Table of Contents

Are you new to the wonderful world of investing? Do you have big dreams of choosing the right stocks, watching the price go up, and counting your money?

Before you get too far ahead of yourself it’s important to temper your expectations. While picking your first stock isn’t nearly as difficult as it sounds, there’s a lot that goes into it.

Here’s something to remember: daily trading volume is much (much) larger than most people realize. For example, on May 24, 2018, the volume from all trading venues on which Nasdaq Issues were traded was as follows:

- Total share volume: 2,035,656,531

- Total dollar volume: $95,904,121,514

There will be days when you contribute a very small amount to these numbers. Of course, as a new investor, there will also be days (more times than not) when you don’t do anything.

Now that we have that out of the way, let’s get down to business. It’s time to learn more about picking your first stock.

First things first, you need to get into the right frame of mind. As noted above, don’t make this selection with the idea that it will turn you into a millionaire. Instead, your choice should be based on a variety of metrics and a sound all around strategy.

Download a PDF version of this post as PDF.

If you’re ready to get started, here are the things you need to do before picking your first stock:

-

Read the News

I don’t know anything about public companies, so it’s impossible for me to make a confident investing decision.

Does this sound familiar? It doesn’t matter what you know (or don’t know) about public companies, as long as you’re willing to learn. And there’s no better way to learn than by reading the news (although we share some other ideas below).

Do this: spend one hour reading the latest news stories about five companies that pique your interest. Don’t worry about anything else for the time being. The only thing on your mind is digging up information on these companies.

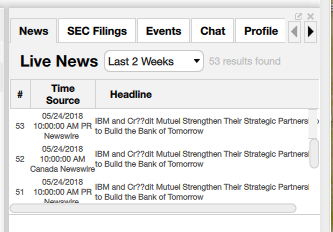

From your StocksToTrade dashboard, you can access live news categorized by:

- Today

- Last 2 Days

- Last 3 Days

- Last 4 Days

- Last 2 Weeks

And that’s just one of your options. There are thousands upon thousands of websites providing news on publicly traded companies. For example, CNBC.com and MarketWatch will keep you busy for quite some time.

Your goal isn’t to formulate an investing decision based on what you read in the news. You simply want to see what’s going on, both the good and the bad, to get a clear idea of the health of the company.

If a particular company misses earnings expectations today, you’ll need to take this into consideration when deciding if it would make a good investment tomorrow.

There used to be a time when the only way to stay current with the news was by reading your local newspaper. Fortunately, in today’s world, investors have all the information they need at their fingertips.

Tip: here’s a long list of some of the best stock market investment websites and news sources.

-

Seek Out Positive Momentum

Do you really want to invest in a stock that’s been tanking for the past year?

While the answer may be yes at times, as a new investor you’re better off focusing your attention on those with positive momentum.

This is one of the easier steps to take, as you don’t have to look much further than a company’s 52-week high and low.

As you’re reviewing a company’s chart over the past year, pay close attention to any momentum that’s picked up as of late. A stock that’s been steadily climbing for the past 52 weeks deserves your attention.

Microsoft (MSFT) is a great example of this, and the chart below shows why:

As of May 25, 2018, its 52-week high was $98.94. Conversely, its 52-week low was sitting at $68.02 (toward the beginning of the period).

As of May 25, 2018, its 52-week high was $98.94. Conversely, its 52-week low was sitting at $68.02 (toward the beginning of the period).

When you look at the momentum as a whole, you’ll see a steady climb over the past 52 weeks. There were a couple dips here and there, but the chart as a whole shows a company that’s on the move.

Just the same, you could examine the five-year chart for Microsoft to get a better idea of its long-term performance.

You’ll see the exact same thing: a company that’s been able to put together one solid year after the next, with very few drop-offs along the way.

There is no such thing as momentum that lasts forever, and you understand this as an investor. However, at least as a beginner, it makes more sense to invest in a company with strong positive momentum as opposed to one that’s been struggling to gain its footing.

-

Invest in What You Know

Will you invest in what you know, or will you expand your reach and hope to learn along the way?

The more you invest the more likely it is that you’ll expand your horizons, seeking out new opportunities for making money. But this article isn’t about what you’ll do down the line. It’s all about the best way to invest as a beginner.

By starting with what you know, you may already have a working knowledge of the companies in a particular space and how they’re performing.

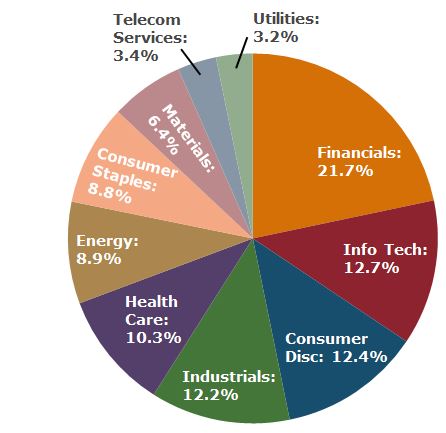

Here are the 11 sectors of the stock market:

- Financials

- Utilities

- Consumer Discretionary

- Consumer Staples

- Energy

- Healthcare

- Industrials

- Technology

- Telecom

- Materials

- Real Estate

(Source: http://market.fodo.us/sectors-in-the-stock-market/)

Maybe you have a strong understanding of technology because you’re the type of person who closely follows companies like Apple, IBM, Facebook, and Twitter (among others).

Or maybe you work in the real estate industry, which is why you have such a strong interest in this sector.

When you invest in what you know it’s only natural to have more confidence in every stock you choose. Not to mention the fact that you already have a strong interest, which allows you to stay current with your investments without having to go out of the way.

There are many great quotes attached to Warren Buffett’s name, but here’s one of the best:

“Never invest in a business you cannot understand.”

