Tuesday’s trading started off with a bang. And despite it being a short week, it looks like we’ll have plenty of opportunities to profit.

After my live Pre-Market Prep webinar yesterday, I had roughly 10 stocks in my show notes.

As the premarket trading action progressed, I picked my number one watch…

But there was another stock that surprised me at the open.

That’s the one I want to talk about today. Because it shows you the power of one of my favorite patterns.

Even though it didn’t have huge percent gains…

It shows you it’s about the process, the pattern, and the mechanics of why they work.

That’s what makes it possible to trade these patterns repeatedly. And it’s what can help you generate consistency as a trader.

The Power Of The Dip And Rip

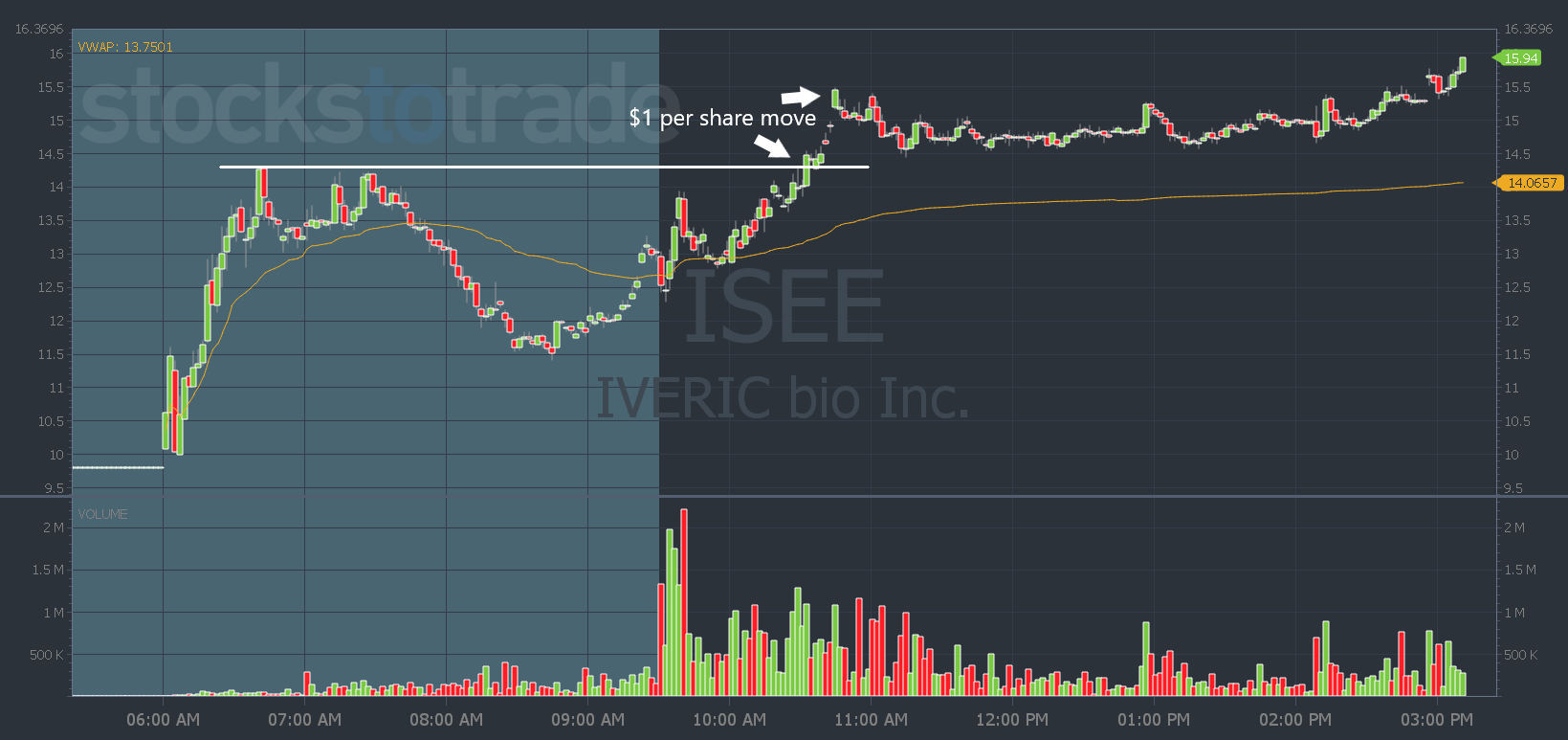

Yesterday in premarket, I didn’t love IVERIC bio, Inc. (NASDAQ: ISEE). It has a high float, I don’t love biotechs, and I thought the phase 3 news was lame…

But then it started to spike at the open. I said it looks like shorts loaded up…

Because what you want to look for in a dip and rip is a big gainer in premarket … Then you want to see it pull back. That draws in the short sellers…

And when a stock dips after the open, that can draw them in even more…

As a long trader, that’s when you sit back and wait for the pattern to develop.

You wait for the stock to break above the premarket high. That’s confirmation that the shorts are wrong and they’re all losing money.

And as their losses grow they start buying. Now you have shorts and breakout buyers pushing the stock higher.

It doesn’t look like much on the chart, but ISEE had a $1 per share move from the break above the premarket high to the morning high of the day.

But that’s the power of the dip and rip.

It’s a simple pattern and it works.

But most people complain about simplicity…

They think you need to trade 50 different patterns and use a bunch of fancy indicators.

They don’t understand that the most successful, consistent, and long-lasting traders don’t trade 50 or 500 patterns.

All you need are a few simple patterns that repeat — like the dip and rip.

Becoming consistently profitable comes down to mastering these simple patterns.

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade