Ever notice that the stocks with the biggest gains tend to be cheap, low-priced stocks?

That’s because these companies are so small it only takes a tiny amount of excitement to wake them up. That gets the stock price moving.

A lot of traders love to play these massive movers. So this post is here to help you navigate the murky waters at the lower end of the stock market.

Do yourself a favor … Before you jump in, learn some strategies. Make sure you know what you’re doing. Follow the advice you’re about to read.

Let’s dig into 7 cheap stocks to watch in 2024 and rules you need to trade them!

Table of Contents

- 1 What Is a Cheap Stock?

- 2 Cheap Stocks to Watch Right Now

- 3 Top Stocks Under $5

- 3.1 The 7 Rules of Trading Cheap Stocks

- 3.2 #1: Look for Chart Patterns on Cheap Stocks

- 3.3 #2 Have a Trading Plan

- 3.4 #3 Use Limit Orders, Not Market Orders

- 3.5 #4 Don’t Be Afraid to Walk Away from Cheap Stocks

- 3.6 #5 Limit Your Losses

- 3.7 #6 Follow the News on Cheap Stocks

- 3.8 #7 Pay Attention to Cheap Stock Volume

- 4 Take Advantage of StocksToTrade Features to Trade Cheap Stocks

- 5 Are Penny Stocks Considered Cheap Stocks?

- 6 Do Cheap Stocks Pay Dividends?

- 7 Conclusion

What Is a Cheap Stock?

Ask 10 different traders what a cheap stock is and you’ll get 10 different answers.

Some will say it’s a stock trading at a lower value compared to its earnings — enough to make a young Warren Buffett drool.

Others would say it’s a stock that’s fallen out of popularity … once loved but now despised by the market.

So how do I personally define a good cheap stock?

First, it’s a stock that’s priced under $10. The companies that trade under $10 are often new and small … These companies have the potential to increase significantly in value in a short amount of time.

Second, the best cheap stocks definitely have a reason they could jump up in price sometime soon…

That could be a great chart setup, like a breakout to all-time highs or a news catalyst bringing in a massive wave of buyers. Sometimes, it can be the growing hype around a stock on Twitter and chat forums.

If you’re looking for cheap stocks to buy, the lower end of the market can be a great place to search. Generally, when a stock is priced so low, Wall Street won’t cover it — that can mean less competition with big traders and hedge funds.

Instead, you’re usually competing with less sophisticated traders and investors at the lower end. Only, you’re smart enough to give yourself the benefit of education, right?

Cheap Stocks to Watch Right Now

I’m always looking for good cheap stocks.

Here are a few examples of some plays I’ll be watching over the next few weeks.

These aren’t necessarily the greatest stocks overall, but they all have something interesting going on. When a sector’s hot, it’s more about the sector catalyst than the stock being great.

Without further ado, here they are…

#1: Ibio Inc (AMEX: IBIO) — The AI Obesity Drug Penny Stock

My first stock pick is Ibio Inc (AMEX: IBIO).

This company is in the biotech sector.

One of the things that you need to know about this 2024 market: Biotech stocks can offer some of the best profit opportunities for small-account traders.

The stock prices are cheap, which allows us to build larger share positions. And the price can spike hundreds of percentage points. That’s how small-account traders can build wealth at a faster rate.

For example, IBIO spiked 330% in two days starting March 27. It’s a cheap biotech stock that announced some bullish news:

- A $15 million private placement.

- Ibio and AstralBio announced a business collaboration using AI to develop antibodies for obesity.

You can see on the chart below how quickly the stock reacts to the news.

But almost more importantly, notice the obvious consolidation around $3 in recent days. Every candle represents 15 minutes:

Price consolidation from a volatile stock like this is a hint that the price could rally and push higher.

It’s not a 100% guarantee. But, thanks to common support and resistance levels like IBIO’s $3 consolidation, we can build positions with proper risk/reward ratios.

Here’s what that means: We only want to trade the best plays. Setups where the potential gain outweighs the potential loss.

