It’s that time again … welcome to the latest edition of Bohen’s Take.

In this edition, you’ll find out what I’ve been up to and the details of an amazing trade we found in the StocksToTrade Pro chatroom. You’ll also learn how you can better use StocksToTrade, what I’ve been reading, and more!

(Looking for more trading tips? Subscribe to our SteadyTrade YouTube channel now!)

Ready to dive in? Let’s do this!

Table of Contents

What’s the Haps?

I’m excited to say that springtime has officially hit Michigan.

It’s great to finally get some outdoor time to rejuvenate in the sunshine. I had an awesome time fishing with my son and doing a bunch of yard work (I enjoy that more than you think!).

If you don’t live in an area with frigid winters, I can’t tell you how much you appreciate spring and summer after holing up from freezing temps for months.

But it’s not just about the sunshine and warmer season. Day traders can find so much value in getting outside. Most of us spend our days staring at trading screens, often completely alone, looking for the next play. Sure, it can be a lot of fun — but it can take a toll.

So, I recommend that everyone go the heck outside! Be active and move your body when the trading day is done. Whatever you enjoy, make sure you get a little exercise and sunshine — your future self will thank you for it!

Don’t just take my word for it. Some studies show that walking outside for just 20 minutes can light up parts of the brain and help improve cognitive functioning. That can be a simple way to help hone your trading focus!

It can be so easy as a trader to waste the day away in an unhealthy way. So, get active!

And day trading doesn’t have to be lonely. Join StocksToTrade Pro where you can share your trading days with me and other members in our chatroom.

My Recent Top Trade Setup

UP Fintech Holding Limited (NASDAQ:TIGR)

If you read my last update, you probably remember this stock.

It’s UP Fintech Holding Limited, and we call it by its ticker: TIGR.

What I love so much about this stock and company since it’s involved in the exciting area of financial speculation (the Chinese market). Small confession: I have a massive obsession for financial speculation.

This trade setup is what we call a ‘gapper,’ which can be a killer setup for swing trades. A gapper is a hot stock that’s pushing new highs and closing at the high of the day (HOD). It can show potential for a multi-day run — just like we saw with TIGR.

The gapper setup can be a great way to save your trades if your trading account’s still subject to the pattern day trader rule (i.e., your account is under $25,000). You can buy a stock in the afternoon and sell it the next day or later, and it won’t count toward your legally allotted three day trades per week. Food for thought.

So, here’s a hypothetical look at how the TIGR trade could’ve played out for some folks…

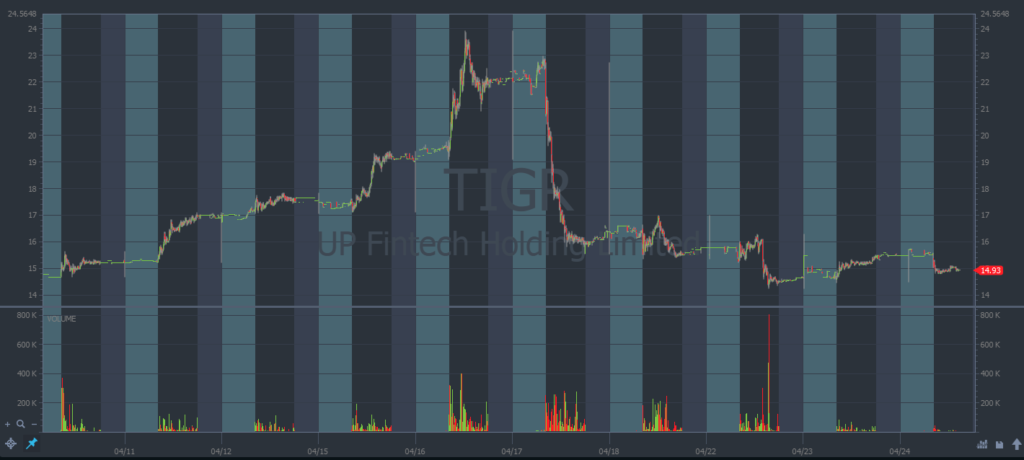

On the afternoon of April 12, we saw TIGR display the gapper setup. Into the close, it was pushing the HOD and sitting on 52-week highs. Strong price action!

Perhaps some bought toward the close from about $16 all the way up to $16.70 or so. The stock closed at $17.50 on the day, looking very good.

The next day, we saw TIGR gap up to open above $19. The gapper setup was playing out like I hoped it would in our trading plan.

On Tuesday, April 16, we finally saw the stock go parabolic. As smart traders, we know that when a stock makes a parabolic up move, we basically have to sell into the spike. That’s exactly how Tim Sykes recommends playing these ‘supernova’ type stocks.

Then let’s say some traders started selling around the $21 mark for a good $4 to $5 per share profit.

The stock then proceeded to up to freakin’ $24! So, there was a little bit of the move left on the table. That’s OK, though. A 25%–30% return on a stock in a few days is a solid trade.

Say some traders closed out their positions. That’s OK too, because the following Thursday the stock opened in the red and panic set in. TIGR dropped all the way down to about $16 that day. It still hasn’t recovered.

All in all, this had the potential to be a great trade. It shows why you need to develop your skill set as a trader. Sure, you can buy a stock and sit on it — but you really also need to know when to walk away.

Ready to learn more about how we find trades? Sign up to join our advanced trading community at StocksToTrade Pro!

StocksToTrade Feature of the Week

Keeping with the theme of the gapper setup and the recent great trade in TIGR, I think we should check out two great features of StocksToTrade that can help you find trades like this.

Those features are two scans called the New High Scanner and the High Low Ticker.

Let’s take a quick look at each:

The New High Scanner

This is one of the most popular scans used on the StocksToTrade platform. It can locate stocks that are making new highs.

We use it all the time in StocksToTrade Pro to find momentum stocks that are trading around an HOD price. With that information, we can dial our attention down to the stocks that show potential to run over the next few days.

The High Low Ticker

This is another scan, and it’s similar to the New High Scanner. The key difference is that the High Low Ticker shows you how many times that stock hit a new high for the day.

With the High Low Ticker, you can also see the number of stocks currently making new highs and new lows — that can be a great bullish and bearish indicator for the general market or a specific sector.

Missing out on scans and potentially hot momentum stocks? Check out the StocksToTrade platform. You can access great charts, scans, news feeds, alerts, and more. Grab a 14-day trial for just $7 now!

What Am I Reading?

I’m always reading multiple books, but the most exciting one at the moment is “How to Fail at Almost Everything and Still Win Big: Kind of the Story of My Life” by Scott Adams.

Adams is the guy best known as the creator of “Dilbert,” the comic strip about corporate life. The guy is crazy smart.

Adams had a truly full life before finding fame and fortune as a comic artist — many ups, downs, and different careers. Throughout the book, he talks about the countless lessons he’s learned in every job, failure, and success he’s ever had.

How does that apply to trading? Learning lessons through failure. Think about it: Most traders fail at some point, almost daily. It’s just a part of the job. So why not learn as much as you can from failing and work toward improving your skills and knowledge?

Adams also talks about developing a skillset and stacking complimentary skillsets to improve performance. Again, this is so relevant to trading. We often have to stack our skillsets in charting, reading statistics, understanding SEC filings, and everything else.

Plus, as I always say: Develop your skills and you’ll never go hungry!

This is a great book. Check it out for yourself!

Q&A: “What Is VWAP and How Do I Use It?”

Traders often see my charts on webinars or posts and ask me about the VWAP indicator. It’s always on my chart.

There’s a simple reason I always have the VWAP displayed: It’s one of the best indicators out there!

VWAP stands for volume weighted average price. That’s basically a complicated way of saying the price at which most of the volume traded for the day.

When a stock price is above VWAP, it tells you that the majority of positions that just entered are currently in profit. When the price is below the VWAP, the majority of positions are losing money. This can give you an indication as to whether traders are looking to close out or add to their positions.

There’s way more to the VWAP indicator … so much so, I recently held a comprehensive webinar on it. Check out the replay here.

The Wrap

That’s it for this edition of Bohen’s Take. I hope you found a few lessons to push you to keep growing, learning, and improving.

If you know me at all, I’m dedicated to living a full life outside of trading. For me, that means spending time with my family and outdoors. It’s also important for me to stay fit, healthy, and pursue a range of hobbies.

If you’re a trader looking to improve your trading and your life, try exercising and spending time in nature when you can. It can be so good for your brain and your body. The combination of exercise and nature is one of the best anti-depressants I’ve ever found.

It’s all about balance, right? So, while you work to improve your life outside trading, don’t neglect your trading skills! Mentorship and community with like-minded traders can help support you in your trading journey.

If you’re looking for a place to share ideas, grow, and develop together, check out StocksToTrade Pro. That’s exactly what we do — check us out!

How do the seasons affect your trading? What’s your key to growing as a trader and as a human? I’d love to hear your thoughts … comment below!