Any old-school trader will tell you that stock scanners change everything. What used to take a trader 3-4 hours each morning can now be done with a few mouse clicks in a few minutes.

Looking for trading opportunities used to be boring and monotonous. So many stocks to watch, so many charts to view.

After the market opened, you hoped you were watching the right stocks. No one was going to come and tell you where the hottest action was.

Those days are over. Now we have stock scanners to do all the heavy lifting for us.

Save your time, save your energy, save your sanity: Use a stock scanner.

Here, you’ll learn all about the wonderful world of scanning, plus we’ll share tips and tricks to help you get up to speed so you’re ready to perform your first scan.

Table of Contents

What Is a Stock Scanner?

A stock scanner is a piece of software that can look through countless stocks, almost instantly, looking for the exact criteria you’d like to find.

Ask it to find stocks making all-time-highs on higher than average trading volume, or anything else you like to see, and — BOOM — every stock meeting your desired criteria is presented to you.

If you didn’t have the scanner, you’d have to flick through a never-ending stream of charts until your eyes were ready to bleed. Why torture yourself? Use a scanner!

Scanners save you time and effort, and allow you to focus on the top trading opportunities according to your criteria. In short, they’re amazing game-changers that no trader should be without.

Stock Screeners

If you’ve spent just a little time around the markets, you might have heard both the terms stock scanners and stock screeners. Are they the same? What’s the difference?

These terms are often used interchangeably, but to be absolutely technically correct, there are some differences between a scanner and a screener.

It comes down to scanning time frames effectively.

Stock screeners were developed when the internet was in its infancy. They were websites where you’d log in each evening and scan for basic criteria such as a stock being above a moving average.

Screeners are basically low tech and used more for longer-term trading.

Stock scanners, on the other hand, came about as the internet and technology evolved. It’s a powerful program on your computer that’s connected to a data feed, scanning stocks for trading opportunities in real time. Now the stock scanner is a thing.

Don’t worry if you misuse these terms — there’s no trading-language police. But it’s good to know the history.

The Top Stock Scanners

There’s a ton of stock scanners on the market. So much so, it’s tough to definitively say which scanner is the best. It all depends on you — your trading style, trading strategy, budget, technological needs, market access requirements, and so much more.

Some scanners are point and click. You literally click a few buttons to start a scan. With others, you may need keen programming skills and statistical knowledge.

Don’t have much computing power? You can opt for a scanner that runs in a browser. If you crave something more intense, you can run a desktop-based scanner, but you will need a powerful computer.

And what about the cost? Again, it’s all over the board. You’ll pay thousands of dollars or more up front for some scanning software. And with others, you might pay a flat monthly fee.

We could go on and on about the differences between scanners …

Here’s what you really need to know: Pick a scanner that best suits your trading style.

If you actively trade U.S. stocks — as much of our team does — consider StocksToTrade. We built this platform with the perspective of a real-world trader and NOT as a bunch of corporate monkeys merely trying to sell a product and make a buck. This video explains the StocksToTrade platform in under 2 minutes:

We’re legitimate traders who want a platform that can serve our needs. We spent our time and money on creating the exact trading platform we wanted.

We’re really proud of our creation, and we think you’ll dig it too. Check out our StocksToTrade scanner and its many awesome features today. Sign up a 14-day trial for just $7.

Types of Stock Scanners

No matter which stock-scanning software you use, you have to know which specific criteria you want to search for in stocks. It may be a chart pattern, P/E ratio, or recent momentum — whatever you establish in your trading plan.

Once you know your desired criteria, you’re ready for the next step: find and use the right kind of scanner. There are four major types of scanners available, let’s take a closer look at each …

#1 Fundamental Stock Scanners

Wanna guess which types of traders use fundamental scanners? If you guessed those who use fundamental analysis, you’re correct! These scanners search for certain fundamental criteria.

Fundamental analysis involves information related to a company’s commercial activities, like ratios and metrics. It can also involve analyzing earnings-per-share (EPS), return on equity (ROE), profit margins, and more.

If you use fundamental analysis, you can set a scanner to alert you to every stock that’s trading at a price/earnings ratio below 10, for example. This is just the starting point. Once the scanner returns a list of stocks, you can then dig into deeper research on these tickers.

#2 Technical Stock Scanners

Traders who scan for technicals can set their scanners to look for certain price action, chart patterns, technical indicators, or trading volume criteria. In short, they’re scanning for technical analysis criteria.

If you’re one of these traders, you can set a scanner to locate all stocks that are above the 200-day moving average, with over $1 million of daily trading volume, and technically in an uptrend.

Once you get your list of stocks, you can then focus on research to narrow down to the juiciest opportunities.

#3 Post-Market Stock Scanners

Post-market analysis involves analyzing the actions of stocks outside of trading session hours. When the daily market sessions end, there’s a ton of data available to traders for analysis.

This includes things like top percentage gainers and losers for the session, stocks with noticeable spikes in trading volume, and much more. You can use a post-market scanner to search for the biggest gainers on increasing trading volume.

It’s just another part of your research and includes a factor that many traders thrive on: volatility.

#4 Intraday Stock Scanners

In contrast to post-market analysis, intraday analysis looks at real-time action of stocks while the market’s open. This requires a more robust scanning program — there’s just so much data from so many angles. And you need it to be analyzed as quickly as possible.

Intraday analysis can involve the analysis factors previously mentioned in this post. You can search for the biggest movers on the day, stocks breaking out to all-time-highs, stocks above the 50-period moving average … pretty much anything you can think of.

Scanning intraday can help you locate market trends while they’re happening. Some day traders run scans for the entire session, preparing to jump onto intraday price waves.

If that’s your trading style, you’ll need a top-level scanner. See why many of the best day traders use StocksToTrade every day with a 14-day trial for just $7.

How to Use Stock Scanners

Hopefully, by now, you have an idea of which scanner will suit your trading plan. As with any tool, you want to master it to develop better results.

Here are a few best-practice tips to help you get the most out of your stock scanning software …

Set Up Intraday Alerts

If you’re an intraday trader, it’s probably obvious that you should set up intraday alerts on moving stocks or for when something unique is happening in the markets.

But even if you’re not an intraday trader, say you swing or position trades for the longer term, you can still use intraday alerts.

Why? You can a spot wave of momentum early.

A lot of traders only look at the market each night to run analysis and set orders for the next day. They can miss the big moves in a stock price.

Don’t wanna miss out? Try scanning for opportunities intraday to help you spot the hottest trends early.

Build a Watchlist

There are thousands and thousands of stocks actively traded in the U.S. each trading day. At any given time, only a fraction of those stocks can offer real trading opportunities, and they can often be in related sectors or areas of the market.

For example, when the marijuana sector is hot, many pot stocks will consistently show amazing trading opportunities. That’s why you fence off areas of the market that show potential.

How? Keep watchlists.

Watchlists are a way to keep tabs on a collection of stocks so that you can quickly locate them and see how they’re performing.

For example, most traders will keep separate watchlists for a handful of hot sectors and maybe a separate watchlist for the stocks they trade most actively. Most top traders keep watchlists to help them save time and focus on improving methods. It’s part of their daily routine.

You can build your own watchlists and learn to trade like a pro. StocksToTrade comes with unlimited watchlist capabilities. Build yours today. A 14-day trial is just $7.

StocksToTrade’s Stock Scanner

There’s an almost endless amount of stock trading opportunities in the U.S. alone.

There are so many different types of stocks. Stocks that are up big, stocks that are down big, $100 stocks, $1000 stocks, 1-cent stocks, high-volume stocks, low-volume stocks … the list goes on.

Back in the old days, traders had to use multiple web-based and desktop apps to run scans. Imagine loading four to five super slow apps, awkwardly running scans while hoping the programs don’t crash. Not fun.

The scanners often required some computer programming know-how and too many wouldn’t even scan all stocks. Sure, you could scan the NYSE and Nasdaq, but what about pink sheets and OTC markets?

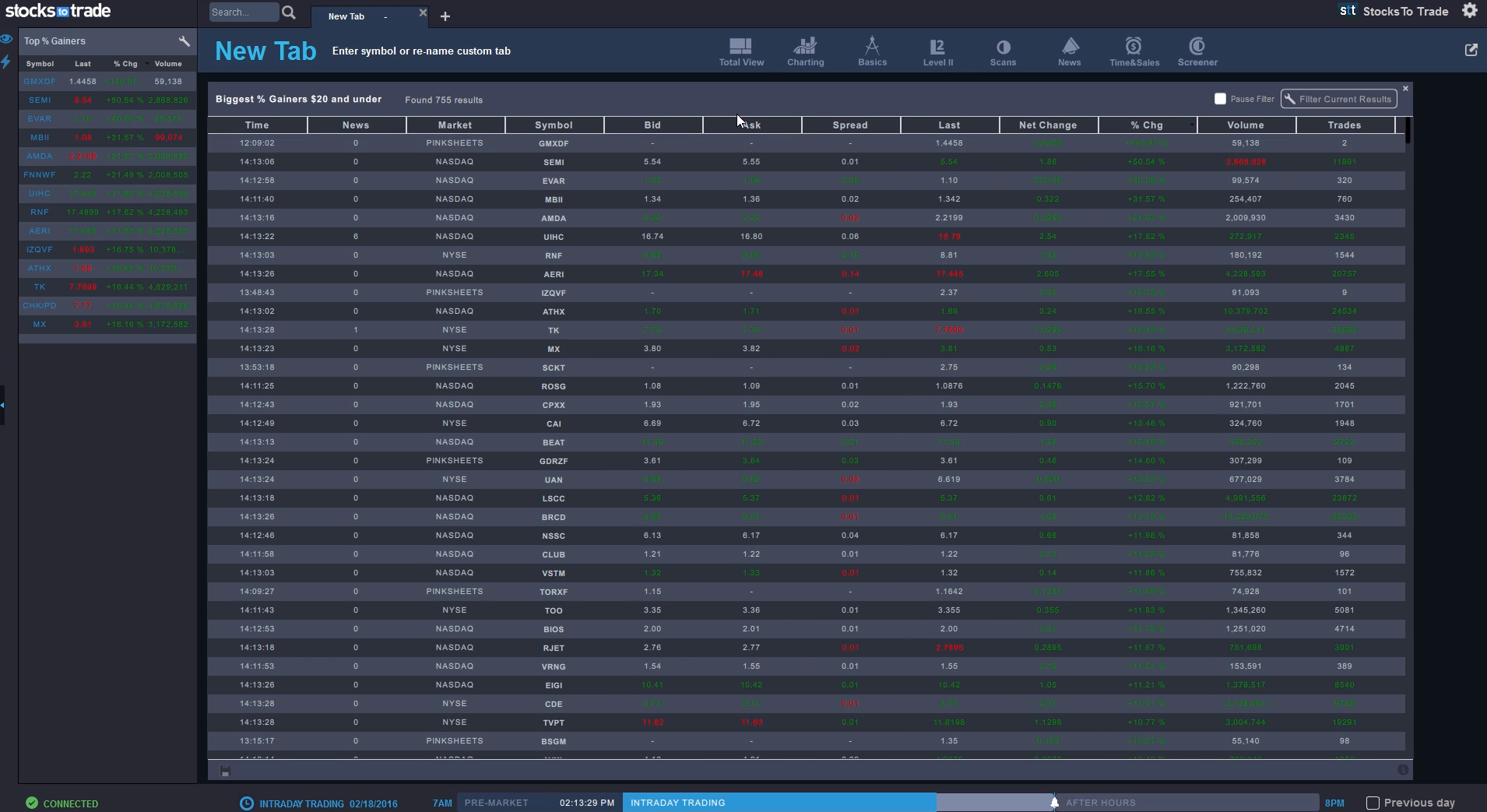

That’s exactly why built the StocksToTrade platform: It’s one place, one program to scan for stocks. That includes every stock traded in the U.S. (over 18,000!) and even the smallest names on the pink sheets.

You can scan for basically limitless criteria, whatever indicates an A+ trade for you. We even have just about every trading indicator in existence.

With StocksToTrade, everything you need for scanning — technical, fundamental, intraday, post-market — is all available in one elegant, easy-to-use program.

See why some of the world’s best stock traders use StocksToTrade for all of their scanning needs. Get a 14-day trial for $7 now!

Take Advantage of StocksToTrade Features

Stock scanning is indeed amazing, but you need to know how to take advantage of every aspect of StocksToTrade.

We worked tirelessly to build an all-in-one dream trading platform for professional traders, so the list of features is pretty long. Here are just a few:

- Super-fast, real-time connections to all U.S. equities, for a live view of what’s happening in the markets.

- Access to all major U.S. equity markets — Nasdaq, NYSE, Amex, OTC, and even pink sheets.

- Quick access to our time-tested strategy scans with the click of a button to help you find your next trade.

- Dynamic, elegant, high-end charting abilities to help you focus on market action.

- Unlimited watchlists of all your favorite sectors, stocks, and market niches.

- Ability to scan for news, SEC filings, and Twitter chatter in real time.

- Key stock statistics at your fingertips: Analyze stocks within seconds.

- Basic company profiles and information to help you in your research.

- High-end paper trading feature to help you develop trading skills without risking a cent.

We can’t possibly list all the features and benefits here … there’s just not enough time or space. And don’t take our word for it, check out STT for yourself. A 14-day trial is only $7 — try it today! See why some of the world’s best traders start their day by loading up our platform.

Conclusion

A stock scanner is a powerful tool in the arsenal of almost every top trader.

You can use a scanner to help you quickly locate the exact trading criteria you’re looking for, and narrow down a list of stocks worthy of your time and research. Greatly improving their odds of finding better trades.

Excited to start using a scanner to help you in your trading and analysis process? You should be! If your trading strategy is solid, all you need to do is pick the right scanner and enter your trading criteria. It’s that simple.

Don’t know how to code or program? No worries! StocksToTrade is a point-and-click scanner. Scanning can be easy. You don’t know what you’re missing until you give it a try. Get a 14-day trial for StocksToTrade for just $7 now!

How long does your scanning process take each day? How many scans do you run? We want to hear about your scanning process — what works and what doesn’t. Leave a comment and let us know.