I posted a video below that explains this concept in more detail.

Don’t waste time on crappy setups! There’s a new profit opportunity every day in this 2024 market. Take advantage of that momentum.

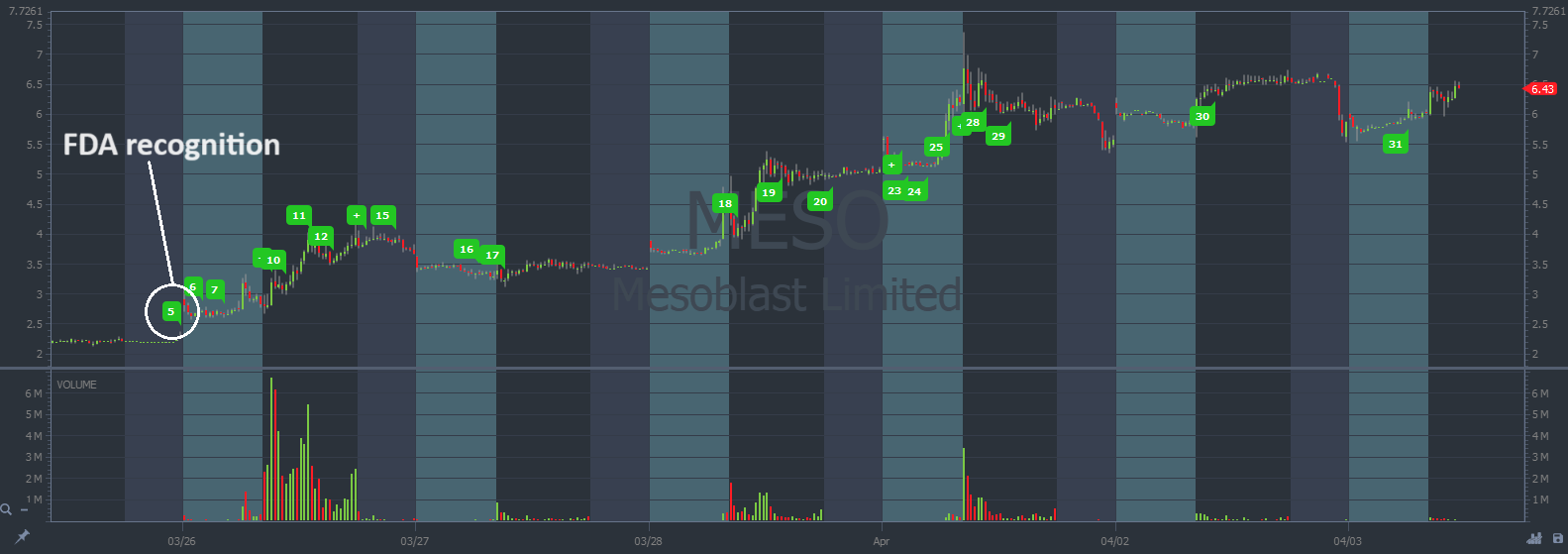

#2: Mesoblast Limited (NASDAQ: MESO) — The FDA Approval Biotech Penny Stock

My second stock pick is Mesoblast Limited (NASDAQ: MESO).

Well well well … look at that. Another volatile biotech stock.

Keep an eye out for more biotech stocks spiking with news.

MESO announced the FDA recognized its phase 3 trial of remestemcel-L. FDA news is a great catalyst for a crappy penny stock like MESO.

In typical biotech penny stocks, price action lazily moves back and forth day to day. The company doesn’t have any announcements because it’s a tiny corporation. Then all of a sudden, there’s legitimate recognition from the U.S. Food and Drug Administration.

You can see the price react on the chart below. It spiked 230% following the news. Every candle represents 15 minutes:

MESO is still trading near the highs. It’s possible the price squeezes higher.

It’s already on a six-day run. And some of the stocks in our niche can run for weeks … It all depends on the strength of the catalyst and the current market environment.

- FDA news is a pretty good catalyst.

- The market is surging in 2024.

Look for major support levels before you enter a trade.

Taking random positions will give you random results.

Instead, approach these setups with a calculated trade process.

#3: Canoo Inc (NASDAQ: GOEV) — The Foreign Trade Zone Catalyst Play

My third stock pick is Canoo Inc (NASDAQ: GOEV).

On March 18, GOEV announced its Oklahoma City location was granted Foreign Trade Zone designation by the U.S. Department of Commerce.

As a direct result, GOEV is estimated to save around $70 million in 2024 and 2025.

Prices already spiked 290% in March. And there’s a chance it pushes higher. The chart hasn’t imploded yet … But remember, it’s a penny stock. The stock will crash eventually. But currently the price is still consolidating.

On the chart below, every candle represents 30 minutes:

To plan a trade: Watch moves up to the breakout level around $4.50 and identify key support.

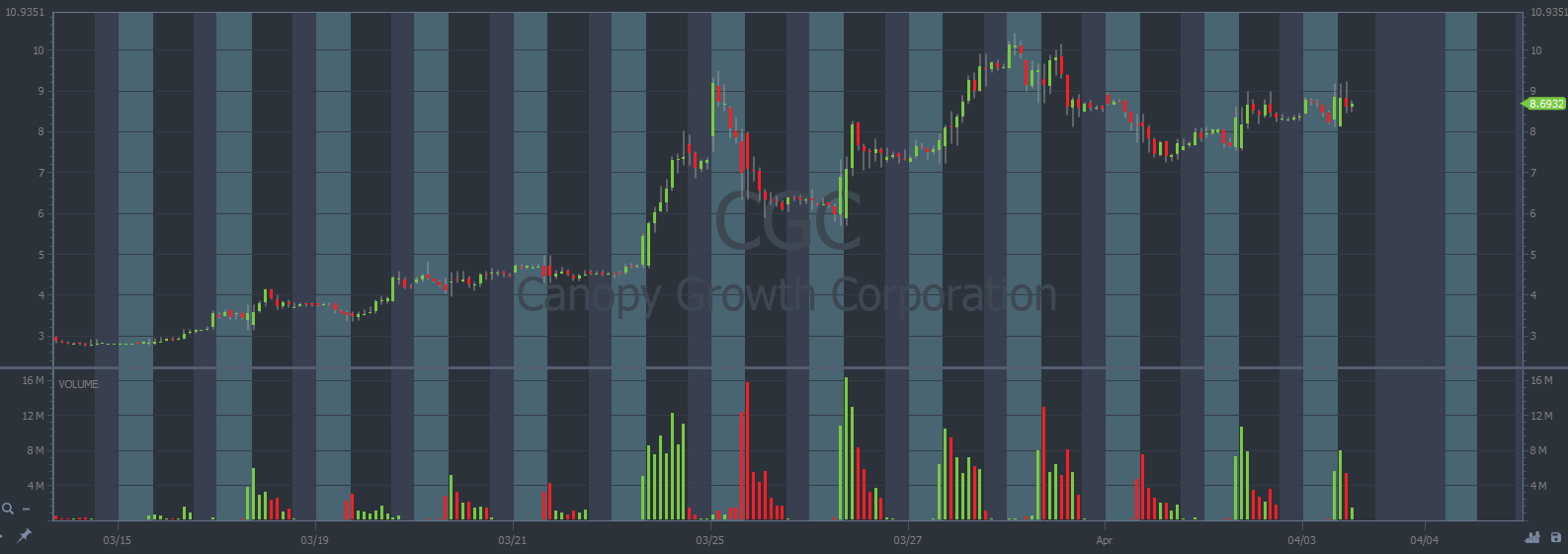

#4: Canopy Growth Corp (NASDAQ: CGC) — The Legal Weed Stock With the Huge Catalyst

My fourth stock pick is Canopy Growth Corp (NASDAQ: CGC).

I already mentioned that biotech stocks are hot right now. Another bullish sector is AI stocks …

But there’s a new sector making headlines in 2024.

Weed stocks.

This sector has been hot before. The volatility usually depends on momentum from larger marijuana legislation.

Over the last few weeks there’s been a lot of talk about marijuana legalization. Both in the U.S. and globally:

- POTUS Biden and VPOTUS Harris both expressed an interest in March of revisiting the U.S. approach toward marijuana.

- Germany decriminalized marijuana starting April 1.

CGC is also running thanks to a catalyst that was announced on March 14.

- There’s a potential acquisition looming. The vote deadline for the acquisition is April 10. We learn the results of the CGC vote on April 12.

This is a classic case of a forward looking statement causing bullish momentum. And the global events within the weed sector are exacerbating the hype.

The chart is still in play. Every candle below represents 1 hour:

There’s an important trading rule that we follow to keep our accounts safe. And it pertains to CGC.

Buy the rumor. Sell the news.

Here’s how it works, when stocks announce upcoming news it can cause a bullish buying spree in anticipation.

But if everyone who would have bought shares on the day of the event already did beforehand, when the event comes to pass there are only sellers left and the stock tanks.

We can trade the price action before and after the event. But don’t hold shares through the April 12 acquisition announcement.

#5: Krispy Kreme Inc (NASDAQ: DNUT) — The Donut Shop Stock With the Ginormous Catalyst

My fifth stock pick is Krispy Kreme Inc (NASDAQ: DNUT).

This isn’t a biotech stock, an AI stock, OR a weed stock. But the catalyst is too big to ignore. And we have to respect the price action of the recent spike.

DNUT launched 40% after announcing a new nationwide business partnership with McDonald’s Corporation (NYSE: MCD) on March 26. You can expect to find a Krispy Kreme donut in a McDonalds near you by the end of 2026!

When the news came out, DNUT instantly started running. Take a look at the chart below:

Notice the price consolidation on March 27 and 28 around the $15 support level. That’s a hint the stock could spike higher.

Prices dipped below $15 on April 3.

But there’s still a possibility that it rallies. We want to wait for the chart to find solid support. Keep an eye on this tasty runner!

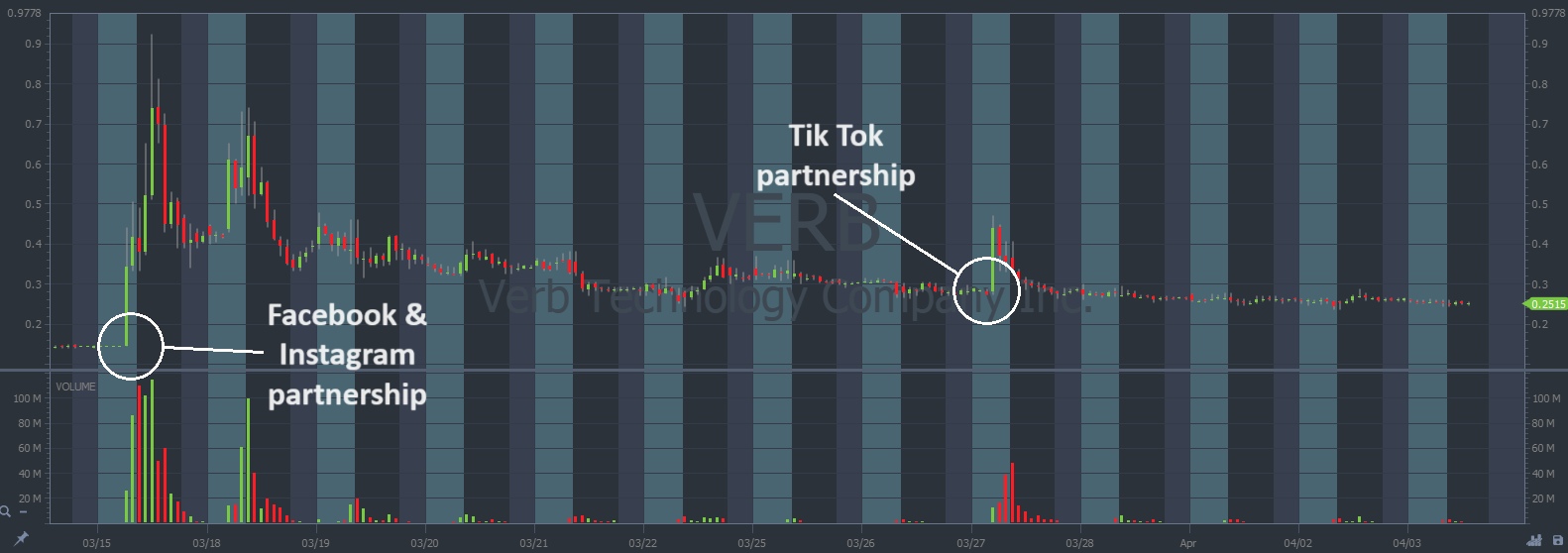

#6: Verb Technology Company Inc (NASDAQ: VERB) — The E-Commerce Penny Stock

My sixth stock pick is Verb Technology Company Inc (NASDAQ: VERB).

VERB spiked 360% on September 5, 2023. This stock has a history of running. And that’s key in our trading niche.

Past spikers can spike again …

Sure enough, on March 15 this year, the company announced a new shopping technology that integrates with Facebook and Instagram. The price immediately spiked 550%.

The move didn’t last long. Prices slid lower the next day and it’s been pretty ugly since then. Despite another fluffy press release on March 27 that mentioned a formal Tik Tok business collaboration.

Take a look at the daily chart below:

This stock wants to spike again!

We just need to wait for the right catalyst.

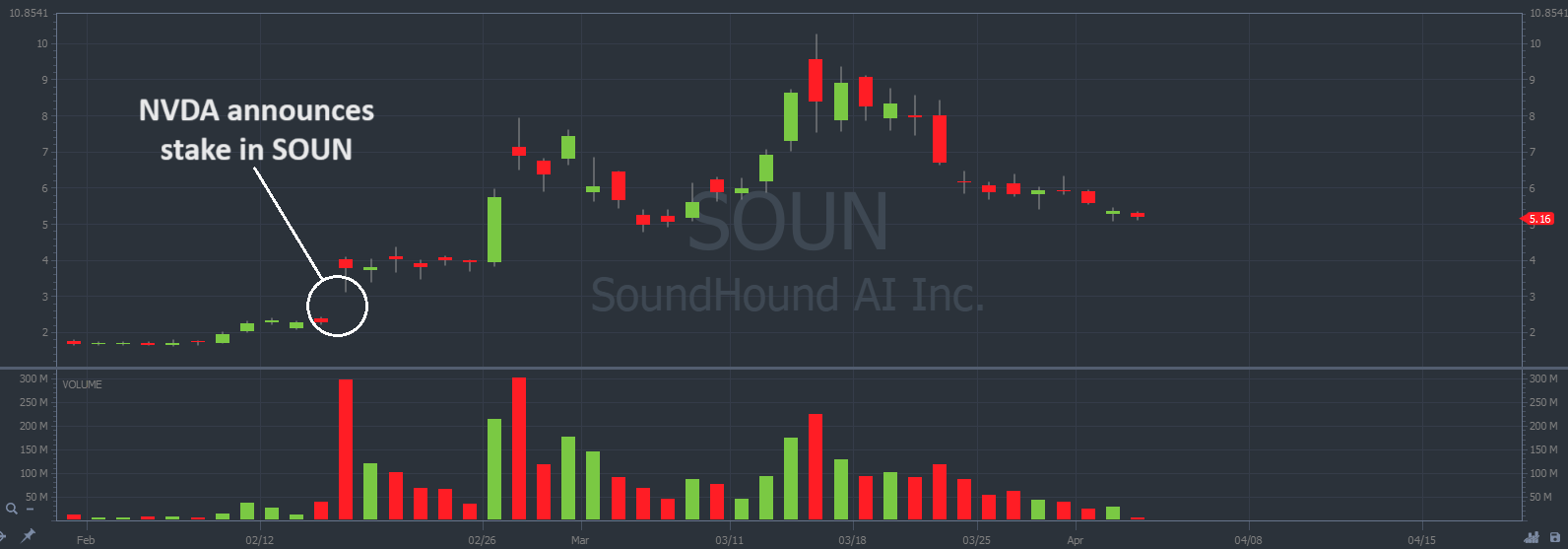

#7: SoundHound AI Inc (NASDAQ: SOUN) — The AI Penny Stock on Short Squeeze Watch

My seventh stock pick is SoundHound AI Inc (NASDAQ: SOUN).

SOUN works in “conversational intelligence.” The company provides a service that helps business people communicate if there are language barriers.

When the AI boom began in 2023, SOUN was one of the first runners. In 2023 the price spiked 410%.

But it sank from those highs in 2024. A lot of trashy penny stocks can spike hundreds of percentage points. But they ultimately crash back down.

It’s possible for the price to rally and push to new all-time highs. But it takes a BIG catalyst and BIG volume to push through all the bagholders.

Enter NVIDIA Corporation (NASDAQ: NVDA): On February 15 it was announced that NVDA bought a stake in SOUN.

NVDA is the star of the U.S. stock market this year and one of the most famous companies globally. The company’s microchips are at the center of this AI and tech boom.

As a result, SOUN spiked 250% since the announcement on February 15. It shot past those highs on February 26 and over the next month reached all the way to $10. It was a 350% move in total.

That’s unsustainable without another catalyst to push it higher.

And it’s likely why prices sank lower during the back half of March. See the chart below, every candle represents one trading day:

Usually I’d say that the stock needs another catalyst before we can plan a trade. But in this 2024 market, SOUN has potential to become the next big short squeeze. There are likely short sellers targeting this stock right now because it’s overextended.

If those short sellers get too aggressive, it could result in a massive squeeze.

Make sure to follow key levels of support and resistance. That helps us identify where the short sellers are hiding.

Top Stocks Under $5

Hot sector penny stocks — whether we’re talking AI penny stocks, biotech penny stocks, or another sector attracting a lot of news — are something traders should always be looking at. The allure lies in the potential for substantial returns on investment, as even minor developments or positive news within these sectors can lead to significant price jumps.

It’s important to proceed with caution and a well-thought-out strategy. The inherent volatility of penny stocks, combined with the speculative nature of emerging sectors like renewable energy and tech innovations, underscores the importance of a meticulous approach. Before diving in, ensure you’ve done your due diligence, looking past the initial excitement to assess the true potential and risks of these ventures. It’s wise to trade these stocks rather than invest long-term, given their unpredictable nature.

Success in trading hot sector stocks priced under $5 hinges on a selective and strategic approach. The goal is to tap into their explosive growth potential while implementing robust risk management practices. By zeroing in on companies making news in their specific niches, traders can seize opportunities for disproportionate gains. This strategy, coupled with a disciplined approach to maintaining a tight investment strategy and promptly cutting losses, can pave the way for trading success in these dynamic market segments.

The 7 Rules of Trading Cheap Stocks

Before you start trading cheap stocks, you need a few pointers. Just because some stocks are cheap doesn’t mean you should rush in and buy without a strategy in place.

There’s a lot of technique involved in trading these stocks — you definitely need to know what you’re doing.

To help you with that, here are seven rules to help get you on the right track when finding, analyzing, and trading these stocks. Follow along…

#1: Look for Chart Patterns on Cheap Stocks

If you had to pick a go-to analysis for trading lower-priced stocks, chart pattern analysis should be at the top of your list.

Traders use chart patterns to track the footprints of other traders in the market. With a well-trained eye, you can spot fear, greed, frenzy, and disinterest — you can learn from the emotional extremes.

