I always say — there will be one…

One runner, one epic trade opportunity…

Even when it seems slow out there, we almost always see at least one of our repeating patterns.

On Monday it was true as well…

The morning started off slow… but when a premarket gainer broke the high of the day — we had a runner!

And two patterns played out in the same stock — three if you follow one of Bryce Tuohey’s patterns.

So today I’ll break them all down for you…

Because this is how you can make the most out of big percent gainers!

How To Trade Multiple Patterns In The Same Stock

ToughBuilt Industries, Inc. (NASDAQ: TBLT) was a premarket gainer on Monday. I don’t like the company or its product…

But we don’t trade penny stocks because they’re good companies. We only care about price action and patterns.

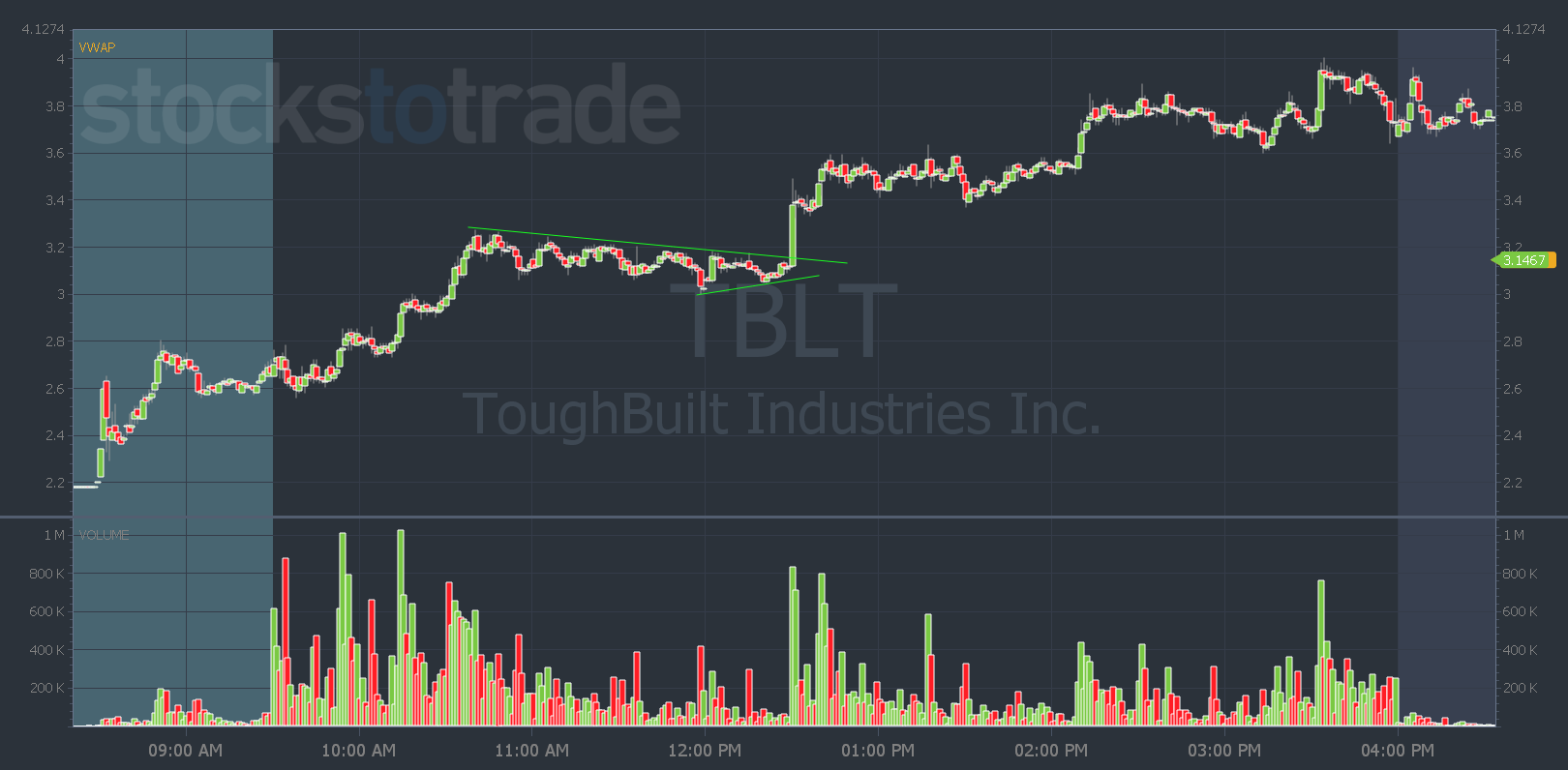

So when I saw TBLT running during my morning SteadyTrade Team webinar, I said it’s a watch for a dip and rip and afternoon VWAP hold.

First, in the morning we got the dip and rip…

The stock broke through its premarket highs after the 9:45 a.m window — which gives the stock more time to lure in short sellers.

It spiked then dipped and retested the premarket highs. Resistance became support and it held before continuing higher.

Then the stock struggled around $3.25 and started heading lower…

If you took profits when TBLT couldn’t break through that level, that’s a good, safe trade. You can always get back in if another pattern sets up…

And that’s exactly what we got into the afternoon. (Get my afternoon trading tips here.)

The stock retraced back to VWAP, stayed above it, and broke through the high of the day.

It’s a textbook VWAP hold high of the day break pattern.

Why is VWAP such a useful indicator to determine if a stock can go higher?

The acronym stands for the volume-weighted average price. If a stock is above VWAP, day traders look at it as a sign that longs are in control. And that most long traders are up on their position.

If a stock is below VWAP, traders look at it as bearish and shorts are in control. Most longs are in the red. Read more about why VWAP is so important here.

So when a stock goes higher after hitting VWAP, it’s a good sign more buyers are coming in. It’s bullish price action.

On Monday VWAP was just below $3 when TBLT pulled back. When it held that level more volume came in and it ripped above the $3.25 high of the day. This is where you can take another entry with another trade and risk-to-reward ratio.

But there’s a third way you could’ve traded TBLT…

The Third Way to Trade TBLT

SteadyTrade Team members received an afternoon webinar from Bryce Tuohey. And TBLT showed a pattern he trades as well…

Bryce likes to use trend lines to plan his trades and entries.

This is similar to a pennant or flag pattern.

He draws a trend line and when it breaks over that. It signals a reversal in the stock and he takes an entry … It looks like this…

You can see the stock was trending downwards making lower highs. But then it made a higher low and broke above the upper trend line. That’s where Bryce would enter.

Then you can exit at the high of the day if it becomes resistance. Or hold for a break out above that level. Your trade plan will depend on your risk tolerance and strategy.

I hope you caught a piece of the multiple trade opportunities TBLT offered.

If you missed out and want some guidance on making trade plans, join me every morning in Pre-Market Prep.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade