I’ve written about the front side and the back side of the move, and how to check all the boxes before you take a trade…

But those are small parts of the analysis that goes into planning a trade…

Once you’ve done your due diligence, you still need to execute your trade. That means knowing where to enter and where to exit.

It can be the toughest part of trading…

You have to deal with emotions like fear and greed that can mess with your timing. You experience indecision and fear of missing the move. Or greed causes you to sell too soon, or hold a stock too long.

Those can be costly mistakes.

Want to see how you can avoid them? Read on to see how you can have trade plans laid out for you…

Two Ways to Avoid Costly Mistakes

A trading plan can help you avoid major mistakes, but only if you’re disciplined enough to stick to it…

You also have to trust yourself that you’ve made the right plan.

When you’re new, that’s a little tougher … How do you know your plan is the right one and that you should trust yourself?

That comes with experience. But if you want to cut down the time it takes you to build that trust, start with some help…

Get a mentor that has the experience you can learn from. When they give you a trade idea with triggers, goals, and stops, follow the plan and see what happens.

Not every trade or pattern works 100% of the time, so review it afterward and see why it worked or didn’t.

Another way to speed up your learning curve and gain experience is to have tech help you out…

Most algorithmic trading executes trades based on programmed criteria. Then the computer buys and sells when a stock hits certain prices. That’s a bit of a stretch for new traders to get into. So here’s the next best thing…

StocksToTrade’s Oracle gives you the 20 hottest tickers with the most explosive potential that day. It won’t execute trades for you, but it will give you the key levels to trade off.

It’s something I wish I had when I first started trading. And even with my years of experience, I still use it every day.

Sure, I can find trades on my own, but why not save time and get confirmation that the levels I’m watching are important? That’s something every trader can use.

Here’s how Oracle could’ve helped you yesterday…

Entries and Exits in Yesterday’s 100%+ Gainer

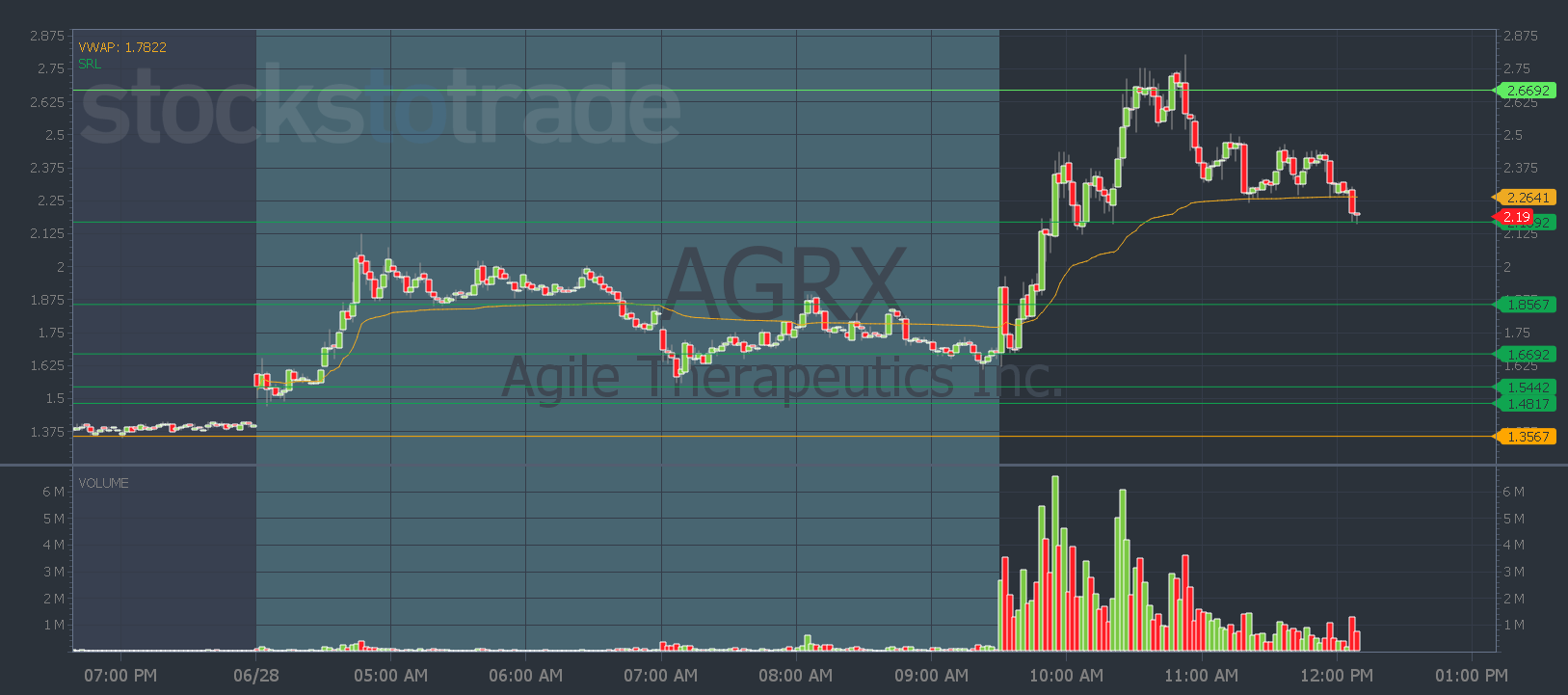

Agile Therapeutics, Inc. (NASDAQ: AGRX) gapped up in premarket yesterday after a big gap up and fail on Monday. That meant that all the short-sellers who shorted on Monday were underwater.

If you were looking for the best potential entry, shortly after the open, Oracle provided $1.97 as the key level to watch. I prefer whole or half-dollar levels so I was looking at $2.

And after AGRX dipped, it ripped through $2. As you can see from the chart below, you can also use Oracle support and resistance levels to guide you on the way up…

Once AGRX broke through Oracle’s $2.17 resistance level, it continued to the $2.67 target.

Want to see how Oracle works? Watch this video to see it in real time.

Why Oracle isn’t Just for Long Traders

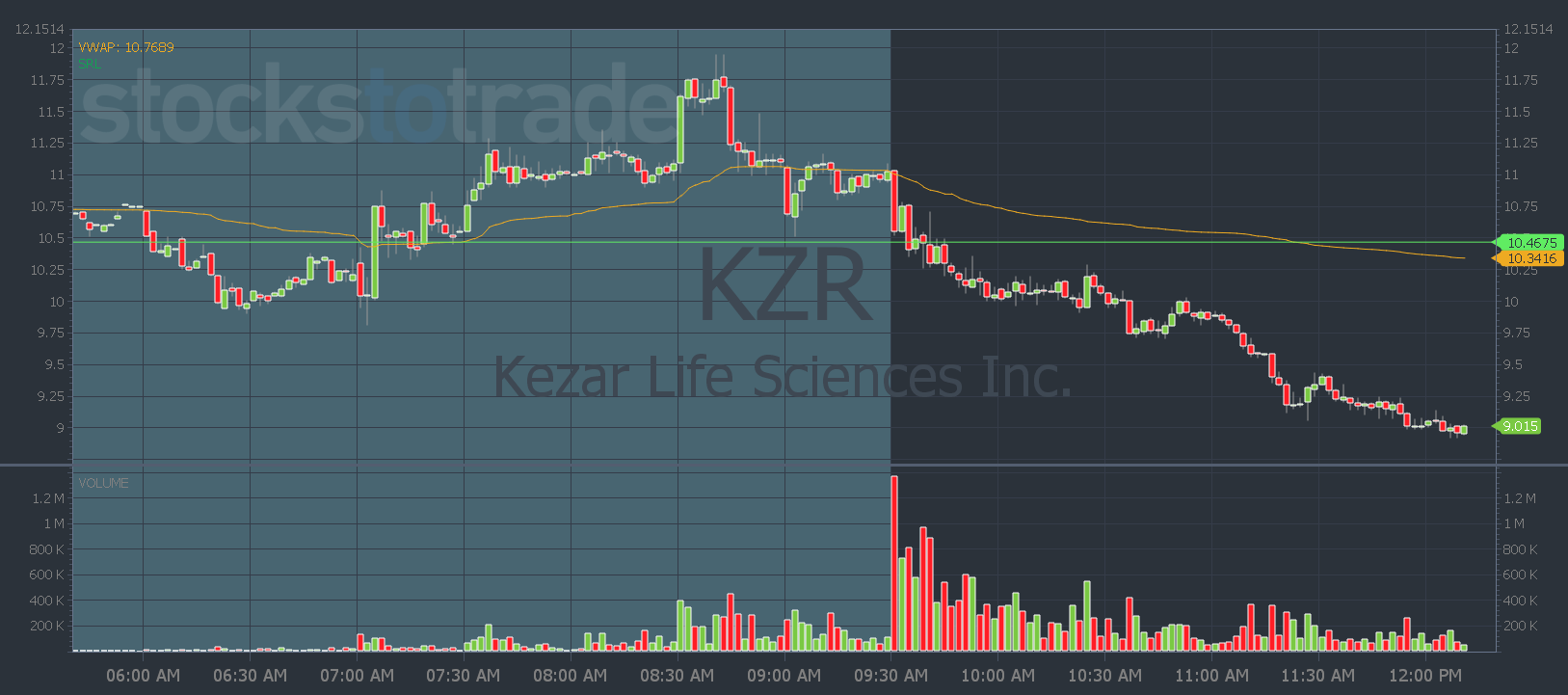

Want to learn a short-selling strategy? Oracle can help you spot entries and exits for shorting too…

Yesterday, Oracle showed a trigger (entry) price of $11.04 and a goal (exit) price of $10.47 for Kezar Life Sciences, Inc. (NASDAQ: KZR).

And even though KZR went lower, that’s still a 50-cent-per-share move. Not bad when you’re learning a new strategy…

And as you gain more experience, you can decide when you want to be aggressive and hold stocks longer. Or scale out to get the most out of your winning trades.

There’s a lot to learn when you’re starting out your trading career. And it never stops — you’ll constantly be adapting to the market and price action…

Why not take some of the work out of it and have tech help you as you go?

StocksToTrade comes with two built-in algorithms … Oracle and our ABCD screener and indicator. And both can help you determine the best potential entries and exits for your trades.

Have a great day everyone. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade