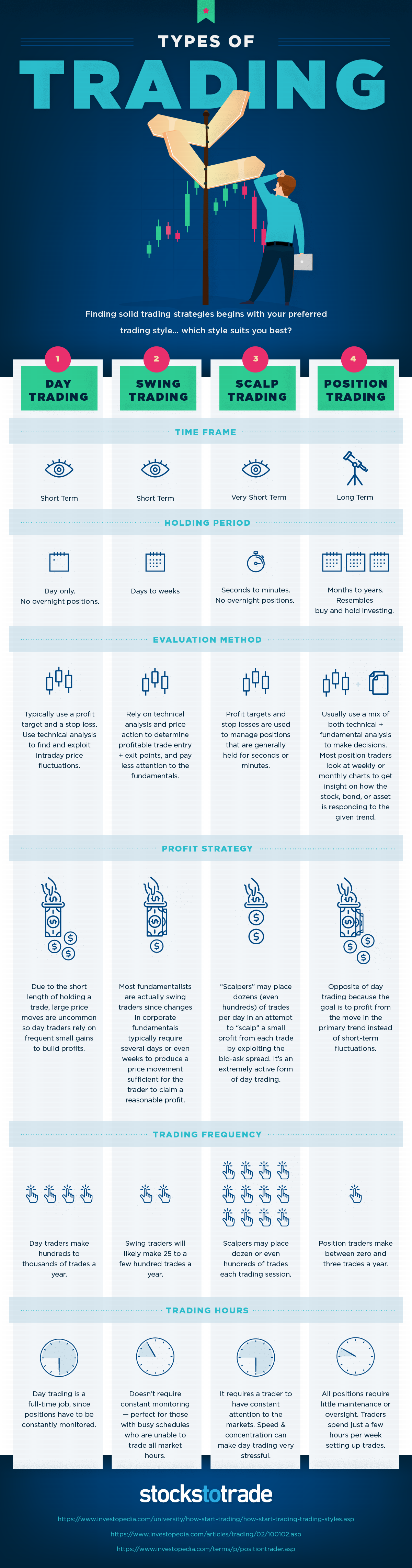

Traders are like snowflakes: no two are exactly alike. Some prefer the fast pace of day or scalp trading, where others prefer slower-paced approaches like swing trading or position trading.

To find the most solid trading strategies for you, it’s important to figure out your preferred trading style. In this infographic, you’ll learn some of the key types of trading. Which style suits you best?

Table of Contents

Day Trading

Day Trading

Day trading refers to short term trades where you enter and exit a trade within the same trading day.

Day traders use technical analysis to find and exploit intraday price fluctuations. To try to maximize profits and minimize losses, you’ll typically use a profit target and set a stop loss.

Due to the short duration, large price moves are uncommon so you’ll rely on frequent small gains to build profits.

Swing Trading

Swing trading strongly relies on technical analysis and price action to determine entry and exit points.

Ultimately, you’re looking changes in corporate fundamentals that can cause swings in price that will allow you to claim a reasonable profit. So a swing trade could be as short as a day or two, or you might take a position for several weeks or even in some cases months.

Swing trading doesn’t require constant monitoring, so it’s a great style for traders with busy schedules who are unable to trade all market hours.

Scalp Trading

Scalp trading is very short term, with positions that might be held from seconds to minutes. No overnight positions!

With scalp trading, a trader might make dozens or hundreds of trades per day in an attempt to “scalp” a small profit from each trade by exploiting the bid-ask spread and targeting small intraday price movements.

A scalp trader is probably the most constantly active type of trader during market hours, constantly buying and selling and letting small gains mount over time. It’s vital for scalpers to have access to low trading commissions.

Position Trading

Position trading is like the slow but steady approach to trading.

Instead of relying most heavily on technical analysis, you rely on a mix of technical and fundamental analysis to located and take advantage of longer-term trends.

A position trader takes a “buy and hold” approach, and might maintain their position for months or even years, checking on weekly or monthly charts to get insight on how the stock, bond, or asset is responding to the given trend.

What kind of trading is most appealing to you? Why? Leave a comment and spark a conversation!

Resources:

https://www.investopedia.com/university/how-start-trading/how-start-trading-trading-styles.asp