There are millions of chart patterns, and you can make it as complicated as you like … but don’t.

You’re generally better off learning a few simple patterns like the back of your hand. Keep it simple. Pick simple breakout trades, the dead-cat bounce, or the supernova pattern.

Find what works for you. Be an absolute master of your chosen patterns.

#2 Have a Trading Plan

No matter what you trade — tech stocks, cheap penny stocks, blue chips, futures, or options — it’s important to have a trading plan.

A trading plan is your set of instructions that detail your trading operations. It often includes specific details:

- Your risk level

- Your go-to trading setups

- The types of stocks you trade

- Entry and exit points

- The case for your trade and so much more…

Think of it like one of those cool technical construction blueprints for a house or building.

Before a single brick is laid, there’s a well-defined set of instructions to guide the construction crew. At all times, everyone involved knows exactly what they’re responsible for and what to do.

Create your trading plan in the same way. Consider every single decision you’ll need to make in your trading: Do you buy more of a winning stock? Do you take a day off after a big loss? When do you jump into a trade and when do you exit? Build it all into your trading plan.

Well-planned trading is smart trading!

#3 Use Limit Orders, Not Market Orders

When you find a stock you want to buy, you’ll have to choose between buying with a market order or a limit order.

With a market order, if you tell your broker to buy 10,000 shares at market, they’ll buy 10,000 shares at whatever price the broker can get them at.

With a limit order, you set a price limit. For example, you might request that the broker buy you 10,000 shares at no more than $1.50. The order will be there until the broker is able to grab 10,000 shares at $1.50 or below.

A novice trader might think that the market order is better … you can get those shares super fast, right? Yes. But it’s a terrible idea.

Here’s why: Cheaper stocks often don’t have much liquidity, meaning there may not be many shares available for you to purchase.

If you try to get everything at market, your order might be filled at a price way higher than you wanted — or expected. That can cost you hundreds, thousands, or even tens of thousands of dollars, depending on the size you’re trading.

Don’t be foolish. Learn to think like a savvy, intelligent trader. In illiquid markets, use limit orders!

#4 Don’t Be Afraid to Walk Away from Cheap Stocks

Newbie traders can get excited when they find a promising trade. Sometimes they’re so keen on the trade, they end up doing something stupid.

Here’s the deal — and I can tell you this from experience — the market’s always there. Every single business day, the market will open, and you can find more trades.

So, don’t feel like you can’t walk away. Make sure everything aligns just right. That includes the trade setup, your entry point, and every piece of your trading plan. If something feels off or you’re called away from your post for any reason, always be willing to walk away from the trade.

There’s no rush, trading is a long journey. Never be afraid to walk away from a trade. There’s always tomorrow …

#5 Limit Your Losses

I don’t care how great of a trader you are, you will have losing trades.

In fact, it’s not uncommon for even the best traders in the world to win 50% or less of their trades. How are they profitable? It’s simple, their winning trades are bigger than their losses.

That means it’s absolutely necessary to minimize your losses as much as possible. Before you enter any trade, set a price at which you’ll exit if you’re losing money. That’s called a stop-loss.

You decide where to place your stop-loss. It could be 10% below your entry price, where the chart pattern is invalidated, or below a previous key support level.

Whatever stop-loss method you pick, make sure you always set it before you get in the trade.

#6 Follow the News on Cheap Stocks

Low-priced stocks can go on runs of 10%, 50%, or even way higher in a very short amount of time.

These price bursts are often due to a company getting news story hype or a company announcement. That means you gotta keep up with the news and buzz around your favorite stocks and sectors.

If you dedicate just a little bit of your analysis time each morning to searching for any news that could impact the price of a stock, it can help you spot the movers before they move.

Don’t have a ton of time? Use a scanner that can alert you to any news stories related to the hottest stocks or sectors. StocksToTrade can do all that for you with a few clicks of a button. Come and check out our news scanning capabilities with a 14-day trial for $7.

#7 Pay Attention to Cheap Stock Volume

Imagine you find an exciting looking trade. It has your favorite chart pattern, it’s in a clear uptrend, and there’s a major news catalyst out that morning. The stock is ready to blow!

You’re so excited to jump on the stock, you’re already counting your profits. You just know it’ll be up 20% or 30% on the day.

The market opens and you enter a limit order to buy 10,000 shares at $2. You eagerly wait to get your fill.

But then it all starts to fade. Your excitement wanes when you see few sellers of the stock. And the volume that does go through is tiny — 100 shares here, 200 shares there. You’re not getting any of them.

Depressed, you sit and watch as the stock makes its run of over 20% over the trading day. Yep, you called an amazing trade, but there was no one there to sell you the stock so you could get on board.

Sounds frustrating, right? It can happen a lot. Can you spot the mistake in this trade?

Before you get too excited about the trade, you should look at the stock’s recent trading volume.

Some cheap penny stocks can trade next to nothing each day. Hardly any buyers and hardly any sellers — those are called illiquid stocks.

So, to save you the future frustration, make sure there is enough volume when you’re choosing your trades. This rule can save you a lot of heartache!

Take Advantage of StocksToTrade Features to Trade Cheap Stocks

Whether you want to actively day trade or are looking for cheap stocks to invest in, you want to use the best tools for the job.

What are the right tools? I’m talking about charts, scanners, news feeds, data, watchlists, and more!

In the old days, to get all of these tools would mean countless subscriptions to websites and a lot of software. It was tedious, annoying, and expensive!

Thankfully today, you can get everything you need in one spot. That’s exactly what the StocksToTrade platform does.

The platform is designed by me and a team of active, everyday traders. It’s exactly what we need to fight the battle of the markets each and every day. It really is THE platform. And it’s created not by software geeks or corporate monkeys, but by real-deal traders.

Here are just of few of StocksToTrade’s powerful features:

- The ability to scan for your favorite trade setups in real time. Just set your criteria and let the software do the rest.

- Slick and easy-to-customize charting.

- High-speed scanning capabilities for news stories, SEC filings, Twitter, and more.

- Access to almost every stock traded in the U.S., including the pink sheets and OTC markets.

- And so many more amazing features that we’re constantly expanding on.

So, if you’re currently battling the stock market without a top-of-the-line weapon, it’s time to better equip yourself. Grab a trial of StocksToTrade for just $7.

Are Penny Stocks Considered Cheap Stocks?

I love trading penny stocks. And yes, they’re considered cheap stocks.

Now, the term “cheap stock” can be subjective. But I like to keep things simple. To me, anything under $10 is a cheap stock. For some traders, it’s $5 or less.

Do Cheap Stocks Pay Dividends?

New students often ask me if cheap stocks pay dividends.

Dividends are more of a perk that can come with a long-term strategy. Looking for a company that pays dividends? These are bigger, established companies (think FANG or blue-chip stocks). These companies have a solid track record of profits and good cash flow.

Cheap stocks are cheap for a reason. A lot of times, these companies are struggling.

But the great thing about cheap stocks is that you can buy more shares with less capital. They have the volatile price movements that we need for short-term trading strategies.

Conclusion

Trading lower-priced stocks can be exciting … But it can also be a terrifying, money-burning endeavor if you don’t know what you’re doing.

The competition in the lower end of the market doesn’t always include the sharpest tools in the shed. But that doesn’t mean you should just jump into it with guns a-blazing.

Follow the seven rules above to learn how to play smart in this niche. And make sure to sign up for our weekly watchlist.

Wanna learn more? Add the stocks from this post to your watchlist to track their progress. They all show some exciting potential. They may not be the right trades for you, but they can help you learn more about charting, hot sectors, news, and more.

If you don’t have a watchlist set up or a way to track charts and news, get a 7-day trial of StocksToTrade for just $7. You’ll have access to premium charts, news scanning, watchlists and much more!

What are your tips for trading cheap stocks? Share your best and worst tales of cheap-stock trading. Leave a comment!