Yesterday I highlighted the power of one of my favorite morning patterns — the dip and rip.

Today, I’m highlighting another simple yet powerful pattern that can occur in the morning or afternoon…

And it can result in some insane moves. I’ll use a stock from yesterday as an example…

Once it broke through the red to green level — it shot up $18 per share! That’s a 63% gain.

I don’t expect traders to hold through that entire move — especially when it halts every few minutes…

But let me show you how you can trade these rockets and capture a chunk of the move while dealing with halts…

Get trade ideas and plans every morning with me here!

Was This Stock Even On Your Radar?

I didn’t talk about Shuttle Pharmaceuticals Holdings, Inc. (NASDAQ: SHPH) in my morning webinars yesterday. But it should have been on your watchlist…

It’s a recent IPO.

And when a theme is hot, you’ve gotta keep those stocks on your radar until the hype fades.

Because they can always come back and squeeze … Just like SHPH did yesterday. The moves aren’t random — they repeat.

That’s why key levels are at the heart of most of my patterns…

The Weak Open Red-to-Green Move

Once a stock has a big day as SHPH did on Tuesday, short sellers pile in and short any pops in the afternoon.

And when it opens weak the next morning, shorts see that as confirmation that their thesis is correct and it’s going lower. So they add into pops in the morning…

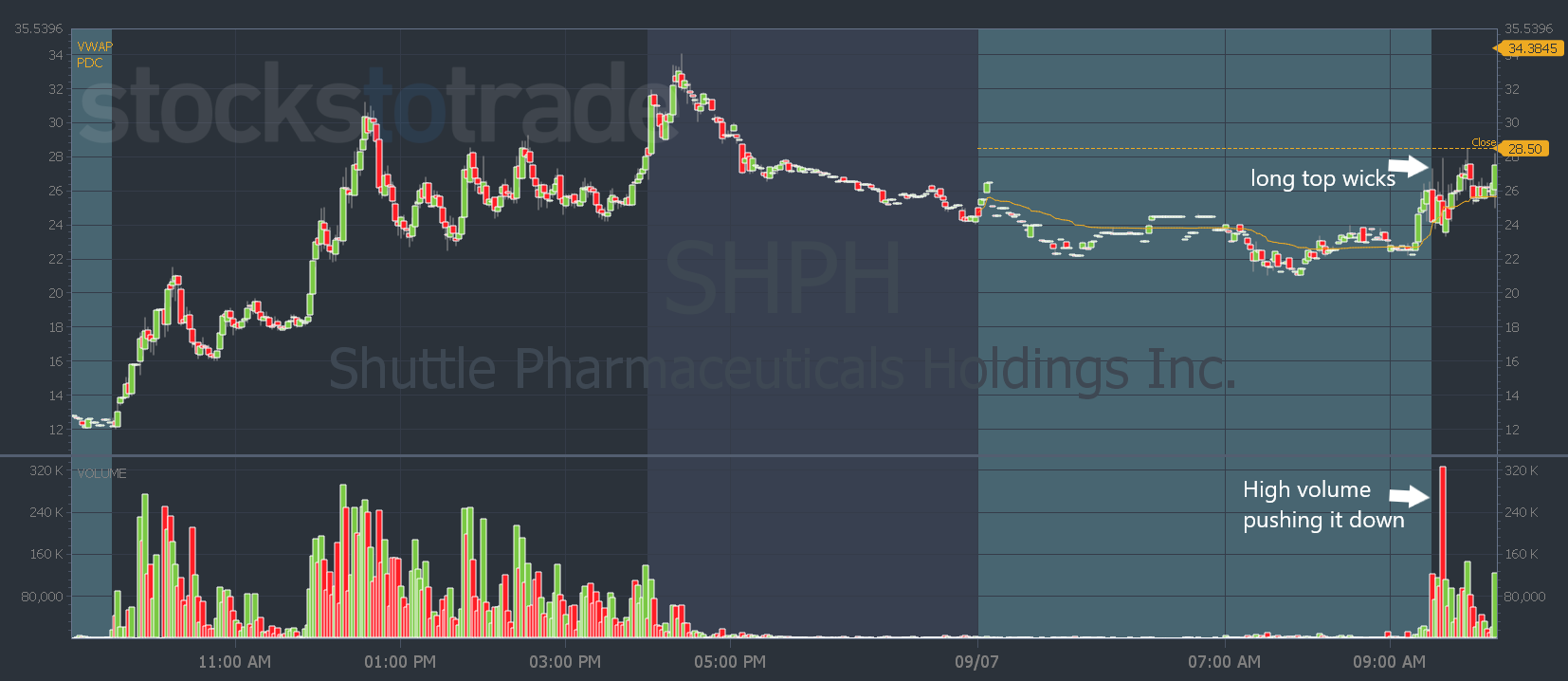

You can see the long top wicks on the candles and high volume which shows selling pressure…

But once the stock goes green (which is NOT the color of the candles, green means it crossed above the previous day’s closing price), that’s when short sellers are wrong…

The move means the stock has more upside momentum.

With SHPH, there was still resistance overhead at the previous day’s high and the after-hours high, so shorts probably added to their position…

But that only added more juice to the squeeze.

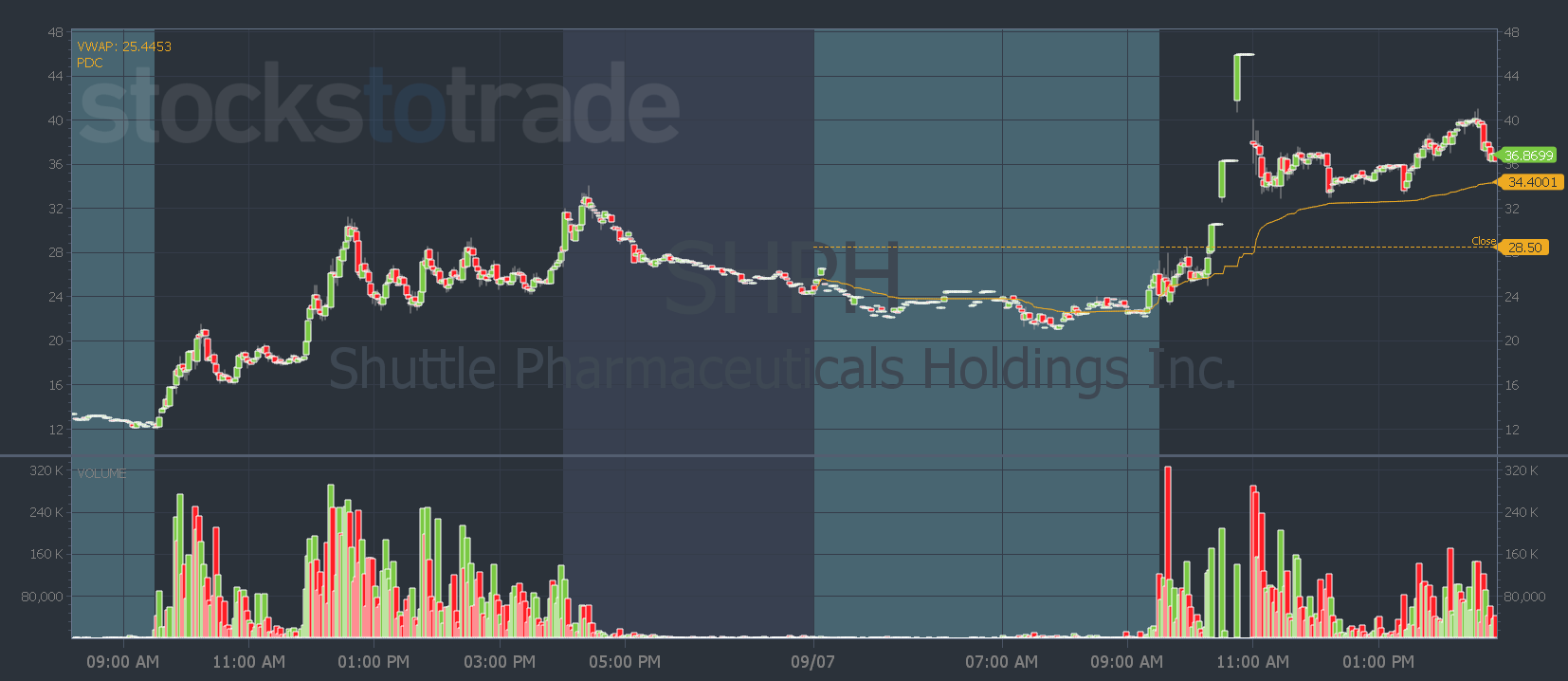

SHPH had such big moves it halted multiple times.

So remembering what I taught about halts the other day, here’s how you can trade these kinds of tickers…

You can enter the stock when it makes its red to green move. But when it halts, you’re left wondering how to manage your position.

That’s why I always say get out as soon as you can after a halt.

With a hypothetical SHPH trade, getting out after the halt still would’ve resulted in a roughly $5 per share gain if you entered at the red to green level.

So now you’re out of the trade and it keeps going…

You have mad FOMO. But you don’t want to chase…

You still need a pattern or thesis for your trade.

Well, you could’ve gotten back in when the stock broke above the after-hours high of $34.

Knowing that the stock already halted you could’ve taken quick gains before it halted again. But if you missed your exit before the halt — follow the same rule…

Holding through that halt would’ve given you another $5 per share gain.

But don’t take this lesson as a reason to start looking for halts to hold through. I’m simply giving you this information to help you if you get stuck in a halt.

You can see that after SHPH had its last halt, it opened about $9 per share lower than the halt. If you got back in or held too long, you wiped out all your gains…

And SHPH continued to go lower … That’s why exiting as soon as a stock reopens is the safest bet.

These patterns are powerful, but you have to know when to get out as well.

Have rules to guide you through trades.

They help you determine when to get in a trade, when to exit, and how much to risk.

If you’re not sure how to set your own rules, try my 3-step system cheat sheet.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade