Welcome to the premiere of my new feature! And what a week to start our recaps. We’ve seen some awesome action with StocksToTrade Pro and on the SteadyTrade podcast.

The markets have definitely been fertile ground for skilled traders recently, and with any luck, we’ll see it continue like this for a while.

In this update, you’ll learn about some of the best trade setups we saw recently, how we found them, what I’ve been up to, and more …

(Hungry for more trading tips? Subscribe to our SteadyTrade YouTube channel now!)

I’ll also tell you how you could’ve found out about some of our best recent setups right as we announced them. And if you’re ready to take your trading to master level, check out StocksToTrade Pro.

Let’s dive in…

Table of Contents

What’s the Haps?

While last week was quite action packed, I’m particularly proud of the fact we put out a few great trade setups on the SteadyTrade podcast.

The trades I’m talking about were in TIGR, LYFT, and APRN, among others.

Let’s check ‘em out:

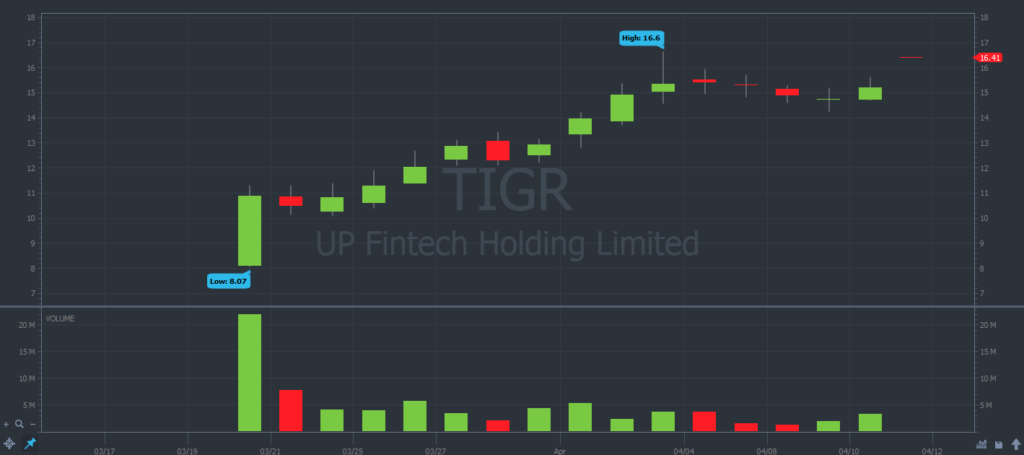

UP Fintech Holding Limited (TIGR)ef="/quote/TIGR/" data-stock="TIGR">TIGR)

UP Fintech Holding Limited (aka TIGR) is a very interesting recent IPO. The company has an app-based trading platform that services the Chinese market. Think of something similar to StocksToTrade — a trading platform, charting, news — but for Chinese traders.

This company is exciting to me for a few reasons …

First, you may know I was the crazy kid who was obsessed with the stock market in the fourth grade. I even remember asking my dad to bring home a copy of the newspaper so I could get some stock quotes and read the financial pages.

If there’s any stock related to trading and speculation, I’ll probably be interested in it. But there’s more to it …

I also think we’re in the golden age of speculation. Look at the recent mania in Bitcoin and other cryptocurrencies. Consider the fact that most of us carry a tiny, powerful computer around in our pockets. We can buy and sell practically any financial product in the world with a swipe of a finger.

I really see speculation booming in the future as an activity, profession, or hobby. If I’m right about that, TIGR is well positioned to benefit.

Another cause for excitement here is the fact that TIGR is involved in the booming Chinese market. China’s modernizing at a crazy fast pace. There are business opportunities all over the place, and people are making money fast. Some of this money will flow into their trading accounts.

So, on to the price action. We recently saw the TIGR IPO, and man, was it strong …

Opening at $8, the stock rocketed up over 25% on the first day. The second day saw a pullback, but the stock quickly recovered before breaking the IPO high. And it kept on running like a freight train.

All in all, at the time of this writing, TIGR is up over 100% since its IPO.

I’m extremely happy that I alerted SteadyTrade listeners to this one.

Blue Apron (APRN)ef="/quote/APRN/" data-stock="APRN">APRN)

I’ve already told you about a very strong IPO with TIGR … Now let’s move to a total crap IPO with APRN.

When I say crap IPO, I mean one of the worst IPOs in recent history.

APRN is the ticker for Blue Apron and now trades on the NYSE. The company is an online meal-prep service. They send out boxes of premium cooking ingredients with recipes for you to cook at home.

I guess it’s cool to receive a box and follow the steps to cook a delicious meal. But at the prices the company charges (roughly $10 per meal), I don’t see why people wouldn’t prefer heading to the grocery store … and saving some money!

It seems I’m not the only one to think this. The company itself is losing a ton of money. Pre-IPO they lost money. Post-IPO they continued to lose money. When I say lose money, I mean to the tune of $76 million last year — all for a company with a market cap of $200 million.

