Market uncertainty is everywhere, and traders are feeling it — company earnings, higher interest rates, the Fed meeting coming up next week.

All of it is creating radical swings in the market…

One minute stocks rally — the next, they’re falling off a cliff.

Traders are chasing moves, overtrading, and getting chopped up going in and out of trades…

That makes planning your entries and exits even more important than usual. Especially if you’re under the PDT and have one shot to nail a good trade.

So today I’ll break down some charts to show you some good entries and exits on some of my favorite patterns…

Need help finding the right entries and exits for trades?

Get on this whitelist now to be one of the first to access an exciting new StocksToTrade feature.

Breaking Down Entries and Exits

Yesterday morning in the SteadyTrade Team, Nkarta, Inc. (NASDAQ: NKTX) was a top candidate for a potential day-three surge. With a day three surge pattern, we look for a break above the high from the stock’s first green day.

But as the day went on, another pattern popped up on my radar…

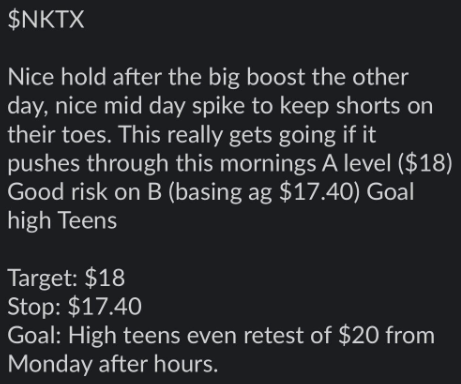

So I alerted subscribers with the notes below:

And you can see what happened a short time later…

The stock broke through that $18 level with high volume and went almost straight to our goal in the high teens. The ideal exit was to sell into the push through $19 where it traded high volume.

But if you’re more experienced and want to hold stocks longer, the next best place to sell was a couple of hours later…

NKTX retested the $19.25 daily high but it barely broke out. You can see on the chart it had no volume to push it higher. And after it failed to break out, it put in a big red candle. That’s a sign the stock’s out of juice and it’s time to exit.

Here’s an example of an entry and exit in a morning trade…

Remember the plan for Sky Harbour Group Corporation (AMEX: SKYH) from the weekly watchlist? I said if it breaks above $8 it could go. What made $8 a good entry?

That was the previous Friday’s close AND it was the whole-dollar level near Friday’s high.

There were actually multiple ways you could have traded SKYH…

The more aggressive trade idea was to trade the dip and rip and buy the break above $7.70 premarket highs. The safer play was my watchlist trade idea to wait until the $8 break.

Those are both nice clear entries on the chart. But how do you know when to sell?

I like to look at whole dollar and half dollar levels to sell. In the SKYH chart above you can see there was big volume and top wicks around the $9 and $9.50 area. That’s a good indication to sell…

And taking $1 or $1.50 per share gains is a good trade. You didn’t have to hold and try to catch the top of the move at $11.

In fact, you could have taken your gains around $9 and re-entered when the stock broke above the $9.50 level. But that’s a risky play. I’d like that trade idea more if it happened in the afternoon.

Another way to spot good exits is by looking back at the daily chart for resistance levels.

But remember, this isn’t an exact science. Stocks won’t hit support and resistance levels exactly. And you won’t nail the bottom and top of every move.

Instead, take profits along the way. When you see profits, take profits.

One of my favorite sayings is: I’d rather be out and wishing I was in than be in and wishing I was out.

With all of my trading patterns, I look for entries when a stock shows strength. I want it to prove to me it can break through key levels with high volume.

When exiting a trade, look for whole dollar or half dollar levels where a stock struggles to go higher. Big top wicks on candlesticks with high volume can also be a sign of selling pressure.

If you want help timing your entries and exits — get on this list now!

We have limited spots available to try StocksToTrade’s killer new algorithm.

Sign up early to grab some awesome perks!

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade