Once you’re in the markets for a while you start to hear new trading terms … Don’t know what puts and calls are? Those are two types of options trading.

2020 is quite the volatile year so far…

We’ve got the coronavirus scare, the big market sell-off, and all kinds of global tension.

Some traders think one way to trade volatile markets is with options.

Not gonna lie — options are complex. A lot of options traders try to profit without actually owning the underlying stock. Yep, they still go through a broker.

Sound risky? It can be. But options traders argue that the rewards make this strategy worth the high risk.

Full disclosure: I don’t trade options.

But I think it’s important that you understand how different players move in the markets. Options trading is a growing trend. Don’t overlook these traders.

And who knows? Maybe you’ll want to try options down the road. I don’t recommend it for beginners. Learn the basics first. Find your consistency. Then try branching out into options if that’s your calling.

Today, we’ll review puts and calls. So let’s start with the most basic question…

Table of Contents

What Are Puts and Calls?

Calls are a contract to sell a stock at a certain price for a certain period of time. Here, you gotta accurately predict a stock’s movement. That’s the hard part — predicting the market’s direction is near impossible.

You buy a call when you expect the price to go up. When you buy a call contract, you can buy a stock at a guaranteed price up until a certain date.

We’ll get to some examples in a bit.

Puts are a contract to buy a stock at a certain price. And like calls, it’s hard to get them right consistently. If you nail it, it can be rewarding.

Traders buy puts when they expect a stock’s price to go down.

Calls and puts allow traders to bet on an underlying stock’s direction — without actually buying or selling the stock.

Now that you have a basic definition of options trading, you’re probably wondering…

Should You Trade Options?

No one can answer that question but you. Trading isn’t for everyone. It’s hard work — no matter which strategy you choose. Day trading, swing trading, options … there’s no such thing as an easy strategy.

What works for you depends on your schedule, your account size, your risk tolerance, and more.

Before you try trading any strategy, make sure you understand the risks.

Advantages and Disadvantages of Options Puts and Calls

Advantages of options trading can include a flexible trading schedule, meaty percentage gains, no PDT rule, and limited risk. Options can look tempting from the outside…

Of course, there’s a downside.

Disadvantages can include losing your entire investment and poor risk/reward. Plus, no one can predict the future. Nothing’s certain.

Managing your risk can be the biggest piece of the trading puzzle. Never risk more than you can afford to lose.

How Do Calls and Puts Work?

Buying and selling call and put options are a function of major brokerage firms.

Let’s go through some examples … But keep in mind you won’t need to do all the calculations in your head.

Brokers will keep track of your profits and losses. The formulas are just to help you better understand the numbers.

Call Basics

The buyer of a call purchases the option to buy the stock for a certain price. The time period is limited for these contracts. The buyer must exercise the call option before the contract expires worthless.

When the call contract expires, the buyer can no longer purchase the stock for the agreed-upon price.

The call buyer makes money if the current price is above the strike price. But the buyer forfeits the entire premium if the price remains below the strike price.

Put Basics

If you buy a put, you’re buying the right to sell a stock at a certain price. You’re betting the price will go down.

The put buyer is like a short seller. This trader tries to profit from a stock’s price drop. If the price falls below the strike price, the buyer’s in the money.

In short, the whole contract is a function of price. Say you sell a stock at $30 and the current price is $20. You can buy it at the current price and sell it for a profit against your contract.

Call and Put Option Examples

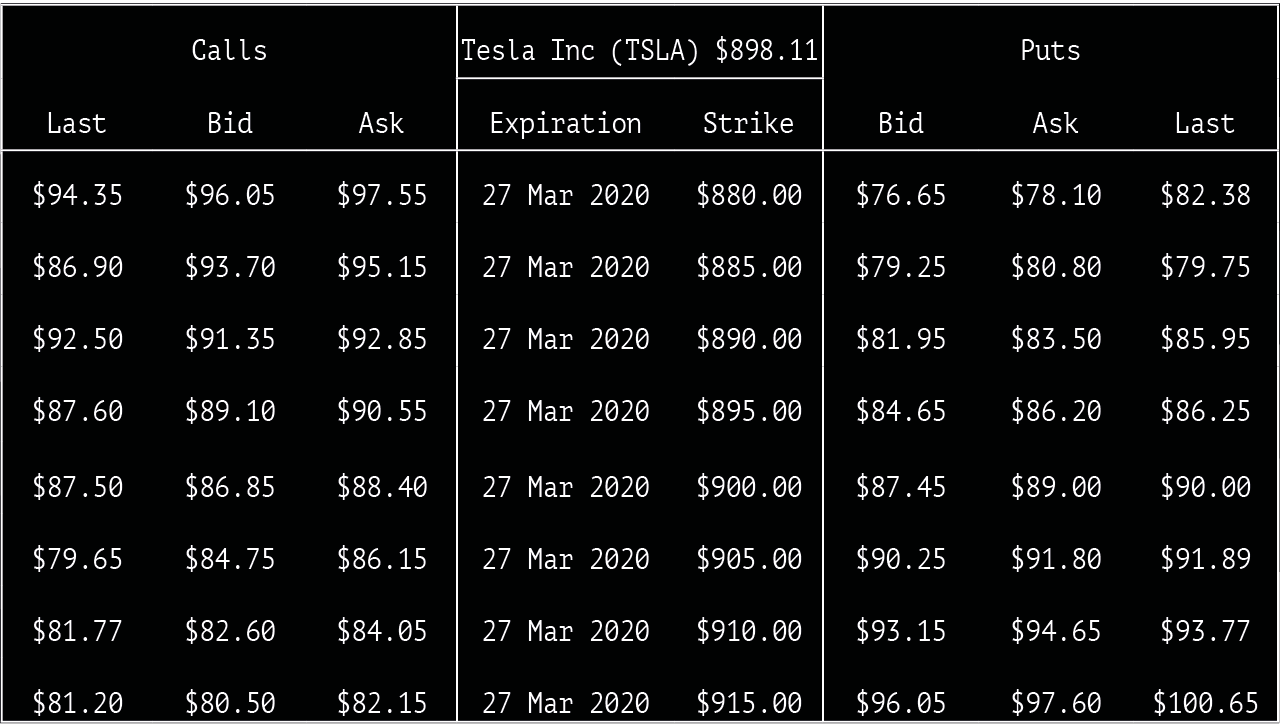

Real-world examples are usually the easiest to understand. For the following example, we’ll use the table below from live trading on February 21, 2020.

I chose Tesla Inc. (NASDAQ: TSLA) because it’s incredibly volatile. It often trades more like a penny stock than the large-cap that it is. The options are liquid. Check out the table:

© 2020 StocksToTrade.com

Buying Calls and Puts

Options contracts come in lots of 100 shares. So the contacts listed above from $76–$100 actually cost between $7,600 and $10,000 per contract.

The strike price is the agreed-upon price at which the actual stock will transact. A call buyer wants to see the stock price above the strike price.

Put buyers want to see the stock price below the strike price.

If you think TSLA will hit $1,000 or higher, you could buy a call for $82.15 with a strike price of $915. As soon as the price rises above $915, your pain would be a little less. And if the price manages to surpass $997.15, you could sell the contract for a profit.

Buying Calls and Puts on the Same Stock

This is one way options traders can make money. They may notice a lot of differing opinions on a particular stock. The volume rises as more people buy and sell. The stock gets a lot of coverage, and the implied volatility surges.

There are cases to buy and sell. (There are a lot of Elon Musk super fans and haters out there.) It’s hard to know who to trust and how the stock will actually move.

Here’s where options trading can offer a strategy that stocks don’t cover.

The table shows TSLA trading near $900. If you think a $200 move is coming in either direction, you could buy calls and puts. You’re potentially hedging your bets so you don’t lose too much betting in one direction.

But if the price holds steady it can cost you big. More on that in a bit.

Selling Calls and Puts

What if you think things will stay the same? Selling options can be a way to potentially profit when the market’s flat.

Markets can move in three directions: up, down, or sideways. You can buy calls to try to profit when the price goes up. When the market goes down, you can buy puts.

But who sells the contracts? Every options contract or trade is only possible because there’s someone on the other side.

The buyers of calls and puts pay premiums to the sellers. If you sell the option, you’re hoping the stock won’t move. That way you keep the entire premium for yourself.

If you expect the price to remain stable, you can sell calls and puts. If the price stays neutral or moves sideways, you make money off the bulls and the bears. But if the price makes a move, you can be on the hook to pay the buyer of the contract.

Strategies to Trade Calls and Puts Efficiently

Now let’s review the details of a few options strategy of stop-limit order examples. Let’s use that table from before.

I gotta say this again: I don’t trade options and this by no means a recommendation to buy or sell anything. I’m using these examples purely for demonstration purposes.

The table above shows actual bids and offers for TSLA. Tesla has a highly liquid options market.

1) The Long Call

Let’s look at a lower-risk, lower-reward options contract.

All these contracts expire on March 27, 2020. The strike price for the first is $880 — about $20 below the current price.

You can buy (or long) a call contract with a strike price of $880 for a premium of $97.55. Remember, these contracts come in share lots of 100 shares each. So the actual cost of one contract is $9,755.

If the price stays above $880, you’re in the money. If the price falls below $880 and the contract expires, the contract seller keeps the entire premium — $9,755.

The break-even price is further away. The price would need to hit $977.55. That’s the cost of the contract plus the strike price. If the contract expires and the price is around $900, you get back about $20 per share. Your risk of losing the entire premium is smaller.

Let’s look at one more example of a higher-risk long call. Here, you buy a contract with a strike price of $915. This premium is less than the first at only $82.15. One contract is $8,215.

If the price rises above $915, it will start to offset the cost of the premium. Break-even on this trade is $997.15. That’s the cost of the premium plus the strike price. Here’s a simple break-even formula:

Breakeven = [Strike Price] + [Call Option Premium]

2) The Long Put

If you think Tesla’s price is dropping, you can buy the option to sell at a certain price. In this case, you have until the contract expires on March 27.

The lower risk would be to buy (or long) a put for $97.60. That costs $9,760 total with a strike price of $915. Break-even would be $817.40. Take the strike price and subtract the premium, the opposite of a long call.

A higher-risk trade would be with a strike price of $880, with a premium of $76.10. This trade would have a break-even price of $801.90. Here’s how to calculate the break-even price on a long put:

Breakeven = [Strike Price] – [Put Option Premium]

3) The Short Call

When selling or going short on any options contract, you want the opposite of the buyer. The buyer wants the stock to hit and exceed the strike price. The seller hopes the stock never hits the strike price.

If you think the price can’t go much higher, you can sell call options. The current bid is $80.50 for a strike price of $915. As long as the price stays below $915 until March 27, you keep the entire premium.

But (there’s always a but) you’re responsible for selling at the strike price no matter the current market price. If the price surges higher to $1,100, you must sell TSLA for $915 per share.

That means you sell at a loss. You get to keep the premium, which can soften the blow … But if the price is $1,100 at expiration, that sets you back $10,450. Ouch.

Here’s how to figure out your current profit or loss when selling a call:

Profit / Loss = { [Premium] + [Strike Price] – [Current Price] } *100

4) The Long Straddle

Just a bit ago, we touched on buying calls and puts on the same stock. That’s known as a straddle.

For this example, you’re convinced TSLA will make a big move. But you don’t know which way it will go. You could place a bet in both directions.

Yep, it makes it harder to profit. Here’s a quick run-down:

You buy a call at a strike price of $915 for $82.15. And you buy a put at a strike price of $880 for $78.10.

To break even, the price needs to rise to $1,075.25 or fall to $875.95. Those are major moves. Any price outside of this zone before March 27 would net a profit.

But if it stays in consolidation between $880 and $915, you lose both premiums. That’s expensive and not ideal for new traders.

I don’t know a lot of traders who want to lose $16,025, which is the cost of both premiums.

Conclusion

Puts and calls can be lucrative but they can also come with plenty of risk.

I’ll be honest, I don’t think options trading is ideal for small accounts or new traders.

It’s a complex — and pricey — game. There are so many traders out there taking huge bets at the risk of blowing up their accounts.

Managing your risk well is one of the smartest things you can do as a trader. That means you need a solid trading plan — and you gotta stick to it.

I think there are smarter ways to trade, manage risk, and build an account. That’s exactly what we focus on in our trading community StocksToTrade Pro. You get mentorship, webinars twice a day, a trading chat room, and so much more. Join us today!

Tell me what you think about puts, calls, and options … Is this really a way to potentially hedge your bets? Leave a comment!