The price action reflects this lack of profitability with the stock being in a consistent downtrend for ages now.

So let’s look at the case for this stock: Bad technicals, bad fundamentals, and bad financials. Plus, there’s a cherry on top … the company will almost definitely have to raise money to stay in business. That means dilution of the stock if you hold it.

This is definitely one I won’t be holding!

Top Trade Setup Last Week

STT Pro setup of the week — VTL (NASDAQ:VTL) 5-minute chart (Source: StocksToTrade)

My pick for top setup last week is really easy! It’s VTL, a little stock that trades on the Nasdaq. And a bunch of StocksToTrade Pro members were able to nail this stock.

It was up BIG in pre-market on unusual price action. That started to flag everyone’s attention. After the open, the stock held its pre-market gains impressively.

At 10:30 a.m., VTL broke the recent high of the day on high volume and rocketed up — much to the pleasure of a bunch of our members.

Here’s something you might hear me say a lot: Unusual volume brings unusual price action. We definitely saw this with VTL.

And check this out … by 10:30 a.m., the stock had traded over 70 million shares and was up over 100%. The stock went on to gain over 300% that day!

What I love about this trade is that we didn’t have to buy it pre-market, we didn’t need to trade as soon as the market opened.

Instead, we were able to trade like snipers. And this is what sniper action really looks like, so take note. We took our time, we saw the setup on high volume, and we got on board. Patience was totally key here!

What Am I Reading?

Recently, I’ve been revisiting Steve Nison’s classic on candlestick charts, “Japanese Candlestick Charting Techniques.”

No matter the type of charts you use, this book shares insight into reading price action off the chart. It also has lots of interesting trading stories and anecdotes.

This is a story about a massively successful Japanese rice trader in the 1800s, Munehisa Homma. Homma basically created the concepts behind candlestick trading. He built a massive fortune and an empire as the top speculator of his day in Japan.

Homma created his own rapid wireless communication network to find out what was happening in various parts of Japan as quickly as possible. He used networks of men holding up flags in towers to communicate signals over huge distances.

This sounds amazingly similar to what the high-frequency trading firms do today, trying to get information to trade from as quickly as possible. Of course, now it’s all done in nanoseconds and with supercomputers.

It’s almost the same method, just with different technology from different eras — crazy! It reminds me of a fantastic Jesse Livermore quote:

“I learned early that there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again. I’ve never forgotten that.”

Overall it’s a great book that can give you insight into trading history. Check it out if you haven’t already!

STT Feature Spotlight

So back to our trades …

VTL was the best trade setup last week, and I wouldn’t have been able to locate it as quickly as I did (or maybe at all) if I didn’t have access to a great StocksToTrade feature. I’m talking about the stock screener.

The StocksToTrade stock screener allows you to tell the platform the exact trading criteria you’re looking for. This may include certain chart patterns, increased volume, fundamental ratios, and numerous other factors.

After you set your criteria on StocksToTrade, the screener will scan the market and deliver you a list of all the stocks that match your input.

It sounds so simple, right? But man, is it powerful.

When finding VTL, I used the StocksToTrade built-in Volume Boost Scan. This is a custom-built scan that finds stocks showing an unusually high amount of volume.

You can check out the exact scan — grab a 14-day trial of StocksToTrade for just $7.

Q&A: “What’s Your Favorite Pattern and Why?”

My favorite pattern will generally be one that works in the current market environment.

Right now, I’d have to say that would be the ‘high-of-the-day breakout on high-volume’ pattern. That’s exactly what we saw on the VTL trade I mentioned.

The setup is pretty simple, and most of the technique you can learn from the name …

You look to buy a stock that breaks the high of the day on high volume. When you see this kind of action, it generally means the market is excited about the stock. It could be primed to go on a big run.

I also love that this setup allows you to be patient. You don’t need to trade at the hectic times of the day, such as pre-market or right at the market open.

You really can be a sniper. I’m not talking about those traders you see in chatrooms who have ‘sniper’ in their handle and trade 10–15 times a day.

I’m talking about real snipers. You sit there patiently … waiting, observing, taking no trades until the stock sets up perfectly. When you see that setup, you take that trade, and you have a logical place to put your stop.

That’s a fantastic way to trade!

The Wrap

I hope you find this rundown on recent happenings as interesting as I found living it!

We often find some killer trade setups to share with our SteadyTrade listeners.

SteadyTrade is the podcast I co-host with my fellow trader and total bozo Steven Johnson.

On SteadyTrade, we talk interesting stocks, market action, and trading tips. We also interview top traders and manage to have tons of fun in the process …

You can check out every episode and get notifications for new ones. Just head over to our YouTube channel and subscribe!

How did you find the market action this past week? How many A+ setups did you see? I’d love to hear how you did — comment below!