What is an ETF?

ETF, PDT, EPS … and so on. Reading the financial news can sometimes seem like navigating a bowl of alphabet soup with its many acronyms.

While these shortened terms help keep things concise, they can also be very confusing when you haven’t learned what the terms stand for or what they mean yet.

This post will demystify at least one spoonful of this financial alphabet soup: What is an ETF? Here, we’ll explain what they are, where they came from, and why they’re worth considering as part of your investment portfolio.

Download the key points of this post as PDF.

What is an ETF?

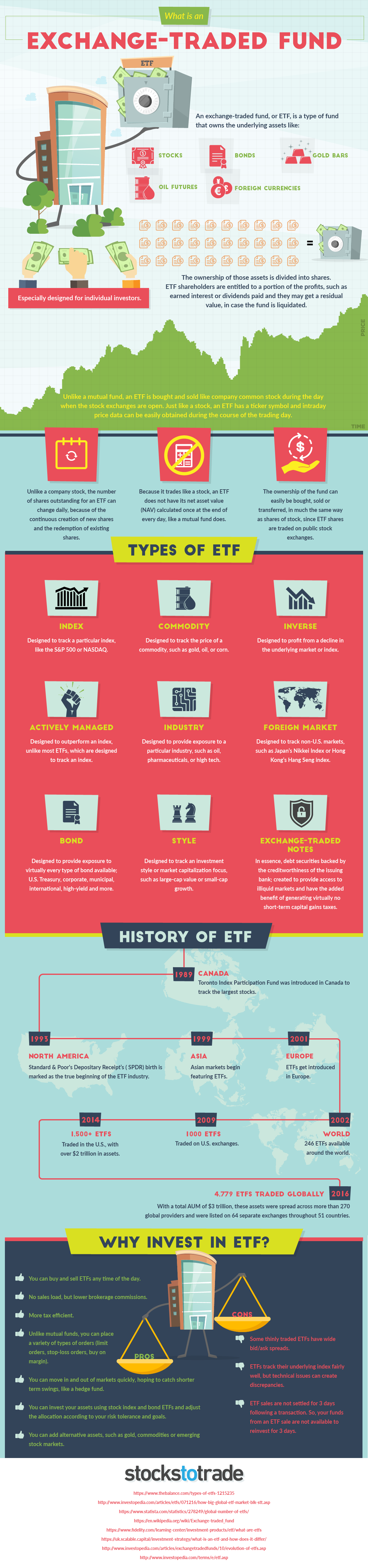

The acronym ETF stands for “exchange-traded fund.” It’s a type of fund that’s specifically designed for individual investors.

An exchange-traded fund owns underlying assets which might include stocks, bonds, gold bars, oil futures, and foreign currencies.

Bundled together, the ownership of these assets is divided into shares. ETF shareholders are entitled to a portion of the profits, which might be realized by earned interest or dividends paid. If the fund is liquidated, they may receive residual value.

How Do You Invest in an ETF?

In reading the definition of an ETF, it can be tempting to think that they’re quite similar to a mutual fund. While ETFs and mutual funds do share some characteristics, there are also some distinct differences.

Perhaps most importantly, an ETF can be bought and sold just like company common stock during regular trading hours.

Like a stock, an ETF has a ticker symbol and intraday price data which can easily be obtained throughout the course of the trading day.

Here are some other important things to know about an ETF:

- Unlike a company stock, the number of shares outstanding for an ETF can change on a daily basis, because new shares are constantly being created and existing shares are constantly being redeemed.

- Unlike a mutual fund, an ETF does not have its net asset value (NAV) calculated once at the end of every day.

- Ownership of the fund can be bought, sold, or transferred in much the same way as stock shares since ETF shares are traded on the same exchanges.

A Brief History of the ETF

Curious about where ETFs came from and how they evolved? Here’s a brief timeline detailing their history:

1989: The Toronto Index Participation fund was introduced in Canada, to track the largest stocks. This is considered the precursor to the modern-day ETF.

1993: Standard & Poor’s Depositary Receipts (SPDR) is born. This is marked as the true beginning of the ETF industry in North America.

1999: Asian markets begin featuring ETFs.

2001: ETFs are introduced in Europe.

2002: At this point, 246 ETFs are available around the world.

2009: Just a few years later, 1000 ETFs are traded on US exchanges alone.

2014: ETFs just keep growing! By 2014, 1500+ ETFs are traded in the US, with over $2 trillion in assets.

2016: 4,779 ETFs are traded globally. As of 2016, with a total AUM of $3 trillion, these assets were spread across more than 270 global providers and were listed on 64 separate exchanges throughout 51 countries.

Types of ETF

There are a variety of different types of ETFs you might encounter. Here are some common ones:

- Index: Designed to track a particular index, for example, the S&P 500 or the NASDAQ.

- Commodity: Designed to track the price of a commodity, such as gold, oil, or corn.

- Inverse: Designed to profit from a decline in the underlying market or index.

- Actively Managed: Designed to outperform an index. These ETFs buck the trend, since most ETFs are designed to track an index.

- Industry: Designed to provide exposure to a particular industry, such as oil, pharmaceuticals, or high tech.

- Foreign Market: Designed to track non-US markets, such as Japan’s Nikkei Index or Hong Kong’s Hang Seng Index.

- Bond: Designed to provide exposure to virtually every type of bond available: U.S. Treasury, corporate, municipal, international, high yield, and more.

- Style: Designed to track an investment style or market capitalization focus, such as large-cap value or small-cap growth.

- Exchange-Traded Notes: In essence, debt securities backed by the creditworthiness of the issuing bank. These are created to provide access to illiquid markets and have the added benefit of generating virtually no short-term capital gains taxed.

Investing in ETFs: the Pros and Cons

Why invest in an ETF? Like any other type of investment, there are pros and cons. Let’s break them down:

Pros of investing in ETFs

- You can buy and sell ETFs any time of day.

- They carry no sales load, but lower brokerage commissions.

- ETFs are more tax efficient than many other types of securities.

- Unlike mutual funds, you can place a variety of order types (limit orders, stop-loss orders, and buy on margin).

- You can move in and out of markets quickly if you want to catch shorter term swings, as with a hedge fund.

- You can invest your assets using stock index and bond ETFs and adjust the allocation according to your risk tolerance and goals.

- You can add alternative assets to your portfolio such as gold, commodities, or emerging stock markets.

Cons of investing in ETFs

- Some thinly traded ETFs have wide bid/ask spreads. The bid is the highest price someone is willing to pay for a stock; the ask is the asking price for a share of the stock. A large gap can prove problematic!

- ETFs track their underlying index fairly well, but technical issues can create discrepancies.

- ETF sales are not settled for 3 days following a transaction, so your funds from an ETF sale are not available to reinvest for 3 days.

- ETF prices are based on the underlying assets. It’s important to do some fundamental and technical analysis with a platform like StocksToTrade to help determine the viability of the trade.

Conclusion: Because they include a bundle of underlying assets, ETFs or exchange-traded funds can provide an opportunity for traders to easily diversify their portfolio without leaving the familiar setting of the stock market.

However, as with any investment type, there are some potential downsides. Some considerations to keep in mind with ETFs are a slower settlement time and potentially wide bid/ask spreads. Be sure to always do your research on an ETF before executing a trade!

Have you ever traded ETFs?

StocksToTrade—is better than ever! We’ve added some major advancements this year that include 3 unique features, exclusive to our platform.