As a trader, it’s important that you know as much about the stock market as possible. That includes understanding the differences between various types of securities.

You probably already have a good grasp on what a stock is, but you might not know that there’s more than one type of stock.

In fact, there are two main types of stock: common and preferred shares. What’s the difference?

In this post, we’ll break down these two types of stock shares: what they are, key differences between the two, as well as advantages and disadvantages of both.

Download a PDF version of this post.

(More Content Below the Infographic!)

Table of Contents

Use on your Own Website!

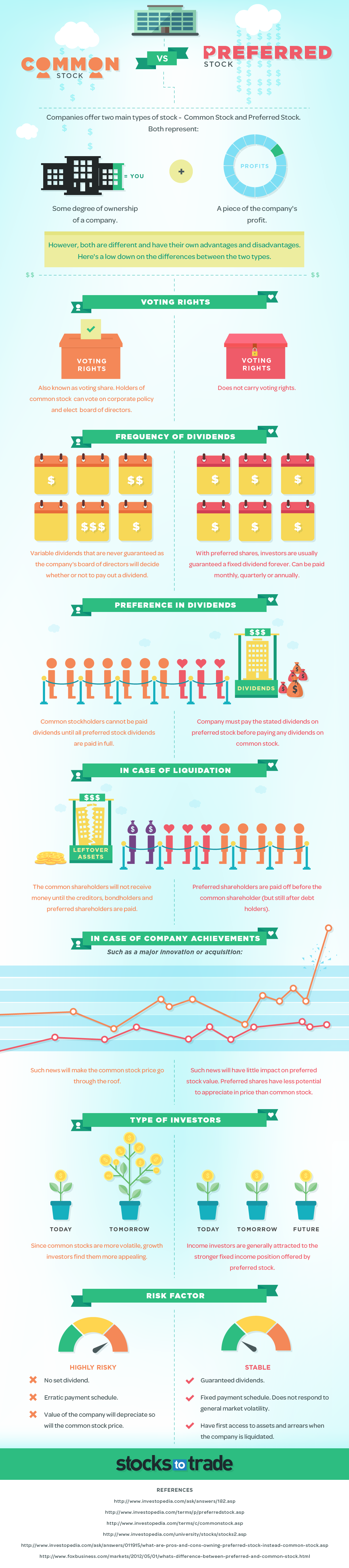

Companies offer two main types of stock: common stock and preferred stock. Both are similar in that they represent the following:

- A degree of ownership in the company. By purchasing shares, you’re effectively buying a piece of the company. The size of the piece you buy is determined by how many shares you buy.

- A piece of the company’s profit. As part-owner of the company, you’re entitled to a cut of the profits as the company (ideally) grows and increases revenue.

But despite these commonalities, you shouldn’t confuse these two types of stock. Common and preferred stock shares are quite different, each with their own advantages and disadvantages.

Here’s a lowdown on the differences between the two.

Voting Rights

Voting rights refer to shareholders’ rights to vote on company matters, including policy, the board of directors, and big changes within the company.

In the stock market, the weight of shareholders’ votes is directly proportional to the number shares they own.

Common Stock: The common stock shareholder has voting rights (also known as voting shares). This means voting on things like corporate policy and electing to the board of directors.

Preferred Stock: With preferred stock, you don’t have voting rights.

Frequency of Dividends

Dividends are payments issued by a company to stock shareholders. They’re typically paid out quarterly, though that’s not always the case.

Common stock: As a common stock shareholder, your dividends are variable. This means two things for shareholders …

First off, dividends aren’t guaranteed, as the company’s board of directors have to decide whether to pay out a dividend. That means you can’t necessarily count on dividends.

Second, the amount is variable, too. The board of directors determines the appropriate amount to issue per share. So even if you receive dividends, you don’t necessarily know or have a say in how much you’ll receive.

Bottom line: Dividends can potentially be incredible, but there’s also a chance you’ll receive no dividends at all.

Preferred stock: With preferred shares, investors are usually guaranteed a fixed dividend forever. It can be paid monthly, quarterly, or annually. Because it’s reliable, some consider this to be an advantage.

Preference in Dividends

The hierarchy of when dividends are paid is different between the two stock types, too.

Common stock: Common stockholders can’t be paid dividends until all preferred stock dividends are paid in full.

Preferred stock: The company must pay the stated dividends on preferred stock before paying any dividends on common stock.

In Case of Liquidation

Sometimes, companies go under. If a company must liquidate, here’s what happens with the different types of stock:

Common stock: The common shareholders won’t receive money until creditors, bondholders, and preferred shareholders are paid.

Preferred stock: The preferred shareholders are paid off before the common shareholders but after the debt holders.

In Case of Company Achievements

If a company achieves a big milestone like a major innovation or acquisition, it affects the different types of stock like so:

Common stock: Great news! A big news catalyst like this can potentially push the common stock price through the roof. This is the big hope of most traditional ‘buy low, sell high’ investors.

Preferred stock: Alas, such news will have little impact on preferred stock value. Preferred shares have less potential to appreciate in price than common stock.

Type of Investors

Both common and preferred stock shares tend to appeal to different types of investors. Here’s a basic key to who’s drawn to both and why:

Common stock: Since common stocks are more volatile, they tend to attract growth investors (or traders who want to build their accounts quickly). They’re well suited and more appealing to research-savvy traders who understand how to take advantage of phenomena like the January effect.

Preferred stock: Income investors (who may have longer-term growth goals or may be more risk-averse) are generally attracted to the stronger fixed-income position offered by preferred stock.

Risk Factor

The risk factor is quite different between the two types of stock. Here’s how it breaks down:

Common stock is generally considered highly risky due to the following:

- No set dividend: Variable dividends mean you can’t count on a regular amount per quarter or payment period.

- Erratic payment schedule: You may not receive dividends regularly or at all.

- More price fluctuation: If the value of the company depreciates, so will the common stock price.

Preferred stock is considered more stable due to the following:

- Guaranteed dividends: You always know how much you’ll receive as dividends.

- Fixed payment schedule: Your dividend payments are regularly scheduled.

- Less fluctuation: These stock shares don’t respond to general market volatility.

- Preference during liquidation: Shareholders have first access to assets and arrears when the company is liquidated.

Conclusion

As you can see, there are plenty of differences between common stock and preferred stock that make them enticing in different ways.

There’s no clear winner between common stock and preferred stock. It’s a matter of evaluating your strategy, risk tolerance, and constitution and determining which shares best align with your goals.

Whether you lean toward common stock or preferred stock, use StocksToTrade to run the technical analysis that can help you make more intelligent decisions in your trades.

Try it out for 7 full days for just $7.00, cancel any time!

Do you trade common stock or preferred stock shares? Leave a comment and tell us your experience!