There are a few lessons I harp on for new traders … Like focusing on the best days and times to trade…

And making sure a stock checks all the boxes before planning a trade.

Yesterday was Money Monday — so it was a good time to look for potential trades…

And there were a few premarket runners with news and high volume that checked some boxes…

But that didn’t turn out to be enough for most of them to run.

However, fast forward to the 9:45 a.m. window and we had a 250% winning play.

What led up to its incredible run?

You had to do more than check the boxes to recognize this play…

Today, I’ll give you two tips that can help you spot the best potential trade.

When Checking The Boxes Isn’t Enough

When you’re looking for a potential stock to trade, you can check all the boxes including the stock’s float, news, and volume…

But what if they all have low floats, news, and float rotation?

Yesterday we had about five biotech stocks running in premarket with news and high volume…

So how can you determine which one is a top candidate to potentially run?

We go to the next criteria…

And on a day like yesterday that wasn’t feeling very frothy — I like to wait for the lone survivor.

That’s either the stock that holds up after the open, or into the afternoon.

If a stock holds up at the open, it’s a watch for a dip and rip…

If every stock fails immediately at the open, wait for the afternoon.

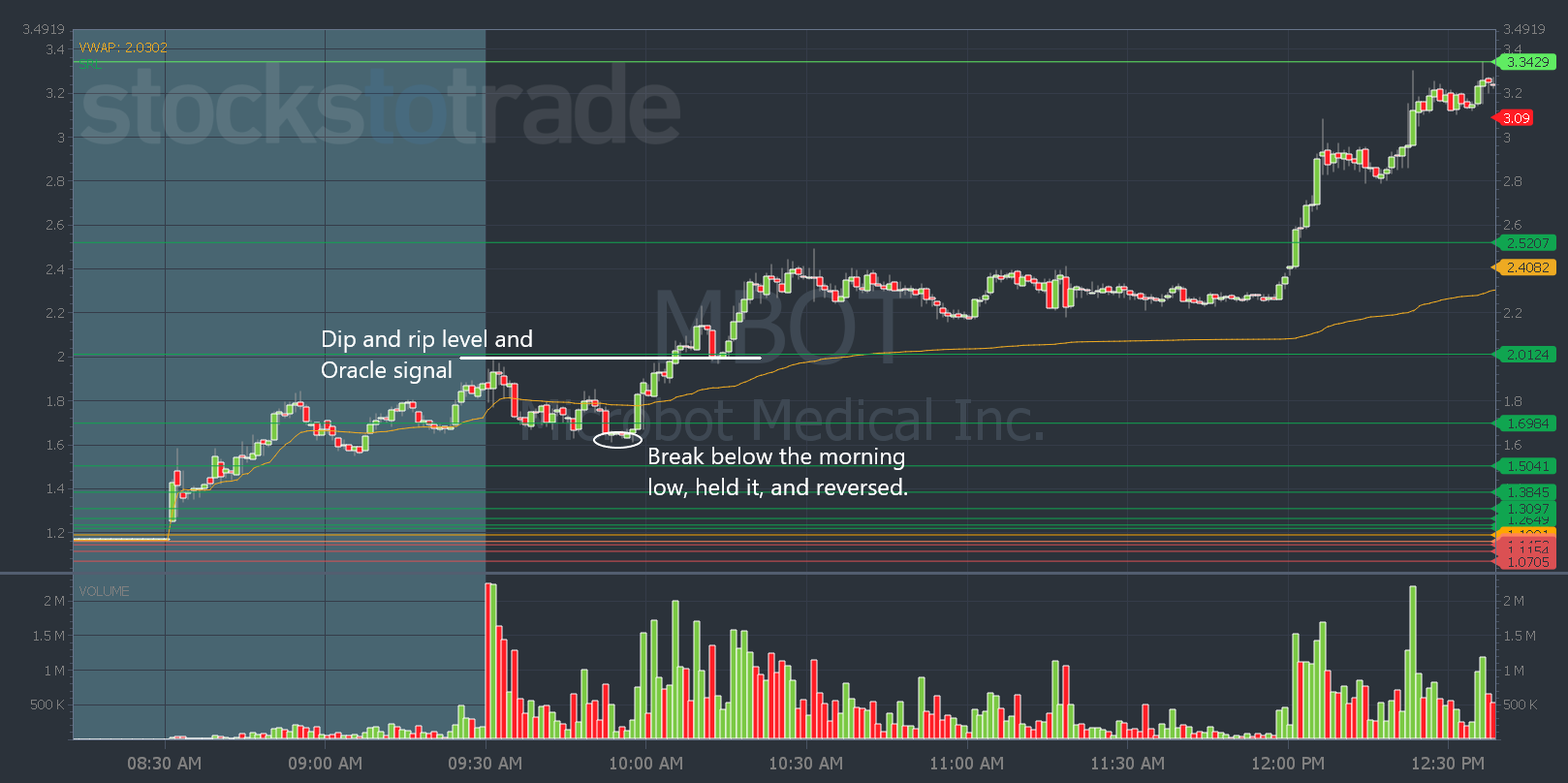

Microbot Medical Inc. (NASDAQ: MBOT) was the one that spiked at the open and held up heading into the 9:45 a.m. window.

So my note in my morning webinar was…

9:41 AM $MBOT we made it to the 9:45 window, top dnr, risk on vwap, if it dies it dies…

The morning dip lured in short sellers — the stock even briefly broke the morning low before bouncing back and that likely lured in even more shorts…

Another way to look for the best potential play is to wait for the Oracle signal…

Oracle had MBOT on its list with a signal of $1.99 (call it $2).

That was basically the dip and rip level after 9:45 a.m. and from there we were off to the races.

So on days like yesterday when there are a lot of premarket runners or the market doesn’t feel super frothy — the best game plan is to wait.

Wait for the 9:45 a.m. window (I wrote about how all new traders should wait until 9:45 a.m. here).

And wait for the Oracle signals.

Because stocks can check all the boxes and still fail…

Patience and having the right plan are what matter.

Stay on top of the markets, stocks, and trade ideas to watch for with my Market Update videos three times per week.

If you want daily live webinars and in-depth lessons and discussions — see how you can get mentored here.

There’s big news coming about our mentorship programs soon!

Have a great day everyone. See you back here tomorrow.

Tim Bohen

Lead Trainer, StocksToTrade