The recent market rally after a big selloff has created choppy price action. Plus, we’re headed into a holiday and short trading week…

We could see even more whipsaw action and that can make trading a little more complicated.

So today I’m sharing one way you can keep it simple…

Now’s a great time to make sure you know what trades are working for you, and which stocks are offering the best trades.

For me, that means sticking to stocks that check all the boxes. And I run over that checklist before taking a trade.

But a box checker looks a little different, depending on which pattern you’re looking to trade.

So let’s break down what boxes I look for and how it plays out on the chart…

Then I’ll share how you can develop your own checklist for trading…

It’s the catalyst that helped me finalize my ideas and get them down in writing.

Get all my trading checklists and resources in the SteadyTrade Team — join here!

What’s a Box Checker?

A stock that checks all the boxes will be different depending on which pattern you want to trade.

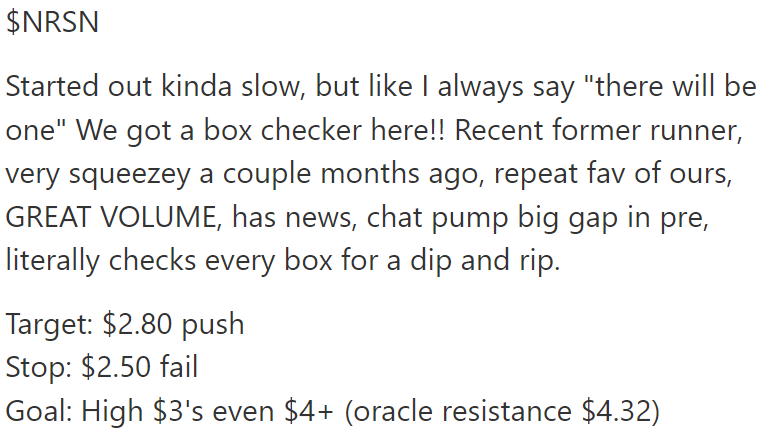

My number one watch yesterday morning was NeuroSense Therapeutics Ltd. (NASDAQ: NRSN).

The Breaking News Chat team alerted the company’s positive study results in premarket. (See the alert here.)

And after NRSN spiked and consolidated, I told SteadyTrade Team members that it’s a box checker for a dip and rip…

Here are my stock criteria for a dip and rip:

- former runner

- news catalyst

- low float

- high volume

- spike and percent gain in premarket

NRSN had them all.

As my notes said, it’s a former runner with a news catalyst. It has a low float of roughly 6 million shares. It spiked in premarket with high volume and rotated the float 35 minutes after the PR.

That made it very interesting. And we got the dip and rip shortly after the open…

Now, for other patterns, I want to see different criteria. For example, for an afternoon VWAP-hold high-of-day break pattern, I want to see the following boxes checked…

- hot sector stock (Ideally)

- News catalyst

- Big percent gainer

- Above VWAP

- After noon Eastern (preferably around 2 p.m.)

But even if a stock checks all the boxes for a perfect trade — the market’s always right. Price action is king.

So while checking the boxes can help you spot an ideal trade, always keep risk management in mind. Have a risk level where you’ll cut losses.

If you want help getting your ideas and mental checklists down on paper, consider reading, “The Checklist Manifesto: How to Get Things Right” by Atul Gawande. (As an Amazon Associate, we earn from qualifying purchases.)

It’s not a trading book per se, but it shows you how using checklists can reduce mistakes in any profession or procedure.

Reading it was a catalyst that helped me finalize my own mental checklists and write them down.

Now I share my checklists and resources with SteadyTrade Team members…

Want access? Jump start your trading in the SteadyTrade Team today.

Have a great day. I’ll see you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade