Table of Contents

Do you have big plans to invest money in a particular company? Are you wondering if you should move forward immediately, or take a step back to learn more? Do you know what to look for before investing?

It’s easy to find yourself pulled in different directions.

On the plus side, you know there’s potential to generate a positive return in the stock market. You’re familiar with the statistics, such as this one (courtesy of CreditDonkey):

“The average stock market return is around 7%. This takes into account the periods of highs, such as the 1950s, when returns were as much as 16%. It also takes into account the negative 3% returns in the 2000s.”

On the downside, there’s no guaranteed return in the wonderful world of stock market investing. Even when things are going well, there’s always the possibility of losing money.

Download a PDF version of this post as PDF.

Fortunately (or unfortunately), when it comes to the stock market, things don’t stay the same forever. Here’s a quote from investment great Lou Simpson that speaks to this:

“In many ways, the stock market is like the weather in that if you don’t like the current conditions all you have to do is wait a while. ”

While fear and doubt are sure to creep into your mind, don’t let this stop you dead in your tracks.

Instead, take the time to grow your knowledge base, answer key questions, and settle on a strategy for chasing your short- and long-term goals.

This brings us back to the first paragraph: You must know what to look for in a company before investing.

If you’re ready to start the research process, here are five things to look for before investing:

1. Information on its Industry (Take a Deep Dive)

This should go without saying, but it’s a mistake that many new (and experienced) investors make.

At the 1999 Berkshire Hathaway Annual Meeting, Warren Buffett gave some of the best advice you’ll ever hear:

“Different people understand different businesses. And the important thing is to know which ones you do understand and when you’re operating within what I call your circle of competence.”

In other words, you need to invest in what you understand and ignore everything else (until you grow your knowledge base, of course).

For example, if you’re deeply involved in social media — maybe because this is the industry in which you work — investing in Facebook, Twitter, and LinkedIn may make good sense.

Conversely, if you don’t know anything about the internet or technology, it doesn’t make sense to throw your money at companies in this space.

Check out the five-year Facebook chart below.

As you can see, it was trading around $24 in June 2013. Fast forward to today, and it’s now trading at roughly $200.

If you understand the social media industry and are familiar with Facebook’s history and future plans, you’re in a position to invest with confidence.

But if you’re simply chasing the bright lights, assuming the stock price will grow 8x again over the next five years, you could be disappointed.

Before investing, do whatever it takes to clearly understand a company’s industry and where it fits in.

2. One, Three, and Five Year Performance

To understand if a stock is a good investment, you must first dive into what’s happened in the past (so you can project your thoughts on the future).

With the help of StocksToTrade, for instance, you can quickly read old news stories and review past filings, events, and other key information before investing. This alone will give you a clear idea of what’s happened to the company as a whole, as well as its earnings history and outlook.

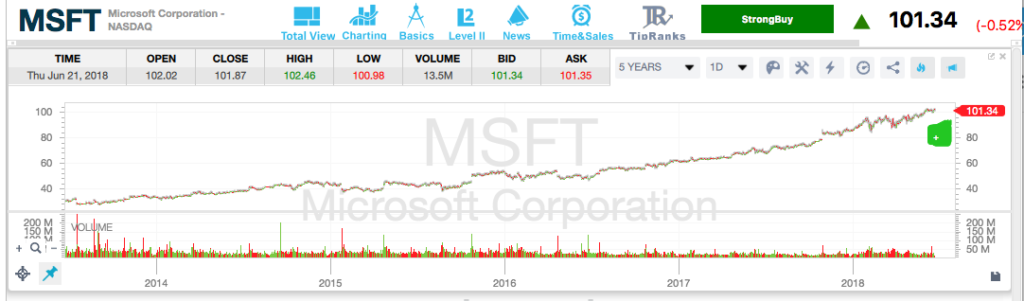

Does the company have a strong history of growth? A company like Microsoft is a great example.

Or are earnings volatile, thus resulting in a more risky investment?

Just the same as anything else, the past doesn’t always dictate the future in the stock market. Even when everything is going well and you’re making money, something can go wrong that leads to the stock tanking.

It only takes a few minutes to review a company’s one-, three-, and five-year performance. When you combine this data with recent news, earnings history, and forecast information, you’ll feel better about what’s to come.

3. Strong Leadership

There’s no other way of putting it: You want to invest in companies with strong leadership, from the top down.

While it’s ideal to find companies with stability at the top, this is easier said than done. Not only that, but things can and will change as the years go by.

Imagine this: You’re interested in investing in a particular company, but a new CEO has just taken over. Do you ignore this and dive right in? Do you sit back to see how things shake out before making your move?

A change in stock price after a change in leadership isn’t guaranteed, but it’s something to watch for.

For example, if the new CEO doesn’t have much experience in the industry, investors may have concerns about a shift in strategy and the overall direction of the company.

On the same token, if a well-established professional within the industry is moved into the role, the change could be good for the company, thus boosting the price per share.

We know that CEOs are paid a lot of money, but that shouldn’t mean much to you as an investor. What you really want to know is whether the person is a strong performer who is capable of growing the company and helping you make money.

If you don’t know where to start, check out this list from Glassdoor that outlines the top CEOs of 2018 (as voted on by employees).

While these CEOs are popular among their workforce, it doesn’t necessarily mean they’re strong leaders. Even so, it’s a good place to start if you’re seeking more information on a company in which you’re interested in investing.

4. Recent News

Good news about a company can go a long way in taking its price per share to new heights.

Just the same, bad news can quickly crush a company and have investors wondering what went wrong.

Before investing in any company— even one that has a strong reputation for long-term success — you need to read as many news articles as possible (ideally, dating back a few months).

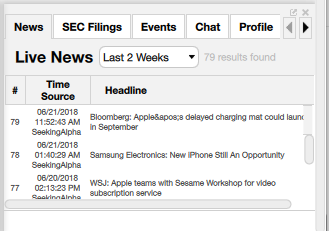

With StocksToTrade, you have access to breaking news along with stories dating back several weeks.

Here’s an interesting excerpt from a CNBC story from September 2017, detailing the impact of the delayed iPhone X release date on Apple shares:

“While the iPhone 8 and iPhone 8 Plus will be out in September, when Apple typically launches its new iPhones, the iPhone X will launch later. Customers will be able to pre-order the iPhone X beginning in October before it launches in November. This is unprecedented for Apple, which hasn’t ever launched an iPhone so late in the year, and so close to the important holiday shopping season. By the time the event was over, Apple shares had slid to $160.20 and were in the red slightly for the day.”

Some companies, such as Apple and other big name brands, always seem to be at the center of their respective industries.

Others, however, fly under the radar in regards to the number of news stories published about them. This doesn’t mean you should overlook these companies or assume that nothing is happening — you simply need to dig deeper.

5. Annual and Quarterly Reports

If you’re a serious investor who wants to make informed trades, you need to get into the habit of reading and comparing annual and quarterly reports.

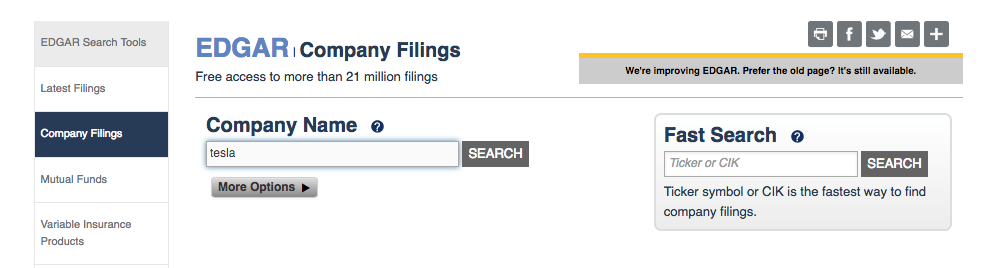

For example, the 10-K report is an annual report that every publicly traded company is required to submit to the Security and Exchange Commission (SEC).

Along the same lines, the 10-Q is required to be filed on a quarterly basis.

The SEC provides access to more than 21 million filings, all of which are full of useful information.

It goes without saying that you don’t have enough time to read through all of these, but if you’re interested in investing in a specific company, then you should take a deep dive.

As you comb through 10-K and 10-Q filings, pay close attention to the risk factors listed. This will give you a better idea of red flags that could result in future trouble.

Here’s a great resource from the SEC if you’re interested in learning how to read a 10-K. It outlines a description of each section, as well as the best practices for using the information.

If you come across something you don’t like, it doesn’t necessarily mean you should cross the stock off your list. It simply means you should dig deeper to get a better feel for the potential impact on the company as a whole and its future stock price.

Conclusion

As you can see, it’s not difficult to learn more about a public company. All it takes is time, dedication, and knowledge of what is — and isn’t — important.

Now that you know what to look for before investing, you’re ready. So, choose a stock that makes sense for you, keep close tabs on its performance, and never stop learning.

With the help of STT Pro, you can learn to make investment decisions that increase your chances of success.