As day traders, one of our primary goals is to identify stocks with upward momentum and capitalize on their potential gains…

But sometimes a premarket spiker can tank at the open and never come back …

How can you avoid getting caught in the bloodbath?

There are usually signs that a stock will fade and leave long traders with losses if they enter…

So today I’ll share the three red flags you can look for to help you avoid that fate.

These were all evident in Aclarion, Inc. (NASDAQ: ACON) yesterday and if you recognized them, you could’ve potentially saved yourself from a loss…

Three Signs A Stock Will Fade

I have three major signs you need to learn to recognize…

Avoid stocks with these three criteria at all costs!

One-and-Done Charts

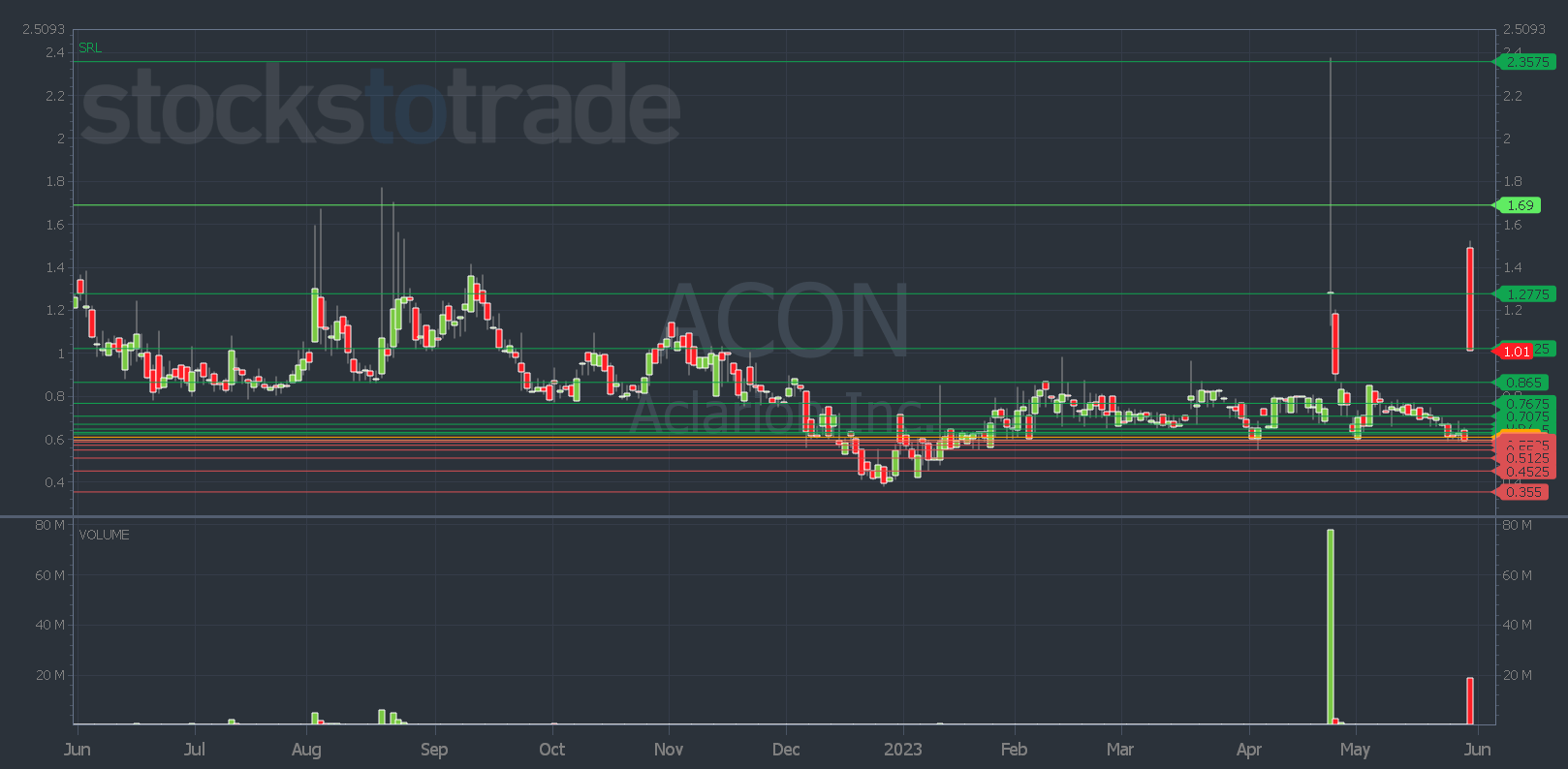

Stocks that tend to fade have a distinct pattern on the daily chart…

They often have a history of huge gap ups and spikes — but they often close back at the open price or even lower…

That’s why I call them one and done…

They can spike for one day or one morning, then they’re done.

That’s a pattern I noticed on the Aclarion, Inc. (NASDAQ: ACON) chart yesterday…

In my morning live webinar, I said it’s one of the reasons I didn’t like the stock.

Notice that every time it tried to spike, it failed and left long wicks on the daily chart.

Yesterday it could’ve even spike at the open. It just completely fell apart.

By avoiding stocks with a history of one-and-done moves, you can reduce the risk of getting caught in fading trades.

Another way to avoid fading stocks is to…

Avoid Stocks That Aren’t in a Hot Sector

Hot sectors are where the majority of traders focus because they can offer the most volatile price movements.

AI stocks like NVIDIA Corporation (NASDAQ: NVDA) and C3.ai, Inc. (NYSE: AI) are breaking out to new highs, so those are the stocks traders are focused on.

When a stock isn’t in a hot sector, it lacks the momentum and interest that can drive prices higher…

That means it’s more likely to fade — just like ACON did yesterday.

The fact that the stock isn’t in the artificial intelligence sector is another reason I didn’t like it yesterday.

And ACON collapsed at the open. This leads me to the next sign of a fading stock…

Avoid Stocks Under VWAP Making Lower Lows

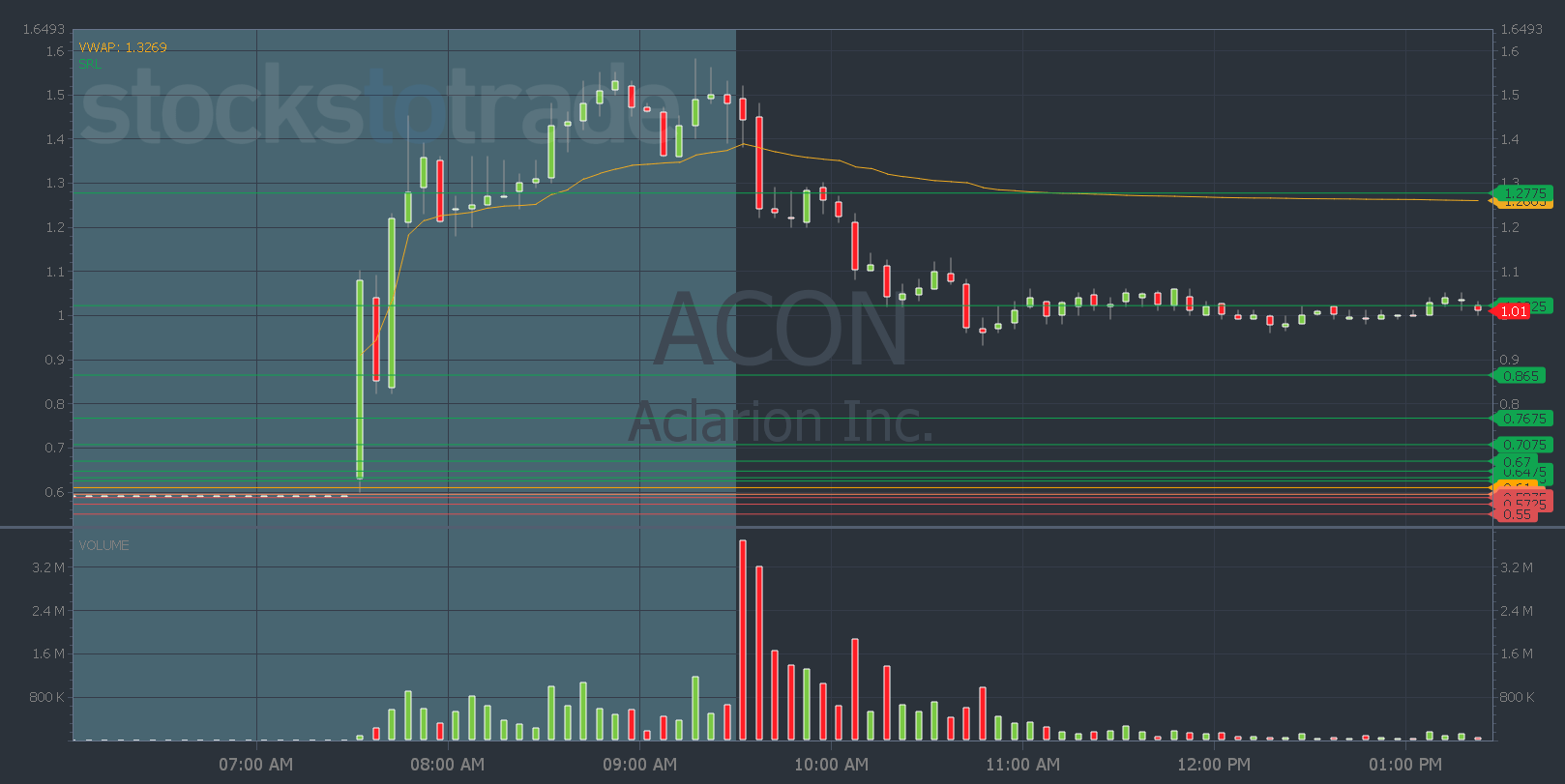

The Volume Weighted Average Price (VWAP) is a popular indicator used by traders to gauge the average price a stock has traded at throughout the day, considering both volume and price.

Traders also use it to gauge the bullish or bearish sentiment of a stock’s price action.

When a stock trades above VWAP, it indicates bullish momentum and potential buying opportunities.

If a stock breaks below VWAP, it signals a shift in momentum and can be an opportunity for short sellers to enter trades.

Within the first 10 minutes of the market open, ACON dropped below VWAP. From there it continued to make lower lows as it faded…

So that isn’t the time to ‘buy the dip.’

Instead, focus on stocks that show strength and upward momentum…

Stocks that are in a hot sector, trading above VWAP with high volume, and have a history of running.

There weren’t a lot of penny stock AI stocks yesterday. The large caps are stealing all the thunder for now…

But there will be one eventually … One stock with AI news, a low float, and a beaten-down chart ready to rip the faces off of short sellers.

Stay up to date with what’s happening in the market and what I’m watching with my Market Update videos.

I send them to you three times a week, plus a ton of other perks when you sign up here.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade