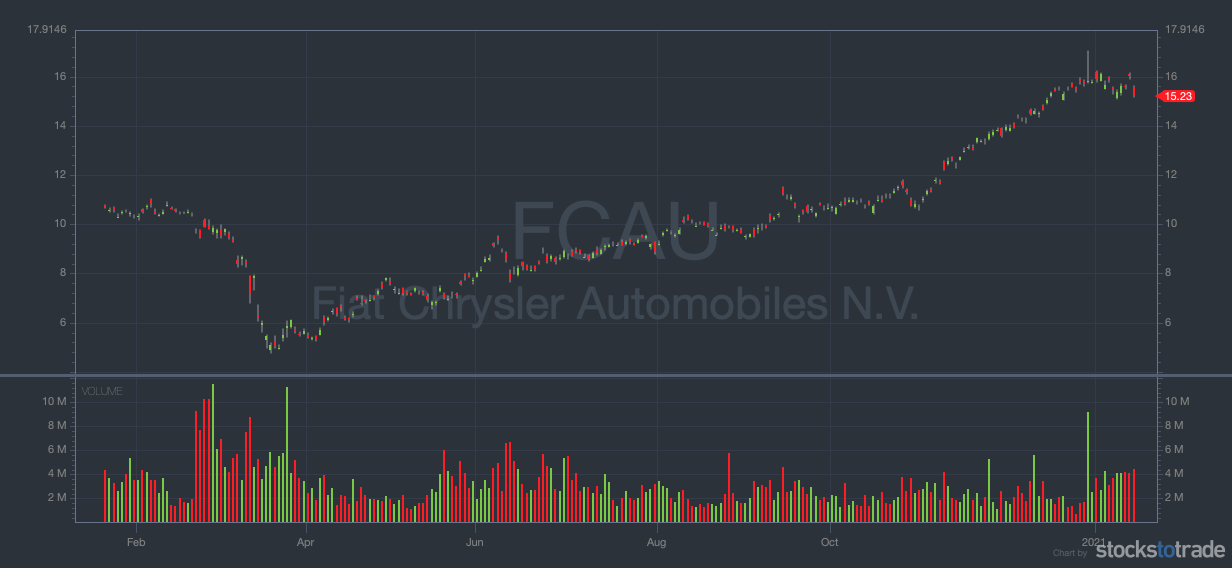

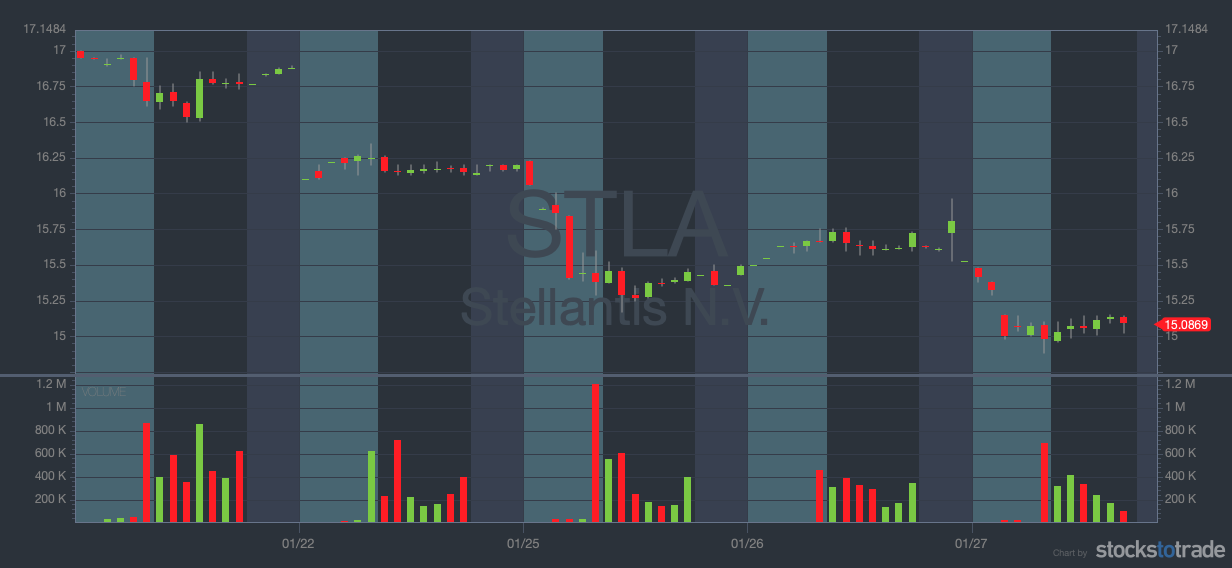

Stellantis NV (NYSE: STLA)

Stellantis is the world’s latest auto giant, formed from the merger of Fiat Chrysler and Peugeot. Better yet, it’s carrying the momentum that Fiat Chrysler (formerly NASDAQ: FCAU) enjoyed in 2020.

Looking ahead, we have to add Peugeot’s EV expertise to the new stock. Analysts’ optimistic ratings for 2021 might be realistic.

Twilio Inc. (NYSE: TWLO)

Twilio is another stock that’s had a monster recovery from March lows. Its value grew by a factor of five — not bad for a stock that bottomed out at $68!

Twilio provides cloud-based communications services for various software developers. That’s something that won’t go out of style any time soon.

XPO Logistics (NYSE: XPO)

Logistics has been a hot sector, and XPO is one of the leaders. It manages supply chains for 69 of the Fortune 100, as well as 50,000 other customers.

In December 2020, it split its warehousing and transportation businesses. It claimed that this was the path to more growth. Traders agreed, sending XPO to all-time highs.

Zendesk Inc. (NYSE: ZEN)

If you’re going to lead a hot sector, you might as well make it technology. Zendesk has been outpacing fellow sector leaders. It’s tripled in value from its 52-week low.

The company is expanding its services and its customer base. Expect this trend to continue.

Get the Stocks on Our Watchlist, Free of Charge

Remember, this list of momentum stocks is just ones we’re watching — NOT advice to buy them now. You should never just copy from another trader. But you can learn how to pick momentum stocks from our process.

We’ll make it easy by sending you our watchlist each week. And then you can build your own.

Conclusion

2020 was a wild year … the wildest I’ve ever seen.

If the momentum can hold, the trend could continue well into 2021.

Keep an eye on these momentum stocks, and others that fit the profile. If this bull run goes on, they might continue leading the market.

Which momentum stocks are on your 2021 watchlist? Let me know — I love hearing from my readers!