Dedicated Daily Accelerator readers know the number one chart pattern I’m looking for right now…

If you’re a new subscriber, I’ll make a long story short.

January jump effect charts are creating some of the best opportunities in the market…

It all started on the first trading day of the year — with a 680%+ gainer! I’ll show you that chart shortly…

And it continued with other stocks that gained as much as 640%, 88%, and 53%.

If you played some of these stocks during the first few weeks of the year then you know how incredible these opportunities have been — if you haven’t, you probably feel like you’ve missed out.

Well, I’m here to tell you that you haven’t.

Here’s why…

Could We See January Jumps in February?

The January effect is where beaten-down ‘real’ stocks tend to jump.

It can be after a bad year like we saw in 2022, or after a year of sideways price action where traders get frustrated and take their tax loss in December. That can cause some stocks to become oversold.

Then in January, renewed optimism takes over and traders come in to buy the dip.

The January jump effect is what I call a similar move in penny stocks. Where you see a beaten-down yearly chart, then incredible volatile bounces in January.

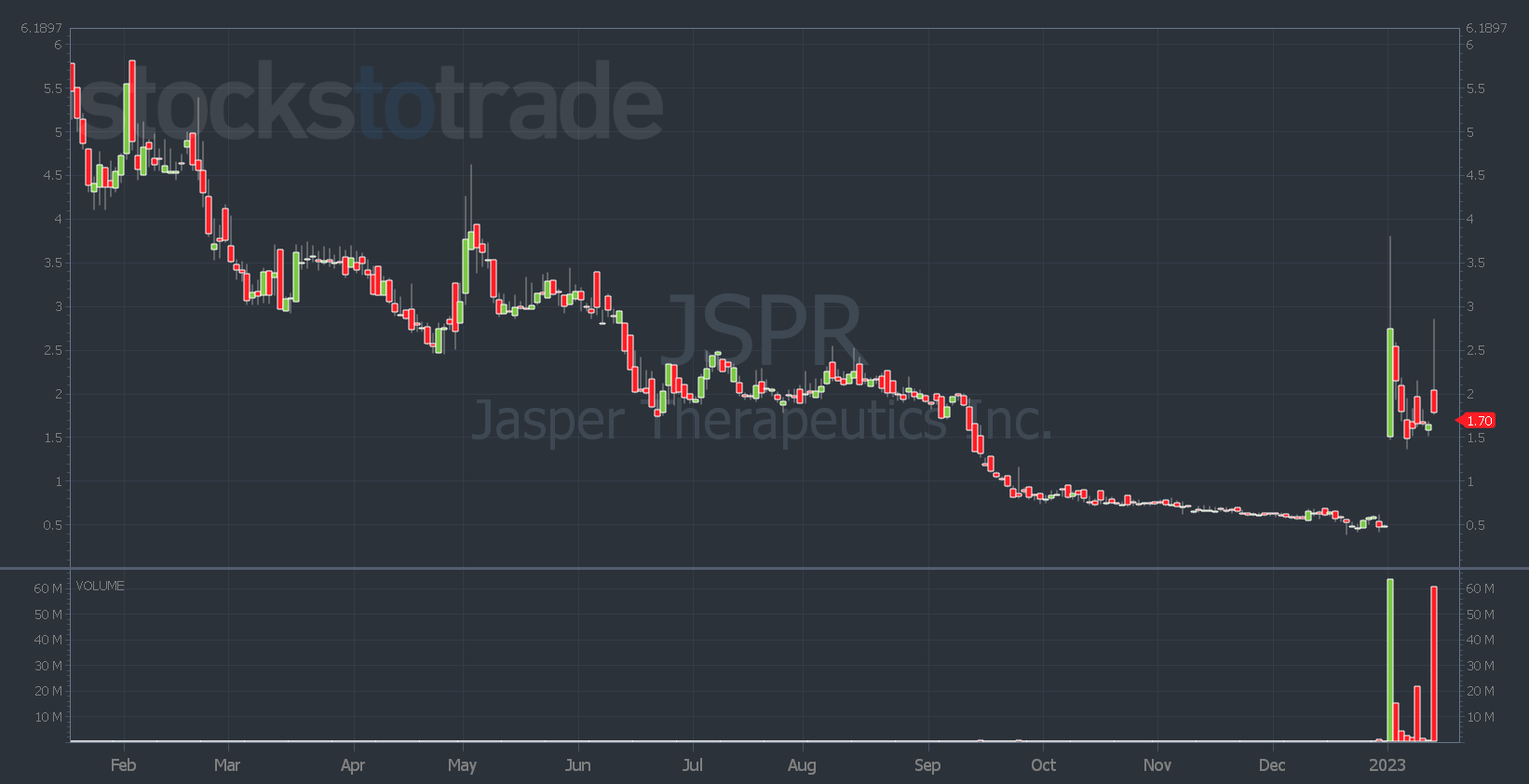

Jasper Therapeutics, Inc. (NASDAQ: JSPR) was the OG penny stock January jump effect play…

A year ago it was its highest point, trading at almost $6. Then all it did was go down for a year straight…

And on the first trading day of the year, the stock jumped over 680% when the company announced news and had massive volume with float rotation.

But despite the name of this effect, it could continue longer than just one month. There are a few reasons why…

First, we’re coming off a year where the market experienced its worst performance in decades…

That means a lot of stocks are oversold or beaten down which creates more opportunities for January jumps.

Second, the overall markets have started to bounce over the last week. That could increase momentum and bring back more traders to the market as they see more profit potential

Lastly, we’re heading into one of my favorite times in the market — earnings season.

It happens four times a year. And can offer great trade opportunities in ‘real’ stocks and penny stocks. Here’s the earnings calendar for this week.

But big tech names like Amazon.com, Inc. (NASDAQ: AMZN) and Apple Inc. (NASDAQ: AAPL) aren’t due to announce earnings until early February.

And after the beating tech stocks received last year, they could be some of the biggest January jumps.

But trading January jump effect charts don’t mean you buy any beaten-down long-term chart that’s gapping up. You still need a plan and a pattern.

That’s where a copy of my ebook comes in handy…

Read it — it’s not long.

And once you know the patterns, you can rinse and repeat them in real stocks or penny stocks.

Whether they’re January jump effect plays, earnings winners, multi-day runners, or day-one spikers…

You get my ebook for free when you join StocksToTrade Advisory. You also get three market update videos a week, a weekly watchlist, a monthly report, and more…

Plus, speaking of earnings … Tesla, Inc. (NASDAQ: TSLA) is also due to announce some potentially huge news soon…

Have a great day everyone! See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade

P.S. Tomorrow night is the biggest event of the year! Mark Croock will share the “switch” he made to his trading that’s helped him land multiple TRIPLE-digit-gains — and he’s going to show you how to make the switch too … Register now before it’s too late!