Liquidity: learn to love it. Traders should stick to a strict liquid diet, because illiquidity is the paper snake of trading.

One of the biggest mistakes new traders make is ignoring a stock’s liquidity, so that’s the Number 3 step in picking stocks taught by STT lead trainer Tim Bohen.

Download the key points of this post as PDF.

Trying to trade an illiquid stock is like grasping a paper snake. It might get your attention by moving around a lot, but illiquidity means it’s got no value for you to buy and sell. Once you grasp it, there is no bite.

The company is considered to be liquid if their assets can be converted to cash easily—and liquidity is one of the indicators of a business’s health. However, high liquidity may also signify a company’s inefficiency to utilize its assets effectively. It is important for a business to remain impressive liquidity to have enough money for regular operating expenses.

Quite simply, a liquid stock is a stock that trades enough shares so that the holder of the stock can easily sell when they choose to. If you are a trader, liquidity is important, both in formulating strategy and executing stop-loss orders. If you are type of trader who looks to buy for keeps, this is not relevant for you. When the stock is liquid and there is a lot of volatility, that is when Level II—how the stock reacts to previous closing price—is most helpful. When there isn’t much action, Level II doesn’t tell us too much.

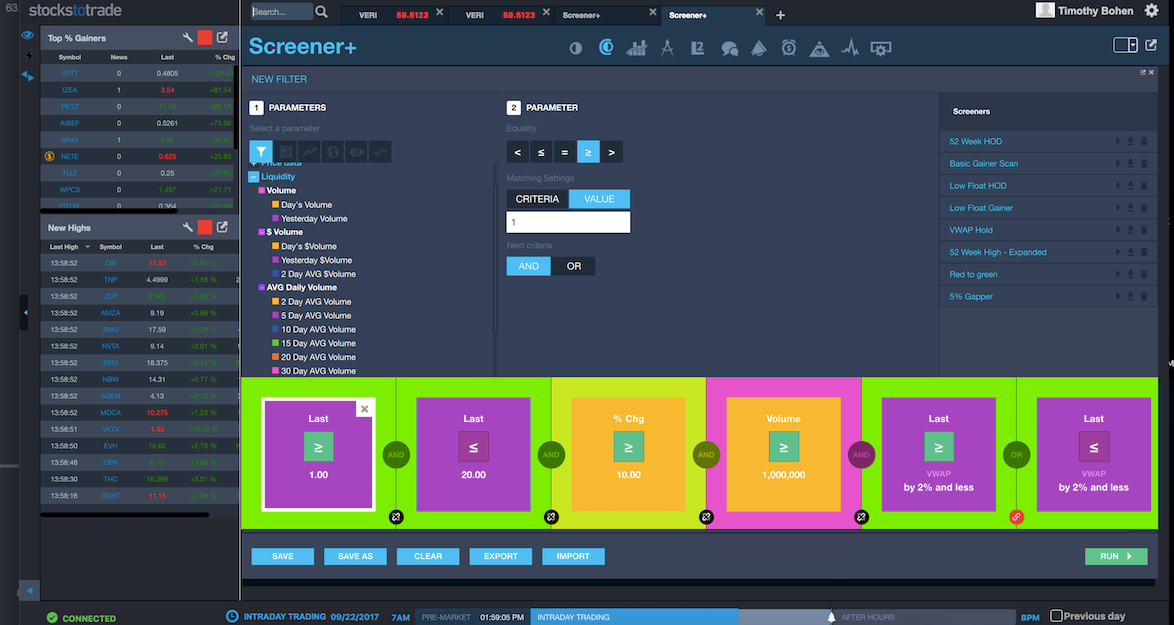

Let’s try an example, using STT filters for liquidity…

We’ll take ABUS (Arbutus Biopharma):

This stock shot up one day, but it didn’t have the volume to support it and lots of people started shorting it. The one-day spike is the caution sign we’re looking for.

This stock shot up one day, but it didn’t have the volume to support it and lots of people started shorting it. The one-day spike is the caution sign we’re looking for.

Tim Bohen and Tim Sykes—and any major day trader, really—recommend only trading stocks that can maintain 1 million or more shares in trading volume over multiple days.

Remember liquidity is important to make sure a stock maintains a trend over multiple days or weeks.

One-day spikes in volume typically create a chart exactly like this one for ABUS. Even though it had a positive catalyst, it was unable to maintain high volume past day one.

The market is all based on supply and demand. If the “crowd” (liquidity) moves on, the odds of your trade being more than a “one and done” is very low. Use the STT scans to locate stocks that have been up multiple days with building or maintained high volume.

Basically, liquidity is even more important than volatility. Liquidity determines how easy it is to trade shares of a stock. The key to penny stocking, for sure, is being able to quickly move in and out of a position, so you should only ever trade stocks that are extremely liquid relative to the capital you trade with.

Here’s a great example of some nice liquidity on an active stock this week—VERI (Veritone, Inc):

STT has ability to filter liquidity, so look for stocks with 1 million or more share volume over multiple days by setting up the filter to reflect this. Anything that hasn’t traded a million shares the previous day should never be on your stock list.

So, once you’ve identified a big percentage gainer and checked for catalysts, look at its liquidity, too, before you decide.

“Think about a stock that’s trading a million shares a day,” says STT’s Tim. “Now, if you buy a thousand or sell a thousand shares, you’re not really going to influence the price and you can get in and out easily. But, if you have 100,000 shares, you represent a much bigger chunk of that million shares a day. You’re going to influence the price and you might not be able to exit your position very easily, because you’ve taken such a large position, so it’s going to be hard to find other buyers or sellers to get out of your shares when you need to. The biggest losses always come when you are taking too large of a position in an illiquid stock, so you should take smaller positions to limit the risk.”

The most useful measure of liquidity for any stock is its average daily trading volume. This varies from day to day, so it’s best use an average. Daily averages are shown for the previous 10 days and three months.

The initial hour of trading at market opening and the last hour’s trading before market close are considered to be the most liquid. If you are able to identify stocks with strong momentum, it is better to buy the stock at the market close and hold the position overnight. Then, you’re money’s working for you while you’re sleeping. The next day, you can close your position right at the market open, when the liquidity is at a high point. You’re also avoiding Pattern Day Trader (PDT) rule when you do this, because you’re not buying and selling the same stock on the same day.

Stay away from the paper snakes, and live to trade another day with STT. In the meantime, you can learn even more here, with STT’s Steady Trade podcast.