This holds true for both beginners and advanced investors alike. If you understand a business, you should feel comfortable investing in it. But if you don’t, you should hold off until you obtain the necessary knowledge. It’s as simple as that.

-

Beware of the Sexy Picks

Everyone wants to make money in the stock market. Even more so, they want to make fast money. And that’s why the “sexy picks” are so tempting.

You know all about IBM, Chevron, and General Motors.

And you also know all about the “up and comers” that are going to change the investing landscape in the months to come. Or so that’s what you’re told.

The problem with these sexy picks is that they often flatline, or worse, thus making your first experience as an investor anything but memorable.

Here’s a great quote by Joey Frenette of The Motley Fool:

“It’s important to tell the difference between investing and speculation early on in your investment career; otherwise, a poorly timed speculation may cause you to give up on investing, even though you haven’t really actually invested. You speculated — gambled, if you will — all while telling yourself that you were investing to make it seem like you were doing something respectable, when in reality you were just pulling the handle on a slot machine with Bitcoin, Ethereum, Ripple, venture miners, or even up-and-coming marijuana firms like Aurora Cannabis Inc. or Aphria Inc.”

As a new investor, you don’t want to chase the so-called fast money, as this can turn you sour on the market in no time at all. There are times in the future when speculation can be well-timed and make sense but forget about that for now.

Sexy picks are often found on over the counter (OTC) markets, which is defined by Investopedia as follows:

“The phrase “over-the-counter” can be used to refer to stocks that trade via a dealer network as opposed to on a centralized exchange. It also refers to debt securities and other financial instruments, such as derivatives, which are traded through a dealer network.”

According to the SEC, investing in OTC stocks remains big business, with thousands of stocks quoted, generating trade volume well into the hundreds of billions per year.

While there may come a time in your investing career when you feel comfortable with OTC stocks, it’s not a place for beginners to dabble.

(Also worth checking out, our 40 ‘Stock Trading Terms For Beginners‘ Article and Infographic!)

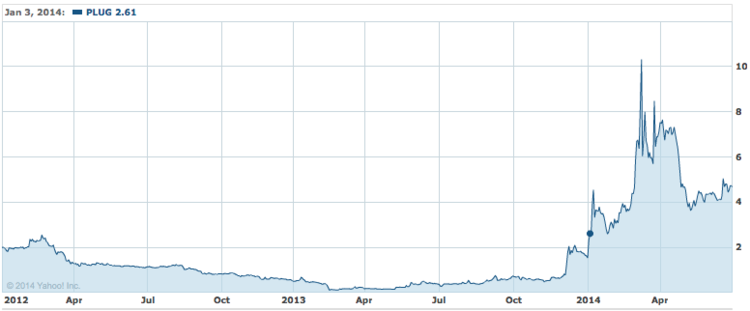

For every penny stock success story, such as Plug Power (PLUG), there are hundreds that fall flat.

(Source: https://traderhq.com/penny-stock-success-stories/)

(Source: https://traderhq.com/penny-stock-success-stories/)

So, with so much risk in the sexy picks, do yourself a favor and play it safe. It’s not always the fun thing to do, but for a beginner, it’s the best approach.

-

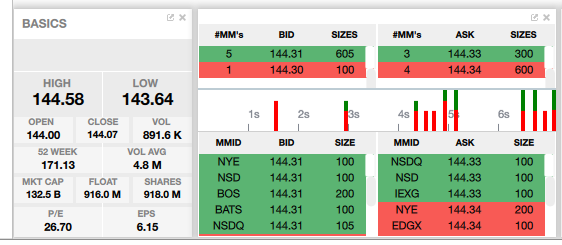

Review the Chart in Great Detail

Now it’s time to become a real trader. You’re moving past what you read in the news, all with the idea of getting down and dirty.

It’s time to review the chart for every company you’re interested in.

Let’s assume there are two investors out there:

- Investor A is in a hurry. He’s interested in tech, follows a few companies in the news, and doesn’t have any interest in reviewing a chart before making a decision.

- Investor B is a bit more patient. He’s also current on the latest and greatest in the tech industry but isn’t willing to do anything until the first reviews each company’s chart.

Who do you think is in a better position to succeed?

Reviewing a company’s chart doesn’t guarantee success, but it will give you a clear understanding of what’s happened in the past along with some metrics to help better predict where things will head in the future.

IBM, for example, is one of those stocks that has been up and down over the past couple of years.

If you’re interested in nothing more than positive gains, IBM may not be right for you considering all the shuffling (see the chart above).

If you’re interested in nothing more than positive gains, IBM may not be right for you considering all the shuffling (see the chart above).

But you can’t focus solely on the ups and downs. There are other things to look for on a stock chart, including the following:

- Open and close

- Volume

- Volume average

- Market cap

- Float

- Shares

- P/E

- EPS

At first, these numbers may confuse you. There’s nothing wrong with that. Being a beginner in the stock market is all about learning. You’re not trying to crack some mythical code. You’re simply trying to learn more about a particular stock and if it fits your investment guidelines.

One of the best things you can do is spend hours on end reviewing stock charts, without ever thinking about investing a single dollar. This practice will help you in the long run, allowing you to more quickly and efficiently read charts in the future.

Conclusion

With the right level of patience and access to a variety of metrics, you should be more confident than ever in making a sound first investment. Picking your first stock doesn’t have to be stressful, it can be a well-thought-out trade- if you plan right.

Everyone has to start somewhere, but as the days go by your confidence level will begin to grow.

If the time has come for you to take action, instead of sitting on the sidelines, join STT Pro today. You’ll soon realize that you’re no longer a beginner, but instead a seasoned investor with the knowledge necessary to make more informed decisions.